Will the Fund Industry Ever Change?

Probably not, as its customers have become very set in their ways.

4 Trends

“Ever,” of course, should not be taken literally. Long before the sun explodes, the fund industry will have ceased to exist. (Some forecasts may safely be made.) In practical terms, though, “ever” means during the next three decades—roughly, the investment horizon for experienced investors.

Over that period, I believe that the answer to the headline’s question is “No, the industry will not change.” When 2050 arrives, its structure will closely resemble today’s.

Nine years ago, when I began writing this column, there were four major fund-industry trends. 1) Passive funds were quickly gaining market share; soon, it seemed, they would outsell actively run funds. 2) Exchange-traded funds were luring customers away from mutual funds. 3) Vanguard was eating the industry’s lunch. 4) Recently popular “liquid alternatives” funds were beginning to lose steam. It appeared that almost all industry assets would remain in equity, bond, and allocation funds, as had been the case for the previous 90 years.

It was difficult to envision how these tendencies might shift. The first three items were interrelated; if actively managed funds significantly outperformed their passively run cousins, then not only would they regain popularity, but the growth of both ETFs and Vanguard would slow. But what conditions could aid them? The global financial crisis demonstrated that an equity bear market would not be enough. In 2008, the Morningstar US Market Index dropped 37%, yet active funds still failed to shine. Admittedly, equity losses did boost the sales of liquid alternatives. But once stocks resumed their climb, investors stopped buying those funds.

The Index-Fund Revolution

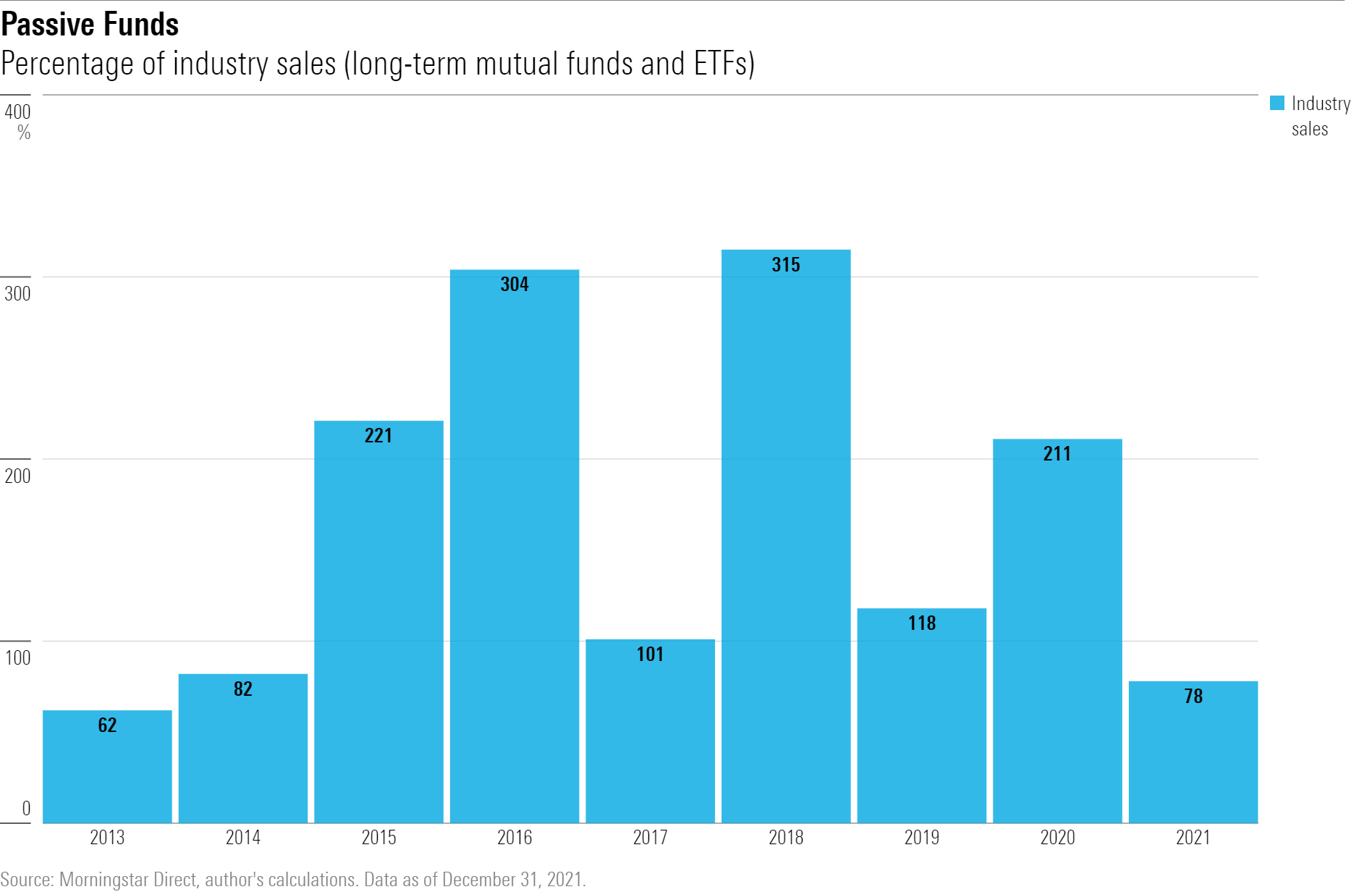

And indeed, nothing has changed. To start, passive funds have gained further ground. In 2013, they accounted for 62% of net fund sales, as measured by mutual fund and ETF assets, excluding money market funds and funds of funds. (Including the latter would lead to double-counting.) Every year since then they have surpassed that mark, usually by large margins.

Figures over 100% are ostensibly gibberish—how can one type of fund record more net new sales than the entire industry?—but they do make sense, in their own way. When passive-fund sales exceed 100% for a year, that means that active funds suffered net redemptions, while passive funds posted net sales. Such was the case from 2015 through 2020, before active funds temporarily recovered. (But only temporarily. This year, active funds are once more in redemption.)

ETFs Prevail

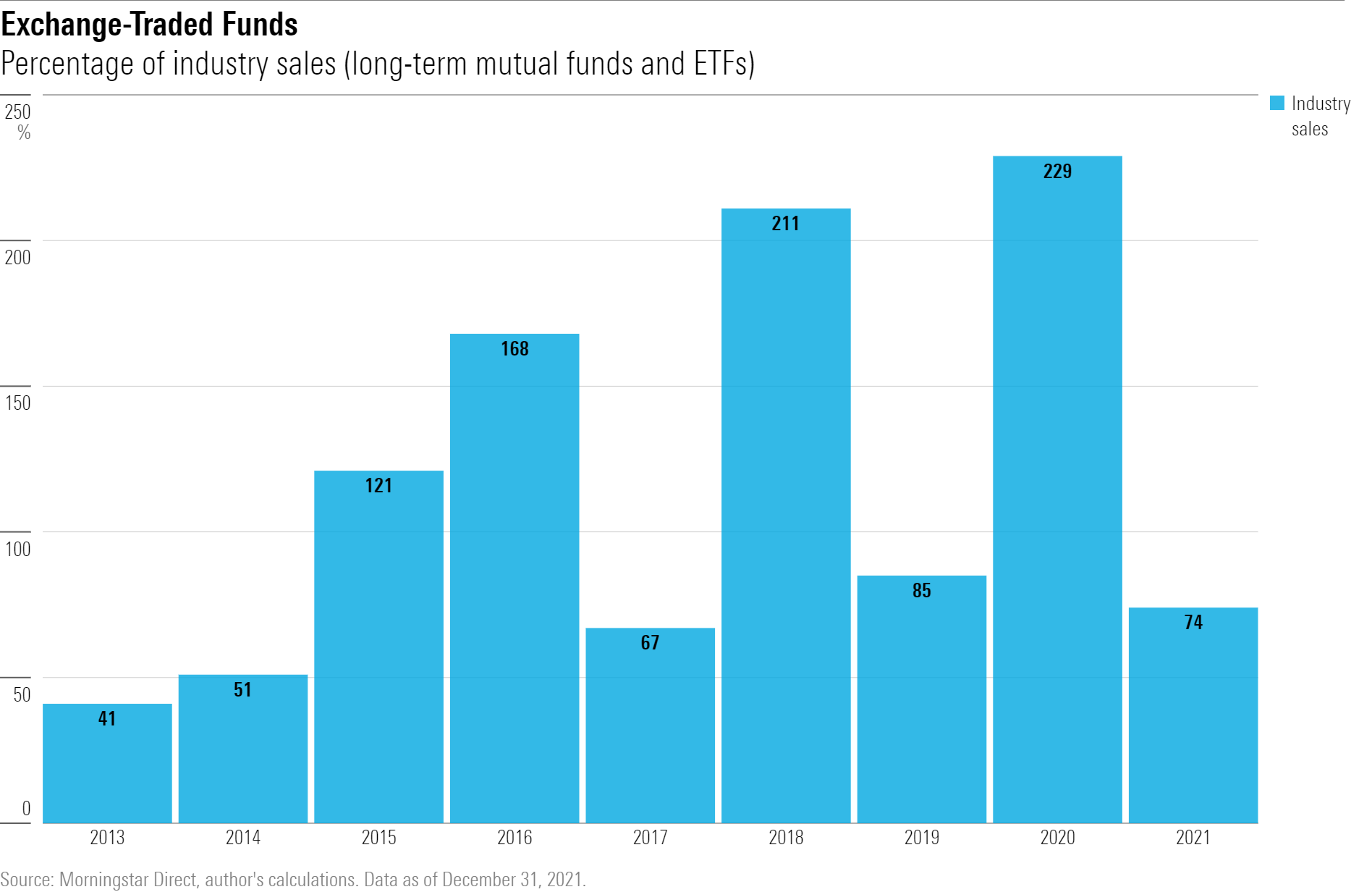

The pattern is similar for ETFs. In 2013, they accounted for 41% of net new sales. Mutual funds were still ahead, but they were unlikely to stay that way, given how rapidly ETFs were eating into their lead. Sure enough, ETFs outsold mutual funds the very next year, and they have not been challenged since. During four of the past seven calendar years, their sales percentages have surpassed 100%.

As with the passive-active comparison, mutual funds mounted something of a comeback in 2021, notching their best showing since 2017. And, again, their revival was short-lived. Last year’s bull market floated all boats, but this year’s bear market has sent mutual funds back into aggregate redemption—deeply so. At $400 billion, net mutual-fund redemptions through June 30 already far exceed any single-year total. Meanwhile, ETFs are on pace to record their second-highest sales year ever, trailing only their 2021 amount.

The Vanguard Steamroller

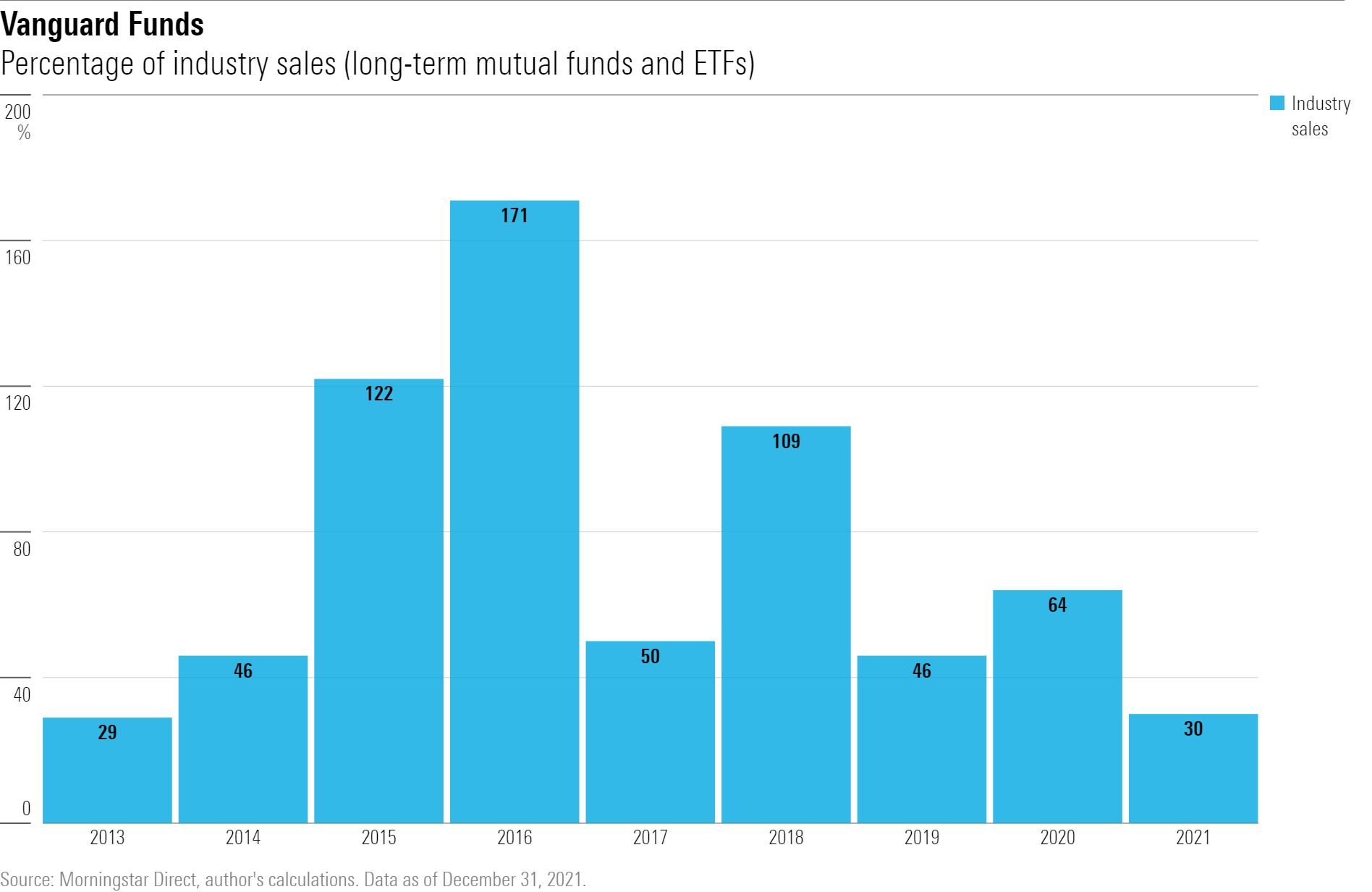

It is déjà vu all over again with Vanguard’s market share. By 2013, Vanguard had already gone where no fund company had been before, receiving 29% of the industry’s incoming flows. In an industry that historically had been fragmented, with its leaders barely achieving 10% market shares, Vanguard’s results rewrote the record book. Worse yet for its competitors, the company was gaining momentum, not losing it. Vanguard has since stepped even further forward.

As with the sales figures for both passive funds and ETFs, Vanguard’s apparent dip in 2021 was illusory. Its percentage of net new sales declined not because its business slumped, but because other fund companies were buoyed by the year’s abnormally high inflows. Once the spigot slowed, thanks to stock- and bond-market losses caused by spiking inflation and the Federal Reserve’s interest-rate hikes, Vanguard’s competitors fell back to earth. In contrast, Vanguard racked up more than $150 billion in net new sales during the first half of 2022.

On the Fringe

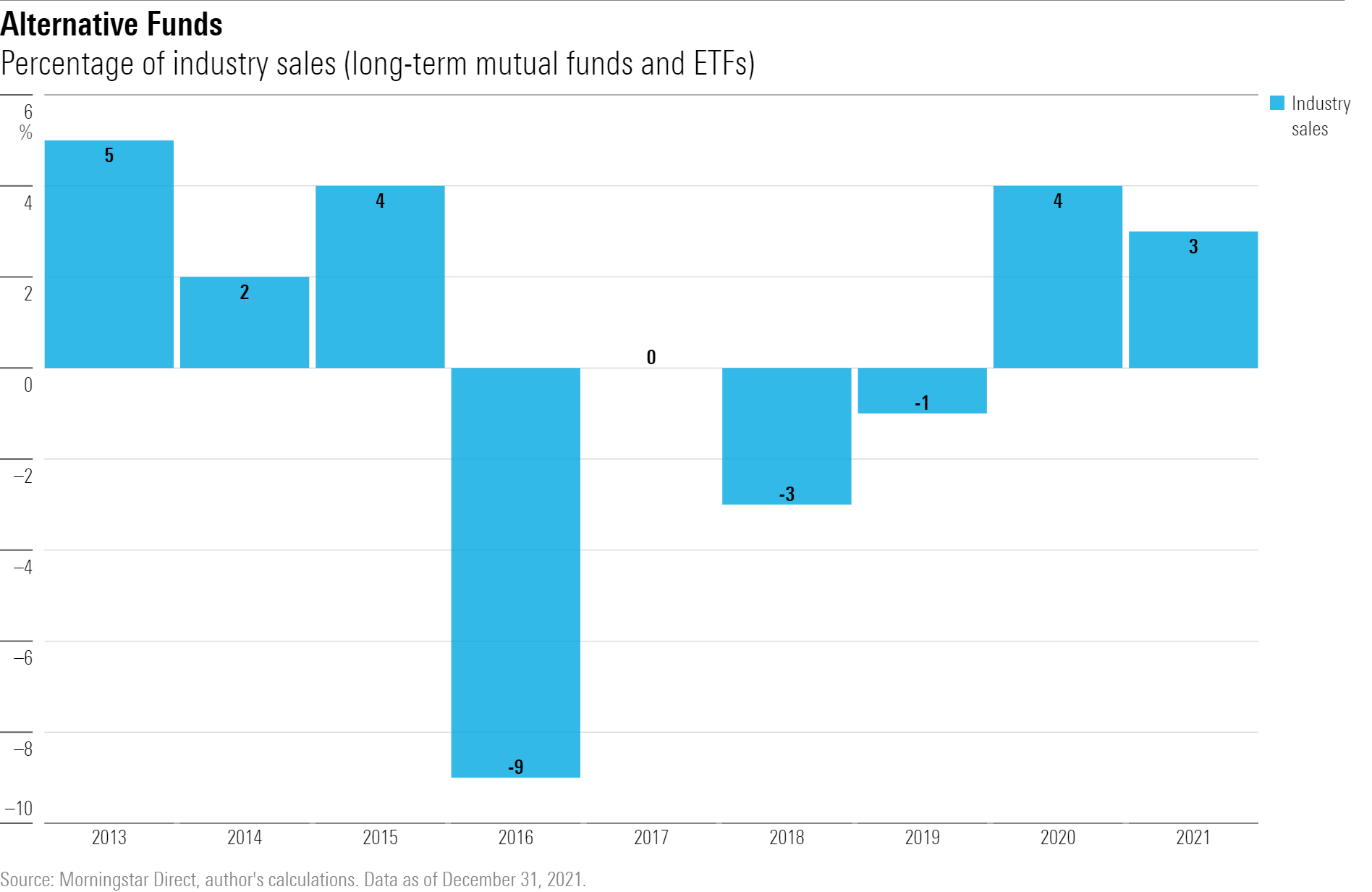

The final 2013 trend, that of sliding liquid-alternatives sales, also played out. Until this year—thanks to the twin stock and bond bear markets, such funds have rebounded this year, although at $23 billion, their net new sales nevertheless trail those of both U.S and international equity funds—liquid alternatives funds could not even match 2013′s modest sales performance. (Negative figures on the chart indicate that liquid alternative funds underwent net redemptions, even as the rest of the industry recorded positive sales.)

Investors Have Spoken

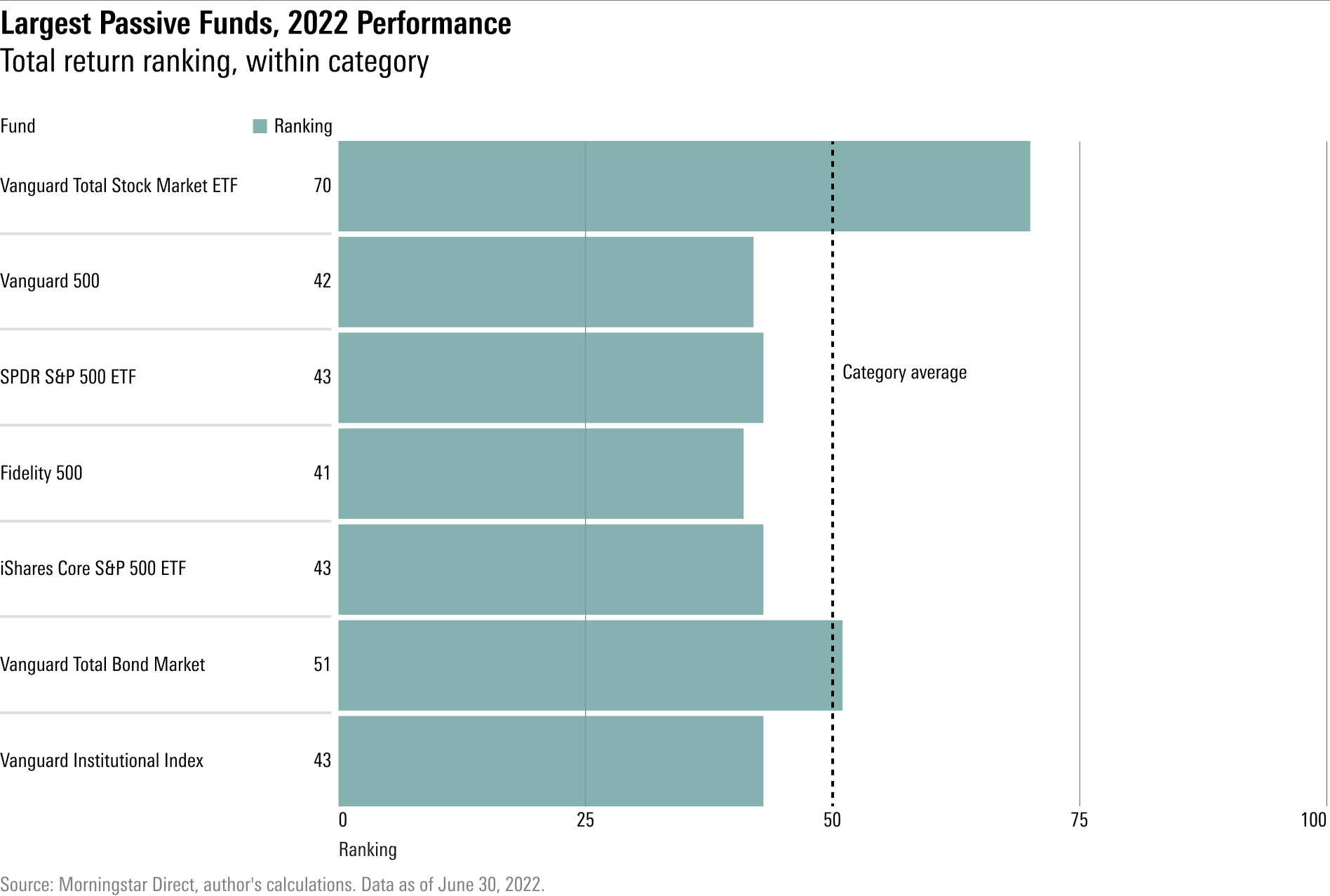

In short, the industry is as it was in 2013—only more so. It almost certainly will continue that path. As with 2008 and again briefly in 2020, a stock downturn has given active fund managers the opportunity to prove their frequent claim: Anybody can profit during a bull market, but when things get tough, the value of active management will be demonstrated. As shown by the following chart, which depicts the year-to-date category rankings through June 30, 2022, for the seven largest index funds—which also happen to be the industry’s seven largest funds, period—most actively managed funds have not outmaneuvered their passive rivals.

The one chance for meaningful change within the industry, I believe, is if inflation stays persistently high, as it did during the 1970s. In that case, liquid alternatives funds would likely remain in favor, thereby permitting them to join the industry’s mainstream. Otherwise, though, I strongly suspect that if I revisit this topic nine years hence, my conclusions will be much the same. It seems that, after several decades of experimenting, fund investors have learned what they like.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)