The Early Read on 2023′s Fund Flows Winners and Losers

A look at some of the funds with the biggest inflows and outflows last year.

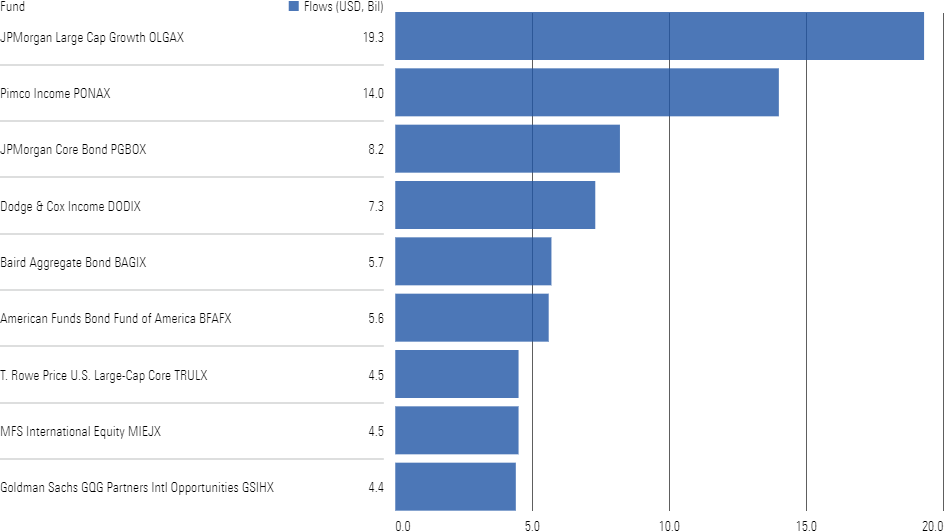

Let’s look at which funds drew the biggest inflows and outflows in 2023. We get the prior month’s and year’s flows in mid-January 2024, so these figures are as of December 2023. Also, I’ll limit it to active funds because flows generally don’t impact passive funds. As you’ll see, core-bond funds reaped strong inflows.

JPMorgan Large Cap Growth OLGAX took in about $20 billion. The fund, which has a Morningstar Medalist Rating of Bronze, had slightly below-average returns of 34.3% for 2023 and 5.7% annualized for the trailing three years. However, the fund strung together outstanding performance from 2017 to 2021, and that may have been enough to fuel investors’ interest.

Next was Pimco Income PONAX, which took in $14 billion. The A shares’ 8.9% return was just a touch above average, but the Silver-rated fund’s three-year returns of 0.7% annualized were top third. The fund now sits on a massive $137 billion asset base.

JPMorgan Core Bond PGBOX took in $8.2 billion. The Neutral-rated A share class returned 5.4%, which was a hair below average for its Morningstar Category, but like Pimco Income, the fund’s three-year return of negative 3.2% annualized was top third.

Dodge & Cox Income DODIX took in $7.3 billion. The Gold-rated fund had a stellar year with a 7.7% return that landed in the top 10% of peers, and its three-year loss of 1.7% was also near the top 10%.

Baird Aggregate Bond BAGIX brought in $5.7 billion. The Gold-rated fund’s 6.4% gain for 2023 and 3.1% loss over the past three years were both top-third.

Investors added $5.6 billion to American Funds Bond Fund of America BFAFX. The fund’s 2023 return of 4.7% landed in the bottom decile, but its three-year 3.3% loss was above average. The fund now has a hefty $80 billion asset base.

T. Rowe Price U.S. Large-Cap Core TRULX garnered a net of $4.5 billion. The fund’s 2023 return of 22.6% was below average, and its three-year return of 9.3% was just above average. Shawn Driscoll took over as lead manager of the Neutral-rated fund in 2022.

MFS International Equity MIEJX enjoyed inflows of $4.5 billion. The Gold-rated fund had top-quartile returns for 2023 and the trailing three years.

Goldman Sachs GQG Partners International Opportunities GSIHX hauled in a net $4.4 billion. It was another strong year for manager Rajiv Jain at this Gold-rated fund. The fund’s 21.6% return in 2023 was in the top decile as was its 6.5% three-year return. The fund now tops $34 billion in total.

Top-Selling Active Funds in 2023

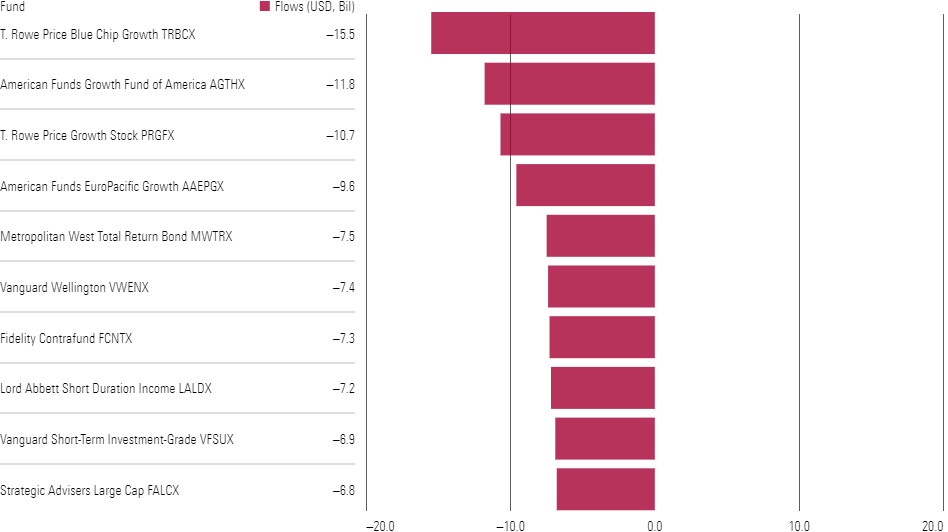

Now for the biggest outflows. Sometimes fund company flow figures do not fully account for collective investment trust conversions, which should not count as outflows, so the figures may be a tad overstated.

T. Rowe Price Blue Chip Growth TRBCX was hit with $15.5 billion in outflows. The Silver-rated fund had a huge year with a 49.3% return, though its three-year return of 2.6% was in the bottom quartile. The fund now has $54 billion in assets.

American Funds Growth Fund of America AGTHX saw $11.8 billion go out the door, leaving it with a $214 billion asset base. The Bronze-rated fund’s 37% 2023 return and 4.3% three-year return were both below the category average.

T. Rowe Price Growth Stock PRGFX had a net $10.7 billion exit. Like Blue Chip Growth, the Silver-rated fund had a great 2023 return (45.2%) but poor three-year results (1.4%). The fund has $46 billion in assets under management.

American Funds EuroPacific Growth AEPGX had $9.6 billion leave. The fund’s 2023 gain of 15.6% and three-year loss of 3.0% were just below the category average.

Metropolitan West Total Return Bond MWTRX had $7.5 billion in net redemptions. The fund bucked the trend of core-bond inflows because it had a poor 5.8% return in 2023 and its three-year loss was 3.9%. The Silver-rated fund also announced that two senior managers would retire, but this was not reported until November, so it’s unlikely that the news affected the year’s flows much.

Vanguard Wellington VWENX shed $7.4 billion. The Gold-rated fund posted a slightly above-average return of 14.4% in 2023 but top-quartile three-year returns of 5.3%.

Silver-rated Fidelity Contrafund FCNTX had $7.3 billion in outflows. The fund’s 2023 return of 39.3% was a tad above average, and its three-year return of 7.5% was top-third.

Lord Abbett Short Duration Income LALDX saw $7.2 billion walk out the door. The Neutral-rated fund had a subpar 2023 return and a modestly above-average three-year return.

Vanguard Short-Term Investment-Grade VFSUX had $6.9 billion leave. The fund produced a nice 6.2% gain in 2023 but was below average for the past three years.

Strategic Advisers Large Cap FALCX had $6.8 billion in redemptions despite top-quartile returns for 2023 and the trailing three years.

Active Funds With the Largest Outflows in 2023

This article first appeared in the January 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)