Farewell, Mutual Funds in 401(k)s?

Behind the accelerating shift from mutual funds to CITs on 401(k) plans.

Earlier this year, Morningstar’s John Rekenthaler wrote that the mutual fund era was giving way to the exchange-traded fund age. Traditional funds may retain a foothold in tax-advantaged 401(k) plans, where ETFs’ tax efficiency is irrelevant. However, another vehicle--the collective investment trust--is undermining even that last bastion for mutual funds.

What’s a CIT?

CITs were first introduced in 1927, three years after the first mutual fund launched. For most of their history, pension plans and other institutions, like banks, were the primary users. There has never been much public CIT information available because at first they tended to be designed for single clients, and the Investment Company Act of 1940, which raised reporting standards for mutual funds, excluded CITs, leaving them under the Department of Labor’s jurisdiction.

When defined-contribution retirement plans, such as 401(k) plans, were born in the 1980s, they preferred mutual funds, in part, because of their better disclosure. But as fee-related lawsuits against 401(k) plan sponsors have surged, there’s been an increased focus on lowering costs. This has given CITs a fresh start.

Costs are CITs’ biggest advantage over mutual funds. Not only do they lack the expense of meeting mutual funds’ reporting requirements, but, unlike 1940 Act funds, they also can negotiate fees with clients such as plan sponsors, under the Employment Retirement Income Security Act, or ERISA. This flexibility has been the single biggest driver of CIT growth in defined-contribution plans, especially in target-date strategies.

Target-Date Strategies Lead the CIT Revolution

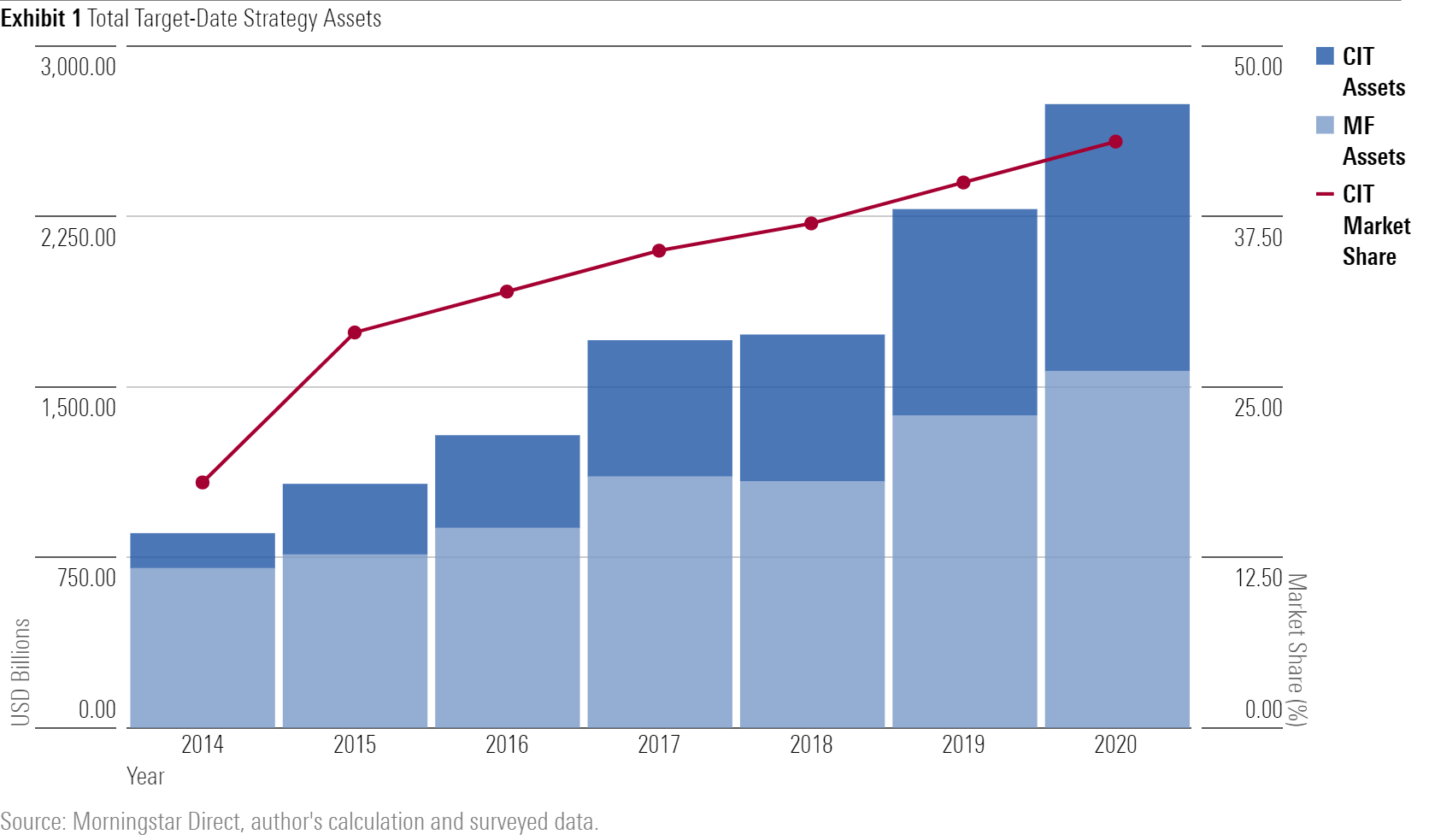

The 2021 Target-Date Landscape highlighted the strong growth of CITs, which grew to approximately $1.2 trillion by the end of 2020. That accounts for roughly 43% of total target-date fund assets, up from less than 20% in 2014.

CITs have been most popular with the largest defined-contribution plans; early adopters were typically large corporations that were already familiar with the structure from their pension plans. Regular conversations with target-date managers make it clear that more plan sponsors have gotten comfortable with the vehicle and its low costs.

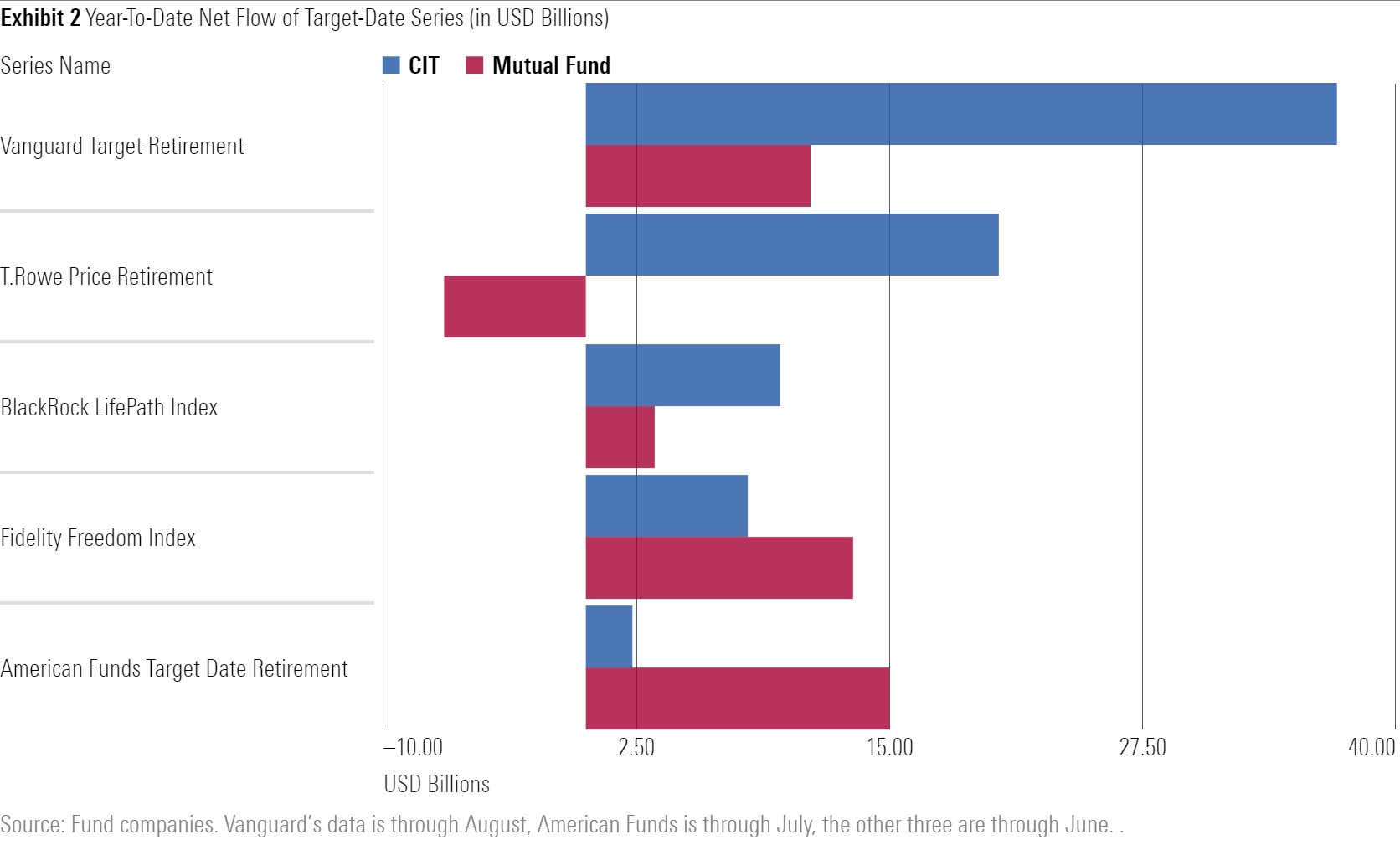

CITs’ 2021 net flows continue to outpace mutual funds’ at three of the five largest target-date providers by market share. The other two took in more CIT flows than last year. Exhibit 2 compares the most recent mutual fund and CIT net inflow data for five of the most popular target-date series.

Vanguard’s CIT collected $37 billion of net inflows through August, more than 3 times its target-date mutual fund flows. In September, Vanguard lowered the minimum investment for Vanguard Target Retirement Trust II shares to $100 million from $250 million, which should help the CIT maintain its inflow momentum.

Flows into CIT veterans BlackRock and T. Rowe’s vehicles continued to outpace their target-date mutual funds.

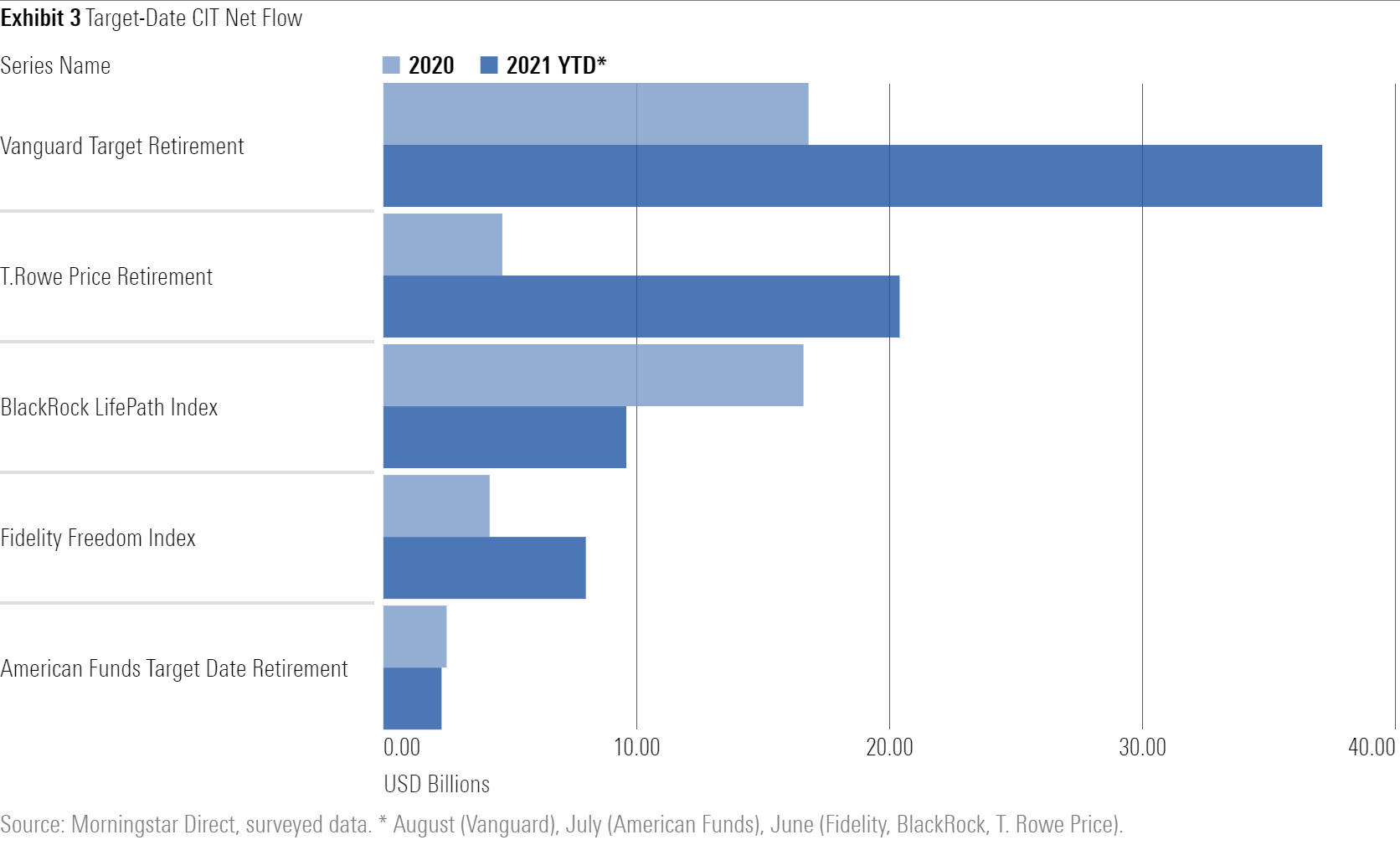

Target-date mutual funds still hold sway at Fidelity and American Funds, but Exhibit 3 shows that momentum is shifting there, too.

All five providers have already either topped, or are on pace to beat, their 2020 CIT net inflows. Fidelity Freedom Index’s $8 billion of CIT net inflows through the first six months of the year is already double what it collected in all of 2020. And net flows into its CITs account for 37% of its total strategy flows, up from 23% in 2020.

American Funds’ $2.3 billion of net inflows through July have nearly matched its 2020 total of $2.5 billion.

The firm also lowered CIT fees for the biggest defined-contribution plans, which could attract more money. In January 2022, fees for plans with $5 billion or more will drop to 0.19% from 0.28%. The family’s cheapest R6 mutual fund share class charges between 0.40% and 0.30%.

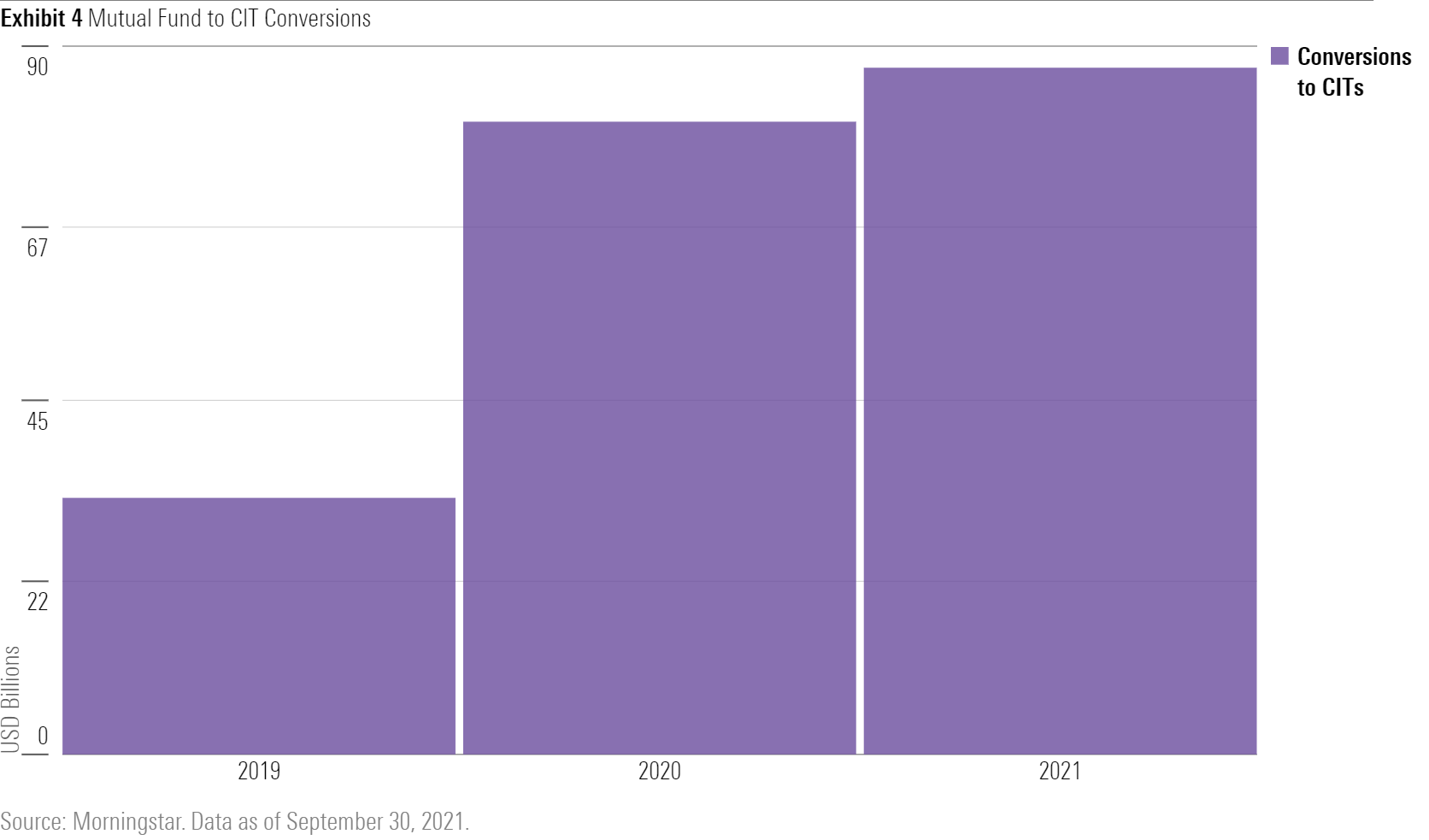

Conversions Are Picking Up, Too

Net inflows aren’t the only indicator of the shift toward CITs. Morningstar estimates, based on flows data that fund companies report to it, that fund families have converted about $87 billion in mutual funds to CITs in 2021 through September, which already surpasses 2020’s $86 billion conversion total. Exhibit 4 shows annual conversions since 2019.

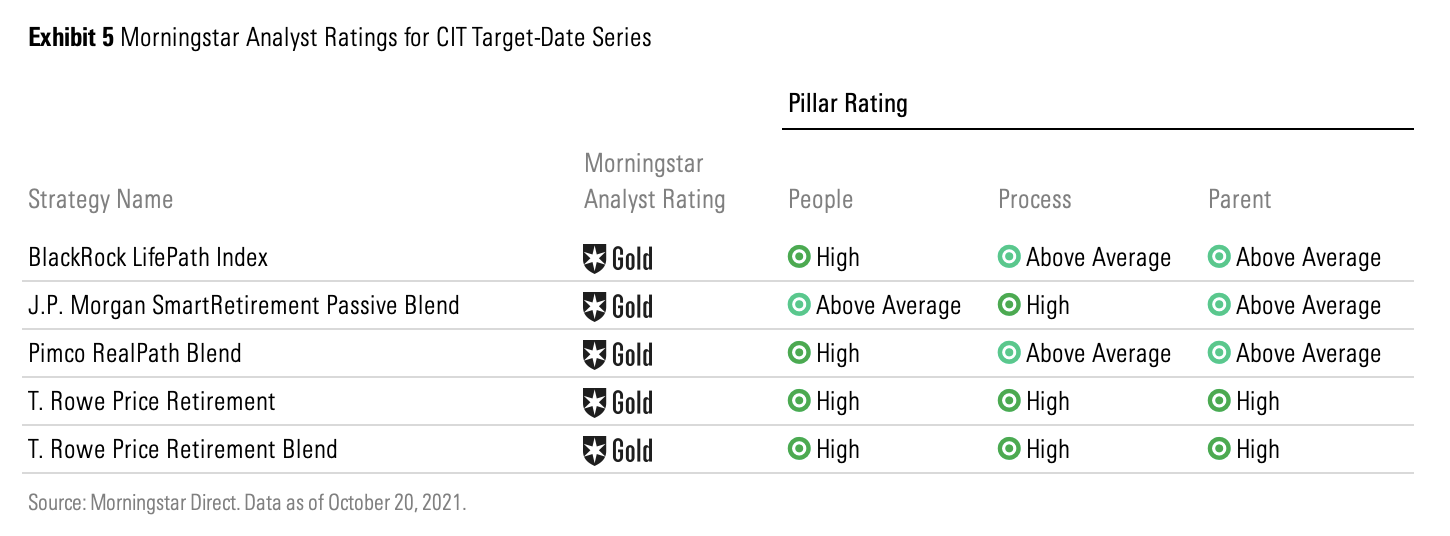

Morningstar’s Highest-Rated CIT Target-Date Series

Morningstar began assigning CITs forward-looking Analyst Ratings in 2019. As managers typically run their CIT target-date funds like their mutual funds, the ratings tend to match those of the cheapest mutual fund share class. Exhibit 5 shows the target-date CIT series that earn Morningstar Analyst Ratings of Gold.

The Future State of CITs in 401(k)s

Target-date strategies, often the default options for 401(k) plans, continue to gain popularity among plan participants--especially younger investors--as more of them opt in to their plans’ qualified default investment options. About half of participants in their 20s held a target-date fund, compared with less than a fourth of those in their 60s (as of 2018, the most recent data available from the Investment Company Institute). Overall, 56% of participants owned a target-date fund, up from just 19% in 2006. CITs continue to take retirement plan market share from mutual funds, and the trend shows no sign of abating.

There also has been a lot of innovation among target-date CIT series. BlackRock in October announced that five plans had already signed up for the target-date strategy with an embedded annuity that it plans to launch in 2022. American Funds and Nationwide also have said they’re teaming up to offer a target-date CIT with an annuity option. It’s too soon to tell whether these strategies will be successful, but if they are, they could help CITs’ growth story.

As plan sponsors get more comfortable with target-date CITs, they could start using the vehicles for stand-alone strategies, too.

Transparency Is Still an Issue

CITs, however, are less transparent than mutual funds owing to lighter regulation. For example, more than two thirds of the 124 unique target-date CITs that report to Morningstar don’t disclose their managers or whether they have changed recently. That’s vital information investors need. Specific plans may offer better disclosures for the series they use, but this information should be easy to find.

Even if CITs overtake mutual funds in 401(k) assets, it won’t truly be a win for investors until investors can find information on them as easily as they can for mutual funds and ETFs.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)