EMEA Sustainable Funds Grew 3 Times Faster Than Other Funds

5 Key Takeaways

- Assets invested in European sustainable funds grew 7% over the past year, compared with just 2% for non-sustainable products.

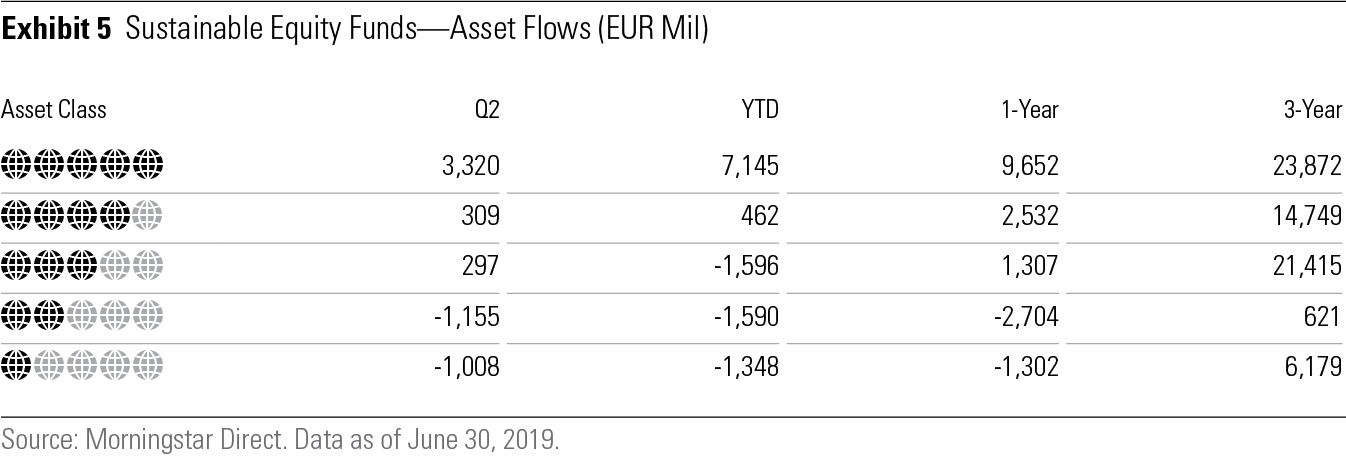

- Sustainable equity funds attracted positive inflows over three, six, and 12 months, in contrast with non-sustainable equity funds, which marked outflows over the same periods.

- Morningstar data shows a clear link between flows towards sustainable equity funds and the Morningstar Sustainability Rating.

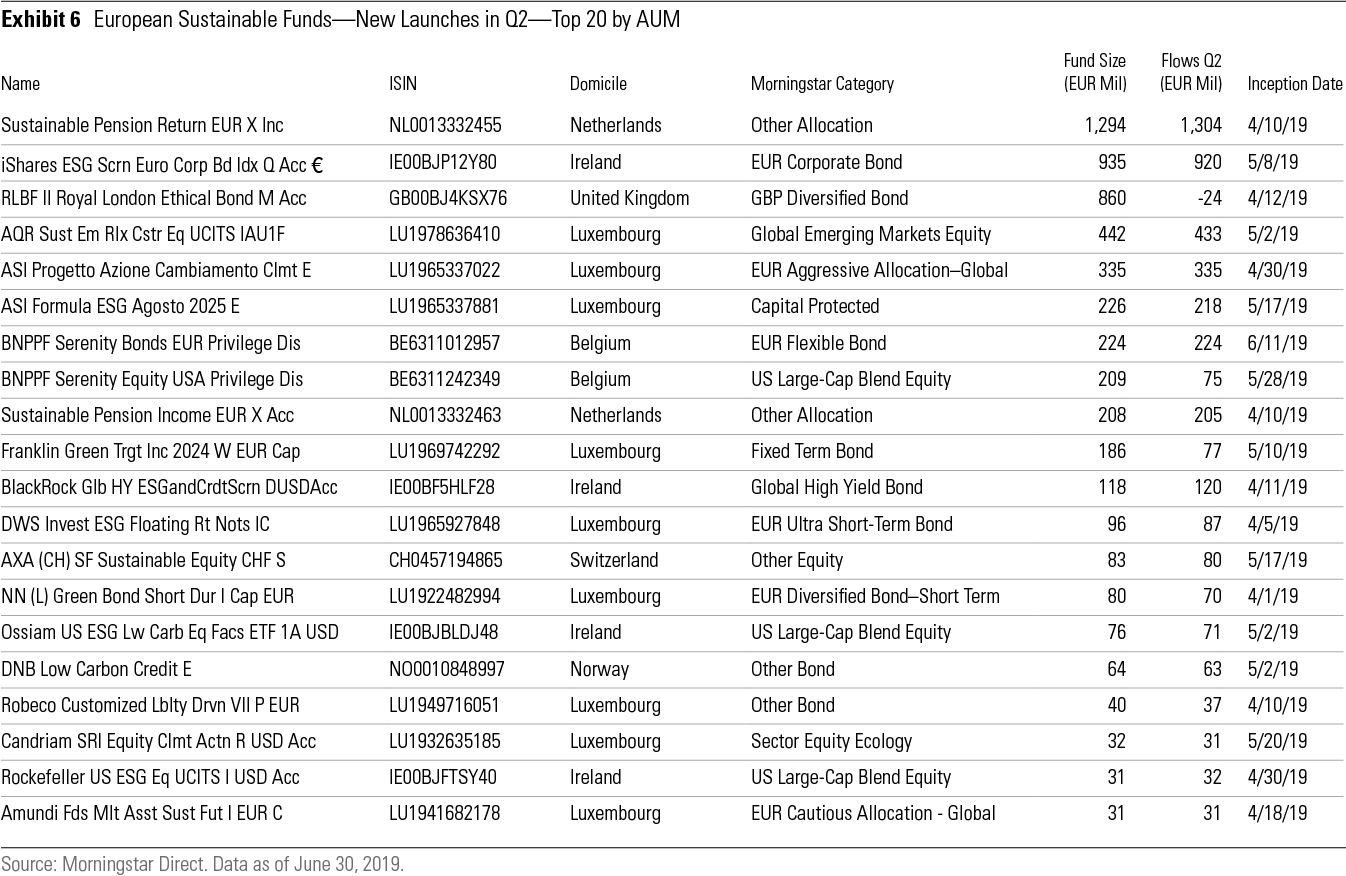

- Seventy-eight new sustainable products were launched in the second quarter. They have experienced EUR 2.8 billion inflows and have EUR 3.1 billion in assets.

Introduction

For this review, we have defined the European sustainable funds universe as those open-end funds and exchange-traded funds domiciled in Europe that, by prospectus, state that they either consider environmental, social, and governance criteria as part of their investment processes, pursue a sustainability-related theme, or seek measurable sustainable impact alongside financial return.

Sustainable Assets Are Growing Faster Than Non-Sustainable Funds

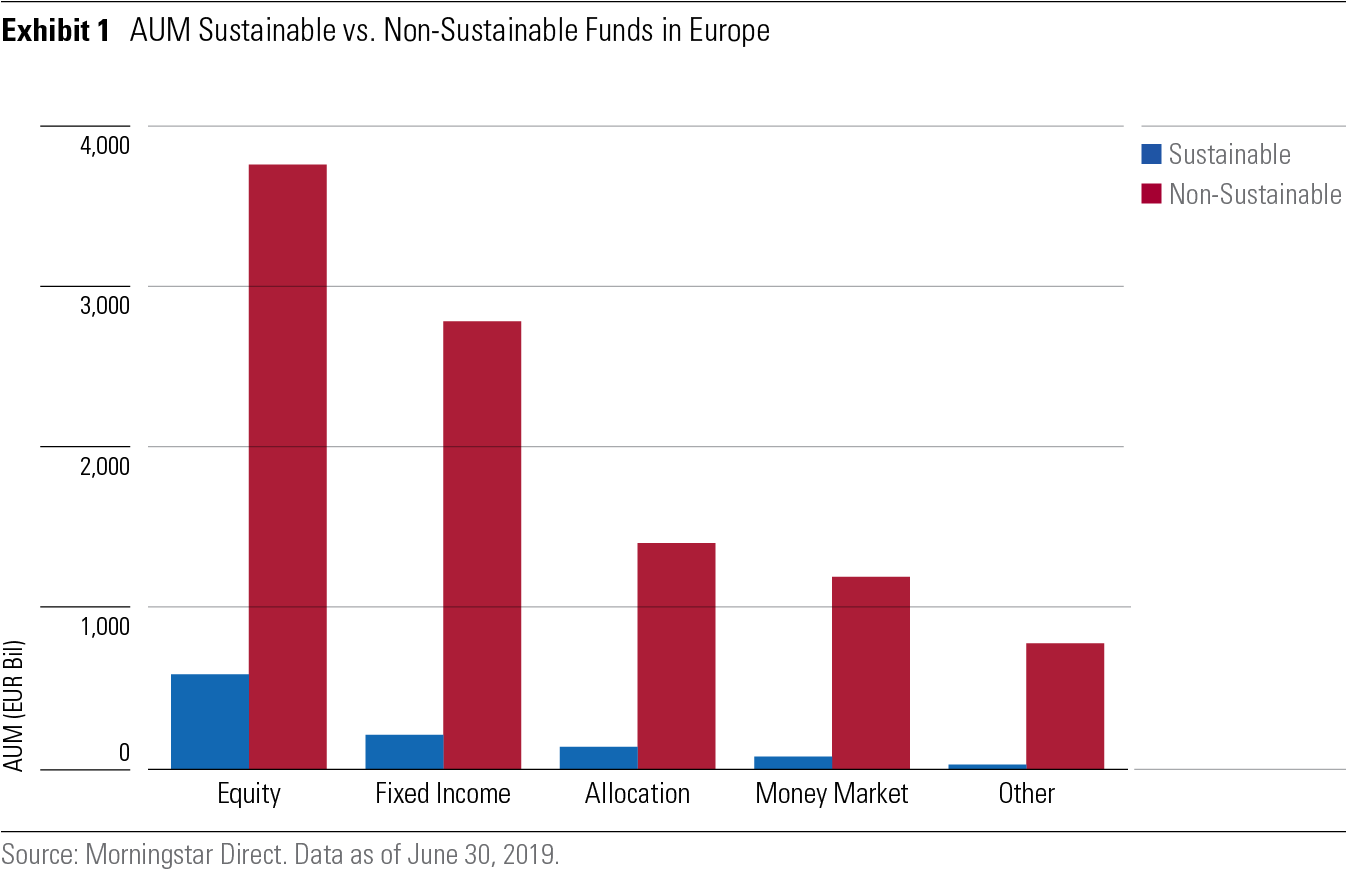

As sustainable investing becomes more mainstream in Europe, the menu of ESG index funds continues to grow. According to Morningstar Direct data, 2,928 sustainable funds (2,825 open-end and 103 exchange-traded products) were available to European investors as of June 30, 2019. At the same time, Morningstar counted 35,901 non-sustainable sustainable funds.

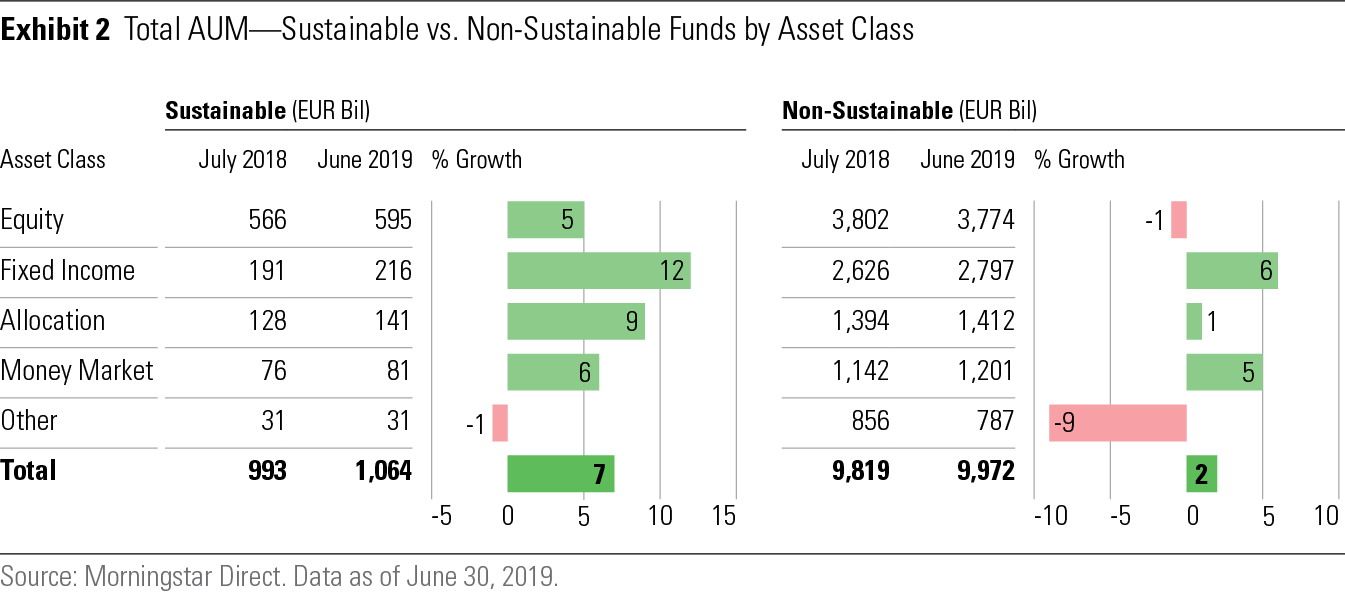

Sustainable funds had EUR 1.06 trillion under management, up from EUR 992.5 billion a year earlier, a 7% increase. Assets in non-sustainable sustainable funds grew just 2%, from EUR 9.82 trillion to EUR 9.97 trillion. (Click images for better viewing)

The gap between the growth rate of equity (+5% versus -1%) and bond (12% versus 6%) assets is impressive, from this point of view.

Equity Investors Prefer Sustainability

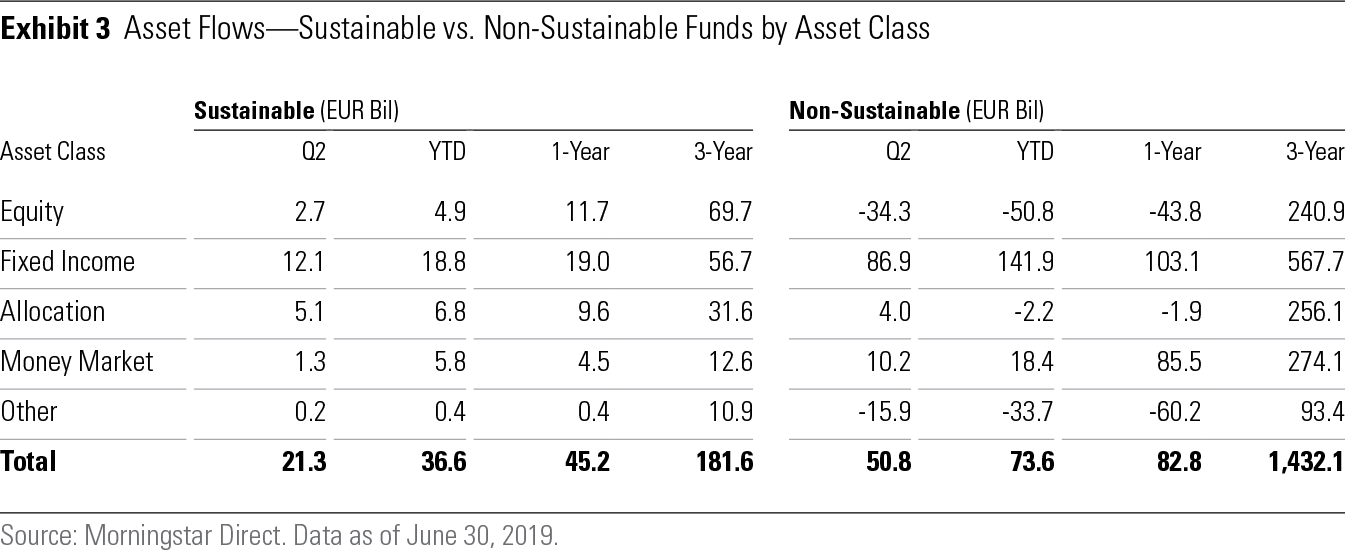

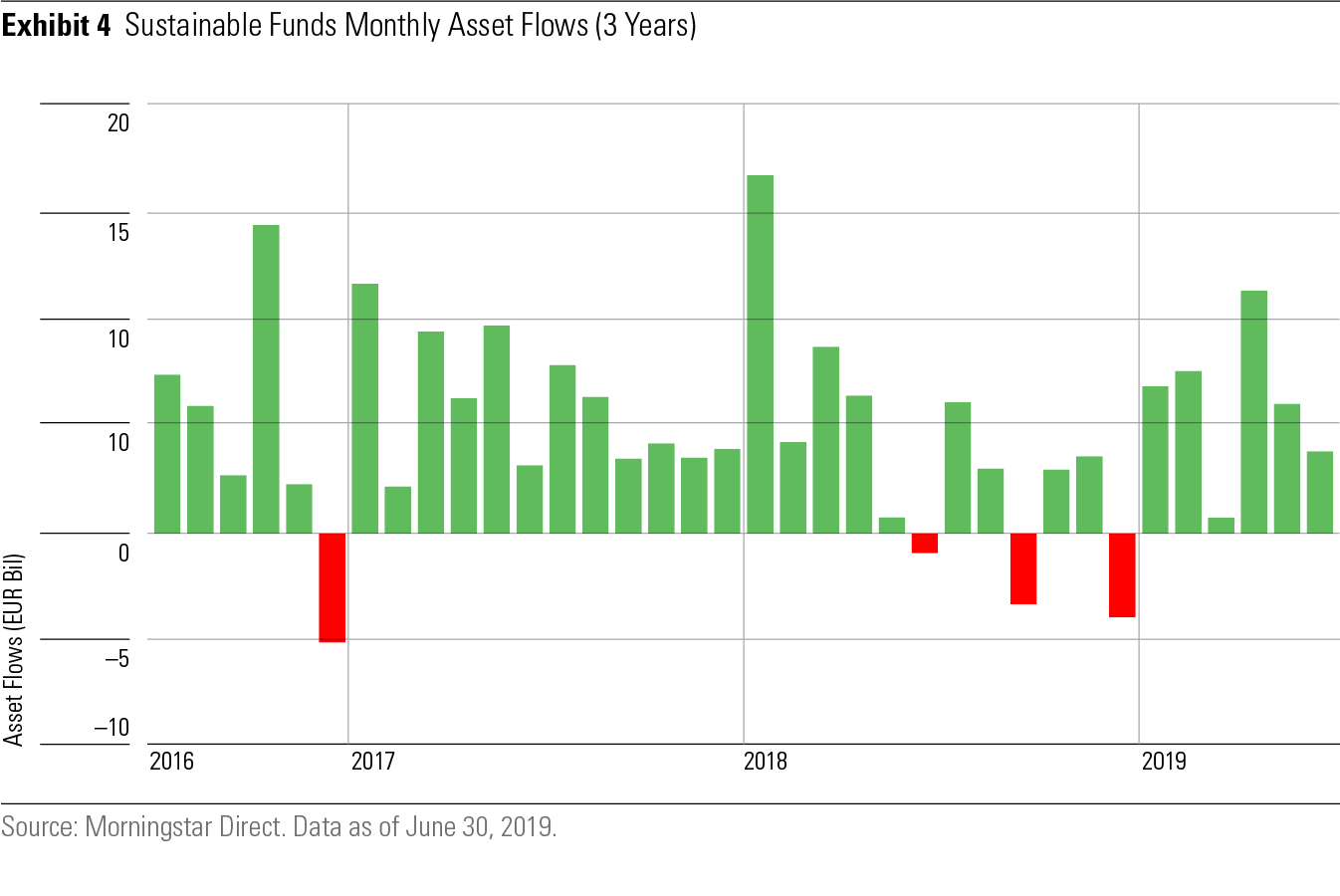

Sustainable products attracted EUR 21 billion of net inflows in the second quarter of 2019 and EUR 37 billion for the year to date.

Notably, sustainable equity funds have experienced inflows while non-sustainable funds have had net outflows over the past year.

Follow the Globes

The Morningstar Sustainability Rating was introduced in 2016 in cooperation with partner research firm Sustainalytics. Currently, 50,000 funds worldwide have a Sustainability Rating. The rating is expressed using globes: a fund with 5 globes has the top ranking; 1- globe-funds are at the bottom. The rating allows investors to evaluate how well the companies in a fund’s portfolio are managing the environmental, social, and governance factors relevant to their industries.

European equity investors sensitive to sustainability issues have largely favored funds showing a High Sustainability Rating, with more that EUR 7.1 billion taken in for the year to date and EUR 9.6 billion gathered in the last year. Equity funds with a Sustainability Rating of Below Average or Low suffered net outflows.

New Launches

Seventy-eight new sustainable funds (nine ETFs and 69 open-end funds) came to market in Europe in second-quarter 2019, expanding the tool kit available to ESG-conscious investors. By asset class, 36 of the 78 new launches were equity products, 26 were bond funds, and 12 were allocation. The rest were miscellaneous and convertible products.

The crop of new funds in second-quarter 2019 has experienced EUR 2.8 billion in inflows and has EUR 3.1 billion in assets.

New fund offerings showed predominantly an overall ESG-related style of investing, with a strong focus on engagement activities (64 of 78). Nine offerings among new products launched in the quarter have a clear low carbon strategy. None has a gender and diversity focus.

BNP Paribas and Legal & General were the most active providers, with five new products each, followed by Amundi, with four new launches. BlackRock, Robeco, UBS, Invesco, Storebrand, and Epworth launched three new offerings each, followed by Actiam, Franklin Templeton, Allianz Global Investors, Monega, Natixis, Rockefeller, and DWS, with two new funds each.

Among the new offerings, Robeco’s Sustainable Pension Return EUR X Inc, which launched on April 10, attracted the most inflows (EUR 1.30 billion) and had the highest assets under management (EUR 1.29 billion) at the end of June.

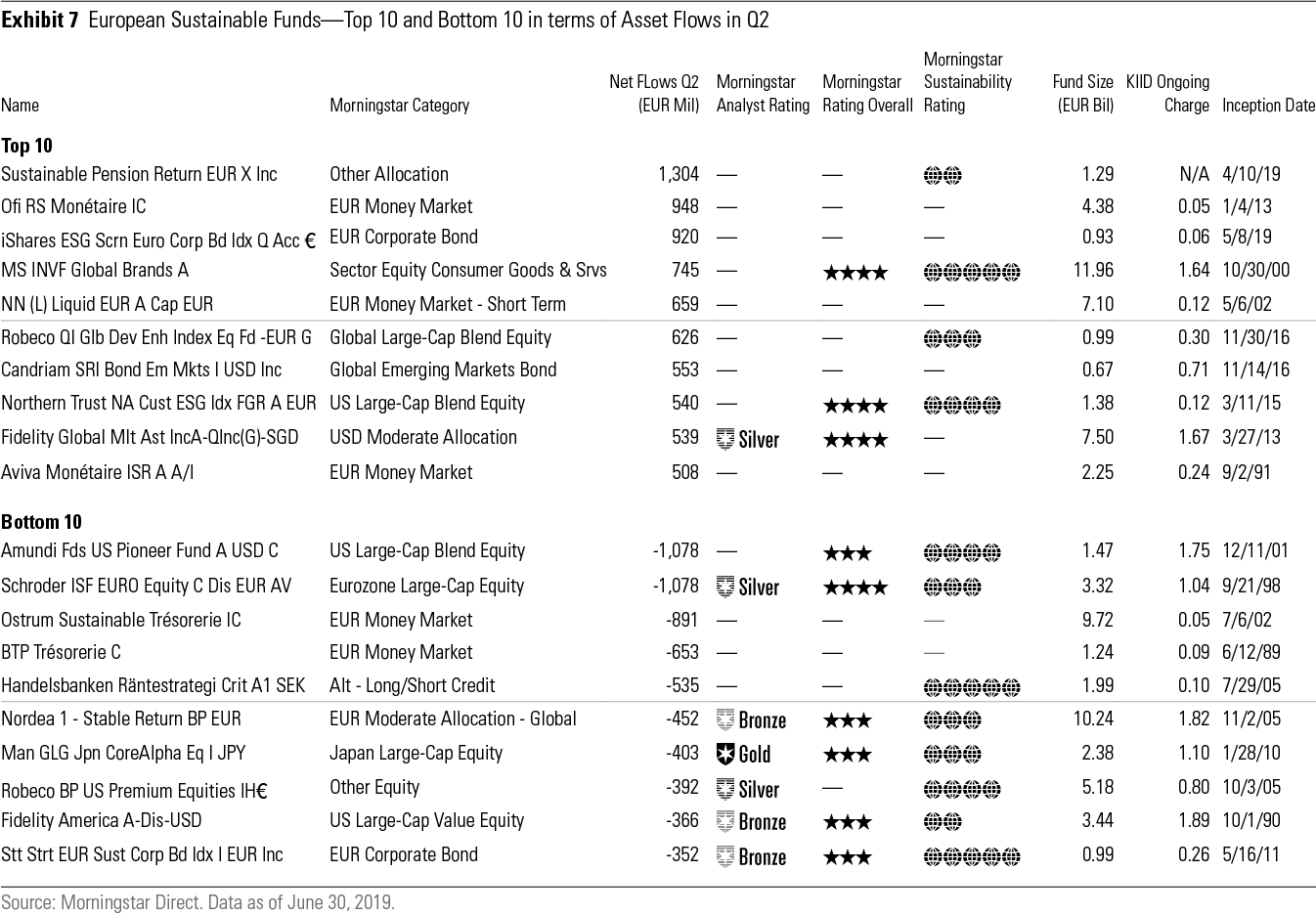

The Leaders and the Laggards in Q2

Broadening the scope to all sustainable funds domiciled in Europe, we again find Robeco’s Sustainable Pension Return Fund at the top of the ranking of products that have raised the most. Among the leaders in terms of asset flows, there are only three equity funds, none of them at the top places on the list.

The only Morningstar Medalist fund among the top 10 is Fidelity Global Multi Asset Income Fund (EUR 540 million of net subscriptions). Morningstar upgraded that fund’s Morningstar Analyst Rating to Silver from Bronze in May 2019. Morningstar analysts think the strategy is well suited to achieve the fund’s target of a 4%-6% annual distribution.

Turning to the laggards, we find two equity funds at the top of list: Amundi US Pioneer Fund and Silver-rated Schroder ISF EURO Equity C Distribution EUR, which both shed more than EUR 1 billion between April and June.

Data Notes:

The figures in this report were compiled on 17 July 2019. Approximately 39,000 Europe-domiciled open-end funds and ETFs that Morningstar tracks from more than 1,750 fund companies across more than 35 domiciles were included. Please note that Morningstar's current asset flows methodology might not include pre-inception subscription-period inflows of so-called target-date funds in net asset flows estimations.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)