6 of the Most Popular Multiasset Income Medalist Funds

It's a heterogeneous group, and the strategies appear less sensitive to rising interest rates than expected.

The environment remains challenging for investors seeking income. The 10-year Treasury yield has recovered from its all-time bottom of 1.43%, but it's still hovering in the low 2% range. Many economists have forecast rates to rise for some time now, but mid- to long-term yields might remain depressed, even after the Fed eventually hikes the short-term federal-funds rate.

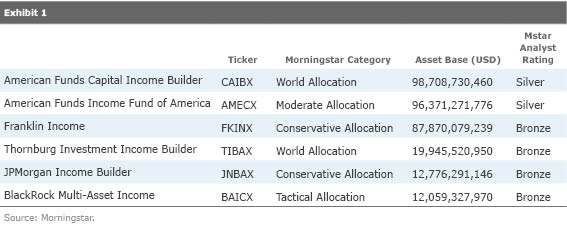

Owing to the low-yield environment, investors have poured money into income-seeking funds. Multiasset income strategies have received particular interest, given their flexibility to hunt for yield across multiple asset classes with limited constraints. This Fund Spy takes a close look at the most popular multiasset income funds that receive a Morningstar Analyst Rating of Gold, Silver, or Bronze. Exhibit 1 includes all funds from Morningstar's various allocation categories with at least $10 billion in assets that have a primary objective of delivering high income and boast a Morningstar Medalist rating.

The funds are similar in that they all use tactical asset allocation and active security selection. However, because of differences in execution and geographical or asset-class boundaries, it's still quite a heterogeneous group. In fact, the six funds that made the cut fall into four different Morningstar Categories. In considering this group, investors should pay attention to three key areas of differentiation: the level of yield offered, the volatility of total returns, and the opportunity set available to the portfolio managers.

Yield/Volatility Trade-Off

Presumably, investors have come for income, and these funds have delivered on that front.

Source: Morningstar.

Of course, generating a high yield typically involves considerable risk-taking. As shown by the standard deviations and betas in Exhibit 3, investors in these multiasset income funds can generally expect moderately higher volatility than a blended benchmark consisting of 50% MSCI World Index and 50% Barclays U.S. Aggregate Bond Index and significantly higher volatility than the bond index alone.

Exhibit 3

Source: Morningstar.

Franklin Income's volatility has come from a mix of stocks and bonds. Longtime lead skipper Ed Perks currently parks about 44% of assets in equities and 37% in high-yield bonds, which includes a sizable allocation to bonds rated CCC. Morningstar recently lowered the fund's Performance Pillar rating to Neutral from Positive, because it trailed its custom benchmark (40% S&P 500, 24% Barclays U.S. Credit Index, 24% Barclays U.S. High Yield Intermediate Index, and 12% Bank of America All Total Return Alternatives U.S. Convertibles Index) during the last decade. The fund's size also bears watching: At a whopping $88 billion, it likely can't take advantage of higher-yielding smaller debt issuers. Even so, the fund's time-tested process and long-tenured management make it a solid choice.

Meanwhile,

Last but not least, two of American Funds' strategies made the cut. Both funds turned in a standard deviation of about 12%, but they got there in different ways.

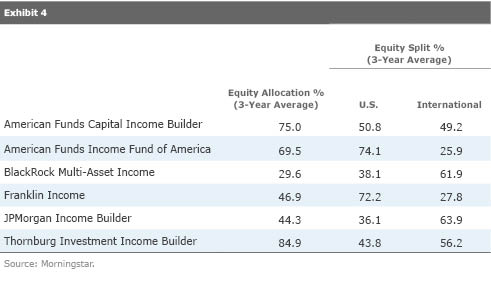

Exhibit 4 outlines the average equity allocations of the six multiasset income funds during the last three years through July 2015 to help provide a sense of how the managers have invested their assets. The remainder of the funds' assets have consisted primarily of a mixture of investment-grade and high-yield bonds, convertibles, and preferred stock, among other areas.

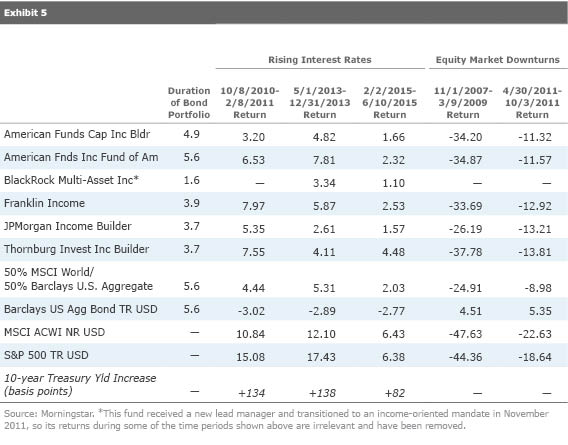

What Lies Ahead One glaring question that remains is, how will these income-focused funds perform if and when interest rates rise? In theory, one might expect the group to suffer, as rising rates create new avenues to earn income, thus making currently high-yielding securities relatively less appealing. However, recent history suggests otherwise. Exhibit 5 shows that during periods when interest rates have spiked during the last five years, these funds have fared well and posted gains, while the Barclays U.S. Aggregate Bond Index produced losses.

Rather than responding to interest-rate movements, these funds appear to be more sensitive to equity markets. The two right-most columns of Exhibit 5 show that during 2008's stock market meltdown and during 2011's midyear sell-off, all of the funds incurred significant losses. They also unanimously underperformed a 50% MSCI World Index and 50% Barclays U.S. Aggregate Bond Index benchmark, though to varying degrees. On a brighter note, all of the funds held up better than broad U.S. and world stock market indexes. Still, the funds' steep losses during equity-market downturns reinforce the point that they take significant risks in their pursuit of high yield.

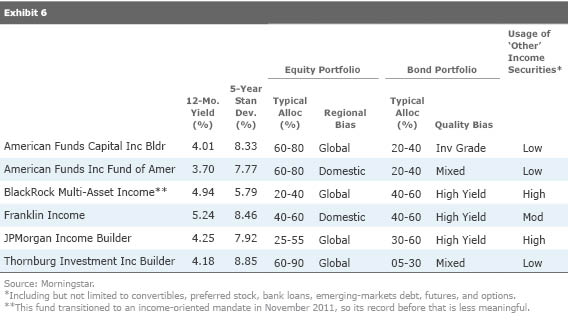

In summary, when choosing among multiasset income funds, investors must strike a balance between yield and risk. Keep in mind that higher yield typically involves greater risk, so understanding a given fund's philosophy and approach to these issues is key to making a decision an investor can stick with. Exhibit 6 includes some of the key findings of this article, which investors can use to pinpoint differentiators among the strategies.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)