Sustainable Portfolio Building Blocks: 2 ESG Funds at the Top of Their Games

A low-cost ESG stock-index fund and a bond fund with social and environmental impact.

Interest in sustainable investing is growing, but many investors don’t know where to begin. Here are two outstanding environmental, social, and governance funds–one stock, one bond–that would be solid building blocks for any sustainable portfolio.

A Low-Cost ESG Stock-Index Fund

The fund tracks the FTSE4Good U.S. Select Index. The mostly large-cap stocks in the index are selected based on an evaluation of how well a company is handling various environmental, social, and governance risks and opportunities it faces. Stocks of firms involved in controversial weapons systems, coal, and tobacco are excluded, and stocks of firms involved in nuclear power generation and the manufacture of infant formula must meet especially stringent standards to be included.

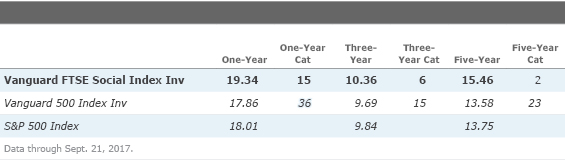

The resulting portfolio has 400-plus holdings, skewed toward growth, although the fund has enough value and core exposure to keep it in the large-blend Morningstar Category. With no sector constraints, the portfolio, relative to the S&P 500, has overweightings in technology, financials, and healthcare and underweightings in energy, utilities, and industrials. Performance over the past five years has been excellent. Through Sept. 21, the fund’s 15.5% annualized five-year return was considerably higher than the S&P 500’s 13.8% return and better than the returns of 98% of its category peers. Over the trailing decade, the fund trails the S&P 500 by a scant 0.2% annualized, owing to its lagging 2008 performance, which resulted from its relatively higher-growth/higher-volatility profile. That said, the fund’s 10-year annualized return still places in the top third of the large-blend category.

Another plus for sustainable investors, which I’ve discussed recently: Vanguard has begun engaging with companies it owns around ESG issues, particularly climate-risk disclosure and the representation of women on boards. It voted in favor of shareholder resolutions this year, requesting that ExxonMobil and Occidental Petroleum disclose what they consider to be the climate-change-related risks to their businesses. (This particular fund doesn’t own those securities, but many other Vanguard funds do.)

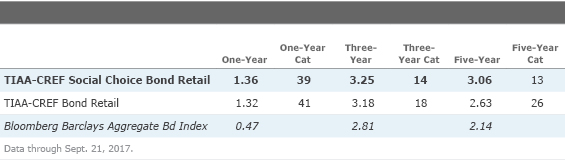

A Bond Fund With Social and Environmental Impact

The fund aims to deliver credit and interest-rate exposure similar to that of the index but does so while also emphasizing environment, social, and governance impact. A little more than half of the portfolio consists of government and corporate bonds that are filtered using ESG criteria. Each sector has its own relevant metrics, with only those bonds ranking in the top half of their peer group making it into the portfolio-selection universe. From there, the strategy follows TIAA’s fixed-income process, with sector managers responsible for security selection and lead manager Stephen Liberatore handling overall risk and allocation decisions. TIAA has been using ESG criteria to manage bond portfolios for more than two decades.

The other half of the portfolio consists of proactive social investments–bonds that finance projects that have measurable social or environmental impact in the areas of affordable housing, community or economic development, and renewable energy and natural resources. The rapid growth of issuance of green bonds and other social-purpose bonds over the past few years has allowed the fund to increase this sleeve to as much as 45% of assets, all while maintaining an overall risk profile in line with its conventional category peers.

Topnotch Performance

The accompanying exhibits show just how well these funds have performed over the trailing five years. I used returns data through Sept. 21 because that was the five-year anniversary of the TIAA-CREF fund. TIAA-CREF Social Choice Bond’s returns not only rank near the top of the fund’s Morningstar Category but also beat those of the conventional

- source: Morningstar Analysts

Vanguard FTSE Social Index’s returns not only land near the very top of its Morningstar Category but also beat those of the Vanguard 500 Index fund by 1.88% annualized over the past five years. Some of that outperformance is related to its growth-tilted portfolio, but even compared with funds in the large-growth Morningstar Category, the fund’s five-year returns would place in the top 15%.

- source: Morningstar Analysts

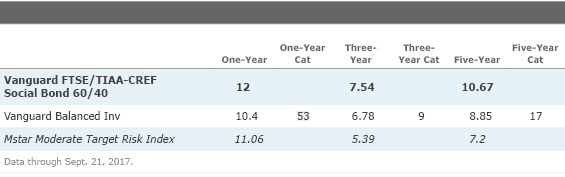

The final exhibit illustrates what would have happened had an investor combined the two funds into a balanced portfolio with a 60% allocation to stocks and a 40% allocation to bonds. The five-year returns of the ESG balanced portfolio would have surpassed those of

- source: Morningstar Analysts

Building Blocks for an ESG Portfolio These funds are great starting points for your ESG portfolio. If you are just getting started and don't really need any bond exposure, just invest in Vanguard FTSE Social Index. Granted, this is a U.S.-only portfolio, but there is nothing wrong with keeping things simple. Investment legends Jack Bogle and Warren Buffett both tout the virtues of basic U.S.-centric indexed portfolios. Buffett argues that most people and even most institutions are likely to be just as well off with an S&P 500 index fund and, for diversification, a Treasury fund than with a complex–and more expensive–globally allocated portfolio of stocks, bonds, and alternatives. For his part, Bogle argues that investors get plenty of international exposure through the multinational companies that are included in an indexed U.S. large-cap portfolio. Whether you agree or not–and for what it's worth, I think it's generally a good idea to have some non-U.S. equity exposure in a portfolio–as an initial foray into sustainable investing, Vanguard FTSE Social Index is hard to beat. You can diversify into international stocks later. That said, if you have the means for it, now is not a bad time to invest outside the United States given that U.S. equity valuations are higher than those of developed markets outside the U.S. I discussed the range of viable sustainable international-stock fund options in a previous column.

If you already have a portfolio with an established stock-bond allocation and want to begin adding new money to ESG, simply allocate to these funds in roughly the same proportion as your allocation. If you don’t have much money to invest, you won’t be able to calibrate as precisely. If you invested the minimum in each fund ($3,000 to Vanguard and $2,500 to TIAA-CREF), you would have a 55% stock/ 45% bond allocation. If that’s too conservative, you can push up your equity exposure by allocating subsequent investments to Vanguard, which can be in any amount. If you set up an IRA with the minimum initial investment for both funds ($3,000 to Vanguard and $2,000 to TIAA-CREF), you would have a 60% stock/40% bond allocation.

For defined-contribution plans that have no ESG fund options, these two would be strong choices, allowing participants to allocate based on their overall stock-bond allocations. If you are a plan participant, ask your plan provider about this. They are often more responsive if you offer specific ESG investment options for them to consider.

Learn more about Morningstar's approach to ESG investing.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)