Earth Day 2023: 6 Top-Rated Funds From Sustainable-Investing Pioneers

How Earth Day mobilized sustainable investing.

The first Earth Day in 1970 is credited with mobilizing the U.S. environmental movement and contributing to the passage of important environmental legislation that led to the creation of the Environmental Protection Agency. The annual event has grown into a sustained commitment to protecting and enhancing our environment, involving more than 1 billion people globally each year.

Today, Earth Day 2023′s mission is “to accelerate change toward a green, prosperous, and equitable future,” and the theme this year is “Invest In Our Planet.” It aims to promote actions by investors, businesses, governments, and citizens to invest in green technology, hasten the transition to a low-carbon economy, and support a just transition.

Socially responsible investment, the precursor of what we now call sustainable investment, emerged in the same era. The first SRI mutual fund, Pax World Fund, launched in 1971. SRI adopted the environmental ethic of Earth Day. Although Earth Day began with an exclusive focus on the environment, it was intended to have a lasting impact. So, we can view sustainable investment as the investment legacy of Earth Day.

Since SRI was a new way of thinking about investment, today’s now familiar tools and practices did not exist. Yet many of the pure-play SRI firms founded in the 1970s are still with us today, standing in contrast to a number of larger fund managers that have brought sustainable-investment products to market in recent years.

Among the U.S. SRI pioneers are fund companies like Impax Asset Management (which acquired Pax World Funds), Calvert Research and Management, Parnassus Investments, Domini Impact Investments, Green Century Capital Management, and Praxis Mutual Funds, as well as boutique asset managers like Trillium Asset Management and Boston Trust Walden.

These firms stand out as authentic, staying true to their purpose at a time when investors are alert to the potential for greenwashing—exaggerated claims or misinformation about the environmental and sustainability characteristics of investments. To protect the interests of investors, the SEC is developing standards for corporate disclosure of climate-related data and rules for asset managers who manage and promote sustainable-investment funds.

Below, I offer some funds to consider, using Morningstar’s array of tools for sustainable investors.

Morningstar’s Sustainable-Investing Framework

Morningstar has developed tools to guide decisions for investors and advisors who want sustainable portfolios. In addition to the Morningstar Rating, which offers peer comparisons on financial performance, its Sustainable-Investing Framework, Morningstar Sustainability Rating, and ESG Commitment Level are resources designed to assist advisors and investors.

Sustainable investing seeks to deliver competitive financial results, while also driving positive environmental, social, and corporate governance outcomes. The Morningstar Sustainable-Investing Framework illustrates the fact that sustainable investing is not monolithic, encompassing a range of investor motivations and manager strategies.

In general, the funds discussed below have a comprehensive process that spans the spectrum: intended to avoid the most destructive and controversial companies, invest in companies that stand out from their peers on ESG issues, improve the behavior of portfolio holdings through engagement, and consider the social and environmental impact of their holdings. They believe that this approach is better for the world and for financial performance over the long run.

ESG Commitment Level

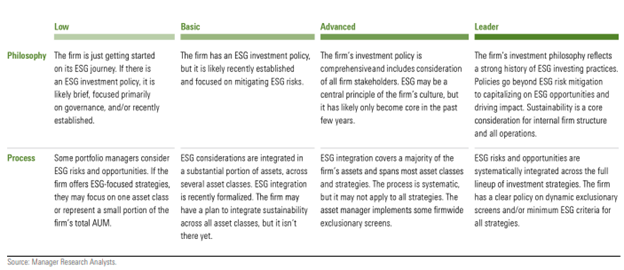

The Morningstar ESG Commitment Level was developed in 2020 to provide investors and advisors with an independent perspective that distinguishes which fund providers have the most developed sustainable-investment practices. It is based on an assessment of their Philosophy and Process, Resources, and Active Ownership. The commitment level of managers is classified as Leader, Advanced, Basic, or Low.

A recent Morningstar ESG Commitment Level report describes what distinguishes Leaders.

- In most cases, these firms have focused on sustainable investing … since day one, and this philosophy remains core to their identities today.

- Over the years, these firms … have been at the cutting edge of developing innovative frameworks to assess ESG risks as well as the impacts.

- These firms stay ahead of the curve by promoting improved disclosures and practices in portfolio companies as well as collaborating with regulators and peers to raise sustainability standards.

- Leading sustainable-investing programs require topnotch talent … to stay at the forefront of best practices. Firms that earn top marks [also] empower their investment talent with robust ESG data and tools.

- Active ownership practices, including engagement and proxy-voting strategies, clearly reflect the firm’s sustainable-investing philosophy.

Socially Responsible Investing Pioneers

We have identified a small set of asset managers that fit the moniker of SRI pioneers—firms that were founded at least 25 years ago, specialize in sustainable investment, and retain their mission (even if currently owned by another entity). The list includes three of the eight firms that qualified as ESG Commitment Level Leaders: Impax, Boston Trust Walden, and Parnassus. (Calvert’s rating as a Leader changed when the ECL no longer rated fully owned subsidiaries separate from their parent owners.) We also include some smaller firms not covered in the report: Trillium, Domini, and Green Century.

For each manager, we’ve featured one equity or allocation fund. The Morningstar Rating measures risk and return against peers, on a scale of 1 to 5 stars (with 5 being the best), and the Morningstar Sustainability Rating measures how a fund’s holdings manage ESG Risk relative to peers, using a scale of 1 to 5 globes. To qualify, a fund must have a Morningstar Rating greater than or equal to 4 stars, a Sustainability Rating greater than or equal to 4 globes, and an inception date before 2003. We selected funds representing a range of geographies, size segments, and styles, as investors consider their asset allocations. The list includes active and indexed mutual funds.

6 Top-Rated Sustainable Funds to Consider

Fund: Impax Sustainable Allocation Investor PAXWX

Morningstar Sustainability Rating: 5 Globes

Morningstar Rating: 4 Stars

Pax World Funds was founded by two Methodist ministers who launched the first SRI mutual fund, Pax World Fund, in 1971 to avoid investing church funds in weapons. Impax acquired Pax World Funds in 2018.

Fund: Boston Trust Walden Mid Cap BTMFX

Morningstar Sustainability Rating: 5 Globes

Morningstar Rating: 5 Stars

Boston Trust Walden, founded in 1974, subadvised its first SRI fund in 1982 and launched its first proprietary mutual fund in 1995.

Fund: Calvert Equity CSIEX

Morningstar Sustainability Rating: 5 Globes

Morningstar Rating: 5 Stars

Calvert Research & Management was established in 1976 and launched its first SRI mutual fund in 1982. Calvert was acquired by Morgan Stanley in 2021 and now offers mutual funds and exchange-traded funds.

Fund: Trillium ESG Global Equity Fund PORTX

Morningstar Sustainability Rating: 5 Globes

Morningstar Rating: 4 Stars

Trillium Asset Management was founded in 1982 and acquired by Perpetual in 2020. Among its services, the firm subadvises mutual funds and manages proprietary mutual funds.

Fund: Parnassus Core Equity PRBLX

Morningstar Sustainability Rating: 5 Globes

Morningstar Rating: 5 Stars

Parnassus was founded in 1984 and launched its first mutual fund in 1992.

Fund: Praxis Value Index MVIIX

Morningstar Sustainability Rating: 5 Globes

Morningstar Rating: 4 Stars

Praxis Mutual Funds is a faith-based fund family founded in 1994. It is owned by Everence.

2 More Sustainable Funds to Look At

Fund: Domini Impact Equity Investor DSEFX

Morningstar Sustainability Rating: 4 Globes

Morningstar Rating: 3 Stars

Domini was established by the principals who founded Kinder, Lydenberg, Domini & Co. (aka KLD Research & Analytics), one of the first SRI research firms, in 1988. In 1991, it launched the Domini Social Equity Fund, the first SRI index fund, which is now actively managed and renamed.

Fund: Green Century Equity Individual Investor GCEQX

Morningstar Sustainability Rating: 4 Globes

Morningstar Rating: 3 Stars

Green Century Capital Management was set up in 1991. It is owned by an environmental nonprofit, whose work is subsidized by profits from the funds. Green Century Equity Individual Investor is an index fund.

Check ESG Commitment Level and Sustainability Rating Before Investing

As we celebrate Earth Day, it is worth considering how our investments shape the world we live in. This intentionality is an important part of sustainable investment. But how do we know if managers and funds are meeting these expectations?

Style purity refers to how faithfully portfolios reflect a fund’s investment objective. For investors in sustainable funds, assessments of a manager’s ESG Commitment Level and a fund’s Sustainability Rating provide meaningful gauges of what we might call “sustainability style purity.” We’ve used this analysis to identify fund managers whose roots go back to the era of the first Earth Day and whose practices have evolved to define authentic leadership on sustainable investment through a focus on managing ESG risk and investing in the transition to a low-carbon economy, buttressed by dedicated engagement on these issues.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)