Would the Dissolution of the Fiduciary Rule Bring Back CEF IPOs?

It's unclear whether the rollback of this rule would help ignite this dormant market, but probably not.

The much-debated fiduciary standard has come under attack by the Trump administration, and its implementation will likely be stalled. In previous columns, we've discussed how this would affect closed-end fund IPOs, and we will revisit that discussion briefly in the context of the potential course reversal.

The fiduciary standard is the highest standard of care required by investment professionals. Before the Department of Labor rule was proposed, it applied only to Registered Investment Advisors under the Investment Advisers Act of 1940. The lines between RIAs and broker/dealers are blurring, however, and regulators (rightly) wanted increased responsibility on the part of the broker/dealers. The fiduciary standard required advisors (and broker/dealers under certain circumstances) to put their clients' interests before their own and to eliminate conflicts of interest or disclose any conflicts that cannot be eliminated. Under the DOL's rules, broker/dealers would have been required to meet the fiduciary standard when dealing with retirement assets and accounts.

What does this have to do with CEF IPOs? Stepping back, from a nuts-and-bolts perspective, launching a CEF isn't free, and traditionally investors have paid those fees. Mathematically, this means that all CEFs trade at premiums at the IPO, and history has shown that most IPO premiums dissipate within a few months of launch. Investors in the IPO are likely to lose money based on share price returns within the first few months of a fund's launch because of the premium dissipation. Coming back to the fiduciary standard, while a newly launched fund may be suitable for inclusion in an investor's portfolio, the reasonable chance of losing money, coupled with the high commissions that brokers earn for selling CEF IPOs, would not meet the fiduciary standard.

There has been a sharp decrease in CEF IPOs in the past few years, and while the fiduciary rule isn't to blame, it most certainly would have made IPOs a more challenging proposition in the future. The number of CEF IPOs reached 41 in 2007 but fell to just nine in 2016. The asset-raise has also been much lower for more recently launched CEFs. It's unclear whether the rollback of this rule will help ignite the CEF IPO market (rising interest rates won't help demand for bond CEFs), but it's worth considering in light of these changes. Our stance remains the same: We do not think CEF IPOs are appropriate investments.

What does this mean for investors? On the whole, CEF discounts should narrow as supply dwindles and demand for high payouts continues. That said, depending on the Federal Reserve's interest-rate moves (how fast and how high), demand could wane if investors no longer need to reach into riskier fare for income generation. What's more, in times of market stress and uncertainty, the volatility of CEFs may be too much for some investors to stomach, pushing discounts wider.

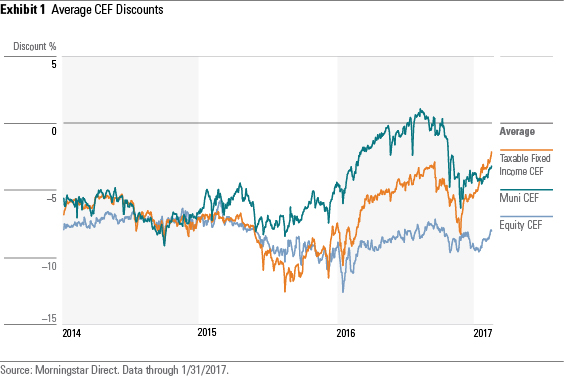

CEF Discount Trends Discounts for the three broad categories of CEFs narrowed last month and are significantly narrower than they were a year ago. Equity CEFs closed January 2017 with an average discount of 8%, compared with 10% at the end of 2016 and 8% in January 2015. For taxable bonds, the average discount narrowed to 2% from 4% at year-end 2016. That group's average discount was 8% a year ago. Muni CEF discounts have been the most volatile over the trailing 12 months. The average muni CEF's discount was 3% at the end of January compared with 4% one month ago (and a year ago). The average muni CEF was selling at a slight premium for much of June to September of last year, though the sell-off was swift, leaving the average discount of nearly 6% by mid-October. Exhibit 1 shows the average discounts for the three major CEF asset classes for the trailing three-year period.

Valuations We use a z-statistic to measure whether a fund is "cheap" or "expensive." As background, the z-statistic measures how many standard deviations a fund's discount/premium is from its three-year average discount/premium. For instance, a fund with a z-statistic of negative 2 would be two standard deviations below its three-year average discount/premium. Funds with the lowest z-statistics are classified as relatively inexpensive, while those with the highest z-statistics are relatively expensive. We consider funds with a z-statistic of negative 2 or lower to be "statistically undervalued" and those with a z-statistic of 2 or higher to be "statistically overvalued." Typically, we prefer to use the three-year z-statistic, which shows the funds that are most heavily discounted relative to their prices over the past three years. Exhibit 2 lists the 10 most undervalued CEFs as of Jan. 31.

Just one CEF looks undervalued based on the three-year z-statistic as of the end of January. Pioneer Municipal High Income Advantage MAV was selling at a 5% discount, and its z-statistic was negative 2.1. The fund's share price has fallen off a cliff recently: It's down 16% over the trailing 12 months, while its net asset value is down just 1%. The fund was also among the worst performing in its high-yield muni Morningstar Category last year and for the year to date based on NAV and share price.

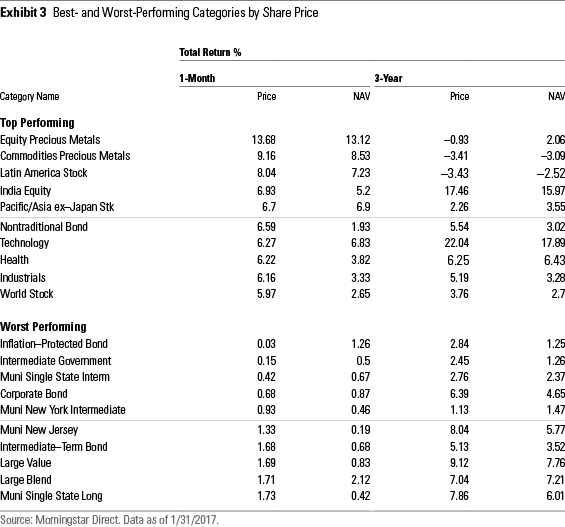

Best- and Worst-Performing CEF Categories The best-performing CEF categories in January, not surprisingly, were commodities-focused. After a tumultuous first few weeks of the Trump administration, the price of gold jumped 5.2% in January and has continued its rise into early February. Equity precious metals gained 14% on share price and 13% on NAV last month while commodities precious metals gained about 9.0% and 8.5%, respectively.

Among the worst-performing were fixed-income categories, as investors expect the Fed to raise interest rates multiple times this year. That said, the market uncertainty still led to positive returns for even these worst-performing categories. The 10 best- and worst-performing CEF categories for January are listed below.

Alaina Bompiedi contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)