The Crypto ETP Market in 6 Charts

As these exchange-traded products face ongoing challenges of volatility and regulatory uncertainty, do they still have a role in investors’ portfolios?

Owing to retail and institutional interest in cryptocurrency, asset managers have demonstrated an increased focus in launching new crypto exchange-traded products. Crypto ETPs have rapidly grown since 2021 and now account for about 3% of all crypto assets.

These products trade on traditional stock exchanges and offer investors access to a diversified portfolio of digital assets, which may otherwise be complicated to invest in owing to factors such as high price volatility, liquidity, transparency, and custodian concerns.

Crypto ETPs come in various flavors, including:

- Physical crypto ETPs, which provide exposure to physical cryptocurrencies in custodian accounts.

- Synthetic crypto ETPs, which use derivatives/futures contracts to replicate the performance of underlying assets.

- Leveraged crypto ETPs, which take simultaneous long-short positions to amplify returns.

- Inverse crypto ETPs, which involve short positions on digital assets.

Here, we explore this growing asset class in detail and evaluate whether such products are suitable for inclusion in client portfolios.

It’s worth noting that our research not only includes the largest names like bitcoin and ethereum, but it also covers altcoins (a category that covers all other cryptocurrencies, such as ripple and litecoin) and products that invest in allied technologies like decentralized finance, nonfungible tokens, smart contracts, and the metaverse.

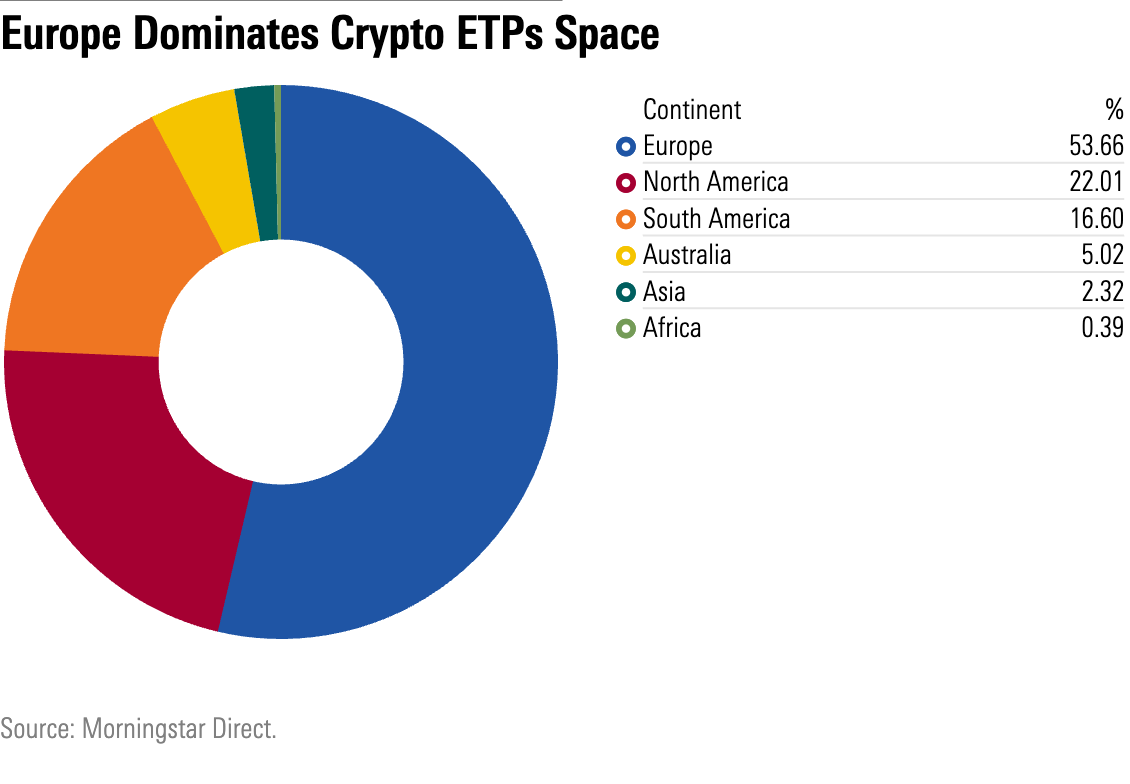

European Markets Lead the Way for Adoption of Crypto ETPs

Crypto ETPs have gained prominence in Europe owing to favorable regulatory environments. Several European countries have developed clear regulatory frameworks for cryptocurrencies, including Switzerland, Germany, and France. These countries have recognized cryptocurrencies as a legitimate asset class and have established rules for their trading and custody.

In contrast, the regulatory environment for cryptocurrencies in the United States is more complex and uncertain. The U.S. Securities and Exchange Commission has yet to approve a bitcoin exchange-traded fund, a type of crypto ETP that holds bitcoin directly, and has been cautious about approving other crypto ETPs. Additionally, the IRS has not provided clear guidance on the tax treatment of cryptocurrencies in general, which has created uncertainty for investors.

European markets are also more mature than the U.S. market in terms of product innovation and range, indicating higher demand for such products. For these reasons, Europe is leading the way on adoption of crypto ETPs. The chart below shows that Europe accounts for roughly half of such products.

A Look at Trends in Crypto ETP Launches

In total, more than 260 crypto ETPs exist with more than $30 billion in assets under management.

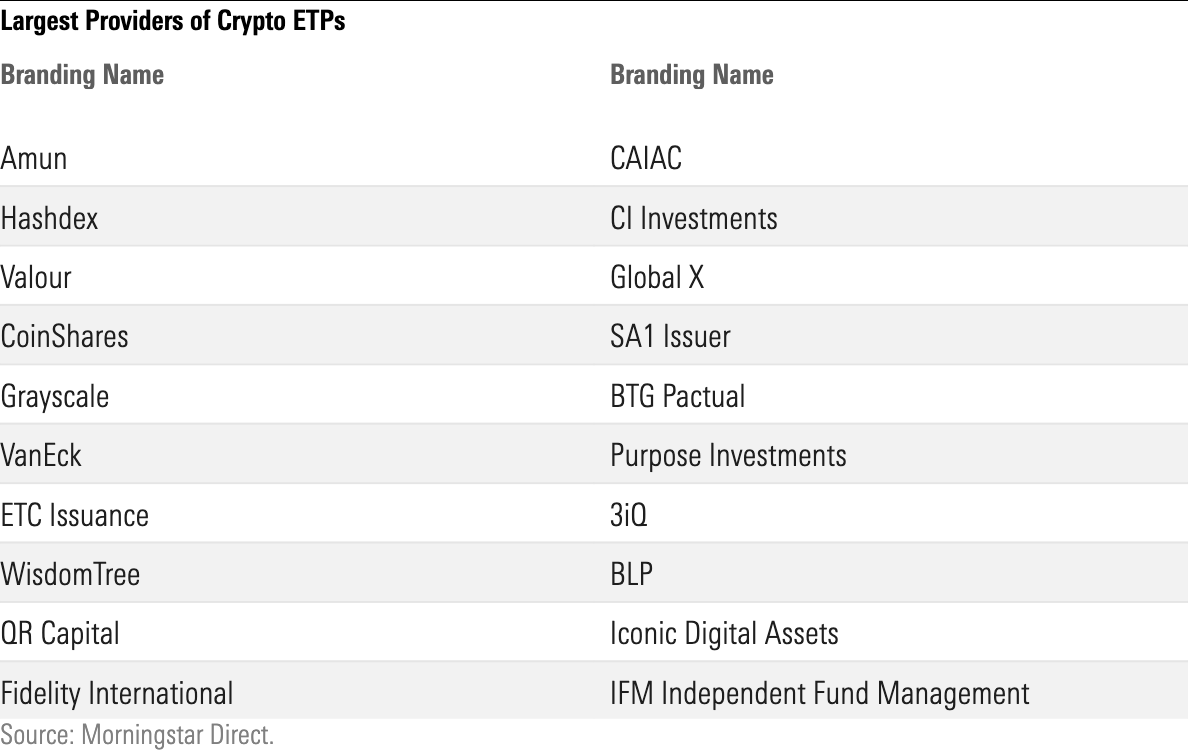

The table below shows the fund houses with the greatest number of such product offerings. In 2022, 21Shares (branding name Amun) was responsible for 17 crypto ETP launches—more than any other fund house.

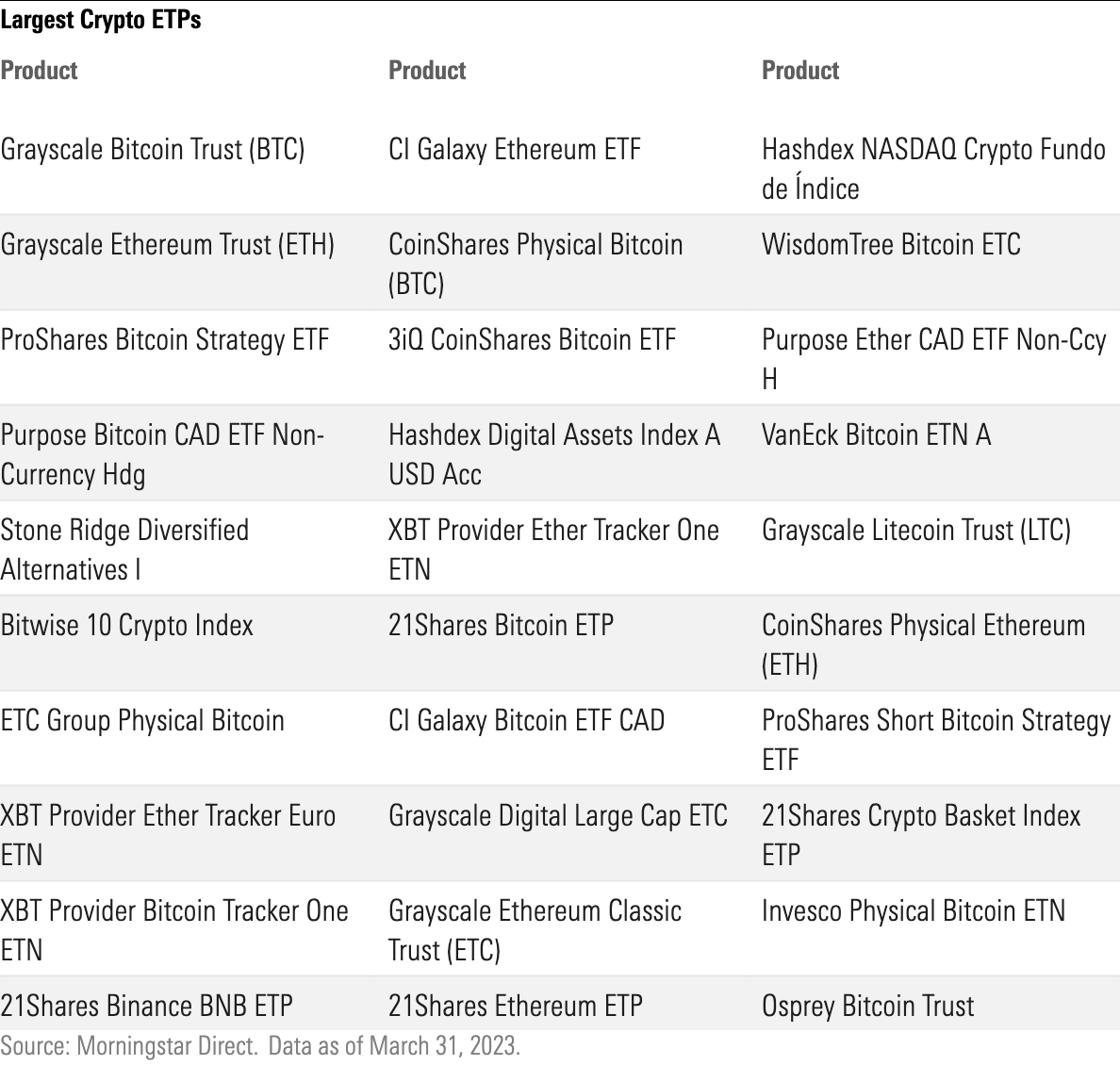

The table below lists the largest crypto ETPs as of March 2023.

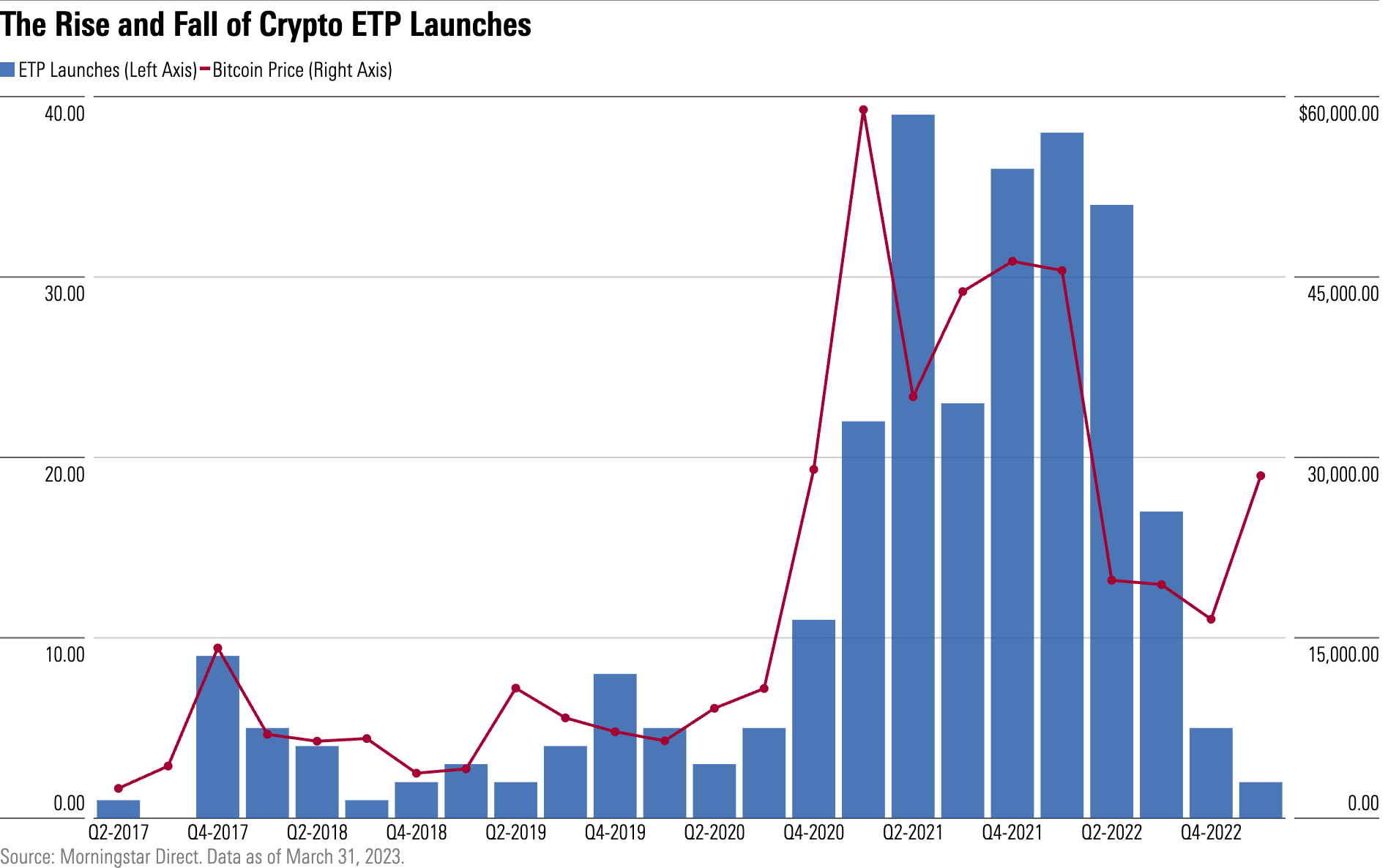

By diving into the numbers, however, we can see that the launch of these ETPs was primarily a bull-market phenomenon. The chart below shows the product launches and closures over time.

When the crypto market started to pick up in the latter half of 2020, fund houses jumped to launch these ETPs. There were a record number of launches in 2021 with more than 130 products coming to market through the year.

With the slowdown of the crypto market, new product launches have seen a decline since 2022, with just two new product launches in the first quarter of 2023. On top of that, 12% of the products launched since 2021 have already been liquidated, including formerly popular names like CoinShares FTX Physical FTX Token, Stone Ridge Bitcoin, and 21Shares FTX Token ETP.

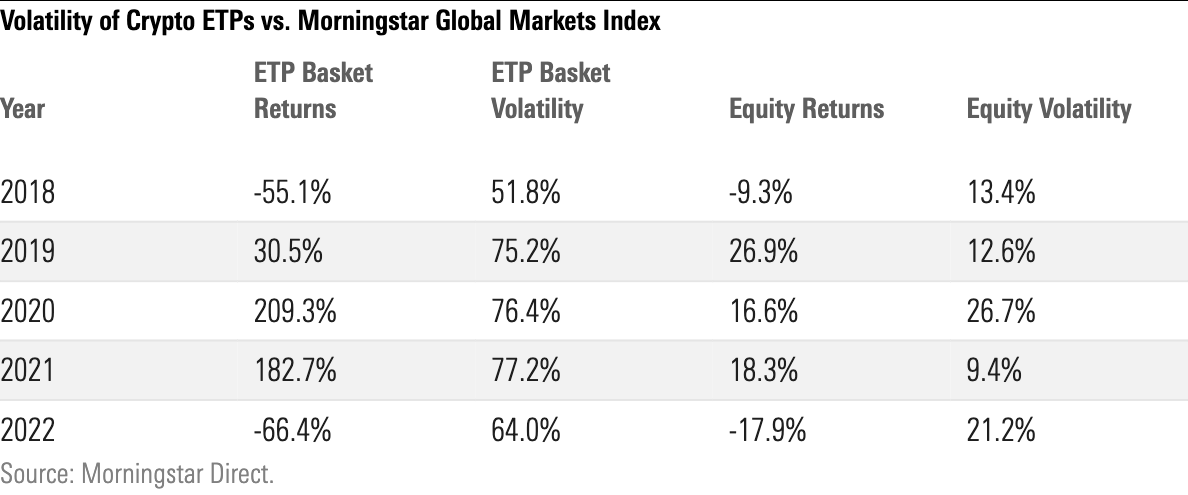

Those that survived have faced severe headwinds and returned just 11% (annualized) for the five years between 2018 and 2022. A compounded average growth rate of 11% at an annualized volatility of a whopping 73%, plus extended periods of severe drawdowns, should make an investor wary.

The following table shows the yearly returns and the annualized yearly price return volatility of the ETP basket against the yearly returns and the annualized yearly price return volatility of Morningstar Global Markets Index (Equity in the table).

Could Crypto ETPs Hedge Against Inflation?

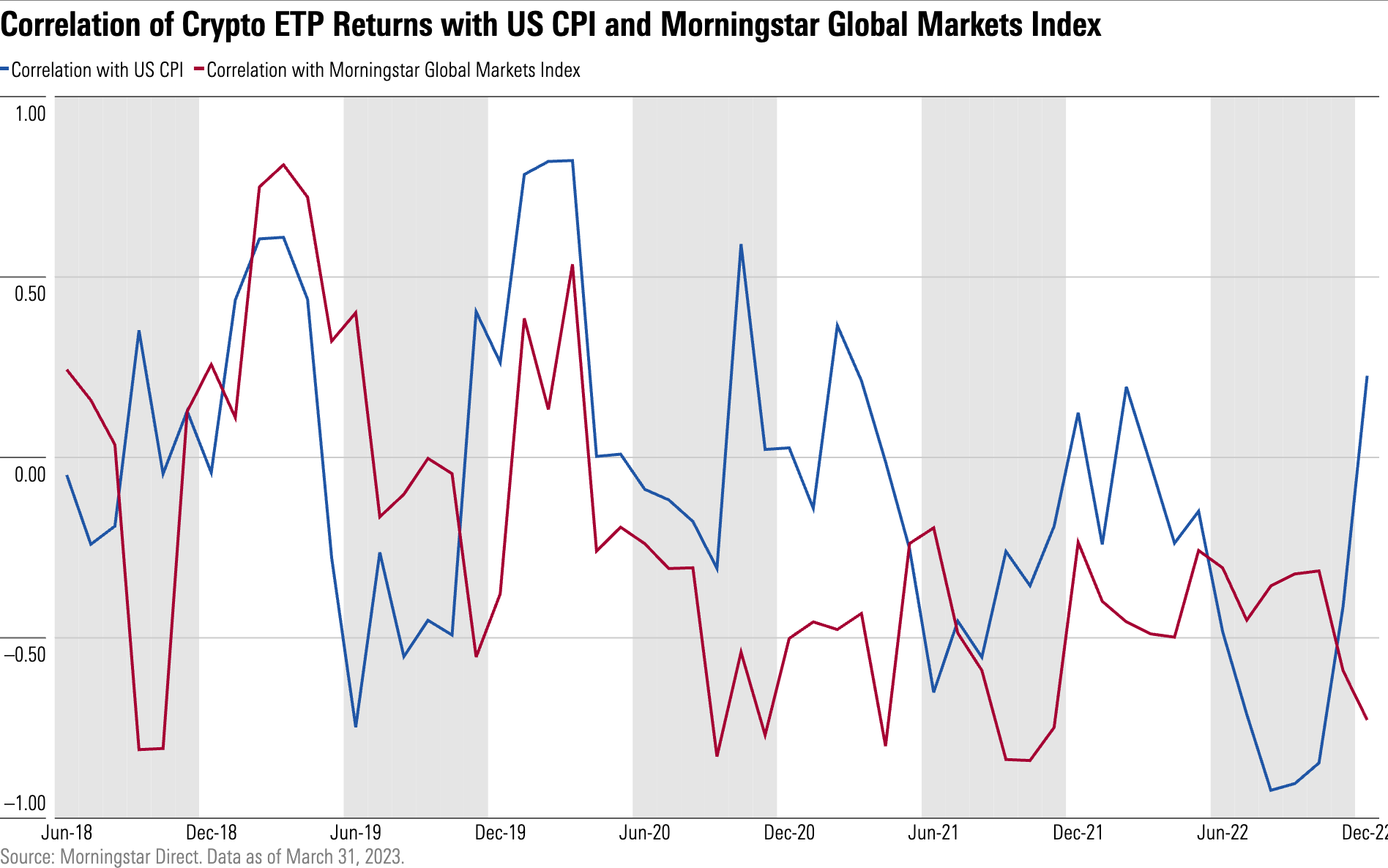

Despite the volatility, some investors have been intrigued by the notion of utilizing crypto products as a hedge against inflation. However, our research suggests that there is no observable correlation trend between the returns of crypto ETPs and U.S. core Consumer Price Index inflation, as measured by the rolling six-month correlation (shown in the chart below). Likewise, the correlation with equity also lacks trend.

The correlation of crypto ETP returns with both the U.S. CPI and the Morningstar Global Markets Index experiences massive swings on both sides. This suggests a lack of conclusive evidence to support the notion that crypto-exposed products could serve as a reliable hedge against inflation or equity.

Including crypto ETPs in one’s portfolio can be a risky bet as they offer almost no hedge against inflation or equity. Moreover, the underlying asset class itself faces ongoing challenges of volatility and regulatory uncertainty.

Altogether, these drawbacks can complicate an investors’ portfolio if not evaluated properly. As the adage goes, “forewarned is forearmed.” Being cognizant of the possible hazards and disadvantages is crucial for making informed investment decisions and taking measures to mitigate potential losses.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)