Oil, Cuba, and Russia, Oh My!

A surprising December capped off a decent year for most CEFs.

The persistent and largely unexpected drop in oil prices during late 2014 and into 2015 was one of the biggest market stories of last year, particularly in closed-end fund land. Of the 569 CEFs in existence as of early January 2015, 26 were in the energy limited partnership Morningstar Category (these funds invest primarily in master limited partnerships) and seven were in the equity energy category. In sum, those 33 funds most affected by oil’s swoon account for nearly 10% of the total and net assets of all CEFs as of Jan. 8. The average MLP fund dropped 11% on net asset value and more than 8% on share price in the fourth quarter of last year.

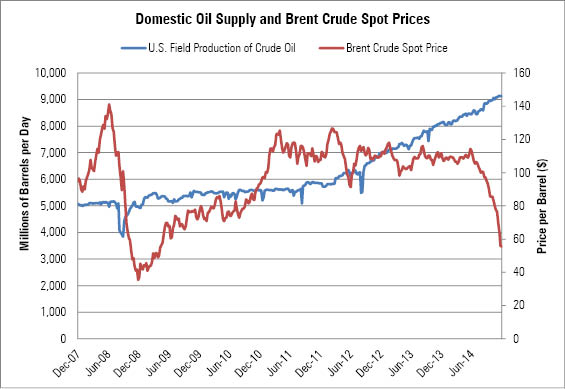

High-yield bond CEFs were also hit hard in the back half of the year because the percentage of energy companies in the U.S. junk-bond market jumped in recent years as the shale boom in the U.S. significantly increased that sector’s need for capital. That domestic oil supply expansion is evident in the chart below. Energy firms made up the largest share of new issuance in the junk-bond market in 2014 (as was the case for the previous five years), leading those firms to account for 15% of the Barclay’s U.S. Corporate High Yield Bond Index as of late 2014, compared with just 6% in 2007.

Another surprise in 2014 was the drop in the long end of the yield curve. The yield on 30-year U.S. Treasuries dropped to 2.75% as of Dec. 31, from just under 4% at the start of the year. Although the Federal Reserve ended its Quantitative Easing program in October and is widely expected to raise short-term rates in 2015, long-term bond yields continued to fall, helped by low inflation in the U.S. and a slowing global economy. These forces gave a boost to U.S. Treasuries, even at historically low yields.

In an unexpected diplomatic move mid-December, the U.S. announced that it would restore full relations with Cuba. Shares of Herzfeld Caribbean Basin CUBA jumped on the news. This fund focuses its holdings on firms expected to “benefit from economic, political, structural and technological developments in the countries in the Caribbean Basin, which consist of Cuba, Jamaica, Trinidad and Tobago, the Bahamas, the Dominican Republic, Barbados, Aruba, Haiti, the Netherlands Antilles, the Commonwealth of Puerto Rico, Mexico, Honduras, Guatemala, Belize, Costa Rica, Panama, Colombia and Venezuela.” Herzfeld Caribbean Basin shares traded at a 12.6% discount on Dec. 16, the day before the announcement and closed at a 9.2% premium on Dec. 17. In the days following, the fund’s premium reached 70% but has since dissipated--the premium on Jan. 8 was 12%. Note that the fund also announced a special distribution of $0.635 per share on Dec. 18.

A surprisingly swift decline in emerging-markets bonds in December capped off 2014. The aforementioned steep drop in oil prices weighed heavily on the currency of some emerging markets, including Russia, which is also dealing with sanctions imposed by the U.S. In an attempt to stop the precipitous drop in the Russian ruble, the country hiked interest rates to 17% overnight from 10.5%, causing investors to second guess the stability of Russia and of emerging markets in general. Russia-focused CEFs took a huge hit, particularly Templeton Russia & East Europe TRF, which dropped 16% on both share price and net asset value in December. The fund closed the year down 39% on share price and 38% on net asset value, making it the second-worst-performing CEF last year. The worst-performing fund was MLP-focused Cushing Royalty & Income SRF, which lost 47% on share price and 55% on net asset value.

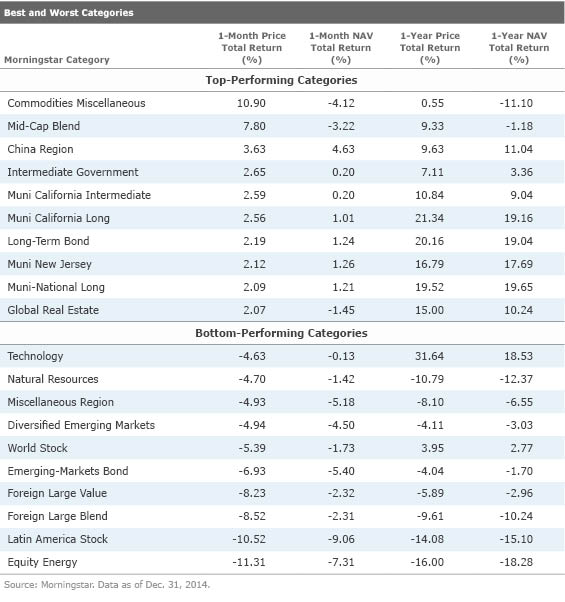

Best- and Worst-Performing CEF Categories In Exhibit 2 are the best- and worst-performing CEF categories in December, based on share price return.

Given the continued drop in oil prices (Brent crude-oil futures as of Jan. 12 reflected a price of $46.66 per barrel) and the sell-off in emerging markets during December, it’s not surprising to see energy and foreign stock and bond categories fill the bottom-performing list. Some of the best-performing categories last month have historically leaned toward longer-duration assets. For example, most of the municipal funds add leverage to already long duration portfolios, often pushing effective duration beyond 10 years. Note that the best-performing category last month, Commodities Miscellaneous, contains two funds, Nuveen Diversified Commodity CFD and Nuveen Long/Short Commodity CTF, whose managers are proposing that the funds convert to exchange-traded funds. Shareholders will vote on this proposal on March 31, but the announcement caused both funds’ share prices to jump significantly, leading the impressive looking one-month share price returns.

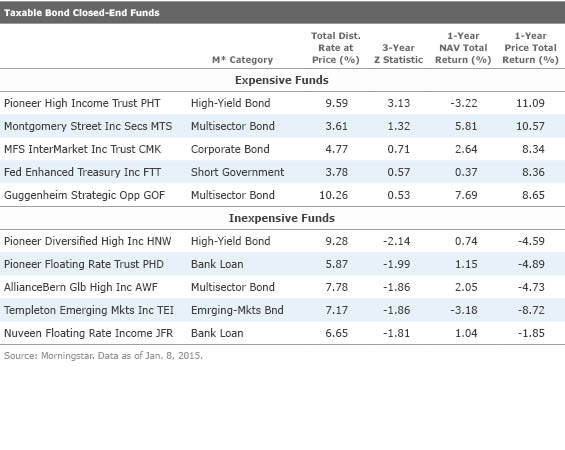

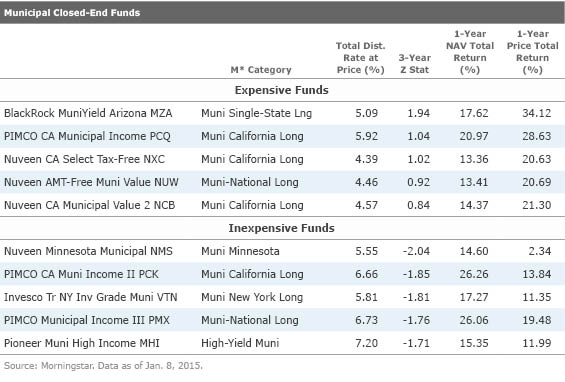

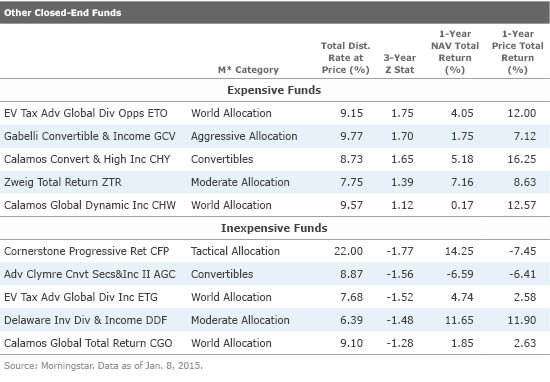

Most Expensive and Inexpensive CEFs Exhibits 3-6 below list the most expensive and inexpensive closed-end funds based on three-year z-statistic as of Jan. 8. The z-statistic measures how many standard deviations a fund's discount/premium is from its three-year average discount/premium. For instance, in these tables, a fund with a z-score of negative 2 would be two standard deviations below its three-year average discount/premium. Funds with the lowest z-scores are classified as Relatively Inexpensive, while those with the highest z-scores are Relatively Expensive. We consider funds with a z-score of negative 2 or lower to be "statistically undervalued" and those with a z-score of 2 or higher to be "statistically overvalued." That said, the z-statistic does have its flaws.

Taxable-Bond CEFs Pioneer High Income Trust PHT looks extremely expensive as its share price rose in the last year, despite a drop in underlying net asset value. For 2014, the fund's share price jumped 11% while its net asset value dropped 3%. The fund's outsized distribution rate likely plays a role here, as investors continue to look high and low for income. Interestingly, the fund's more globally invested sister, Pioneer Diversified High Income HNW, was the most inexpensive taxable fixed-income fund as of Jan. 8. That fund lost 4.5% in share price, despite a 0.75% gain in net asset value last year. It's likely that the fund's more global mandate caused concern among some investors, pushing the share price down.

Equity CEFs

The most expensive equity fund as of early January was Morgan Stanley Eastern Europe RNE, a fund that announced board approval of its liquidation. The proposal needs shareholder approval, which the board will seek in February. If approved, the fund will divest all of its assets, which caused its discount to narrow to 4.7% from 14.4% on the date of the announcement. That discount was 6.8% as of Jan. 8.

As mentioned previously, Herzfeld Caribbean Basin shares got a boost from thawing relations between the U.S. and Cuba. The fund’s sudden jump in share price caused it to look expensive on a three-year statistical basis.

Surprisingly, BlackRock Energy & Resources BGR saw a turnaround in sentiment in the first week of the year--through Jan. 8, the fund’s share price jumped 3.9% while its net asset value dropped 3.6%. This fund holds the equities of energy-related firms and held 41% in exploration and production firms and 44% in integrated oil firms as of Dec. 31.

Municipal CEFs 2014's muni market surprised many investors. After a poor showing in 2013 (only three muni funds posted positive net asset value returns that year), every muni CEF ended 2014 in the black on both a share price and net asset value basis. Relatively steady returns throughout the year meant that there weren't too many good deals. The story remained the same at the start of January.

Other CEFs

News You Can Use The end of a calendar year brings a plethora of special distributions. Exhibit 7 lists significant distribution changes and special distributions announced in December.

Mergers & Fund Liquidations BlackRock completed a number of mergers in early December, some of which were mentioned in the November CEF Monthly. The fund company also announced that its board approved the merger of BlackRock MuniYield NJ Quality MJI into BlackRock MuniHoldings NJ Quality MUJ and of BlackRock PA Strategic Muni BPS into BlackRock MuniYield PA Quality MPA. The mergers are expected to close in early 2015.

The board of directors of Morgan Stanley Eastern European RNE approved a proposal to liquidate the fund. Shareholders will vote on the proposal in February 2015.

The managers of Nuveen Diversified Commodity CFD and Nuveen Long/Short Commodity CTF are proposing the funds convert to exchange-traded funds to seek a closer alignment between the funds’ share prices and net asset values. Shareholders will vote on this proposal on March 31.

Strategy & Manager Changes On Dec. 22, Nuveen Investments finalized the restructuring of seven of its covered call funds and several paid distributions in early January in conjunction with this restructuring. Each restructured fund also changed its name and ticker. For a full list of funds affected and the relevant changes, read Nuveen's press release here.

Warren Mar and Jens Nystedt joined the management team of Morgan Stanley Emerging Markets Debt MSD and Morgan Stanley Emerging Markets Domestic EDD at the beginning of December.

Central Europe Russia & Turkey CEE added Sylwia Sxczepek to the fund’s management team last month, while Sebastian Kahlfeld continues to serve as deputy portfolio manager.

The board of directors of Royce Focus Trust FUND approved a new advisory agreement with Sprott Asset Management. Shareholders will vote on this new agreement in the first quarter of 2015.

Ares Multi-Strategy Credit ARMF amended a nonfundamental investment policy regarding the investment in CLOs. The fund cannot invest more than 30% in CLOs or more than 7.5% of its assets in subordinated tranches of CLOs.

BlackStone/GSO Long Short Credit Income BGX announced that the board approved an increased the fund’s ability to invest in long investments to 150% of assets from 130%.

Share Repurchases, Tender Offers, & Stock Splits BlackRock Enhanced Government EGF completed its annual repurchase offer which was oversubscribed. The fund repurchased shares at $15.01 per share on a pro rata basis.

Adams Express ADX and Petroleum & Resources PEO extended share repurchase programs. The funds can purchase up to 5% of outstanding shares should the discounts reach 10% or wider. The shares will be purchased in the open market as determined by the management team.

General American Investors GAM renewed the authorization to purchase a specified number of outstanding preferred shares if those shares trade below $25 per share.

John Hancock Financial Opportunities BTO, John Hancock Hedged Equity & Income HE, John Hancock Premium Dividend Fund PDT, and John Hancock Tax-Advantaged Dividend Income HTD renewed share repurchase plans, under which the funds may purchase up to 10% of outstanding shares in the open market during calendar year 2015.

Oxford Lane Capital OXLC commenced a repurchase plan for up to $35 million in shares of the fund’s common stock. The offer expires on March 31, 2015.

European Equity Fund EEA will conduct a tender offer to purchase up to 5% of outstanding shares, at 98% of net asset value, beginning Jan. 22. The fund’s shares traded at an average discount that exceeded 10% during the measurement period, triggering the tender offer.

Cornerstone Progressive Return CFP, Cornerstone Strategic Value CLM, and Cornerstone Total Return CRF completed one-for-four reverse stock splits on Dec. 29.

Other Fund Announcements The board of directors of Aberdeen Japan Equity Fund JEQ approved a revision to the fund's discount management program set in place in May 2012. The revision allows the fund's managers to purchase up to 10% of outstanding shares.

JP Morgan China Region JFC announced that it changed its tax policy after authorities stated they would no longer seek to claim 10% capital gains tax on the foreign institutional investor traded Chinese shares. The fund's policy has been to accrue 100% of the contingent liability for all realized and unrealized gains in A Shares and B Shares. Read more details on the new policy here.

Mexico Equity & Income MXE announced that activist investor Phil Goldstein was elected to the fund’s board of directors. Goldstein is the manager of Bulldog Investors, a hedge fund known for its focus on closed-end funds.

Effective Feb. 27, shareholders of Sprott Physical Gold PHYS and Sprott Physical Silver PSLV can redeem shares in physical gold or silver.

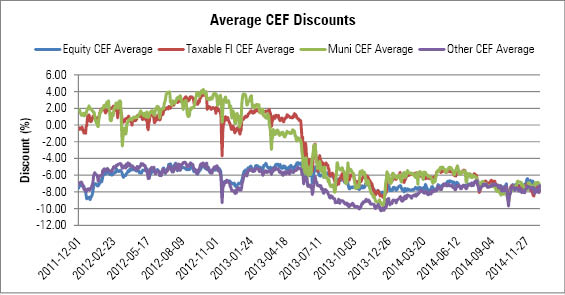

Discount Trends Equity and fixed-income average CEF discounts widened in December while municipal funds and "other" CEFs saw a slight narrowing of the average discount over the month. Historically, equity funds have tended to sell at wider discounts because of the lower distribution rates compared with bond funds. But the large and persistent disparity between the high premiums of bond funds and wide discounts of equity funds following the crisis was unusual.

From the start of 2014, the average discount for equity CEFs remained unchanged, but fluctuated between 9.1% and 6.4% throughout the year. The average bond CEF saw its discount widened by more than 100 basis points over the year, to 7.8% from 6.7%. That group’s average discount ranged between 8.9% and 5.3% during 2014. For municipal bond CEFs, the average discount started and ended the year at 7% and fluctuated between 9.2% and 4.9% throughout the year. Exhibit 7 below shows the average discounts for CEFs over the last three years.

Conclusion While there were many bright spots in 2014 (the S&P 500 Index, for one, gained nearly 14% for the year), there were pockets of volatility, many of which made headlines in the fourth quarter. Overall, CEF investors fared well in 2014—Seventy-eight percent of all CEFs posted positive share price returns and 86% were in the black on a net asset value basis for the year. The volatility that marked the close of 2014 has continued into the start of 2015 and is likely to continue throughout the year as many of 2014's issues remain unsettled. Long-term investors have little to fear, however, if they've focused on managers with good long-term track records implementing well-defined and repeatable strategies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZD4DY5U6GRAO5B7EP7NAECJAMM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)