A Muni Fund and a Tech Fund Earn Ratings Upgrades

Here are some highlights from September.

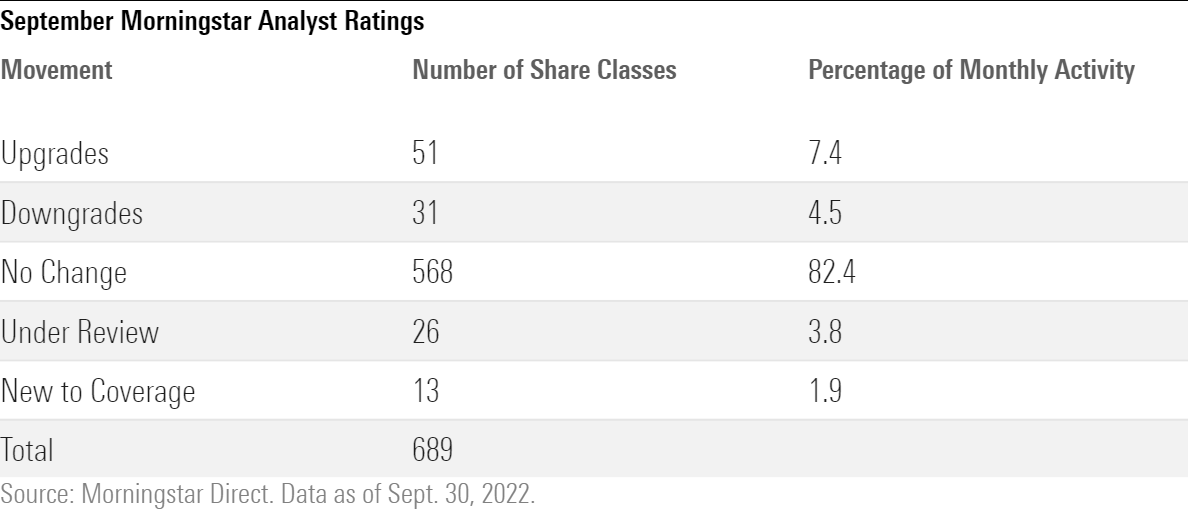

Morningstar updated the Analyst Ratings for 689 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in September 2022. Of these, 568 maintained their previous rating, 51 earned upgrades, 31 received downgrades, 13 were new to coverage, and 26 went Under Review owing to material changes such as manager departures.

Looking through share classes and vehicles to their underlying strategies, Morningstar issued 132 Analyst Ratings during September. Of these, five were new to coverage, and the remainder had at least one investment vehicle that a Morningstar analyst had previously covered.

Below are some highlights of the upgrades, downgrades, and strategies new to coverage.

Upgrades

A deep experienced team at MainStay MacKay High Yield Municipal Bond MMHIX earned an upgrade of its People rating to High from Above Average in September, driving an upgrade of the Morningstar Analyst Rating of its cheapest share classes to Silver, while the remainder earned Neutral ratings. The co-CIOs of the muni-bond team, Bob DiMella and John Loffredo, have put together a group of veterans with expertise across the muni market, including the below-investment-grade debt that constitutes this portfolio. The team takes a thoughtful approach, establishing macro themes and conducting fundamental credit research while trading lightly in unrated securities, the riskiest corner of the market.

The distinctive, valuation-sensitive approach of Columbia Seligman Technology and Information SLMCX supported an upgrade of the Process rating to Above Average from Average. As a result, the fund’s cheapest share classes now earn Silver ratings, while the priciest share class moves up to Bronze. Lead manager Paul Wick has steered this fund since 1990 and employs a contrarian strategy, focusing on valuations, cash flow, and organic growth rather than product launches or hot trends. Buying relatively cheaper tech fare, he feels comfortable stashing 45% to 55% of the fund’s assets in the top 10 holdings; that tactic has been effective, as those picks have outperformed, and the fund has often lost less than its average Morningstar Category peer in tech downturns.

The managers of Virtus KAR Small-Cap Core PKSFX and Virtus KAR Small-Cap Growth PXSGX have demonstrated substantial skill as well as an ability to add talent to their team. Both funds’ People ratings were thus upgraded to High from Above Average. As a result, the Analyst Ratings of Small-Cap Core were upgraded to Gold for its cheapest share class and Silver for the others, while Small-Cap Growth’s ratings climbed to Silver for all share classes. Managers Jon Christensen and Todd Beiley have helmed both funds for about a dozen years and are backed by seven analysts with an average of 10 years’ tenure at Kayne Anderson Rudnick, a wholly owned subsidiary of Virtus. (Three of those analysts have joined the team since 2018.) The team invests primarily in companies with strong brands and sustainable cost advantages, which has led to fine risk-adjusted results.

Downgrades

Questions about the repeatability and consistency of the approach of Victory RS Small Cap Growth RSEGX merited a downgrade of its Process rating to Average from Above Average, driving a downgrade of the Analyst Ratings of its more expensive share classes to Neutral. The cheaper share classes retain a Bronze. An experienced and stable team searches for companies with high returns on capital, low debt, and sustainable earnings growth. However, the portfolio’s average returns on invested capital and net margins have typically been weaker than those of the Russell 2000 Growth. And technical indicators have pushed portfolio turnover to the high side while failing to protect capital in downturns.

The sudden departure of the longest-tenured portfolio manager at Boston Partners Small Cap Value II BPSCX led to a downgrade of its People rating to Above Average from High. The Analyst Ratings of the mutual fund’s institutional share class and the separate-account version of the strategy dropped to Silver, while the investor share class fell to Bronze. Dave Dabora, an original partner of Boston Partners and a manager of this fund since 1998, retired in September with no advance notice from the firm. George Gumpert takes the reins, and while he’s comanaged the fund since 2005, he’s backed by a dedicated team of two analysts, one of whom was just added from the firm’s central research team when Dabora left. This is small by industry standards. The team does receive support from that central team, but the fund’s team does much of the research for this portfolio and two others on its own.

New to Coverage

GMO Resources GOFIX has a veteran lead manager with insight on both traditional resources stocks, such as oil producers and metals and mining firms, as well as nontraditional resources firms in the solar, wind, and water industries. It earns an initial Analyst Rating of Silver across its share classes. Lucas White has run this fund since 2015 and previously worked on the quantitative stock-picking models that help build the portfolio here. The models’ approach to security selection is undifferentiated relative to most peers, but White’s expertise underpins an Above Average People rating.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)