Do You Need a Mid-Cap Fund?

Mid-caps offer great risk/reward potential, but check your existing weightings before buying a dedicated fund.

Question: Do I need a mid-cap fund in my portfolio? If so, what percentage of my assets should it be?

Answer: It's not hard to understand the rationale for adding small-cap stocks to a portfolio. In contrast to their larger-cap, more-mature peers, small-cap companies are often more nimble and have greater growth opportunities ahead of them, which can equate to higher long-term returns. But what about companies that fall into the mid-cap squares of the Morningstar Style Box? Do you need to bother with mid-caps at all?

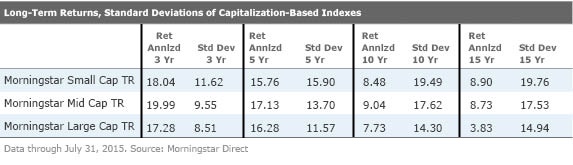

Sometimes referred to as the market's sweet spot, mid-cap stocks are positioned in a way that gives them the potential to achieve impressive risk-adjusted returns. Mid-cap companies are usually not as dependent on a single product as their smaller-cap peers can be, meaning that mid-caps' revenue and cash flow are often more consistent and the stock price is less volatile. But mid-caps are also not yet hampered by their size, either (meaning that once a company reaches the mature large- or giant-cap stage, its growth potential slows down). And if you look at the data below, you can see that mid-caps have outperformed their large-cap peers, but with lower volatility than small caps. In fact, the returns of mid-cap stocks have also beaten those of small-cap stocks during the trailing three-, five-, and 10-year periods, with lower volatility (as measured by standard deviation).

Morningstar defines large caps as the top 70% of companies trading in the U.S. market by market capitalization (in other words, companies with market caps above roughly $17 billion). Mid-caps are the next 20% by market cap (which encompasses companies above $4 billion but below $17 billion). Small caps, as defined by Morningstar, are the smallest 10% of the U.S. market, or companies with market caps below $4 billion (but above $1.2 billion). These indexes cover 97% of the investable U.S. market.

Of course, past is not prologue--meaning that there is no guarantee that mid-caps will continue to outperform small caps during the next 10-year period; in fact, small caps probably have more long-term upside potential than mid-caps, especially at mid-caps' current valuations.

How Much Exposure to Mid-Caps Do You Need? To determine how much exposure an investor needs to mid-caps, the total stock market can be a good starting benchmark. Total market index funds typically devote about 18% to mid-caps--6% to each of the mid-cap style box squares. Morningstar data show mid-caps as accounting for 20% of its U.S. equity universe.

The mid-cap weightings of many target-date funds land in a similar ballpark. The Gold-rated

What Do You Already Own?

If you have a portfolio saved in Morningstar.com's

tool, it's easy to see how much exposure to small- and mid-caps you already have. It's possible that you don't need to own a pure mid-cap fund if you already have plenty of exposure to smaller-cap companies in your portfolio. (

can show you the percentage of your equity exposure that falls into each square of the style box, which helps you get a handle on how much of your portfolio's equity exposure is in mid-caps versus small caps and large caps.) For instance, as I mentioned earlier, 18% to 20% of total market indexes are currently in mid-caps. So, if you have a total market index fund, you may have all you need unless you wanted to explicitly overweight this pocket of the market. In my case, I actually do have a small allocation to a mid-cap fund; but even without it, my portfolio would have 22% of equities in a blend of small/mid-cap stocks (and 14% in purely mid-caps) from just the S&P 500 index fund and the small-cap stock fund that I also own.

Choosing the Best Fund for Your Portfolio If, after examining your holdings, you decide that your portfolio would benefit from adding a mid-cap fund, there are some different routes you could take. As Morningstar analyst Mike Rawson pointed out in a recent article, "Mid-Cap Stocks: In the Market's Sweet Spot", many investors turn to an index fund to get mid-cap exposure. In fact, Rawson points out, 75% of the assets in the mid-blend Morningstar Category are invested in index funds, which is a higher percentage than any of the other U.S. equity categories. In the article, Rawson goes over a few of his favorite mid-cap index funds and ETFs.

Morningstar director of fund research Russ Kinnel also discussed some of Morningstar's favorite actively managed mid-cap funds in the recent video report "3 of the Best Mid-Cap Funds". (Also, to see the full list of Morningstar Medalist funds in the mid-cap categories, Premium Members can

.)

Alternatively, investors might consider a fund that invests in both small- and mid-cap stocks in one fell swoop (sometimes you hear this referred to as a "smid" allocation). Most such funds land in one of the three mid-cap categories. A smid or blended small/mid-cap allocation can make sense because it can lead to higher returns than a purely large-cap-focused equity exposure over long time periods, but adding in the mid-caps helps tamp down some of the volatility you would experience if you offset your large caps with only small- and micro-cap stocks. Smid funds allow you to have just one fund instead of two smaller positions. Smid funds may also be better than dedicated small- and mid-cap funds from a tax-efficiency perspective, because their market-cap parameters are more fluid. A few of Morningstar's favorite smid funds include

Have a personal finance question you'd like answered? Send it to TheShortAnswer@morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)