How Morningstar Analysts Find Prospects

Learn how to use Search Criteria to find high-potential funds.

Morningstar Prospects is a list of up-and-coming or under-the-radar strategies that Morningstar Manager Research monitors to potentially bring under coverage. As part of their daily work, Morningstar analysts hunt for promising, competitive strategies that they may one day cover. Analysts typically use some combination of a few key parameters when beginning to screen for them.

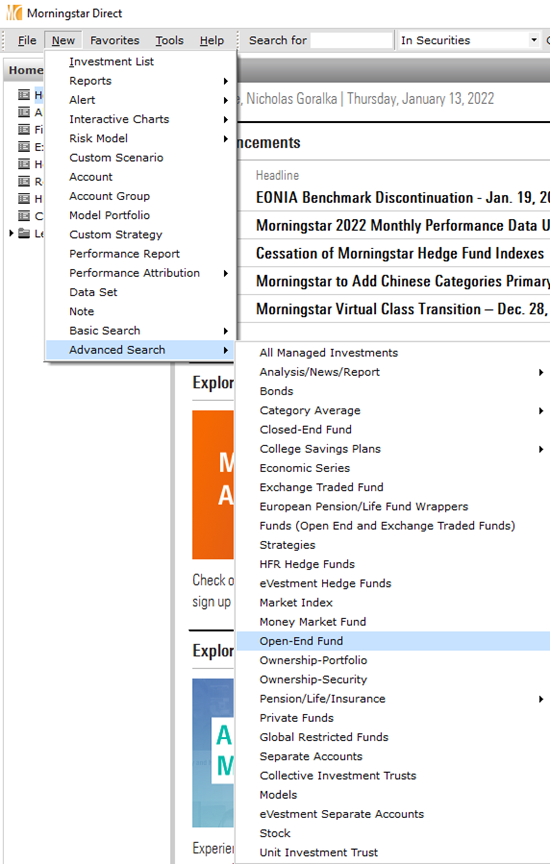

To filter the large investable universe, analysts use Morningstar Direct's "Advanced Search" feature, which can be found by going to the "New" menu and hovering over "Advanced Search." For simplicity's sake, this example will look for open-end equity funds that don't have qualitative Morningstar Analyst Ratings. (The results are as of Jan. 13, 2022).

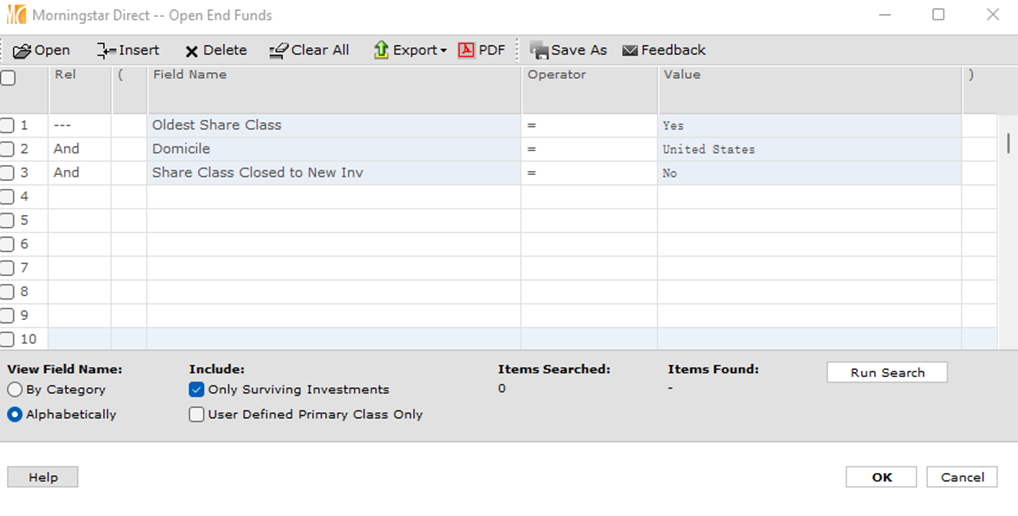

Select "Open-End Fund" and an empty search criterion box appears into which you can enter your desired parameters. If you have trouble finding data points in the "Field Name" column, you can switch the "View Field Name" option to "Alphabetically" (it may take a moment for Direct to switch). When prospecting, Morningstar analysts often start by selecting oldest share class to focus on distinct strategies, then domicile (in this case the United States), and then funds that are not closed to new investors. This narrows the universe to unique options that are still available to U.S.-based investors.

Next, filter by "Morningstar Category." For this example, we'll assume the analyst is looking for a large-value or large-blend fund not yet under full coverage. To do that, you'll have to open a parenthesis in the search criterion, select Morningstar Category equals large blend or large value and close the parenthesis. Choosing "or" in the first column is important; leaving it as "and" will provide no results because no strategy inhabits more than one category. Forgetting the parenthesis also can foul the results.

A quick way to isolate promising funds that Morningstar analysts do not cover is to search for those with high Morningstar Quantitative Ratings because only funds not currently under qualitative coverage get quant ratings. Another way to find uncovered funds is to choose "Morningstar Analyst Rating = NA."

The Morningstar Quantitative Rating uses a model to anticipate how human analysts might rate strategies if they covered them. A high MQR does not guarantee the strategy would receive the same qualitative rating, but it can surface strategies that look interesting. Screening for funds with Gold MQRs peels away most of the universe--just 29 funds clear the screens. Allowing funds with Silver or Bronze MQR ratings would provide more results.

From there, an analyst might layer on additional fundamental criteria that approximate the quality of the strategies' people, processes, and parents, such as:

- Manager tenure: Screening for funds whose most tenured managers have been around for at least five years can point to experienced and stable investment teams.

- Fund size: Looking for strategies with at least $500 million in assets can lead to funds with lower odds of being liquidated or merged away.

- Fees: Searching for funds with below-category-median expense ratios relative to share classes in similar distribution channels can lead to competitively priced options.

Those filters winnow the field to eight results.

Clicking "OK" shows the results, which includes several index funds. To screen for only active funds, choose the "Index Fund" data point in the Field Name column and "No" in the value column.

Analysts can tweak the screen's parameters and add others, such as portfolio turnover, holdings characteristics, risk metrics, and performance measures, to find more or fewer strategies worth investigating, but this is a good thumbnail of how they begin to look for promising uncovered funds. Below are the results for each domestic Morningstar Style Box category as of Jan. 13, 2022, using our example's criteria:

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OSPGGQHXJVCGLBHR5CUUQWH3NQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)