PIMCO Prevails in a High-Profile Proxy Battle

Shareholders voted against PIMCO's adversaries, and CEF IPOs are back under the microscope.

A proxy fight at a PIMCO closed-end fund caught the attention of investors outside of the typically insular CEF world. In early 2015, Ironsides Partners initiated a proxy fight with PIMCO Dynamic Credit Income PCI. At that point, the firm owned about 1% of the fund's outstanding shares and attempted to add founder Robert Knapp and a lawyer for the firm, Richard Cohen, to the fund's board. Ironsides' grievances with PIMCO's board of directors included the fund's persistent discount, its purportedly unclear strategy, and "mediocre" returns given the fund's "aggressive" use of leverage and derivatives. Ironsides also claimed the management team was more incentivized by earning fees than delivering superior long-term performance. Knapp and Cohen said that, if elected, they would work to narrow the discount by share repurchases, tender offers, or even firing PIMCO as the advisor to the fund.

PIMCO responded by noting that PIMCO Dynamic Credit Income's discount has been consistent with similarly invested peers and that the investment environment since the fund's January 2013 launch has been volatile. It also said, "PCI's investment strategy has been clear since inception--to deliver attractive income--and PIMCO has delivered on that strategy." PIMCO noted that PIMCO Dynamic Credit Income's portfolio managers and other senior executives own more than $5 million in shares of the fund and have a vested interest in long-term results outside of manager fees. Before the April 30, 2015, proxy vote, the fund's proxy advisory firm, ISS, issued a recommendation in favor of PIMCO and its current board. In the end, shareholders rejected the proposal, though both Knapp and Cohen received nearly 13% of votes.

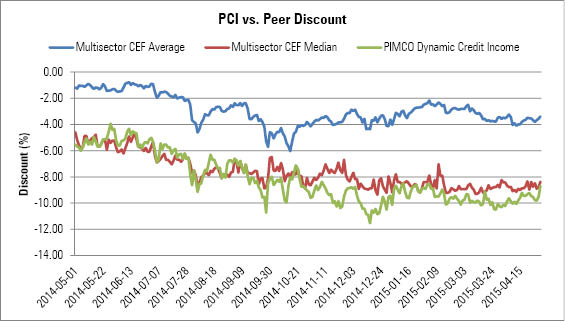

While it's true that PIMCO Dynamic Credit Income's discount is wider than other PIMCO CEFs, the discount requires some examination. Exhibit 1 below shows the fund's discount over the past year versus the multisector CEF Morningstar Category average and median discounts.

Source: Morningstar

PIMCO Dynamic Credit Income has consistently traded at a wider discount than the average multisector CEF, but the average is a bit misleading thanks to PIMCO High Income PHK, which has traded at an average premium of 51% for the past three years. As of April 30, no other fund in the category had an average premium of more than 10%. That outlier shrunk the category's average discount on April 30 to negative 3.40% and caused the historical average to look high. A more meaningful measure of how the fund is trading versus peers is to compare it with the category's median discount of negative 8.38%; its 8.70% discount was in line with the median at month-end and has been more or less aligned with the category median over the past year.

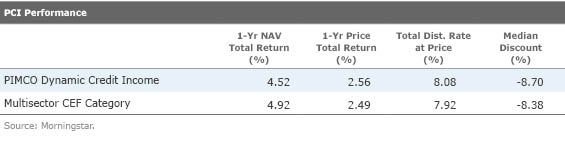

The fund's discount is also more understandable given its returns over the past year. Exhibit 2 shows how the fund stacks up versus the multisector CEF category in terms of performance and the distribution rate and discount as of April 30. Its distribution rate is on par with its average peer, and its net asset value total return over the past year was slightly lower than average.

Fiduciary Standard and CEF IPOs Another of Ironsides' complaints was that the fund's IPO premium dissipated quickly and never returned. This is a fair criticism, though it should be levied on all CEF IPOs, not just PIMCO Dynamic Credit Income. We've discussed our opinion on CEF IPOs in the past, but recent regulatory developments are worth highlighting and the topic is worth revisiting in light of these new developments.

The adage that CEF IPOs are sold, not bought, rings true. The very nature of the CEF IPO process stinks of commission-hungry brokers taking advantage of retail investors who often find themselves on the wrong end of the deal. Following the 2008 financial crisis, there were a few attempts to impose the Fiduciary Standard (which requires advisors, but not the brokers who make money by selling IPOs, to put their clients' interests before their own) on anyone providing fee-based investment advice. Efforts so far haven't been successful, but momentum behind the Fiduciary Standard has been building.

Taking a step back, the Fiduciary Standard is the highest standard of care required by investment professionals, but it currently applies only to registered investment advisors. The lines between investment advisors and broker/dealers are blurring, however, and regulators are pushing for increased responsibility on the part of the broker/dealers. Under the Investment Advisors Act of 1940, only RIAs are held to the Fiduciary Standard, which requires advisors to put their clients' interests before their own and to eliminate conflicts of interest or disclose any conflicts that cannot be eliminated.

Broker/dealers generally don't have to meet the Fiduciary Standard. While broker/dealers must ensure that an investment is suitable for clients, they are not required to put their clients' interests ahead of their own and are not required to disclose conflicts of interest. This opens the door for questionable investment recommendations that, while perhaps passing the test of suitability, provide the broker with large commissions at the expense of the investor.

From a nuts-and-bolts perspective, launching a CEF isn't free, and traditionally investors have paid those fees. Mathematically, this means that all CEFs trade at premiums at the IPO, and history has shown that most IPO premiums dissipate within a few months of launch. Investors in the IPO are likely to lose money based on share price returns within the first few months of a fund's launch because of the premium dissipation. (For a more detailed discussion of the CEF IPO premium, see Morningstar's CEF Solutions Center.) So, while a newly launched fund may be suitable for inclusion in an investor's portfolio, a reasonable chance of losing money, coupled with the high commissions brokers earn for selling CEF IPOs, doesn't meet the Fiduciary Standard.

One of the first attempts at imposing the Fiduciary Standard on brokers following the 2008 crisis was the Dodd-Frank Wall Street Reform and Consumer Protection Act, which proposed to give the SEC the power to extend the Fiduciary Standard to broker/dealers. The bill went into law in late 2010, and the SEC was charged with studying the need for the application of the Fiduciary Standard on broker/dealers. In early 2013, the SEC asked for data and information regarding the costs and benefits of imposing the higher standards. The SEC hasn't yet released the results of this information request or addressed whether the standard should apply to broker/dealers.

In the meantime, the Department of Labor proposed a rule that would apply the Fiduciary Standard to advice given to retirement plans and participants (pensions and individuals) in late 2010. Amidst pushback from the industry, the proposal was withdrawn in late 2011. The Department of Labor took up the cause again in early 2015, this time with President Obama backing the issue. The latest proposal would label any advisor receiving payment for advice a "fiduciary" and would apply the Fiduciary Standard, no matter what the advisor uses as a title (broker, RIA, and so on). While this is a good starting place, the latest proposal doesn't go far enough. As written, broker/dealers can still provide advice to clients in nonretirement settings that may put their own interests ahead of the clients.

The lack of a Fiduciary Standard for broker/dealers should worry CEF investors in particular, because brokers selling shares of newly launched CEFs do not have to put client's interests before their own. And the imposition of the standard on brokers should worry CEF firms. If broker/dealers are held to the Fiduciary Standard for all fee-based advice, it's hard to imagine the CEF IPO process continuing in its current form, because of the conflict between the broker's interest (earning high fees) and the client's interest (to not lose money).

All of that said, some asset managers are finding ways to cope with the new regulations, and most likely the CEF IPO market will evolve, hopefully for the better. For example, last month, Calamos Investments launched a new fund, Calamos Dynamic Convertible and Income CCD, which included secondary market support for the share price via a warranty program. Calamos promised to purchase shares in the secondary market if the fund's discount dropped below 2% during the first year of trading. To be sure, the discount is likely to remain within the acceptable range until the secondary-market support from Calamos is gone, but it's a (small) step in the right direction.

Best- and Worst-Performing CEF Categories Performance-wise, international CEFs did well last month, especially those invested in emerging-markets stocks. A rebound in oil prices boosted master limited partnership CEFs as well as those invested in the equity of energy firms. State municipal CEFs took a hit after another downgrade to Puerto Rico's municipal bonds. State muni funds can invest in Puerto Rico bonds and retain the tax benefits of investing in their own state's bonds. This can lead to fairly large allocations to Puerto Rico in some state muni-bond funds, especially as the supply of muni bonds has waned in recent years.

Exhibit 3 lists the month's best and worst performers by category.

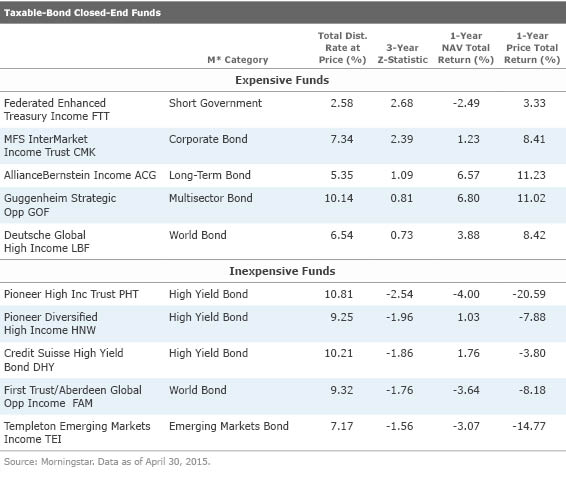

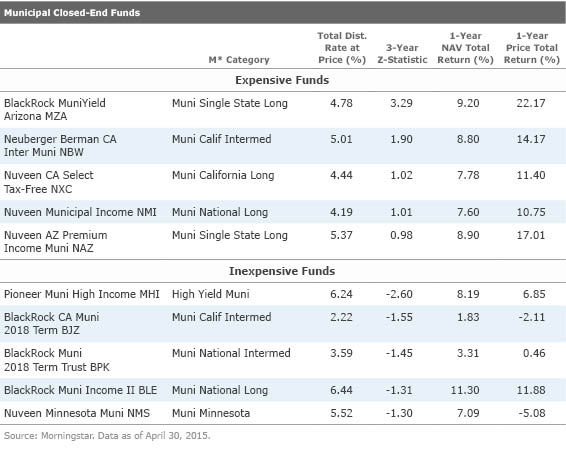

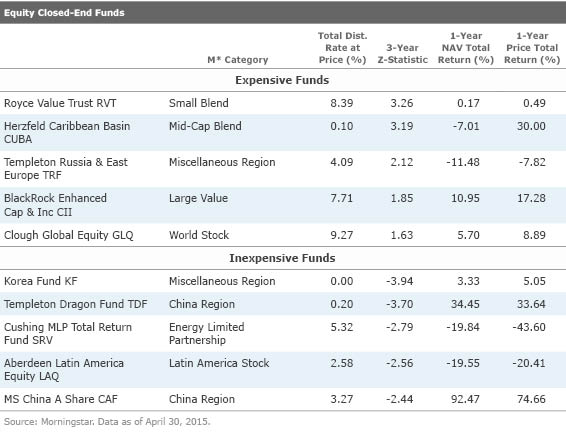

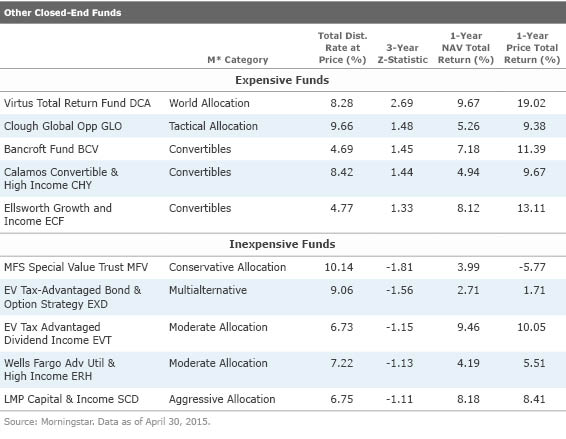

Most Expensive and Inexpensive CEFs The exhibits below list the most expensive and inexpensive CEFs based on three-year z-statistics as of May 8. The z-statistic measures how many standard deviations a fund's discount/premium is from its three-year average discount/premium. For instance, in these tables, a fund with a z-score of negative 2 would be 2 standard deviations below its three-year average discount/premium. Funds with the lowest z-scores are classified as Relatively Inexpensive, while those with the highest z-scores are Relatively Expensive. We consider funds with a z-score of negative 2 or lower to be "statistically undervalued" and those with a z-score of 2 or higher to be "statistically overvalued."

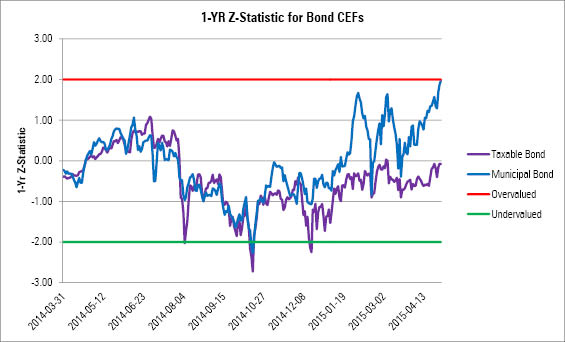

The three-year z-statistic is not the only relevant time period for valuation discussions. Exhibit 6 below shows the average one-year z-statistic over the trailing 12 months ended April 30 for taxable-bond CEFs and muni-bond CEFs, as well as levels of overvaluation and undervaluation (2 and negative 2, respectively). The average taxable and muni CEF looked undervalued during the fourth quarter of 2014, though the average muni CEF bounced back much more quickly.

Source: Morningstar

Despite a few municipal CEFs at or nearing undervaluation (based on a three-year z-statistic) listed in Exhibit 5, the average muni-bond CEF looked very close to overvalued as of April 30. Despite concerns over Puerto Rico and certain municipalities' ability to pay debt, investors still like muni-bond funds for their tax-advantaged payouts. These funds tend to have long durations (especially the leveraged CEFs), so rising rates will likely have more of an impact on the underlying NAV and share prices of these funds than the generally lower-duration taxable-bond funds (note that lower duration does not imply low duration). On the whole, taxable-bond CEFs look fairly valued as of April 30. The group's one-year z-statistic has been fairly volatile over the past year, though it only reached undervaluation three times: in early August, late October, and mid-December of last year.

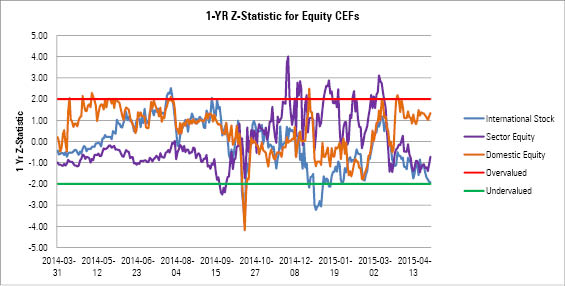

Exhibit 8 below shows the average one-year z-statistic over the trailing 12 months ended April 30 for international, sector, and domestic equity CEFs with the levels of overvaluation and undervaluation (2 and negative 2, respectively). International equity funds took a hit earlier this year, and the group's average valuation is beginning to look appealing as of April 30. Domestic-equity funds, on average, look more fully valued, though not overvalued on the whole. Sector equity funds include MLPs, which took a hit in late 2014, though the diverse group's average z-statistic jumped well above 2 many times from late 2014 through early March 2015. Health-care funds make up a relatively large part of this group, and those funds performed well over the past year. In fact, that group was the second-best-performing category during the first quarter of 2014.

Source: Morningstar

Other CEFs Exhibit 9 lists the five most overvalued and five most undervalued CEFs in the "other" category, which includes convertibles funds and allocation funds. Only one fund, Virtus Total Return DCA, looks overvalued on a three-year statistical basis, and no funds look undervalued based on the same measure.

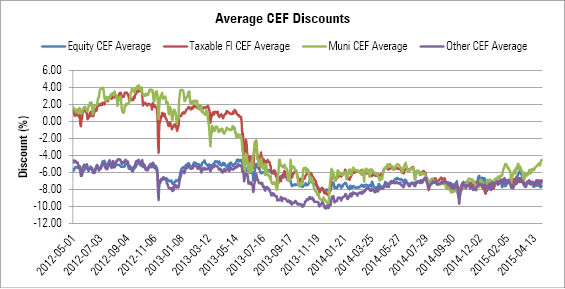

Discounts and Premiums Exhibit 10 below shows the average discount for equity, taxable-bond, muni-bond, and other CEFs over the past three years. The average discount of muni CEFs narrowed over the past month to 4.5% from about 6%. The average discounts of the other groups remained largely unchanged at the end of April.

Source: Morningstar

News You Can Use Outside of the PIMCO proxy fight, April was a relatively quiet month in CEF news.

On April 1, NexPoint Credit Strategies NHF completed a spin-off of NexPoint Residential Trust NXRT, an independently run publicly traded REIT. Shareholders of NHF received a pro-rata taxable distribution of NXRT common shares.

On April 13, BlackRock MuniYield NJ Quality MJI merged into BlackRock MuniHoldings NJ Quality MUJ and BlackRock PA Strategic Muni BPS merged into BlackRock MuniYield PA Quality MPA.

Exhibit 11 lists significant distribution changes during April.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZD4DY5U6GRAO5B7EP7NAECJAMM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)