Dividend-Stock Investing: Which Funds Are the Best Long-Term Bets?

A different approach to finding investment options.

The Low-Cost Imperative

Note: This column covers similar ground as February’s “Which Type of Dividend Fund Do You Prefer?” but from another perspective. Its content is entirely new.

Investors who seek higher dividends than provided by the overall stock market can increase their income either by buying equities directly, or through funds. Morningstar frequently publishes articles addressing each strategy. This column discusses only funds, taking a somewhat different angle than the usual approach. While it does recommend investments, its main intent is to provide a framework for thinking about dividend-stock funds. How should investors conduct a search?

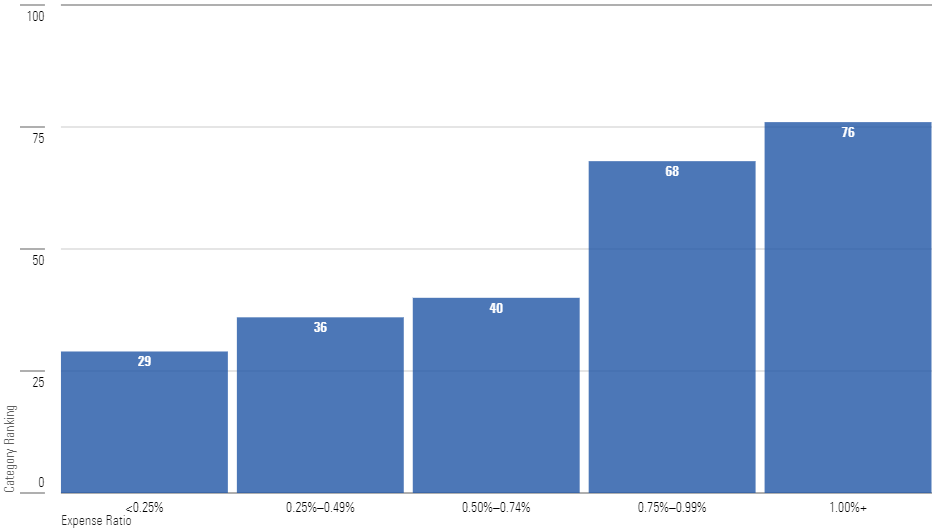

There are several reasonable approaches to screening for dividend-stock funds, but only one correct starting point: expense ratios. That statement does not come solely from principle, although the evidence linking lower fund fees with higher future returns is persistent. I also ran the numbers. The following diagram shows the average 10-year return ranking, relative to others in the category, for large-company U.S. funds with “dividend” in their names. The rankings are sorted into five expense-ratio groups. Smaller is better, as Morningstar assigns a score of 1 to the top fund and 100 to the bottom. The study includes both mutual funds and exchange-traded funds.

Costs Matter!

A Reliable Pattern

It’s as Jack Bogle would have predicted. Not only do the cost buckets fall neatly into line, but so do almost all their underlying components. For example, only one of the 19 funds with an annual expense ratio of less than 0.50% placed in the bottom quartile for its category. Meanwhile, only one of the 16 funds with and expense ratio of at least 1% registered in the top quartile; eight landed in the lowest quartile.

Given that outcome, the ground rule comes easily: Don’t own pricey funds. The lone high-cost exception to the general rule, Applied Finance Dividend AFALX, not only outgained 80% of large-value funds over the past decade but did so with slightly less volatility. An impressive showing given the fund’s steep 1.2% annual expense ratio. However, few people (except the fund’s managers obviously) would expect the fund to buck the odds for a second straight decade.

Youthful Beauty

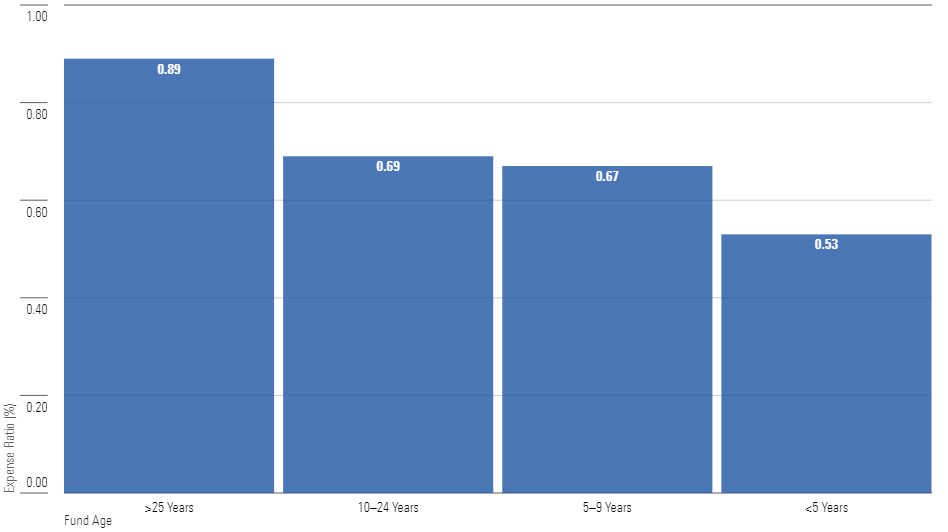

Normally, I would proceed by supplementing the low-cost search with a performance screen, along with perhaps an inquiry into which funds have received favorable Morningstar Medalist Ratings. However, seeking veteran dividend-stock funds is not easy because most of the group’s truly cheap funds have only recently been launched. The chart below illustrates the point: It displays the average expense ratio for dividend-stock funds, sorted by fund age.

Newer Funds Are Cheaper

That is not how the business is supposed to work! In theory, funds are costly when first offered (unless the sponsoring company initially waives some of its charges), because they have not yet achieved economy of scale. Over time, one would expect their expense ratios to decline, as larger asset bases permit the funds to collect more fees, thereby lowering their expense ratios in percentage terms.

However, the practice tends to be quite different. Most companies anchor their funds’ expense ratios near their original terms, making only modest cuts. To meaningfully discount their funds’ customary prices, organizations usually opt to create new funds—in particular ETFs. Such has been the case with dividend-stock funds, as ETFs have formed most of the group’s recent launches.

Conducting the Search

For that reason, my first screen was very simple: Seek dividend-stock funds with expense ratios of less than 0.25%, regardless of their performance histories. While most such funds lack long track records, they are nevertheless good bets to outgain their older rivals, thanks to the advantage of their lower costs.

As that test was rather severe, I then provided an opportunity for slightly pricier funds that had proved their worth. Adding to the list were funds with expense ratios between 0.25% and 0.49% if their 10-year returns were above their category averages and their 10-year Morningstar Risk scores were lower. (Using a 0.75% expense ratio cutoff would also have been defensible, as several funds in that cost range—such as Columbia Dividend Income GSTFX and Hartford Growth Dividend and Growth HDGIX—have performed well. In a column, however, less is more.

I erected a final hurdle by eliminating funds that either suffered double-digit losses in 2022 or did not exist for the full calendar year. This restriction, I confess, was rather arbitrary. On the other hand, dividend-stock funds exist in part to hedge against technology stock downturns, so there is a certain logic in requiring such funds to have demonstrated that ability.

To summarize, the process was

1) Identify all U.S. dividend-stock funds with expense ratios below 0.25%.

2) Supplement the list with funds that have expense ratios from 0.25% to 0.49%, and above-average 10-year performances.

3) Retain only those funds that lost less than 10% in calendar 2022.

Naming Names

Continuing the spirit of technology-stock diversification, I sorted the 11 finalists into two groups, based on their technology exposures. The first batch is decidedly light, as none of the funds invest more than 12% of assets in that sector. Not entirely coincidentally, all boast generous trailing 12-month yields. These funds, by and large, favor income.

Best Funds: Technology Light

| Fund | Expense Ratio (%) | Technology (%) | 12-Month Yield (%) |

|---|---|---|---|

| SPDR S&P 500 High Dividend ETF SPYD | 0.07 | 2.94 | 4.58 |

| Global X S&P 500 Quality Dividend ETF QDIV | 0.20 | 8.15 | 3.10 |

| Vanguard High Dividend Yield ETF VYM | 0.06 | 9.60 | 3.02 |

| iShares Core High Dividend ETF HDV | 0.08 | 10.29 | 4.04 |

| Schwab U.S. Dividend Equity ETF SCHD | 0.06 | 12.12 | 3.44 |

The remaining funds, with one exception (Invesco Dow Jones Industrial Average Dividend ETF DJD), pay lower yields, along with possessing technology stock positions of at least 17%. That their tech companies are relatively tame is demonstrated by their temperate 2022 performances. Nonetheless, they offer somewhat less diversification than the first group’s funds.

Best Funds: Technology Medium

| Fund | Expense Ratio (%) | Technology (%) | 12-Month Yield (%) |

|---|---|---|---|

| iShares Core Dividend Growth ETF DGRO | 0.08 | 16.66 | 2.31 |

| WisdomTree U.S. Total Dividend ETF DTD | 0.28 | 16.77 | 2.51 |

| Invesco Dow Jones Industrial Dividend ETF DJD | 0.07 | 17.57 | 3.41 |

| WisdomTree U.S. LargeCap Dividend ETF DLN | 0.28 | 18.55 | 2.47 |

| Vanguard Dividend Appreciation ETF VIG | 0.06 | 22.66 | 1.87 |

| WisdomTree U.S. Quality Dividend Growth ETF DGRW | 0.28 | 29.28 | 1.85 |

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)