A Guide to Selecting Strategic-Beta ETPs

A brief guide outlining how we set out to separate the wheat from the chaff in this field.

A version of this article was published in the July 2015 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor by visiting the site.

Strategic-beta exchange-traded products, or ETPs, continue to proliferate. As of the end of June, there were 422 such ETPs, by our count; 71 of them (17%) were launched over the past 12 months. Strategic-beta ETPs collectively held $448 billion, representing 21% of all ETP assets. These hybrid active/passive varietals present a new learning curve and a distinct due-diligence challenge to investors. Here, I provide a brief guide outlining how we set out to separate the wheat from the chaff in this field and a short list of those funds we think are the cream of the crop.

Low Cost, Low Cost, Low Cost Did I mention low cost? If there is one thing investors can control, it is cost. As Jack Bogle has reminded us time and again, in investing, you get what you don't pay for.

Many asset managers are rolling out suites of strategic-beta ETPs to justify higher fees and to distract investors from this fundamental principle. In some cases, the fees charged by these funds have encroached on active management territory. Do not pay active management prices for passively managed funds.

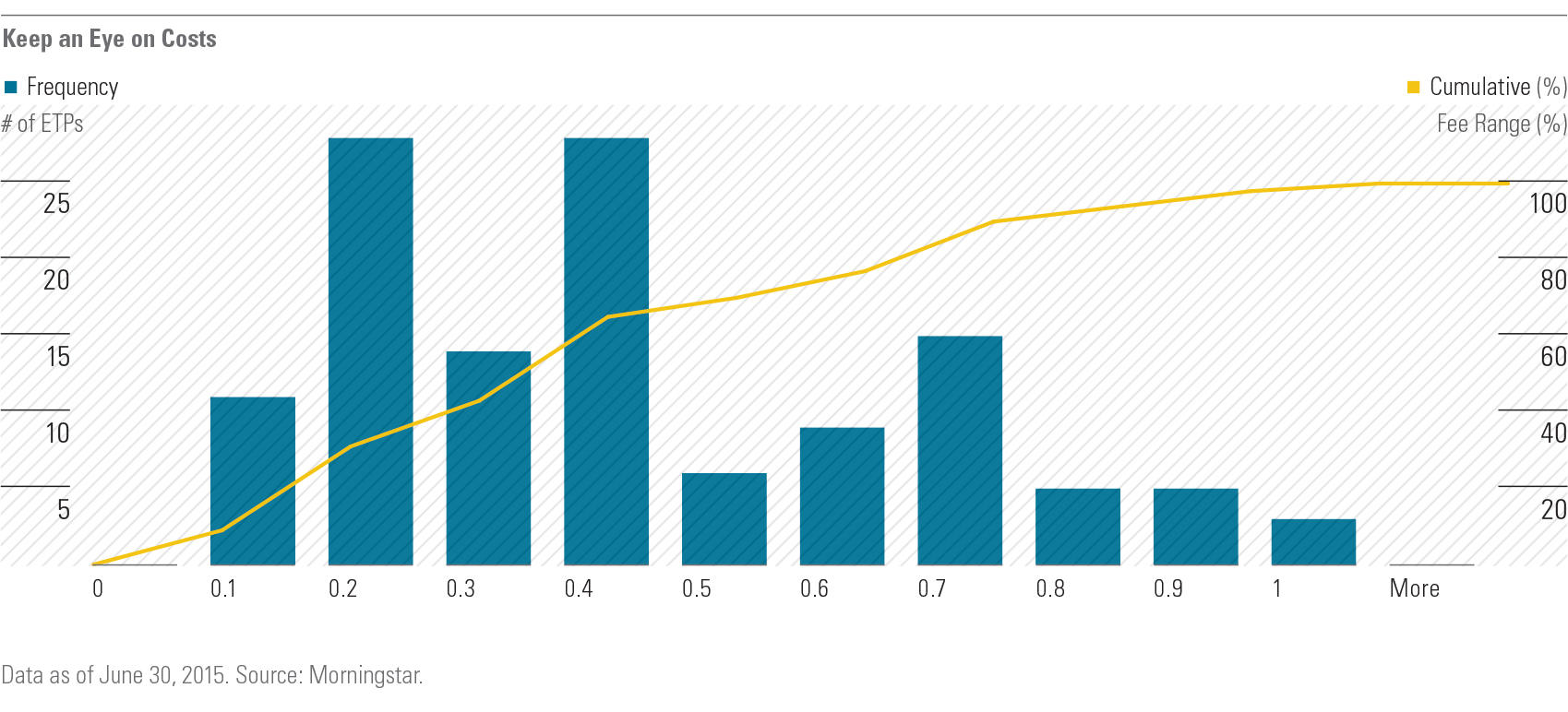

Fortunately, the majority of these funds are reasonably priced, and there has been evidence that a combination of competitive forces and economies of scale will push their fees down over time. In the histogram below, I’ve plotted the fees charged by the 124 strategic-beta ETPs that invest in large-cap U.S. equities. Two thirds of these ETPs take an annual toll that is less than or equal to 0.40%. Forty basis points is 10 times the fee levied by the lowest-cost plain-vanilla U.S. equity ETF,

SCHB, but a far cry from the 0.93% median rake of large-cap no-load mutual funds. Products falling into this range are generally sensibly priced. The remaining third charge fees in excess of 0.40%. These products merit an added degree of scrutiny. Any strategic-beta ETP that invests in U.S. stocks and takes a toll of 70 basis points or more should be viewed with suspicion.

Sensible Strategy Strategic-beta ETPs are the offspring of an active and a passive parent. Like their active parent, they deliberately stray from the "market" portfolio with the intent of improving relative returns, decreasing or increasing relative risk, or some combination of the two. As is the case with selecting active managers, investors must assess these products' strategies to ensure that they are sensible and efficient and have ample capacity.

Most strategic-beta ETPs’ underlying benchmarks are built to exploit one or more factors. Thus, the sensibility of the strategy depends on the viability of the factor or factors it looks to harness. There have been hundreds of factors “discovered” by academics and practitioners over the years. Most of these are the result of data mining and have no basis in sound economic theory (unexpected earnings autocorrelations?!?). [1] Economic intuition and investor behavior form the foundation of the good ones.

Value makes sense. Investors demand extra compensation to assume the risks associated with value stocks (cyclicality, leverage, and so on), and one would expect that buying assets on the cheap would naturally yield respectable returns. Momentum is driven by investors’ herding behavior. On the upswing it makes assets overshoot their fair values, often further and for longer than can be reasoned. Momentum works in reverse as well, often giving rise to value. These two are near-unimpeachable. That’s not to say they couldn’t be diluted or arbitraged away at some point, but I wouldn’t count on it. I personally buy into the behavioral explanations of these factors more so than their risk narratives. I don’t think that investors, on the whole, will ever behave well—blame it on our caveman brains.

As I mentioned before, there are a host of other factors that have been discovered ranging from borderline silly to serious contenders. The latter include quality and low volatility. Both factors are relative newcomers, and neither has been as fully vetted as value and momentum. Of course, that hasn’t prevented index and ETF providers from launching a raft of products aimed at delivering them in a readily investable form.

Quality is closely related to profitability, which, along with investment, is a component of the newly minted Fama-French five-factor model. [2] Profitability passes the intuition test. After all, the present value of a stock is a factor of its future cash flows—the more profitable the firm, the greater its expected cash flows. From a behavioral point of view, it can be argued that investors tend to underestimate the sustainability of firms’ current profitability or otherwise misprice profitable stocks. Quality and profitability have recently been put to work by the likes of Dimensional Fund Advisors and AQR in their fund lineups. Quality is in vogue in ETF-land, too, as demonstrated by the rapid rise of

QUAL, which has amassed some $840 million in net new inflows in the two years since it launched.

The low volatility anomaly flips the traditional notion of the relationship of risk and reward on its head. Research has shown that less-volatile stocks have produced risk-adjusted returns superior to those of their more volatile counterparts. There are plenty of reasonable arguments as to why that might be. There is also research showing that this relationship might not be as clear-cut as it seems and may not persist. All told, low-volatility strategies have worked in the past, may or may not work in the future, and have yet to be enshrined in the way that value and momentum have.

Efficient Exposure Not all factor exposures are created equal. Nuanced differences in index-construction methodologies can yield meaningfully different performance profiles amongst similarly labeled strategies. Furthermore, there is a whole lot of messy reality (like costs) that exists between factor theory as it is documented in academia and the rubber-meets-road implementation of factors in practice. It is important to understand how efficiently these funds' underlying benchmarks are capturing their targeted factors and whether they might be missing the mark by virtue of being costly to implement or loading up on other, unintended exposures.

In a recent research piece, Northern Trust’s Michael Hunstad and Jordan Dekhayser elegantly distilled their analysis of this concept into a “factor efficiency ratio,” or FER. [3] The FER is a ratio of the active risk coming from intended factor bets to the total active risk of a strategic-beta benchmark—with active risk being calculated versus the index’s market-cap weighted parent benchmarks. The authors found that strategic-beta indexes with higher FERs generate higher risk-adjusted returns.

The tools employed by Hunstad and Dekhayser are out of reach for many investors (myself included). Fortunately, there are other implements readily available at no cost that can help you conduct factor analysis on your own. My personal favorite is Portfolio Visualizer (www.portfoliovisualizer.com). You can plug any ETF (or traditional mutual fund) you'd like into this powerful tool to decompose its historical factor loadings in a number of different ways and analyze how they've evolved over time. You can also do side-by-side comparisons of strategic-beta ETPs employing like strategies to analyze their relative loadings on different factors and how they vary with time.

Has Capacity The persistence of any factor is reliant on there being someone on the other side of the table willing to take the opposite side of your factor bet. In order for value to produce excess returns, there must be a cohort of investors shunning value. If everyone were to simultaneously bet on value, it would ultimately become the "market." Thus, it is important to understand the capacity of factor bets, much the same way it is important to understand the capacity of an active strategy.

In May 2013, MSCI published an exhaustive analysis of the capacity of its various strategy benchmarks across a number of geographies on behalf of Norway’s Ministry of Finance. [4] The key takeaway as it pertains to capacity?

“…it should be noted that market capitalization weighted indexes are the only macro consistent indexes. All other index weighting schemes cannot be held by all investors. This puts natural bounds on the capacity of a risk premia allocation. As an index increasingly deviates from a market capitalization-based index, it becomes less and less investable, particularly for funds of very large size.”

Where is there capacity? Generally speaking, look for the foundational factors (value and momentum) in broad, deep markets (U.S. stocks, developed ex-U.S. stocks). This is where I personally believe these factors have the most staying power.

A Capable, Responsible Sponsor Last, but certainly not least, it is important to partner with a capable, responsible sponsor. Morningstar research has shown that good stewards of shareholders' capital have tended to produce better long-term investor outcomes. [5] Fees (which I've discussed at length above) factor into our assessment of stewardship. It is not surprising that firms with lower fee levels have, on average, experienced greater Morningstar Success Ratios—the percentage of an asset-management firm's mutual fund offerings that have both survived and outperformed their respective Morningstar Category median fund's results over a given time period. Culture also factors into our assessment of fund sponsors' stewardship practices. We tend to frown upon firms that emphasize salesmanship over stewardship, product proliferation over useful and meaningful innovation. There is plenty of spaghetti being slung at the wall in the strategic-beta arena. Stay away from the slingers, and focus on firms that take a measured approach to product development and offer their funds at reasonable prices. (Have I mentioned that costs matter?)

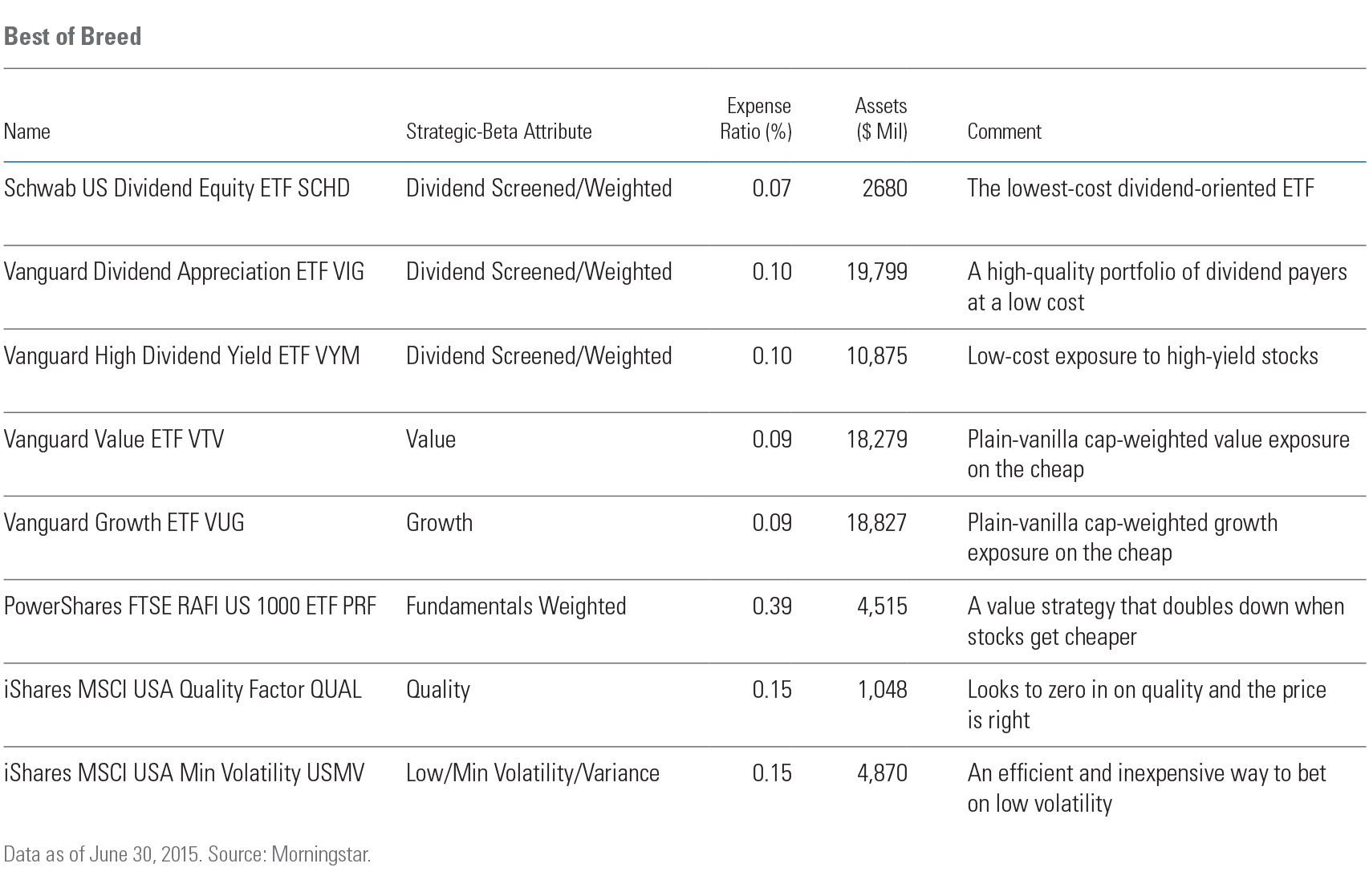

Our Favorites Using the criteria I've described above, I've whittled down the field of 124 strategic-beta ETPs that invest in U.S. large-cap stocks to a short list of my favorites. These funds are reasonably priced (all have fees lower than 0.40%), employ sensible, efficient strategies that have ample capacity and are managed by capable, responsible sponsors.

[1] Harvey, C., Liu, Y., & Zhu, H. 2015. “…and the Cross-Section of Expected Returns.” http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2249314

[2] Fama, E., & French, K. 2014. “A Five-Factor Asset Pricing Model.” Fama-Miller Working Paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2287202

[3] Hunstad, M., & Dekhayser, J. 2015. “Evaluating the Efficiency of ‘Smart Beta’ Indexes.” Journal of Index Investing, Vol. 6, No. 1, P. 111. http://ssrn.com/abstract=2510987

[4] Bambaci, J., Bender, J., Briand, R., et al. 2013. “Harvesting Risk Premia for Large Scale Portfolios.” https://www.msci.com/resources/research/articles/2013/Harvesting_Risk_Premia_for_Large_Scale_Portfolios.pdf

[5] Hughes, B., Lutton, L., West, C., et al. 2015. “2015 Morningstar U.S. Mutual Fund Industry Stewardship Survey.” http://corporate.morningstar.com/us/documents/ResearchPapers/US-MutualFundIndustryStewardshipSurvey2015.pdf

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZD4DY5U6GRAO5B7EP7NAECJAMM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)