T. Rowe Price Upgrade Leads the Way in February

For a change, we have more upgrades than downgrades.

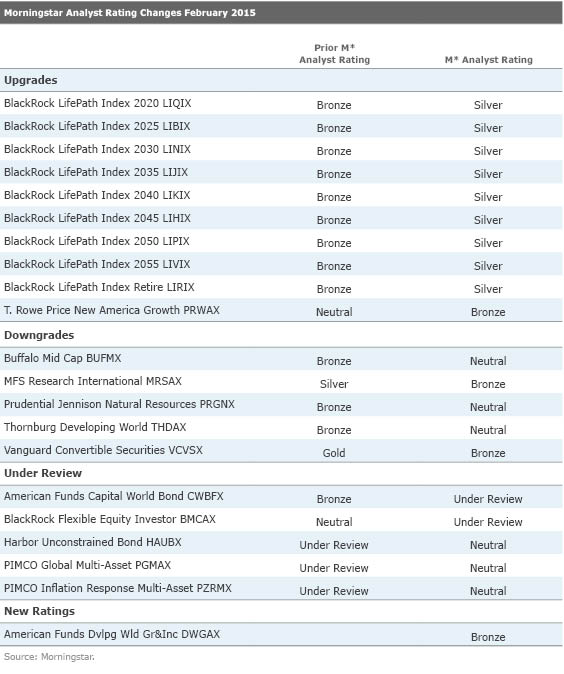

We’ve upgraded more funds than we downgraded for a change. BlackRock’s target-date funds account for most of the upgrades, but, hey, we’ll take what good news we can get. Besides BlackRock, we have changes to funds from big name shops like T. Rowe Price, Vanguard, and American Funds. Here are some highlights. See the table below for the complete list of changes.

Upgrades

BlackRock has a long history of implementing deliberate, well-researched changes to its target-date funds. The firm’s recent research on investor preferences and behavior, as well as a review of its long-term capital market assumptions, led to a significant increase in stock exposure in several of its target-date funds in late 2014, though the stock exposure at retirement saw just a modest increase. Investors in the BlackRock LifePath Index series stand to benefit from its solid mix of index-based strategies and attractive fees in addition to the firm’s robust research effort. These factors combined to lift the series’ Morningstar Analyst Rating to Silver from Bronze.

Downgrades

The retirement of

The fund’s long-term track record remains strong--it landed in the top decile of peers over the past 10 years, and its fees are low.

New Rating

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/C3BD5QQZTNEMBAM7D35YO7ZH6A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YGF5R6YDPJESJOU7XABKHHIP3Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)