Profit From Market Downturns With Deeply Discounted CEFs

The year 2015 has been unkind to many CEFs, but investors can purchase shares at steep discounts.

The latest policy statement from the Federal Reserve, released in mid-June, left the federal-funds rate unchanged but strongly hinted at two rate hikes later this year. While short-term rates remained roughly the same from the start of June, the 30-year Treasury rate rose to 3.11% at the end of June from 2.94%. This increase in long-term rates caused taxable fixed-income closed-end fund discounts to nosedive--the average discount for the group ended the month 254 basis points wider than the start of June. Nearly every taxable-bond Morningstar Category saw its average discount widen more than 200 basis points last month, including bank-loan CEFs, which prompted a number of questions from readers.

Back in 2013, I wrote an article highlighting the role that Libor floors will play in the performance of bank-loan funds when short-term interest rates begin to rise. Briefly, a Libor floor sets a minimum payment amount if the reference rate (here, Libor) falls below the specified "floor." Morningstar strategist John Gabriel discussed Libor floors in May and noted that, at the end of 2014, the weighted average Libor floor on the S&P/LSTA U.S. Leveraged Loan 100 Index was 0.85%. That’s 57 basis points higher than June 30’s three-month Libor of 0.28%. If, as many expect, the Fed begins its rate hike with a 25-basis-point increase, holders of these loans (and owners of bank-loan funds) will not see any increase in coupons collected. In fact, it would take three 25-basis-point bumps before coupons increased.

An added layer of complication for CEF investors is that many bank-loan funds use leverage and pay Libor plus a spread for that leverage. This means that the cost of leverage will increase as the Fed ups short-term rates, but the underlying holdings will not generate higher coupons. It is this dynamic that is likely holding bank-loan CEF share prices back (and keeping discounts wide) despite their low interest-rate sensitivity and the expectation of rising rates, which is typically an environment in which bank loans thrive.

Best- and Worst-Performing CEF Categories Energy-related CEFs continued to struggle in June. The energy limited partnership and equity energy Morningstar Categories each had their worst month for the year to date--in terms of average share price declines--thanks to another drop in oil prices. The average energy limited partnership CEF saw its net asset value plummet 8.5% and its share price drop 10%, while the average equity energy CEF's NAV lost 6% and the share price fell 8.5%. For the year to date through June, both categories top the worst-performers list, with the average energy limited partnership CEF down 13.5% on share price and 9.4% on NAV and the average equity energy CEF down 10.6% on share price and 8.6% on NAV. Other poor-performing categories for the year to date include utilities, natural resources, Latin America stock, and equity precious metals, all negatively affected by the drop in oil and commodity prices.

It hasn’t been all bad news in CEF-land--30 of the 66 CEF Morningstar Categories posted positive share-price returns for the year to date through June, and 41 posted positive NAV returns. The three best-performing Morningstar Categories for the year to date, each posting double-digit share-price gains, were Japan stock, foreign large blend, and health. The table below lists the best- and worst-performing Morningstar Categories (based on share-price total returns) for the year to date through June.

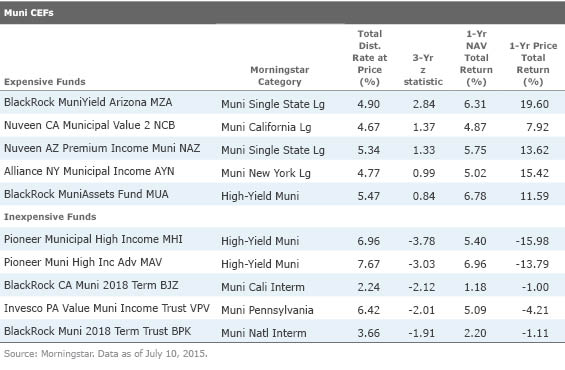

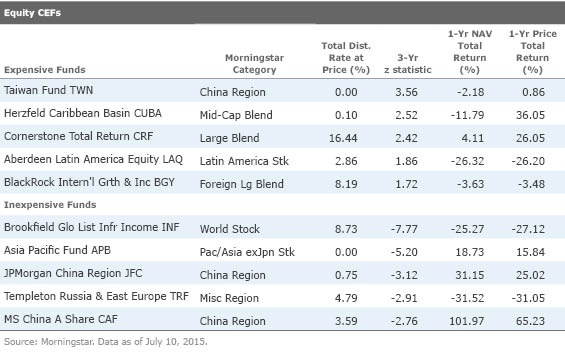

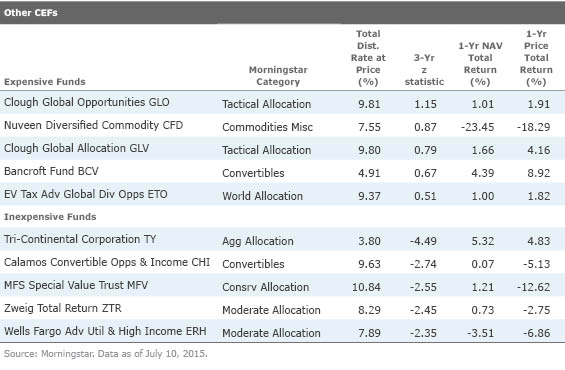

Most Expensive and Inexpensive CEFs The next four tables list the most expensive and inexpensive closed-end funds based on three-year z-statistics as of July 10. The z-statistic measures how many standard deviations a fund's discount/premium is from its three-year average discount/premium. For instance, in these tables, a fund with a z-score of negative 2 would be two standard deviations below its three-year average discount/premium. Funds with the lowest z-scores are classified as Relatively Inexpensive, while those with the highest z-scores are Relatively Expensive. We consider funds with a z-score of negative 2 or lower to be "statistically undervalued" and those with a z-score of 2 or higher to be "statistically overvalued."

Taxable-Bond CEFs

Taxable-bond CEFs, on average, saw discounts widen in June as worries over rising interest rates led to a broad sell-off. This caused CEFs that were already trading at attractive valuations, based on their three-year z-statistic, to look even more attractive at the end of June. For example,

Municipal CEFs

Municipal CEFs were dealt a double whammy in June, causing further dislocation of share prices and NAVs. First, the increase in long-term interest rates in June put downward pressure on these funds' NAVs and share prices because of their typically long durations. Second, Puerto Rico’s governor announced that the country hoped to work with debtholders on a restructuring deal and asked officials in Washington to extend to the commonwealth a right to file bankruptcy. While some muni managers have avoided Puerto Rico for years (PIMCO’s Joe Deane, for example, sold all of his Puerto Rico bonds by February 2013), others still hold some of the island’s debt (Western Asset, for example, still holds a moderate exposure in some of its municipal CEFs). State municipal funds are more likely than national municipal funds to hold a more concentrated position in Puerto Rico bonds because of their triple tax-exempt status.

Equity CEFs

The S&P 500 dropped nearly 2% last month, bringing the year-to-date gain to just more than 1%. While the less-than-stellar performance for the U.S. stock market is noteworthy, the real story these past few weeks was the erratic performance of the Chinese stock market. The Shanghai Stock Exchange Composite Index dropped more than 10% in June (it dropped even further in early July and has rebounded slightly as of this writing). For the year to date through June, the index remained in solid positive territory, however. Two China-specific CEFs look quite undervalued based on three-year z-statistics--Asia Pacific Fund APB and MS China A Share CAF had three-year z-statistics of negative 5.2 and negative 2.8 as of July 10.

Other CEFs

News You Can Use

Initial Public Offering On June 19, Eagle Asset Management launched the year's third CEF, Eagle Growth & Income Opportunities Fund EGIF. The fund raised $127.5 million in assets. Eagle Growth & Income Opportunities Fund is a tactically managed portfolio, investing in dividend-paying stocks and debt securities. It has a 12-year term. Three of the four funds launched in 2015 through June included term limits.

The year’s fourth IPO, Tekla World Healthcare THW, launched on June 26 and raised $580 million in assets. The fund will invest globally in health care and health-care-related securities. This is the second health-care CEF IPO from Tekla Capital Management in the last year. The firm also runs two additional health-care CEFs. Health care has been on a tear: The CEF health-care Morningstar Category is up 30% on NAV and 34% on share price over the trailing 12 months through June.

Manager & Strategy Changes Eaton Vance announced that portfolio manager Walter Row will retire later this year. Row currently serves as co-portfolio manager on 11 of Eaton Vance's equity CEFs, including Eaton Vance Tax-Managed Global Dividend Equity Income EXG, the fourth-largest CEF in existence based on net assets as of mid-July. Row will remain with the funds until the end of October 2015. The remaining fund managers will pick up his duties. Michael Allison, currently a named comanager on eight of Row's CEFs, will be named a comanager to the remaining three funds after Row's departure. Row and Allison have worked together since 2008 on various Eaton Vance CEFs.

Eaton Vance also announced that Thomas Metzold will retire on July 31, 2015. Metzold was co-portfolio manager for six Eaton Vance municipal-bond CEFs and will be replaced by Craig Brandon on the Eaton Vance Muni Income 2028 Term Trust ETX and by Cynthia Clemson on the remaining muni CEFs.

Flaherty and Crumrine announced that longtime comanager Robert Ettinger is no longer serving on the firm’s management team. Ettinger, who joined the firm in 1985, is preparing to retire. No replacement has been announced, though the firm’s CEFs remain in the hands of a very long-tenured and experienced team of managers.

Invesco announced that Robert Wimmel is no longer a member of the team that manages its municipal CEFs.

John Hancock announced that longtime comanager Mark Maloney will retire on Aug. 31, 2015. Maloney served as co-portfolio manager of several of the firm’s preferred-share-focused CEFs for more than 15 years. Lead manager Greg Phelps remains on the funds and was joined by Joseph Bozoyan on June 1. In light of this change, Morningstar has placed

BlackRock Build America Bond Trust BBN announced a strategy and name change. The fund will no longer be required to invest at least 80% of assets in Build America Bonds but will still focus on taxable municipal credits. Its new name is BlackRock Taxable Municipal Bond Trust. The ticker remains the same.

Tortoise MLP Fund NTG announced it is changing its investment policy to lower the amount of natural-gas-related master limited partnerships the fund is required to invest in. Going forward, the fund must invest at least 50% of assets in natural gas MLPs, instead of the previous 70% threshold. In a press release, management said that merger activity in the natural gas infrastructure MLP sector had reduced the number of securities available. It believes lowering the required limit will improve the fund’s diversification.

Mergers Nuveen NY Dividend Advantage Muni NAN completed the merger with Nuveen NY Performance Plus Muni and Nuveen NY Dividend Advantage Muni 2.

Ares Dynamic Credit Allocation ARDC is seeking shareholder approval to merge with ARES Multi-Strategy Credit ARMF.

The merger of Cornerstone Progressive Return Fund into Cornerstone Strategic Value CLM closed on June 26.

Other News Oxford Lane Capital Corp OXLC is offering 2.25 million shares of common stock in a secondary share offering. The fund will use the proceeds to acquire investments and for general working capital purposes.

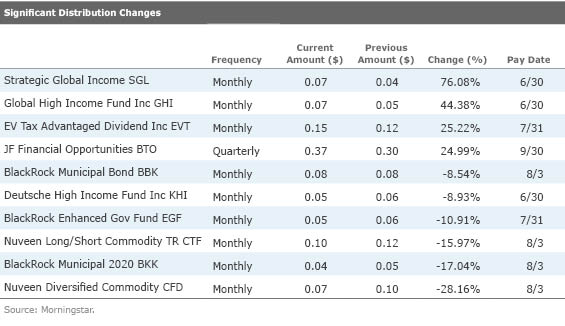

Exhibit 6 lists significant distribution changes during June.

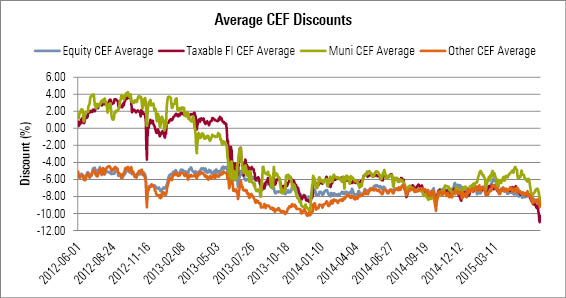

Discounts & Premiums During June, average discounts continued to widen for all four broad category groups. Taxable-bond CEFs saw the largest gap, to 10.3% from 7.7%. Municipal CEFs fared just slightly better with a 190-basis-point widening in the average discount last month. All signs point to the Federal Reserve raising rates this fall, and some investors have decided to flee the space before rates actually increase. Those willing to weather the storm can find many funds trading at historically low discounts, including many usually high-priced PIMCO funds. Exhibit 7 shows the average discount for equity, taxable fixed income, municipal, and other CEFs over the trailing three years through June.

- source: Morningstar Analysts

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZD4DY5U6GRAO5B7EP7NAECJAMM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)