18 Quality Undervalued Cyclical Stocks

Economic uncertainty has left a large number of cyclical stocks trading at attractive prices.

Amid speculation about the possibility of a recession, cyclical stocks had a tumultuous start to the year. As a result, many have been beaten down into undervalued territory. For long-term investors, there are notable opportunities among high-quality names such as U.S. Bancorp USB and International Flowers & Fragrances IFF.

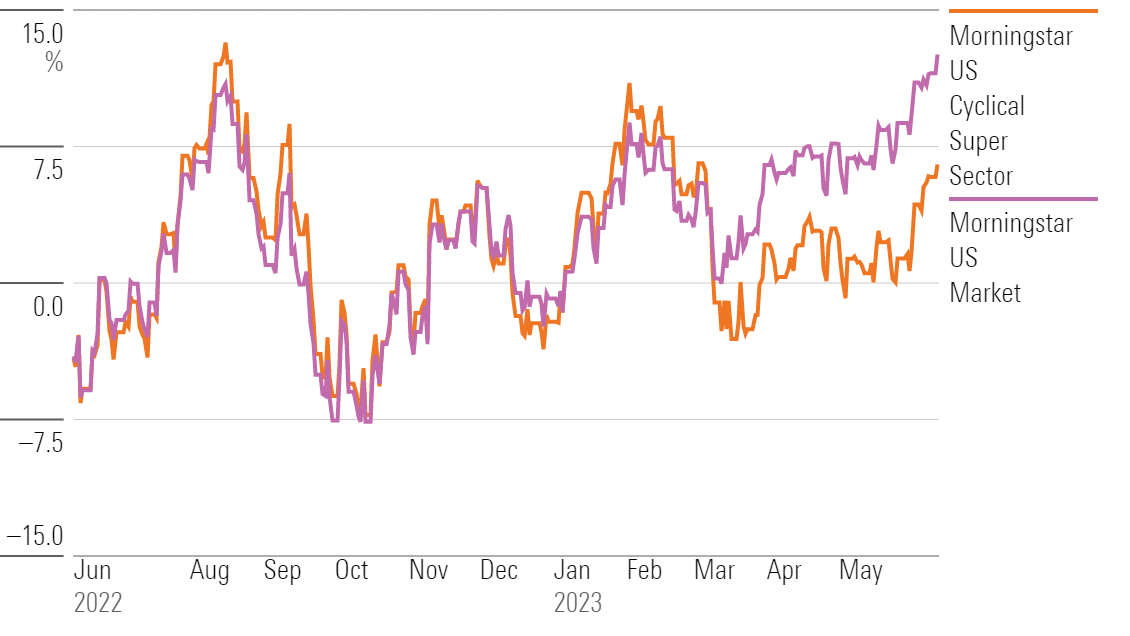

To find the best opportunities for investors, we searched for undervalued names among the 568 stocks in the Morningstar US Cyclical Super Sector Index. As of June 15, 2023, the index rose just 13.87% for the trailing 12-month period while the broader market grew 20.57% as measured by the Morningstar US Market Index.

Although cyclical stocks have seen sustained growth over the second quarter of 2023, there are still plenty of four- and five-star names trading at discounted prices. Of the 233 stocks in the Cyclical Super Sector Index covered by Morningstar analysts, 228 (the vast majority, and nearly half the stocks in the overall index) were undervalued as of June 15.

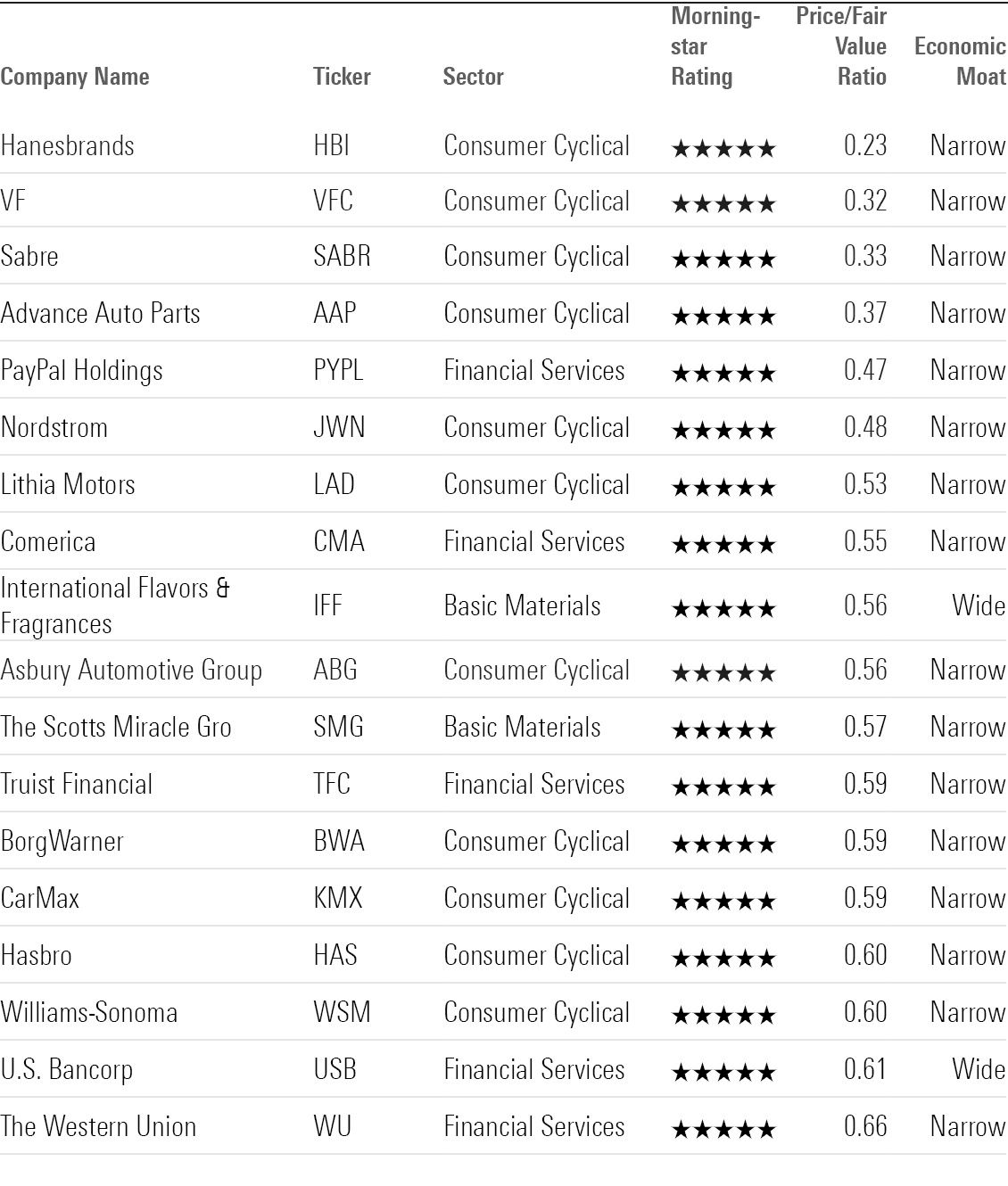

To narrow this list, we screened for undervalued stocks that have earned a Morningstar Economic Moat Rating to find companies with the strongest durable competitive advantages. The combination of undervalued stock and an economic moat can offer greater odds of future outperformance.

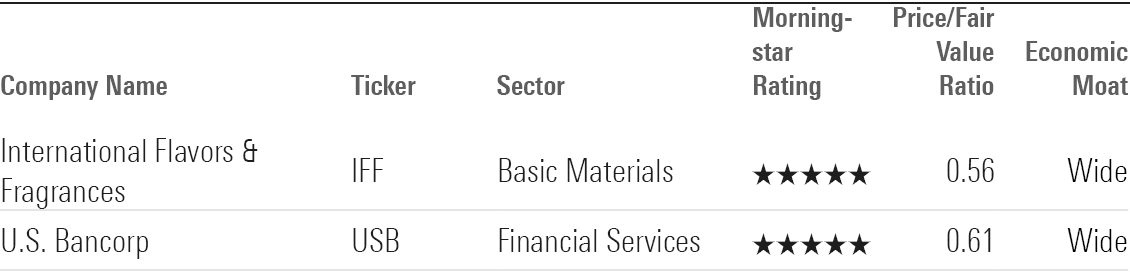

That screen took us down to 18 stocks. From there we honed in on those with wide economic moats, meaning their competitive advantages are expected to last more than 20 years, which left us with two stocks: International Flavors & Fragrances and U.S. Bancorp, both of which traded more than 30% below their fair value estimates.

The full list of 18 undervalued consumer cyclical stocks with moats can be found at the end of this article.

Morningstar US Cyclical Super Sector

What Is a Cyclical Stock?

Cyclical stocks follow the overall economy, rising and falling alongside macroeconomic trends. That’s largely because many of the industries in the category depend on discretionary spending. The cyclical super sector includes stocks from the basic materials, consumer cyclical, financial services, and real estate sectors. JPMorgan Chase JPM, Tesla TSLA, and McDonald’s MCD are among the largest companies in the Morningstar Cyclical Super Sector Index.

The Best Cyclical Stocks to Buy Now

These were the two wide-moat stocks among the most undervalued names in the Morningstar US Cyclical Super Sector Index as of June 15:

- International Flavors & Fragrances

- U.S. Bancorp

Of the two, International Flavors & Fragrances is more undervalued, trading at a 44% discount to its fair value estimate set by Morningstar analysts.

Top Two Undervalued Cyclical Stocks

International Flavors & Fragrances

- Industry: Specialty Chemicals

- Morningstar Fair Value Estimate: $140.00

“International Flavors & Fragrances is a global leader in the specialty ingredients space. The company has grown rapidly via acquisition, having added DuPont’s nutrition and biosciences business in 2021 and Frutarom in 2018.

“IFF is the largest specialty ingredients producer globally. The company sells ingredients for the food, beverage, health, household goods, personal care, and pharmaceutical industries. The company makes proprietary formulations, partnering with customers to deliver custom solutions. The company’s Nourish division, which generates roughly half its revenue, is a leading flavor producer. Its health and biosciences business, which generates around one-fourth of revenue, is a global leader in probiotics and enzymes. IFF is also one of the leading fragrance producers in the world.

“We assign a wide moat rating to International Flavors & Fragrances. Moaty businesses that operate in this space tend to benefit from switching costs, intangible assets, or cost advantage. For IFF, we cite only intangible assets and switching costs. The company’s highly valuable intangible assets (in the form of proprietary formulations) provide significant pricing power, while switching costs help ensure durable economic profit generation.”

—Seth Goldstein, strategist

U.S. Bancorp

- Industry: Regional Banks

- Morningstar Fair Value Estimate: $53.00

“U.S. Bancorp is one of the nation’s largest regional banks, with branches in roughly 26 states, primarily in the Western and Midwestern United States. The bank offers many services, including retail banking, commercial banking, trust and wealth services, credit cards, mortgages, and other payment capabilities.

“The bank has national scale and a unique mix of fee-generating businesses, including payments, corporate trust, wealth management, and mortgage banking, all while avoiding investment banking. The payments business consists of merchant acquiring, corporate payments, and the more typical retail credit cards and debit cards. The trust business involves being an admin and custodian for different investment vehicles. Most regional peers don’t have these in their business mix. While these units have generated attractive returns, their heavy fixed-cost nature and scalability have led to consolidation in both industries and therefore heavy competition, with U.S. Bancorp now a relatively small player. Having this more complete product portfolio does give the bank competitive advantages.

“Its latest strategy has been to focus on its payments ecosystem, expand its branch footprint, and pursue new acquisitions and partnerships. The bank has moved into several new population centers over the last several years, has partnered with State Farm, and is investing in its payments ecosystem. It wants to win more software-centric merchant acquiring business while also cross-selling more payments-related services to its corporate banking clients and vice-versa.”

—Eric Compton, strategist

Top 18 Undervalued Cyclical Stocks

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/N7VBPGEKIZDBPEAHLKIWYNRLBE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)