Bond Funds and Vanguard Keep Taking in Cash

Investors continued to flock to fixed-income funds last month.

Note: This is an excerpt from the Morningstar Direct U.S. Asset Flows Commentary for January 2020. Download the full report.

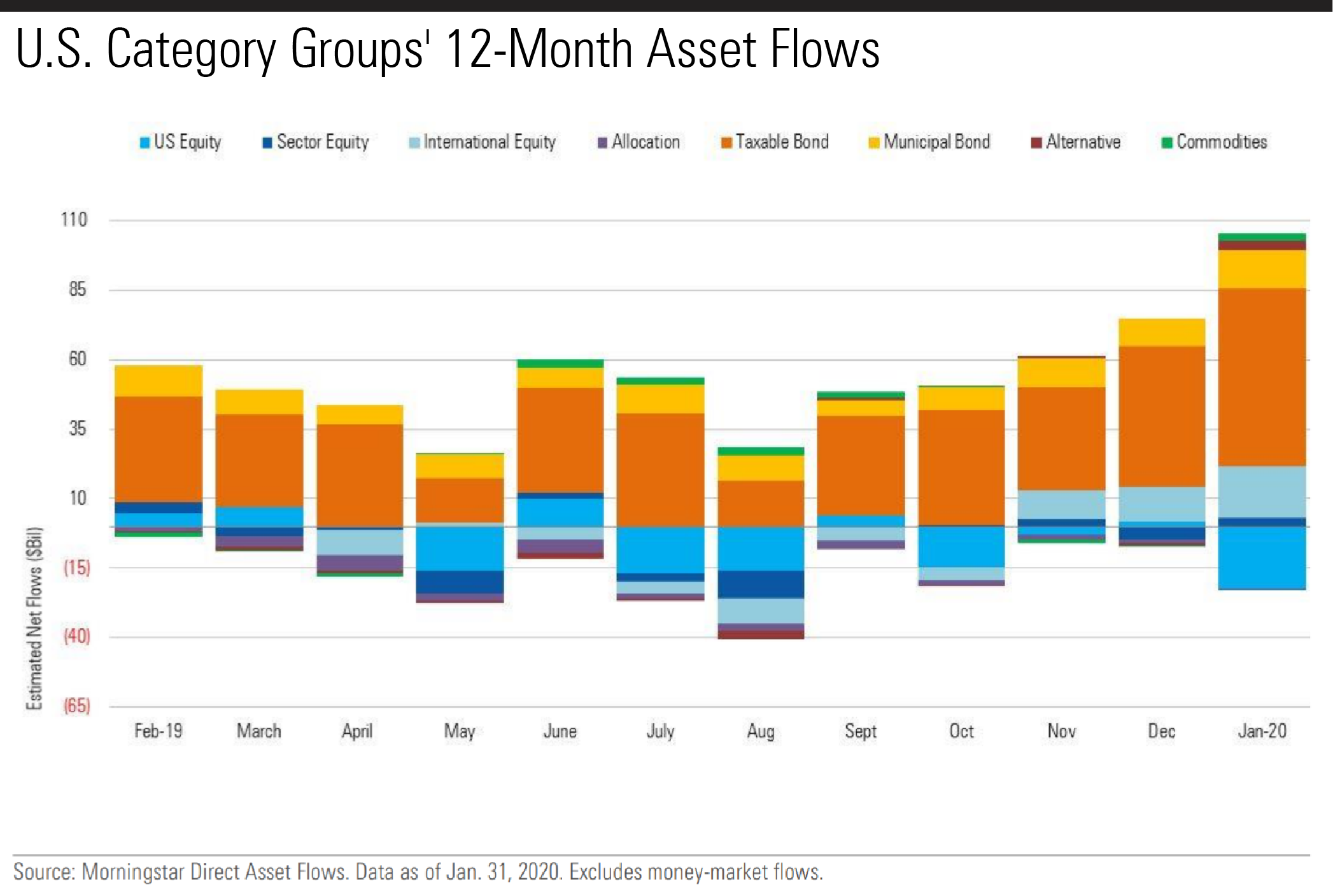

Fixed-income funds continued to take in assets in January 2020, building upon a record 2019. Taxable-bond funds collected a record $63.6 billion for the month, surpassing the old record of $59.5 billion set the month before. Taxable-bond flows accounted for nearly 77% of the $82.8 billion that entered long-term funds in the period. Records fell for municipal-bond funds, too, as investors continued to hunt for sources of tax-free income.

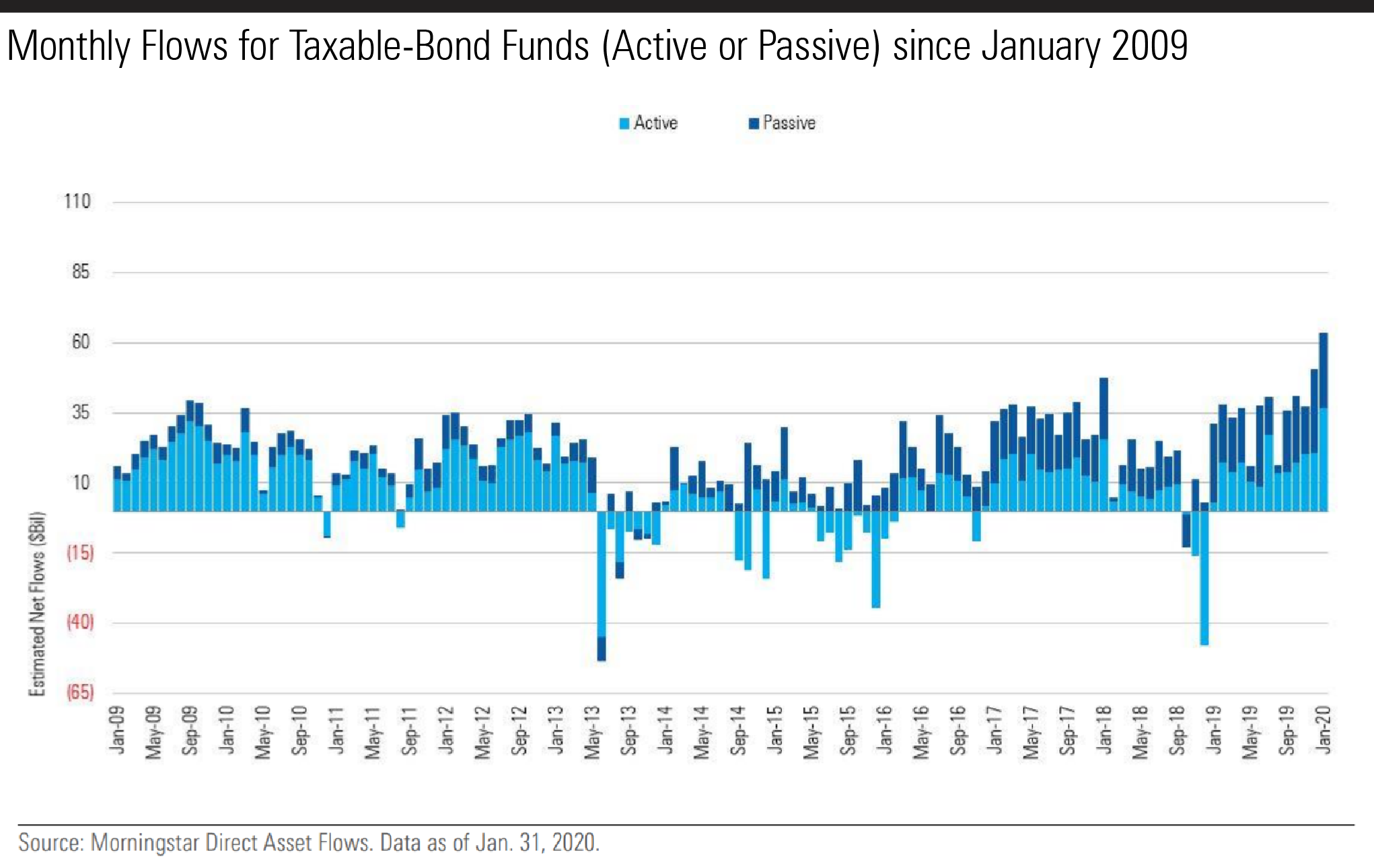

The strong January marked 13 straight months of inflows into taxable-bond funds. Both actively and passively managed funds in the Morningstar Category benefited. Actively managed taxable-bond funds raked in $36.9 billion in January, their best showing since September 2009. Their passively managed counterparts added $26.7 billion.

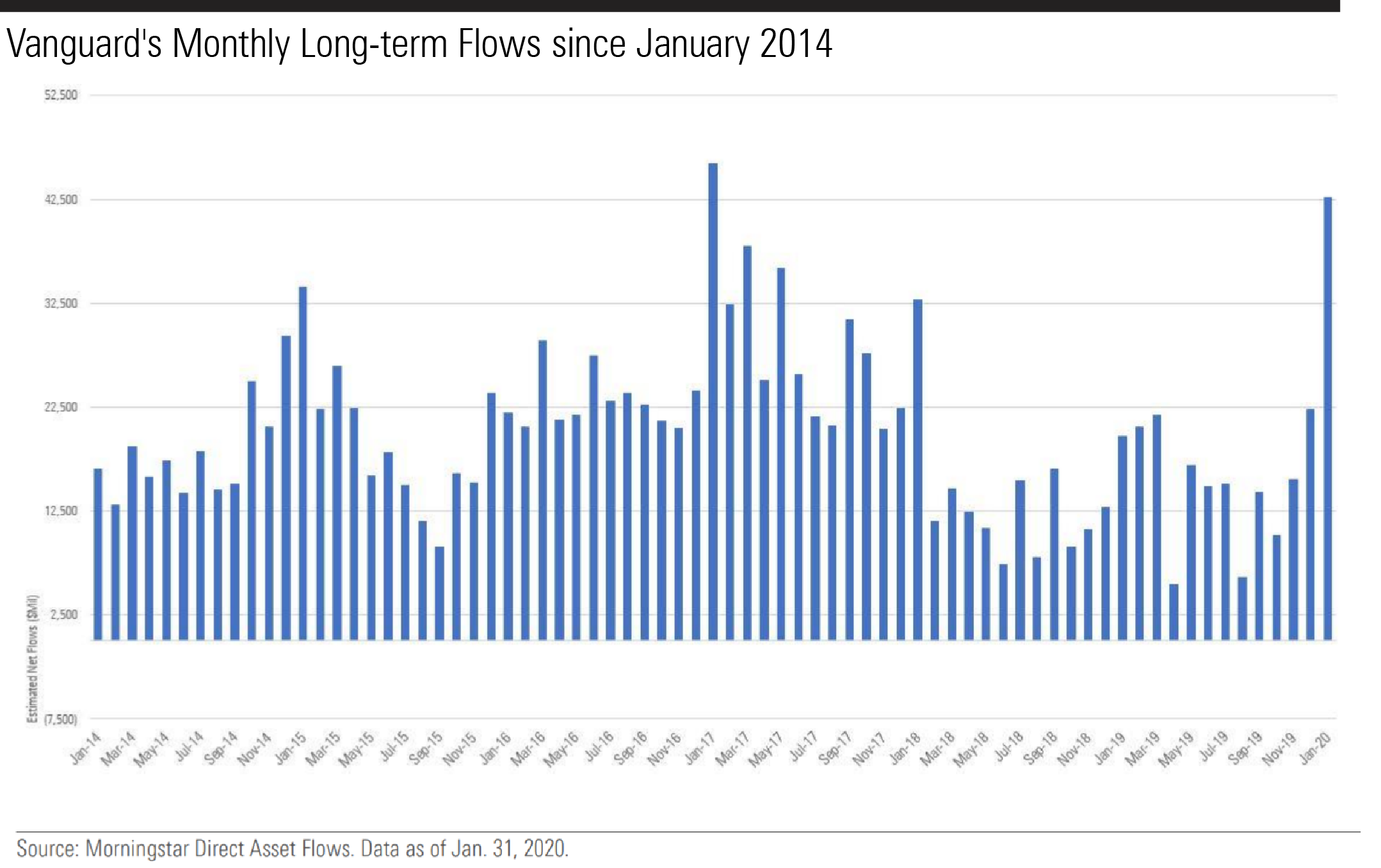

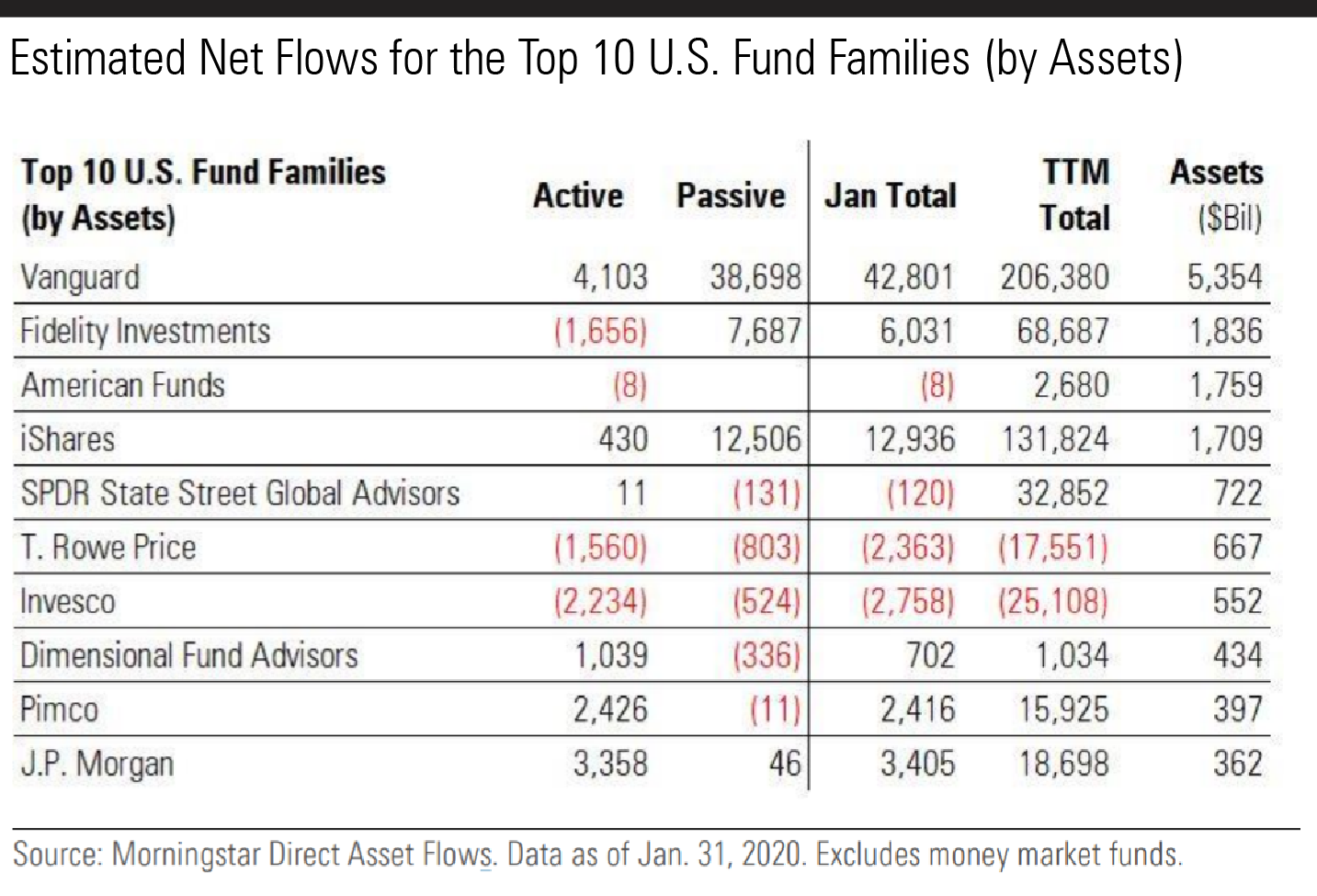

Vanguard's $42.8 billion haul in January was its second-highest tally of long-term assets ever; in January 2017, it took in $46.0 billion. With nearly $5.4 trillion of long-term assets in its open-end funds and exchange-traded funds, Vanguard is the largest fund family, capturing more than a fourth of market share (compared with just 10% in 2000). A couple of its broad index funds powered the firm's impressive flows in January. Vanguard 500 Index VFIAX had $7.1 billion of inflows--the most for any single fund for which Morningstar collected data in January--followed by Vanguard Total Bond Market Index's VBTLX $5.4 billion.

Invesco topped the list of firms with the heaviest outflows as it struggled to digest its acquisition of Oppenheimer. Invesco's funds saw an estimated $2.8 billion in net redemptions in January. The firm has had net outflows in 14 of 16 months since it announced its merger with Oppenheimer in October 2018.

/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)

/s3.amazonaws.com/arc-authors/morningstar/c17460f8-595a-4e95-a06c-f1e4fd09d811.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c17460f8-595a-4e95-a06c-f1e4fd09d811.jpg)