Don’t Overlook Short-Term Fixed-Income Just Yet

Attractive income remains available at the front end of the curve.

How Have Investors Used Fixed-Income Allocations in 2023?

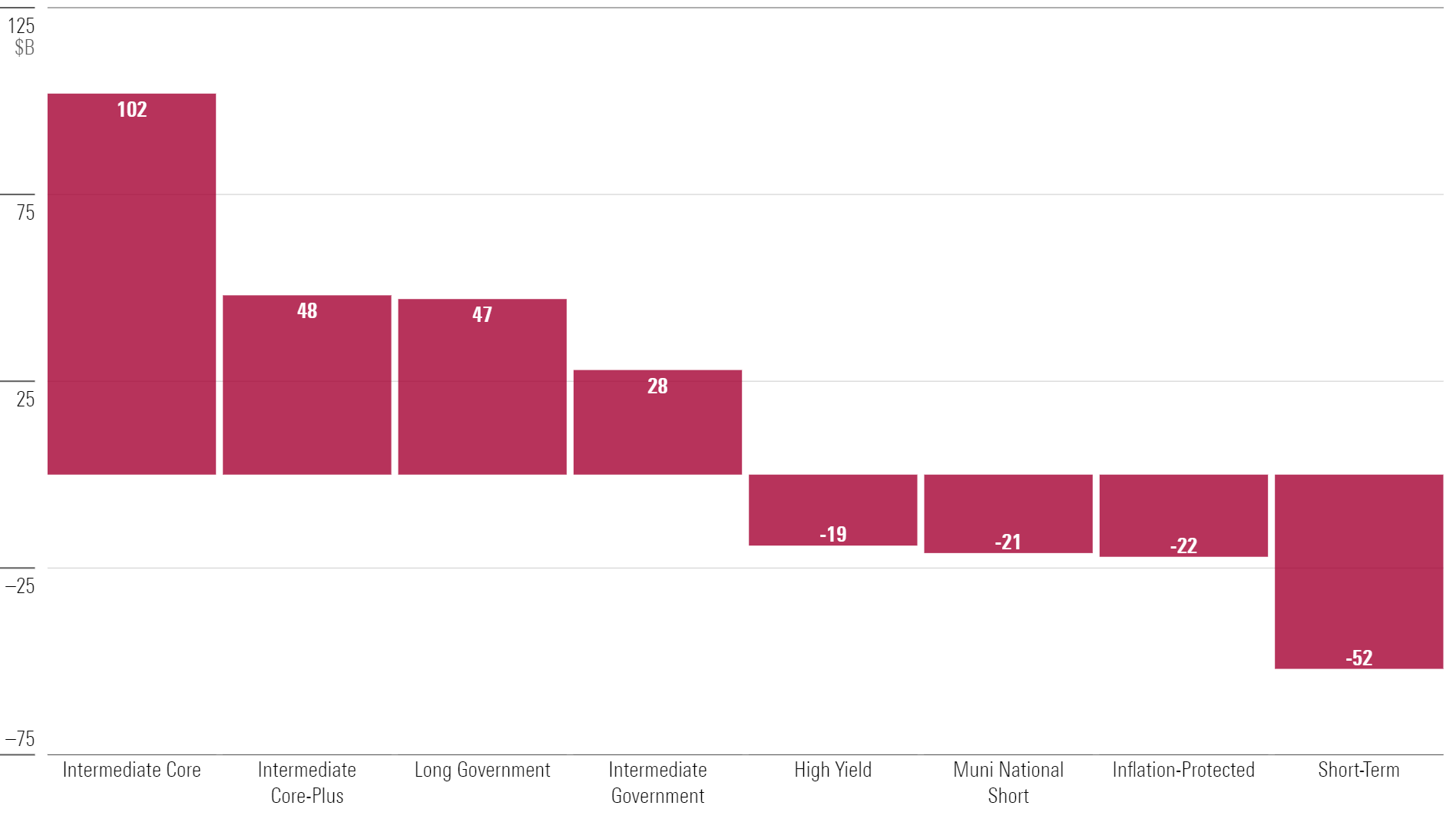

Investors have pulled more than $52 billion from short-term bond funds so far in 2023 as monetary and economic signals seem to suggest it’s safe to take more interest-rate risk again. There is still opportunity for competitive risk-adjusted returns in the category, though.

Short-term bonds offer higher yields than long-term bonds when the yield curve is inverted, as the U.S. Treasury curve has been since July 2022. While it may sound logical that such conditions would drive investors to strategies focused on the shorter end of the curve, the opposite has been true through the first 10 months of 2023; the short-term bond Morningstar Category has seen more than twice the outflows of any other fixed-income category. Investors have instead opted for longer-term bond categories, chiefly government and core bond funds, signaling their willingness to assume more interest-rate risk once again.

2023 Year-to-Date Net Flows by Morningstar Category

Attractive Short-Term Opportunities Remain Available

It may be too early to overlook the opportunity that’s still up for grabs within short-term fixed income today.

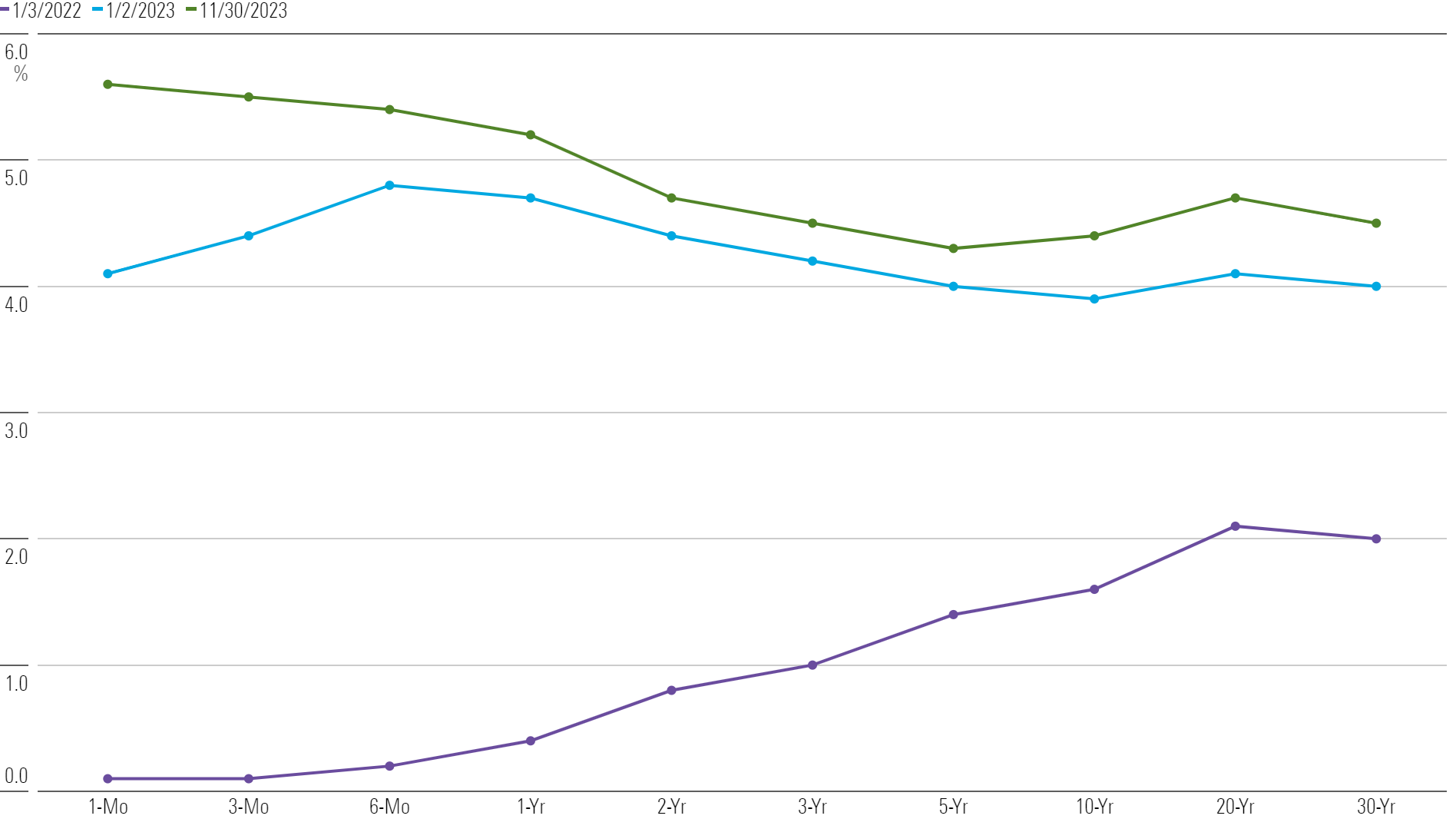

The year began with investors pricing in a “Goldilocks” scenario in which the Fed would deftly bring the U.S. economy in for an ever-elusive soft landing and sidestep a recession. After entering 2023 at 4.4%, the two-year Treasury yield dipped below 4% at points in March and April.

Yet the Fed remains committed to hitting its 2% inflation target, which underpins the popular sentiment that rates will stay “higher for longer.” As a result, the two-year yielded 4.7% in November, a far cry from the 1.9% yield it offered in March 2022 before the start of the current tightening cycle.

Even with strong November reports of cooling inflation, it’s still not out of the realm of possibility that rates rise higher. Although unlikely, this possibility suggests it may not be worth the risk for investors to time the Fed pivot by reallocating to longer-duration fixed-income.

U.S. Treasury Yield Curve: Then and Now

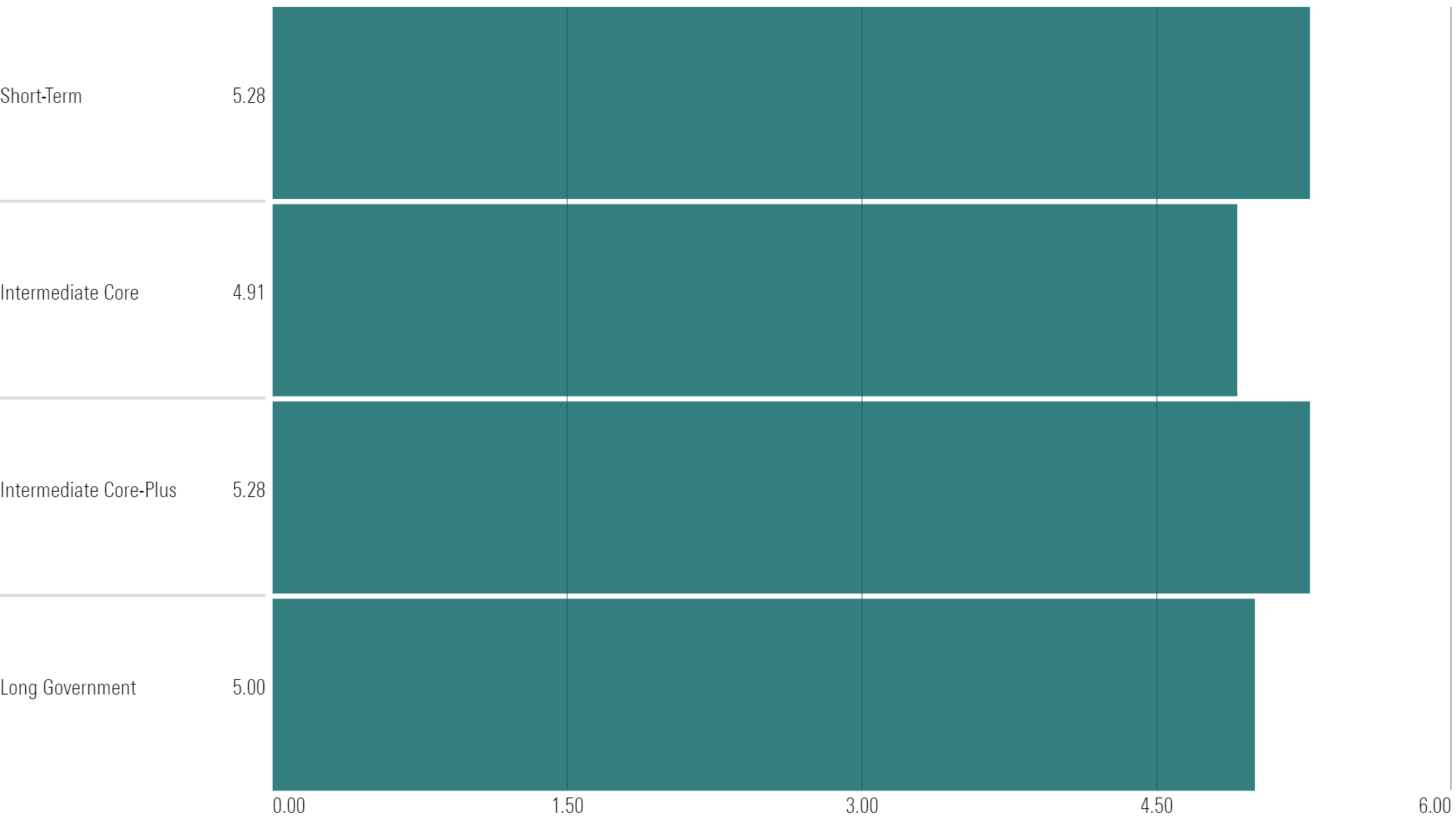

The median distinct short-term bond fund yielded 5.3% as of October 2023, up from 4.4% entering the year. For investors reluctant to take on more interest-rate risk, the short end of the yield curve still offers attractive income, without as much risk as securities on the longer end. The short-term bond category not only offers protection from rate risk, but many strategies in the group also are cautious about assuming credit risk.

Using SEC yield as an estimate of current yields, the median short-term bond fund’s yield was on par with that of the median core-plus offering (which often includes some exposure to high-yield and emerging-markets debt) as of October 2023. That’s not likely to persist for long.

SEC Yields by Morningstar Category

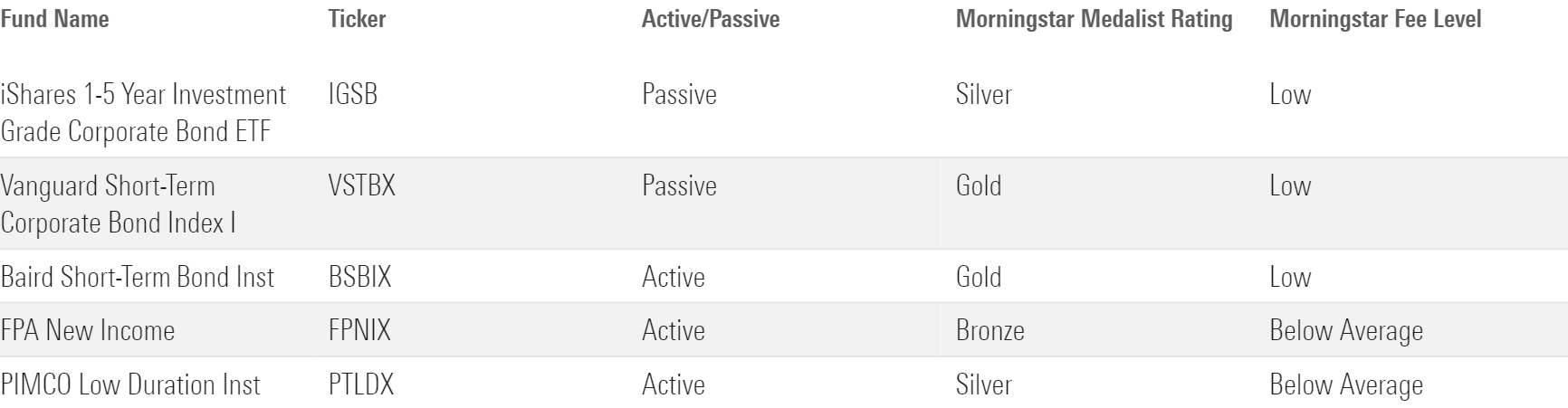

Short-Term Bond Morningstar Medalist Options

Here are some good options for taking advantage of the opportunity in short-term bonds. They each have strong analyst-driven Morningstar Medalist Ratings and competitive fees.

Short-Term Bond Medalist Options

IShares 1-5 Year Investment Grade Corporate Bond ETF IGSB offers cheap passive exposure to the short end of the curve. So does Vanguard Short-Term Corporate Bond Index VSTBX. But they do so in slightly different ways. While both track similar short-term indexes, the iShares fund has a tighter opportunity set, filtering out certain types of bonds such as Eurobonds, or bonds issued and traded outside where the bond’s currency is denominated.

Baird Short-Term Bond’s BSBIX straightforward approach under co-CIOs Mary Ellen Stanek and Warren Pierson is centered around bottom-up security selection. Unlike some more-complex offerings in the category, this strategy eschews derivatives and leverage. It mimics its one-to-three-year index’s duration, meaning managers won’t be making active bets on rates with this portfolio.

FPA New Income FPNIX manages a more eclectic short-term portfolio that at times features securitized products such as collateralized loan obligations. Yet manager Abhijeet Patwardhan and his team manage risk well in this high-quality mandate. This strategy is shorter than most peers and has historically been among the category’s least volatile.

Pimco Low Duration PTLDX de-emphasizes credit risk and prioritizes downside protection, too. Former Morningstar Fixed-Income Fund Manager of the Year winner Jerome Schneider (2015) leads Pimco’s short-term strategies, including this one, where he is not afraid to hold modest positions in high-yield, emerging-markets debt, and non-U.S. currency.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f490381f-5450-44be-b474-313f03204bfb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f490381f-5450-44be-b474-313f03204bfb.jpg)