No Two Bull Markets Are Alike, Either

Don't count on reversion to the mean, especially in the short run.

A version of this article was originally published in the March 2017 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

After writing about how specific sectors and styles (growth and value) fared during the last five bear markets, a reader asked if we would run the same analysis on the last five bull markets. Great idea! Let the analysis begin.

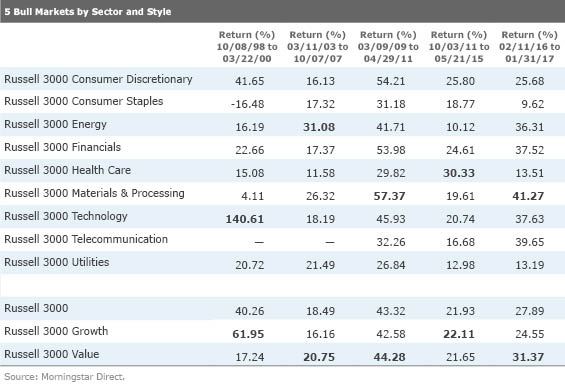

As you might imagine, the results during the last five bull markets—the last of which is ongoing—are to some extent mirror images of what we found for the last five bear markets. The best-performing sector during the 1998-00 rally, technology (as measured by the Russell 3000 Technology Index)—which gained an earth-shaking 140.6% annualized gain during that 18-month period—was subsequently the worst-performing sector during the 2000-03 bear market, falling an annualized negative 78.1%. This is a reminder that while not at all times absolute, reversion to the mean is at least a strong tendency as bull markets become bear markets and vice versa.

So, while we were somewhat surprised to see that growth stocks (as represented by the Russell 3000 Growth Index) actually performed better than value stocks during three of the last five bear markets or corrections, value stocks have beaten their growth cousins in three of the last five rallies, including the current one. (Please see the accompanying table.)

Naturally, it follows that value-oriented sectors led the way in each of those instances. Energy led all sectors with a 31.1% annualized return during the 2003-07 bull market as oil prices spiked. Perhaps more surprisingly, materials stocks performed best in two of the next three rallies, 2009-11 and 2016-present. In fact, materials beat the Russell 3000 in three of the last four bull markets, with its only dud in the 1998-2000 rally. Who would have guessed? (In somewhat less surprising news, Morningstar’s equity analysts currently consider the sector the most overvalued.)

A mean-reversion-related question that bottom-fishers might ask: How frequently was the worst-performing sector in a bear market the best performer in the next bull market? It didn’t happen once, at least not during the past five bear/bull cycles.

Let’s turn it around: How often was the worst-performing sector in a bull market the best performer in the subsequent bear? That did happen, first with consumer staples. That sector lost an annualized 16.5% during the 1998-2000 rally but was then the only sector in the black during the 2000-03 bear market, gaining an annualized 19.5%. Chalk one up for mean-reversion.

But that was the only instance, although utilities narrowly missed the title during the mid-2011 bear market, losing 5.7% versus negative 5.5% for consumer staples. So, as we warned in our last article, trying to capitalize on mean-reversion can sometimes get you in trouble, at least in the short run.

The energy sector’s experience in recent years offers another case study. That sector was the weakest sector during the 2011-15 rally, gaining just 10.1% annualized versus 21.9% for the Russell 3000. But despite being the weakest sector during the prior rally, the sector was slammed during the 2015-16 correction as oil prices plummeted, falling by nearly one third.

Thus, especially over the short term, reversion to the mean is at best a tendency, certainly not a law. So, investors shouldn't try to use it as a timing tool. Harkening back to our last piece, there are no hard and fast rules about which sector or style will do best in a rally either, regardless of what happened in the previous one. Diversification remains an investor’s best friend when it comes to either surviving a downturn or participating in a rally.

/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)