15 Top Funds Leading the Way on ESG

These Morningstar Medalists will make you feel good while investing.

The ability to outperform traditional benchmarks while pursuing sustainability initiatives has often seemed an elusive goal for investors. Using the Morningstar Analyst Rating together with the newly launched Morningstar ESG Commitment Level, investors can now identify funds that deliver the best of both worlds.

What is the Morningstar ESG Commitment Level?

To help investors understand where a strong environmental, social, and governance approach fits within a fund's broader investment objectives, we debuted the Morningstar ESG Commitment Level in November 2020. The ESG Commitment Level is a qualitative measure of the extent to which asset managers and funds incorporate ESG considerations into their investment processes. The scale runs from best to worst as follows: Leader, Advanced, Basic, and Low.

Firms and strategies that earn the Leader designation integrate ESG factors fully into their security analysis and portfolio construction, and they deliver desirable ESG outcomes at the portfolio level, such as a high sustainability profile or advancement of the UN Sustainable Development Goals. These firms boast impressive ESG resources, and they typically have best-in-class practices for reporting and disclosure. For Advanced firms and strategies, ESG considerations are a key part of the investment process, even if they fall short of Leader funds in one or more areas.

So far, the ESG Commitment Level only applies to a subset of funds under Morningstar analyst coverage. We recently released our second batch of ESG Commitment Level assessments, bringing the total to more than 800 strategies and 70 asset managers. For the full paper, click here.

The Top 15

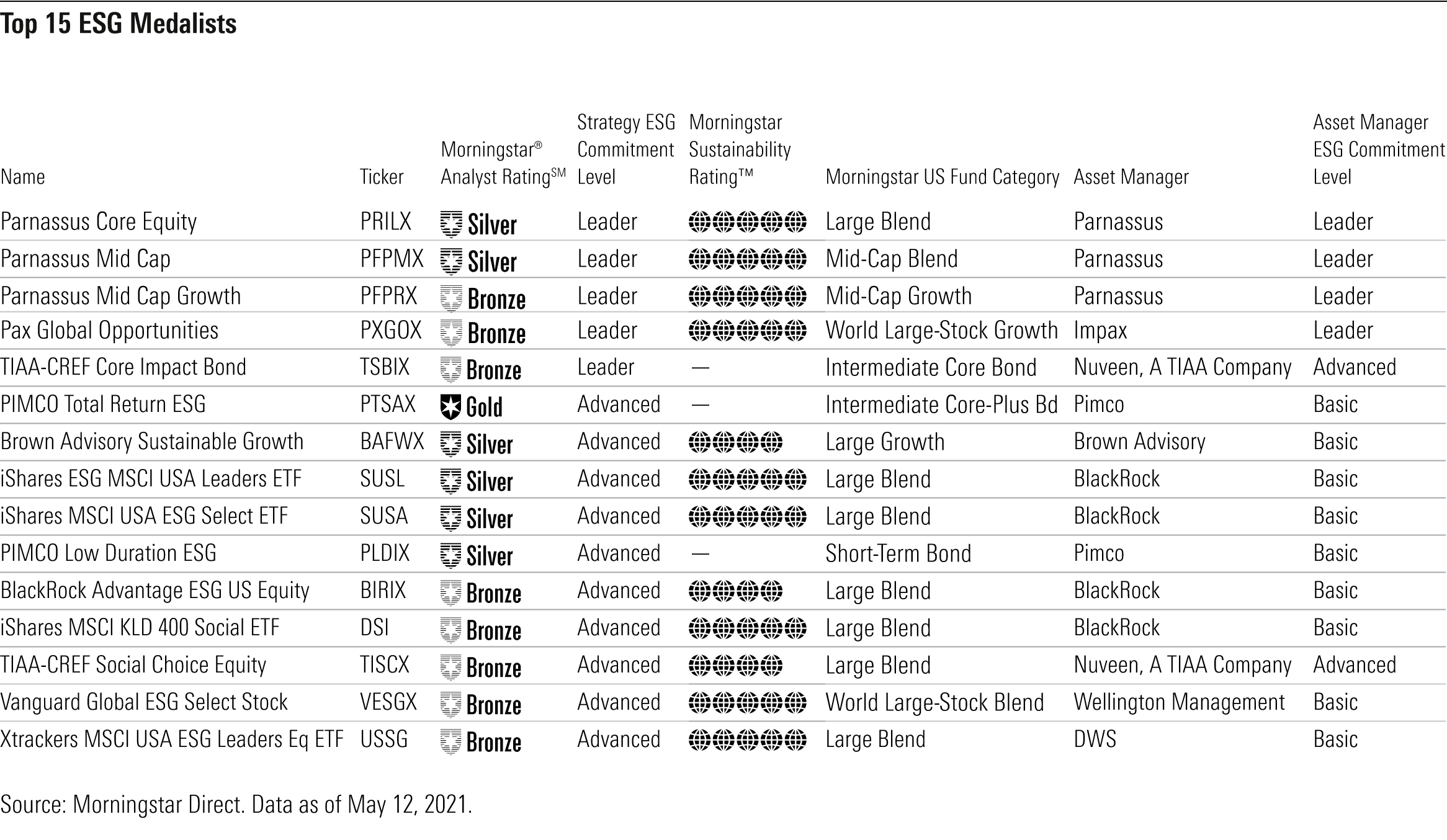

Fifteen funds earn top marks for both their Morningstar Analyst Ratings, which evaluate a strategy's future potential for outperformance, and ESG Commitment Levels. Exhibit 1 shows the funds that earn Analyst Ratings of Gold, Silver, or Bronze and an ESG Commitment Level of either Leader or Advanced.

The two asset managers on this list that earned an ESG Commitment Level of Leader, Parnassus and Impax, both boast decades of experience in responsible investing, evidenced in the high quality of ESG integration in their intentionally sustainable fund offerings.

The Leaders

Parnassus Core Equity PRILX, Parnassus Mid Cap Growth PFPRX, Parnassus Mid Cap PFPMX Parnassus offers three equity funds that are Morningstar Medalists and earn a Morningstar ESG Commitment Level of Leader. These funds are driven by a rigorous, firmwide approach to ESG investing that is a head above the competition. Parnassus isn't new to ESG investing--the firm's focus on sustainable investing dates back to its 1984 inception, resulting in a steady investment team with substantial experience in the field. This experienced team produces topnotch ESG research, which is a key driver of security selection and portfolio construction, risk management, and proxy-voting strategies.

Parnassus’ funds apply the same firmwide philosophy in each strategy. The process excludes companies involved in controversial businesses and then employs ESG, quality, and valuation screens to filter out about 85% of the benchmark. From there, managers look for companies with sustainable competitive advantages, increasingly relevant products or services, exemplary management, and ethical practices. For example, VF Corp VFC is an outdoor apparel company focused on improving its sustainability by setting science-based targets for carbon intensity and leading the way in circular business models.

The resulting portfolios are concentrated, with a focus on downside protection and stable competitive footing. This leads to a quality bias, but the managers also consider valuation, ensuring that the portfolio holdings are not overly expensive. Management skillfully blends sound investing principles and ESG expertise in this compelling suite of funds.

Pax Global Opportunities PXGOX Bronze-rated Pax Global Opportunities is the U.S. version of Ireland-domiciled Impax Global Equity Opportunities, both of which earn a Morningstar ESG Commitment Level of Leader. These funds benefit from a thoughtfully designed, well-structured ESG approach that drives an edge in the global large-cap equity space.

Broad exclusions of controversial industries are common in ESG investing, but this fund takes a more nuanced approach. The manager duo that has led this strategy since its 2018 inception targets companies possessing sustainable competitive advantages that should profit from a transition to a more sustainable economy. The fund’s positive inclusion strategy provides investors the opportunity to benefit from the sustainability transition across industries, a step above the blunt approach employed by some peers.

The team balances the rigorous ESG approach with a sound stock-selection process that avoids overvalued securities and manages portfolio-level risk. The managers invest with conviction, leading to a relatively concentrated bottom-up portfolio that looks different from its MSCI All Country World Index benchmark when it comes to regional and sector exposure. Such positioning can lead to periodic short-term underperformance, but this strategy offers an edge in the long term.

TIAA-CREF Core Impact Bond TSBIX TIAA-CREF Core Impact Bond is a worthwhile ESG mandate wrapped in a solid relative-value-driven process. A robust team incorporates traditional ESG screening alongside proprietary rankings and impact investments, making this one of the purest ESG bond strategies out there.

Lead manager Steve Liberatore is a firm veteran and heads up the firm’s ESG and impact investing efforts in fixed income. He is backed by two comanagers and over 100 investment professionals. The firm’s 28-person ESG team ranks potential investments according to a proprietary ESG framework, which is tailored to each industry. Most of the fund’s assets (60%-70%) invest in the top performers according to this ESG research. The remainder of the portfolio is dedicated to impact investments, which are bonds issued to finance a project that results in a “direct and measurable” impact toward some environmental, social, or governance goal. The fund’s ESG mandate, robust resources, and incorporation of impact investments make for a strong overall offering.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)