When You Should Consider Fundamentally Weighted ETFs

And how to make the most of this contrarian investment strategy.

Investing against the crowd is not easy. Contrarian investors often make bold bets that may take time—sometimes years or longer—before paying off. Contrarian investing comes in many different shapes. It encompasses any strategy that diverges from mainstream market views on where and when to invest.

One straightforward and commonly used contrarian approach is rebalancing a portfolio back to a target allocation. This requires investors to sell well-performing assets and buy underperforming ones. Rebalancing allows investors to consistently manage their portfolio risk in hopes of benefiting when market sentiment proves incorrect.

Exchange-traded fund investors can deploy contrarian strategies by using value ETFs or those tracking fundamentally weighted indexes like Invesco FTSE RAFI US 1000 ETF PRF and Schwab Fundamental US Large Company ETF FNDX. Value ETFs typically hold only stocks that are cheap relative to their book value or a similar fundamental metric and often cut more expensive names. On the other hand, fundamentally weighted ETFs target the entire stock market, including growth stocks, but use metrics like operating cash flow, sales, and book value to size their positions instead of market cap. Their weightings reflect the current economic footprint of the underlying companies instead of relying on the market’s opinion of future prospects, breaking the link between prices and portfolio weightings.

For example, PRF weights the 1,000 largest constituents from the FTSE US All Cap Index by their fundamental size, which includes a firm’s book value, sales, cash flow, and dividends (averaged over the trailing five years). Companies with large economic footprints top the portfolio, such as Berkshire Hathaway BRK.B, ExxonMobil XOM, and Microsoft MSFT. In contrast, the strategy underweights companies with more growth built into their valuation. Nvidia NVDA made up only 0.17% of PRF at the end of April 2024, or 4.18 percentage points lower than its weighting in the Morningstar US Market Index.

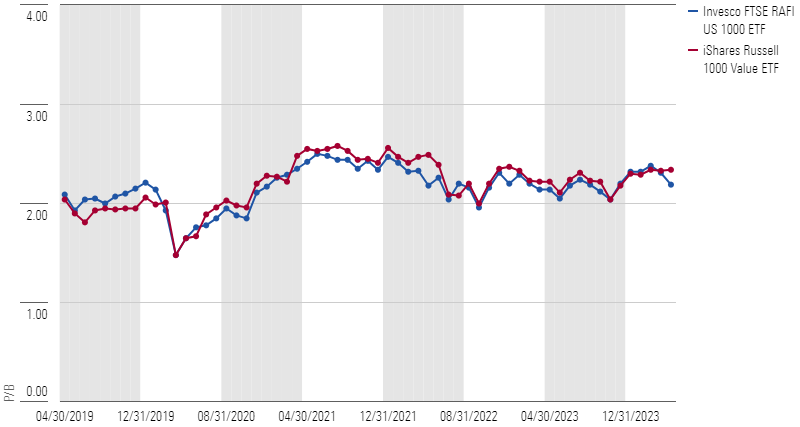

Shunning stocks whose prices have grown expensive relative to their fundamentals imparts a value orientation in line with more conventional market-cap-weighted value ETFs like iShares Russell 1000 Value ETF IWD. This has been evident in the average valuation of PRF and IWD, as shown in Exhibit 1.

Different Philosophies, Similar Price/Book

Different Philosophies

While IWD and PRF sport similar valuations, their construction philosophies differ. IWD selects stocks in the cheaper half of the market based on their price/book ratios. It then weights stocks by market cap. If a holding’s price goes up, its weighting in IWD’s portfolio increases, tilting it toward the largest and more expensive names.

PRF does not screen for cheaper stocks. It targets the largest 1,000 US stocks across the value-growth spectrum and weights them by fundamental size. If a company’s stock price declines relative to its fundamental size, PRF will increase its exposure at the next rebalance. Similarly, if a stock’s price goes up relative to its fundamentals, PRF will trim its exposure. This buy-low, sell-high mechanism limits PRF’s exposure to richly valued stocks and tilts it toward cheaper stocks, capturing the essence of value investing.

Examining the Annual Rebalance

To understand how fundamentally weighted strategies like PRF implement their contrarian bets differently from traditional value index funds, I will examine the buy-low, sell-high approach embedded in their rebalancing.

For each holding in PRF’s portfolio, I pulled its price/book, price/sales, and dividend yield before and after the rebalance to approximate the metrics PRF uses to select and weight stocks. I split the portfolio into two cohorts based on whether a holding’s weighting increased or decreased and compared their characteristics after controlling for how much each stock’s weighting changed.

Stocks whose weightings increased at the rebalance were cheaper relative to their fundamental metrics, like book value or sales, while the opposite was true for holdings whose weightings decreased. Exhibit 2 demonstrates the weighted average characteristics of stocks with increased weightings versus those that were trimmed down, as well as the before and after characteristics of PRF’s portfolio.

Rebalance Characteristics

While reweighting pushed the portfolio toward cheaper stocks, the opposite was true of positions that entered or exited the fund. Stocks entering the top 1,000 US companies by fundamental size had healthier fundamentals than those departing.

This distinguishes PRF from a market-cap-weighted value index fund like IWD. PRF’s contrarian strategy occurs in the reweighting of holdings, while IWD’s contrarianism stems from stocks moving in and out of its portfolio altogether. Well-performing stocks in IWD graduate to iShares Russell 1000 Growth ETF IWF, as Meta Platforms META did in 2023. PRF merely trims back any names that increase their price multiples. PRF cut Meta’s weighting to 0.92% from 2.13% at its last rebalance in March 2024.

Likewise, PRF doesn’t flinch when valuations drop. PRF increased its stake in Microsoft after a disappointing 28% decline in 2022. Microsoft went on to rally and returned 58 percentage points in 2023. In contrast, IWD hasn’t owned Microsoft shares since the end of June 2019.

IWD tethers its portfolio to the value half of the market, but that isn’t the case for PRF. Growth stocks improving their fundamentals increase their long-term weighting in PRF, even if their weightings are trimmed back when their prices balloon. PRF can take on a growth bias compared with large-value peers when growth stocks’ fundamentals outstrip those of value stocks. But its value tilt can also sharpen when top-performing stocks are built on future growth, not fundamentals. As of April 30, Nvidia made up just 0.17% of PRF’s portfolio despite being the third-largest holding in the Russell 1000 Index. But PRF heavily overweighted fundamentally stronger mavens in the index’s top 10 holdings: Berkshire Hathaway and J.P. Morgan Chase & Co JPM.

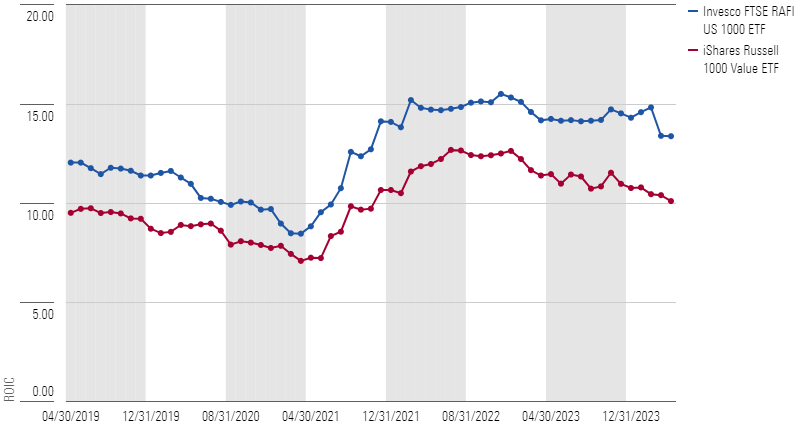

Holding growthier companies adds a quality tilt to PRF that should temper some of the risks of value traps and shore up the portfolio’s durability. Exhibit 3 illustrates PRF’s consistently higher profitability, as measured by return on invested capital, over IWD.

PRF’s Higher Dose of Quality

Final Thoughts

Investors intuitively group fundamentally weighted ETFs with conventional value ETFs because they live on the same block of the Morningstar Style Box. However, unpacking their portfolios and rebalancing techniques paints a picture of two divergent philosophies. IWD buys only cheap stocks. PRF buys everything, but it sizes its bets according to the fundamentals of the underlying companies instead of price. This way, PRF avoids overpaying for stocks across the value-growth spectrum while still focusing on stocks with cheap valuations and a tilt to quality.

Contrarian investing can come with elevated volatility and the possibility of underperforming the market for a significant period. Understanding how contrarian ETFs work, especially when they reshuffle their portfolios, can keep investors grounded when markets go against them so they can reap the rewards when their contrarian bets deliver.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)