The Best Fund Companies and Their Ratings

We recently updated our Parent rating, a crucial element in evaluating how well a fund will serve investors in the long run.

A version of this article first appeared in the November 2019 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Since our enhanced methodology rollout in November, we are now publishing fund company Parent ratings on a five-level scale instead of three. We've moved from ratings of Negative, Neutral, and Positive to Low, Below Average, Average, Above Average, and High.

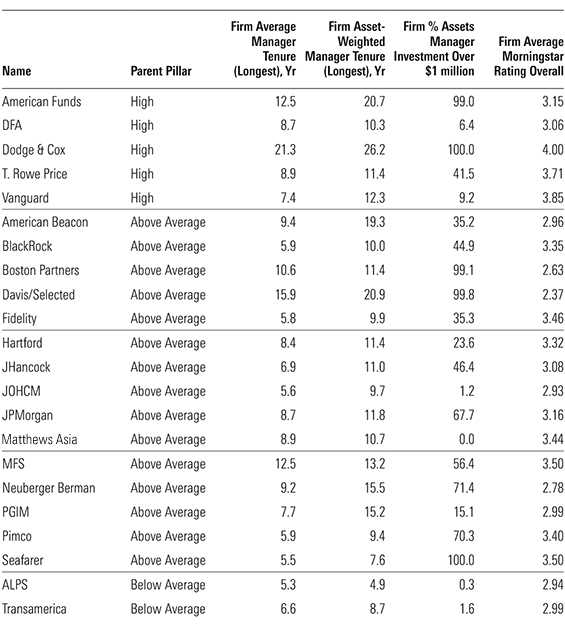

By now, we've published Parent Pillar ratings on more than 50 fund complexes, so I thought I'd share some of those ratings with you. Because Neutral equates with Average, I'll focus on the other rating bins. None has yet come in at Low, so that leaves just three levels to discuss this month: High, Above Average, and Below Average.

First, let's review how we rate fund companies. We don't just talk to fund managers. We regularly do onsite visits to meet with key decision-makers as well as many of the people we don't regularly talk with on manager calls, including analysts, traders, sales leaders, and compliance heads. The idea is to understand where a firm is headed, what its values are, and how much talent it has beyond the portfolio managers' desks.

We take a few angles on fund companies. Most important is culture. We see it in how long-term a company is focused. We see it in how long managers and analysts stay. We see it in the firm ownership structure. Culture is one of the hardest things to build in the investment world and thus the greatest moat in asset management.

We also look for any regulatory infractions or other signs of less ethical practices such as selling hot funds, allowing funds to grow too large and diminishing the integrity of capacity-constrained strategies, or naming figureheads as managers in order to game manager-tenure statistics.

We also care about what short-term pressures may lead a firm to give investors short shrift, such as a planned sale, IPO, or high debt levels.

And, of course, we look at the other pillars of our Morningstar Analyst Ratings to see if it's all coming together in strategies that serve investors well.

Why Parent Matters It's easy to view a mutual fund in isolation. If it has the right combination of manager, strategy, and fees, is parent so important? Well, yes, in the long run, it is, and mutual funds are long-term investments. That manager will have better support from analysts and traders at a good fund company. In addition, good managers are more likely to stay at firms with a strong culture than firms where they are the lone stars and feel like they are doing all the heavy lifting.

And when that manager does retire or leave, a good fund company will have a better bench to turn to for a replacement. Witness each of our highly rated firms and you'll see that manager transitions are far better than typical of the industry. Often, we keep a Morningstar Medalist rating on a fund after a change at these firms; that is much less likely to happen at a fund with an Average parent.

The Best in Class At this point, only five firms that have met our lofty standards for a High Parent rating: American Funds, DFA, Dodge & Cox, T. Rowe Price, and Vanguard. Here are some excerpts from our analysts' takes on each firm:

Vanguard by Alec Lucas: Vanguard gained its stature by following Jack Bogle's playbook: pairing relatively predictable strategies, both passive and active, with minimal costs. That's enriched Vanguard's investors, and those outside its flock who have benefited from industrywide fee compression. While Vanguard's passive business now faces stiff price competition from its biggest rivals, inflows into its U.S. strategies still dominate.

T. Rowe Price by Katie Reichart: The firm's success is rooted in its fundamental approach to active management and deep analyst bench. Investors benefit from managers' generally long tenures at the firm, well-planned manager transitions, reasonable costs, and attention to capacity. … Despite headwinds facing active managers, T. Rowe remains a powerhouse within U.S. and international equities. Fixed income is an area to watch. Several long-tenured managers have recently retired or will do so soon. Sound succession planning has smoothed the transitions, but the firm needs to ensure the bench remains deep.

Dodge & Cox by Tony Thomas: The San Francisco-based firm, founded in 1930, benefits from a strong investment culture. CEO Dana Emery and chairman Charles Pohl are also lead members of the investment team; they run the firm and its funds with a long time horizon. But there are no stars here--an intentional and enduring characteristic of the firm. Each fund is run collaboratively by one of five investment policy committees, whose members average more than 20 years at the firm. The analyst ranks are broad and deep, with impressive levels of experience. In all, the firm has approximately 60 managers and analysts, most of whom are Dodge & Cox lifers. Team members rarely leave for any reason other than retirement. The team's financial incentives are appropriately aligned. Portfolio managers invest heavily in their strategies, helping align their interests with investors'. Dodge & Cox is 100% employee-owned, allowing staff to participate in the firm's economic success. Moreover, it has helped Dodge & Cox avoid short-term pressures that often face public firms on Wall Street. The firm's approach to new strategies is admirable, having rolled out just six in its history. Management has also proved willing in the past to safeguard its strategies by closing funds. All around, Dodge & Cox is a model fund family.

DFA by Daniel Sotiroff: Dimensional Fund Advisors continues to be an outstanding steward of its shareholders' capital. … Co-CEOs David Butler and Gerard O'Reilly oversee a strong culture focused on market efficiency and transaction cost management.

Dimensional's investment strategies are rooted in research from the top minds in financial academia. These same researchers use a rigorous vetting process when developing new strategies or modifying existing ones. Proposals must be exploitable in a well-diversified, low-turnover, and cost-effective manner. Changes to existing strategies and the introduction of new funds are rare when they do occur.

American Funds by Alec Lucas: The firm's multimanager system drives its success. Dividing each fund into independently run sleeves lets managers invest in line with their styles, enhancing diversification and reducing the overall portfolio's volatility. The funds' analyst-led research portfolios help develop the next generation and recruit top talent with the promise of running money from the start. The result is an investment culture marked by lengthy tenures, strong manager fund ownership, and competitive long-term records.

Capital's efforts to bolster its fixed-income operations are bearing fruit. It now has the tools to compete with the best bond shops, and the talent. It has added six veteran managers since 2015, including Pramod Atluri, who was nominated for Morningstar's 2019 Rising Talent award.

Above Average There are many more firms that rate Above Average in our methodology. Most have areas of excellence, but they either have some pockets of weakness or other limitations that keep them out of the top spot.

You can see the complete list in the accompanying table. Among the notable members are giants like Fidelity and Pimco as well as boutiques like Matthews Asia and Boston Partners.

Fidelity by Katie Reichart: Fidelity isn't without challenges but remains well positioned enough to compete in a changing industry. It earns an Above Average Parent rating. The firm's diversified asset mix has shielded it from steady outflows from its active U.S. equity funds, with its taxable-bond, international-equity, and low-priced index offerings attracting assets. Its revamped target-date offerings have improved, and in 2018, the firm plans to launch an additional series combining active and passive funds to better compete in an area where investor interest has grown.

Attracting and retaining talented investment professionals is more important than ever. The equity division came under fire in 2017 amid reports of sexual harassment and a hostile work environment, leading to portfolio manager dismissals and a change in leadership. While Fidelity addressed the personnel issues and is working to improve collaboration through weekly team meetings, more-open floor plans, and improved feedback systems, it remains to be seen how the division may incorporate team-based elements into the legacy star-manager system. Meanwhile, the fixed-income division remains in steady hands following the retirement of a longtime CIO. While the bond analyst and manager ranks have seen more change than usual lately, the team-oriented structure of its investment-grade and municipal offerings helps minimize the impact of departures.

Below Average Below Average firms might have some decent parts, but they also have some big deficiencies, as you can see at Transamerica and ALPS, which have Below Average ratings.

Transamerica by Laura Lutton: We have downgraded Transamerica Asset Management's Parent rating to Below Average after four Transamerica entities agreed to a $97 million settlement with the SEC in August 2018. The fine relates to the firm's mismanagement of quantitative strategies between 2010 and 2015. The SEC found that the quant models were developed by an inexperienced analyst and rushed to market. After the firm discovered problems in the models, it didn't disclose the shortcomings to fundholders or the funds' directors. The SEC's findings cast doubt on the firm's corporate culture, product-development priorities, and subadvisor oversight.

ALPS by Tayfun Icten: The firm's focus on niche strategies and its execution capabilities have been effective, but its product development efforts have been distribution-centered rather than focused on delivering strategies with enduring investment merit. ALPS' history of lineup churn seems likely to continue and drives its Below Average Parent rating.

Conclusion The fund company behind your funds is a critical piece to your investment success. It pays to seek out the best.

Morningstar Investment Management LLC, a Registered Investment Advisor and subsidiary of Morningstar Inc., is portfolio construction manager for the Transamerica Asset Allocation series of funds managed by Transamerica Asset Management, Inc. and subadvisor to the Morningstar ETF Allocation Series Portfolios managed by ALPS Advisors, Inc. In addition, Morningstar, Inc. and its affiliates have material business relationships with other firms mentioned in FundInvestor.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)