Some CEFs Are Getting a One-Time Boost to NAV

The potential for rising rates casts ARPS in a new light, and falling commodity prices continue to pressure MLP closed-end funds.

The potential for rising interest rates isn't just affecting closed-end fund discounts and premiums, but also the market for auction rate preferred shares. ARPS are a type of leverage used by CEFs. ARPS are typically perpetual in nature and pay dividends to preferred shareholders based on a weekly auction. If the market becomes illiquid (no one is willing to bid), the payment is based on a maximum penalty rate, which is pegged to a short-term index. Pre-2008, this was the most popular type of leverage financing used by CEFs, but the ARPS market became illiquid in 2008. It remains "frozen" today, which means funds still using ARPS are paying the (very low) penalty rate.

While the industry largely redeemed outstanding ARPS shortly after the ARPS market froze, about $6 billion in ARPS remains outstanding as of June 2015, according to Fitch Ratings. Previously, most firms bought back ARPS at par, but recently funds have attempted to redeem outstanding ARPS at discounts to par. LMP Corporate Loan TLI, for example, redeemed 97.5% of its outstanding ARPS for 90% of par in late June. Why the change? For the most part, fund firms generally redeemed ARPS after the 2008 market freeze to preserve their reputations, but activist investors have spurred on the recent redemption programs.

Common shareholders should care about this for two reasons. First and foremost, if ARPS are redeemed at a discount, the action is immediately accretive to a fund's net asset value, and therefore to its common shareholders. For example, take a fund with $50 million in total assets, which includes $10 million in ARPS (the fund has $40 million in net assets). The fund redeems $1 million of the ARPS at 90% of par value (or $900,000) using proceeds from newly issued leverage (perhaps a line of credit or variable-rate ARPS). After the redemption, the fund still has $50 million outstanding (it just swapped one type of leverage for another, it didn't liquidate underlying holdings) but the makeup is slightly different--$9.9 million in leverage and $40.1 million in net assets. This is a 0.25% return to the NAV. To be sure, a fund's share price may not follow suit, so while the underlying NAV will increase, shareholders may not actually benefit with a higher share price. Secondly, the replacement leverage is likely to be more expensive because the penalty rate on ARPS is currently very low (in the neighborhood of $0.01 to $0.02 per common share), which is a disadvantage to common shareholders.

Calamos Dynamic Convertible and Income July marked the first month that Calamos Investments began to purchase shares of its newly launched Calamos Dynamic Convertible and Income CCD in the secondary market. In an effort to support secondary-market trading, the firm said it would purchase a certain number of shares (as limited by the SEC, $125,000 in shares or 25% of the fund's average daily trading volume over a four-week measurement period) if the discount dropped below 2% between July 7, 2015, and Feb. 25, 2016. The fund's discount has been wider than 2% since the start of July and Calamos has been purchasing the maximum number of shares allowed each day. Because of the limits placed on the firm by the SEC, the actual number of shares purchased has been small--typically around 5,500 to 5,600 shares--and hasn't counteracted the broad sell-off in the CEF market. This fund lost nearly 7.0% on share price in July alone, though its NAV was up 0.34%. Its average convertibles peer lost 3.5% on share price and 0.61% on NAV.

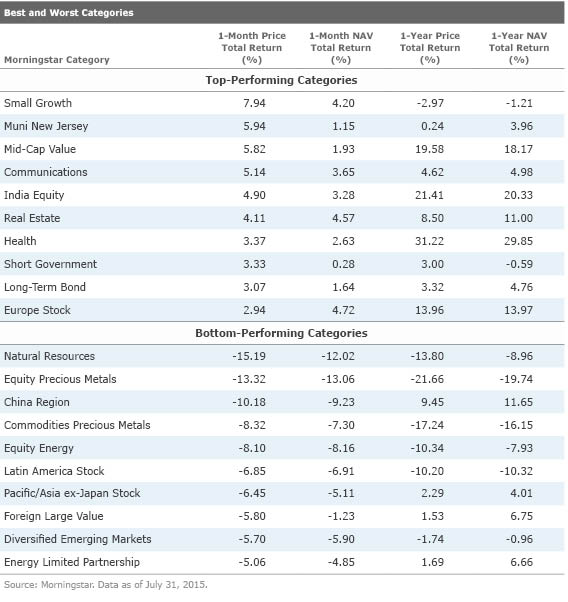

Best- and Worst-Performing CEF Categories Commodities and related categories (natural resources, energy precious metals, commodities precious metals, equity energy, and energy limited partnerships) suffered last month as commodity prices continued to drop. The S&P GSCI Index, which measures a basket of 24 commodities, lost 14% last month, and the index was down more than 40% for the 12 months ended July 31. The Credit Suisse Commodities Benchmark, which provides long-only exposure to commodities through futures contracts, lost 13% in July and 38% for the trailing 12 months, while the Bloomberg Commodity Total Return Index, which tracks the returns of a diversified commodity basket, lost 11% last month and 28% during the last year.

The average energy limited partnership CEF lost 20% on NAV and 24% on share price in the last three months, damping what was a strong medium-term record for these funds. For the three-year annualized period through April 30, 2015, the average MLP CEF was up 12% on NAV and 9% on share price. Through July 31, the average fund's three-year annualized return was 3% on NAV and negative 1% on share price. Exhibit 1 lists the best- and worst- performing categories in July based on share price return.

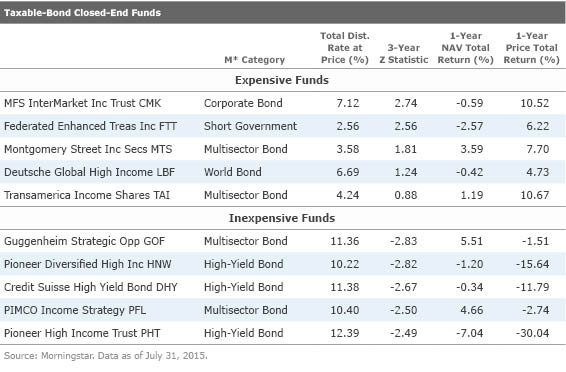

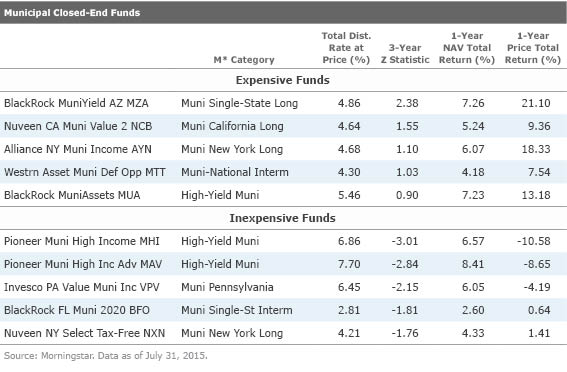

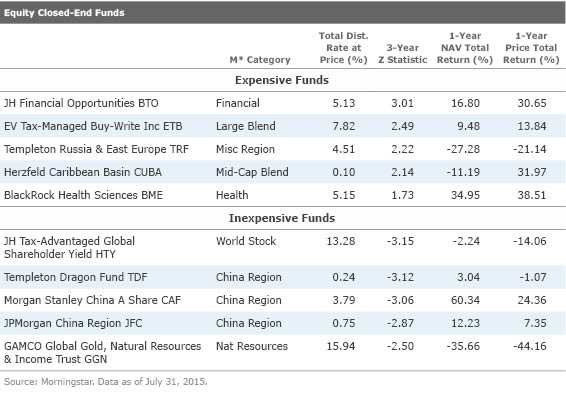

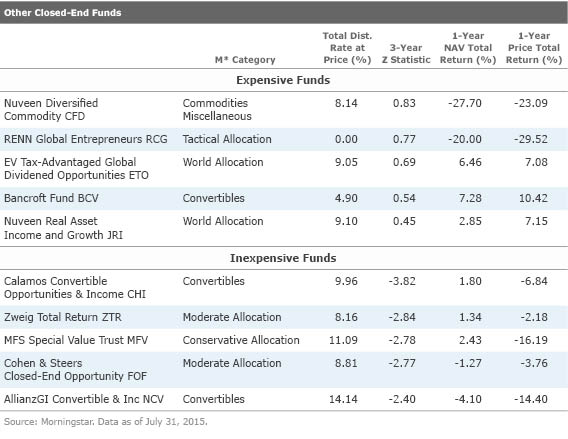

Most Expensive and Inexpensive CEFs The following exhibits list the most expensive and inexpensive CEFs based on three-year z-statistics as of July 31. The z-statistic measures how many standard deviations a fund's discount/premium is from its three-year average discount/premium. For instance, in these tables, a fund with a z-score of negative 2 would be two standard deviations below its three-year average discount/premium. Funds with the lowest z-scores are classified as Relatively Inexpensive, while those with the highest z-scores are Relatively Expensive. We consider funds with a z-score of negative 2 or lower to be "statistically undervalued" and those with a z-score of 2 or higher to be "statistically overvalued."

Taxable-Bond CEFs The discounts of most taxable-bond CEFs continued to widen last month. The table below shows the five most undervalued taxable-bond CEFs as of July 31. In all, 14 taxable-bond CEFs had three-year z-statistics of less than negative 2 at month-end, and all but one of the 14 fell into either the high-yield bond and multisector bond Morningstar Categories. PIMCO manages six of the 14 undervalued funds, though the two PIMCO funds with the largest historical premiums (PIMCO High Income PHK and PIMCO Global StocksPLUS & Income PGP) appeared fairly valued as of July 31.

Municipal CEFs Although Puerto Rico did not officially default until the first days of August, negative headlines and the possibility of default weighed on the municipal market. Pioneer Municipal High Income MHI had a 2.5% weighting to Puerto Rico as of June 30, a likely reason for the fund's precipitous discount widening during the last few months. The fund's share price and NAV return were both positive (just under 1%) for July, but for the year to date through July, the fund lost nearly 10% on share price, though its NAV was slightly positive (1.5%). Pioneer Municipal High Income was the most undervalued muni CEF as of July 31.

BlackRock MuniYield Arizona MZA looked overvalued based on its three-year z-statistic of 2.4, and its 16% premium seems strangely high. This is one of just two CEFs invested in Arizona municipal bonds (it holds no Puerto Rico, but a small exposure to Guam) and is half the size of Nuveen's Arizona CEF (Nuveen Arizona Premium Income Municipal NAZ) with about half the daily trading volume. BlackRock MuniYield Arizona began selling at a premium in early 2014 and that premium has persisted, while Nuveen Arizona Premium Income Municipal shares have largely been trading at a discount since early 2013. Interestingly, BlackRock MuniYield Arizona's distribution rate at share price was lower as of July 31 (4.9% versus 5.4%), which generally leads to a narrower discount, but it outperformed Nuveen Arizona Premium Income Municipal over multiple time periods on a NAV total-return basis.

Equity CEFs After a strong runup starting in late 2014, China's stock market took a nosedive, causing some investors to panic-sell shares of China CEFs. The Shanghai Stock Exchange Composite Index, for example, dropped 14% last month alone. Three of the most undervalued equity CEFs invest primarily in Chinese equities, and each had three-year z-statistics near or below negative 3 as of July 31.

Banks have been a bright spot for equities in 2015--

Other CEFs Despite a more than 11% annualized drop in share price during the last three years, Nuveen Diversified Commodity CFD appeared fairly valued (and had the largest positive z-statistic among this group) as of July 31. The fund's shareholders approved a conversion to an exchange-traded fund, which is subject to regulatory approval. This has brought the fund's share price more in line with its NAV as investors anticipate the conversion.

News You Can Use Initial Public Offerings Nuveen High Income 2020 Target Term JHY launched on July 29. The fund raised $124 million in assets and will invest primarily in shorter-maturity, high-yield corporate bonds.

AllianzGI Diversified Income & Convertible ACV announced that the underwriters purchased 90,000 shares in overallotment for gross proceeds of $2.25 million. In sum, the IPO raised $282.25 million.

Mergers, Liquidations, and Reorganizations Ares Management and Kayne Anderson announced plans to merge their investment operations, creating Ares Kayne Management. The merger is expected to close in January 2016, subject to regulatory approval. Ares runs two credit-oriented CEFs, though shareholders approved the merger of the funds (Ares Multi-Strategy Credit Fund ARMF into Ares Dynamic Credit Allocation ARDC), which is expected to occur during the third quarter of 2015. Kayne Anderson manages four MLP CEFs.

The board of directors of MFS InterMarket Income Trust CMK approved a plan to liquidate the fund, expected to take effect in early September 2015.

Deutsche Global High Income LBF and Deutsche High Income Opportunities DHG announced board approval of an amendment to extend the fund's effective liquidation date beyond 24 and 30 months, respectively, following the initial date of the 2015 annual meeting. The amendments await shareholders' approval.

Federated Investment Management Company, the advisor of Federated Enhanced Treasury Income FTT, recommended to the board of directors that the fund open-end, with a target conversion date during the fourth quarter of 2015.

Manager and Strategy Changes Ryan P. Lentell joined the portfolio management team of John Hancock Financial Opportunities.

Federico Kaune joined the portfolio management team of Strategic Global Income SGL and assumed the daily responsibilities for Global High Income GHI.

Ares Dynamic Credit Allocation may now invest up to 30% of its managed assets in collateralized loan obligations and other asset-backed securities, and may invest up to 7.5% in subordinated CLOs.

First Trust Mortgage Income FMY can now invest up to 35% of its managed assets in securities that, at the time of investment, are rated below BBB-.

Other News In early August, Guggenheim Partners announced a settlement with the SEC over a failure to disclose a potential conflict of interest related to a loan to an executive at Guggenheim Partners Investment Management. The firm hasn't confirmed or denied the allegations, but has said that clients were not harmed by the loan and that the loan was not illegal. The firm's CEFs did not trade widely out of line with peers on the day of the announcement, though we will continue to monitor the funds and the allegations against the firm.

Alliance California Municipal Income AKP and AllianceBernstein National Municipal Income AFB announced a voluntary tender offer to purchase up to 100% of the outstanding auction preferred shares at 94% of par. The offer expires on Aug. 24, 2015.

Aberdeen Emerging Markets Smaller Company Opportunities changed its ticker symbol to ABE from ETF, effective July 31.

Cornerstone Total Return CRF announced a 1-for-3 rights offering entitling shareholders of record on July 17 to subscribe for an aggregate of 1.5 million additional shares. The offer expires Aug. 14, 2015.

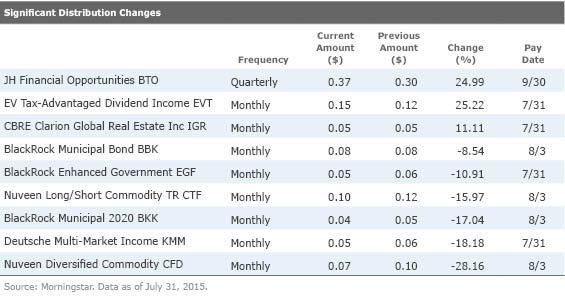

Eaton Vance Tax-Advantaged Dividend Income EVT adopted a managed distribution policy and will pay a fixed distribution amount each month going forward.

Exhibit 6 lists significant distribution changes during July.

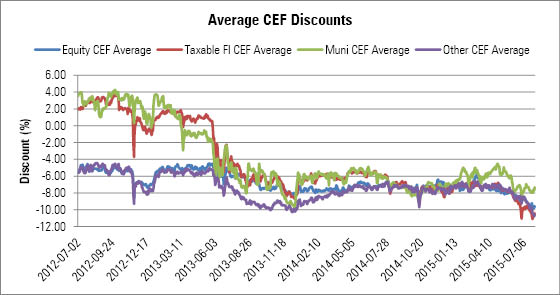

Discounts & Premiums During July, average discounts continued to widen for three of the four broad category groups. After months of negative headlines pushed the prices of municipal CEFs further from their NAVs, the group experienced a rebound, as the average discount narrowed to 7.3% from 8.2% last month. The average discount for taxable-bond CEFs widened, though not by much, to 10.4% from 10.3%. The exhibit below shows the average discount for equity, taxable fixed-income, municipal, and other CEFs over the trailing three years through July 2013.

Source: Morningstar. Data as of July 31, 2015.

----------------------------------------------------------------------------------

CEFA Advisor Summit at Morningstar's Office in Chicago

The CEFA Advisor Summit will be held at Morningstar's office in downtown Chicago on Sept. 17. This is a free event and features speakers from BlackRock, Nuveen Investments, Western Asset Management, and more.

Agenda Highlights: • The Role and Benefits of CEFs • Expanding Income Opportunities for Your Clients • U.S. Energy Renaissance and MLPs • International Exposure With CEFs • A Closer Look at Business Development Companies • Alternative Strategies in the CEF Space To attend, register here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZD4DY5U6GRAO5B7EP7NAECJAMM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)