13 Top-Performing Large-Value Funds

Oakmark, Putnam, and Vanguard are among the funds with the best track records in the category.

The returns of large-value stock funds (especially growth funds) continue to lag those of the overall market.

However, top performers in the category, including Oakmark Investor OAKMX and Putnam Large Cap Value PEYAX have beaten the broader market’s returns. Similar funds from Schwab, Blackrock, and Fidelity have also seen strong track records over the last one-, three-, and five-year time frames. The best funds include:

- Empower Large Cap Value MXEQX

- Fidelity High Dividend ETF FDVV

- Hotchkis & Wiley Value Opps HWAIX

- Invesco FTSE RAFI US 1000 ETF PRF

- iShares Core S&P US Value ETF IUSV

- iShares S&P 500 Value ETF IVE

- JHancock Disciplined Value JVLIX

- Oakmark Investor OAKMX

- Putnam Large Cap Value PEYAX

- Schwab Fundamental US Large Company ETF FNDX

- SPDR Portfolio S&P 500 Value ETF SPYV

- Vanguard S&P 500 Value ETF VOOV

- Vanguard Windsor VWNFX

Large Value Stock Performance

Stocks have been on a strong run, with the Morningstar US Market Index returning 29.64% over the last 12 months. However, large-value funds have recently posted weaker returns than their large-blend and growth peers. The exception was 2022, when large-value funds posted smaller losses during the bear market.

For the past year, the average large-value fund is up shy of 22%, lagging the market by nearly 8 percentage points. That performance is further overshadowed by the average large-growth fund, which has gained 34.45%.

It’s a similar story looking back over the last three- and five-year time frames. Large value lags the overall market by more than 2 percentage points per year over the last three years and nearly 4 percentage points per year for the last five years.

Large-Value Funds vs. US Market Index

What Are Large-Value Funds?

Large-value funds invest in big US companies that are less expensive or growing more slowly than other large-cap stocks. Stocks in the top 70% of the capitalization of the US equity market are defined as large-cap. Value is based on low valuations, such as low price ratios and high dividend yields, or slow growth (low growth rates for earnings, sales, book value, and cash flow).

Screening Large-Value Funds

For this article, we screened returns data from the past five years for open-end and exchange-traded funds that ranked in the top 33% of the category using their lowest-cost share classes over one-, three-, and five-year periods. We also filtered for funds with a Bronze, Silver, or Gold Morningstar Medalist Rating. We excluded funds with assets under $100 million and analyst coverage under 80%.

This left us with 13 funds, seven of which are index funds, while the remaining six are actively managed. Among the top-performing index funds, three track the S&P 500 Value Index.

Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes that are not accessible to individual investors outside of retirement plans, or they may be aimed at institutional investors and require large minimum investments. The individual investor versions of those funds may carry higher fees, reducing returns. In addition, medalist ratings may differ among the share classes of a fund.

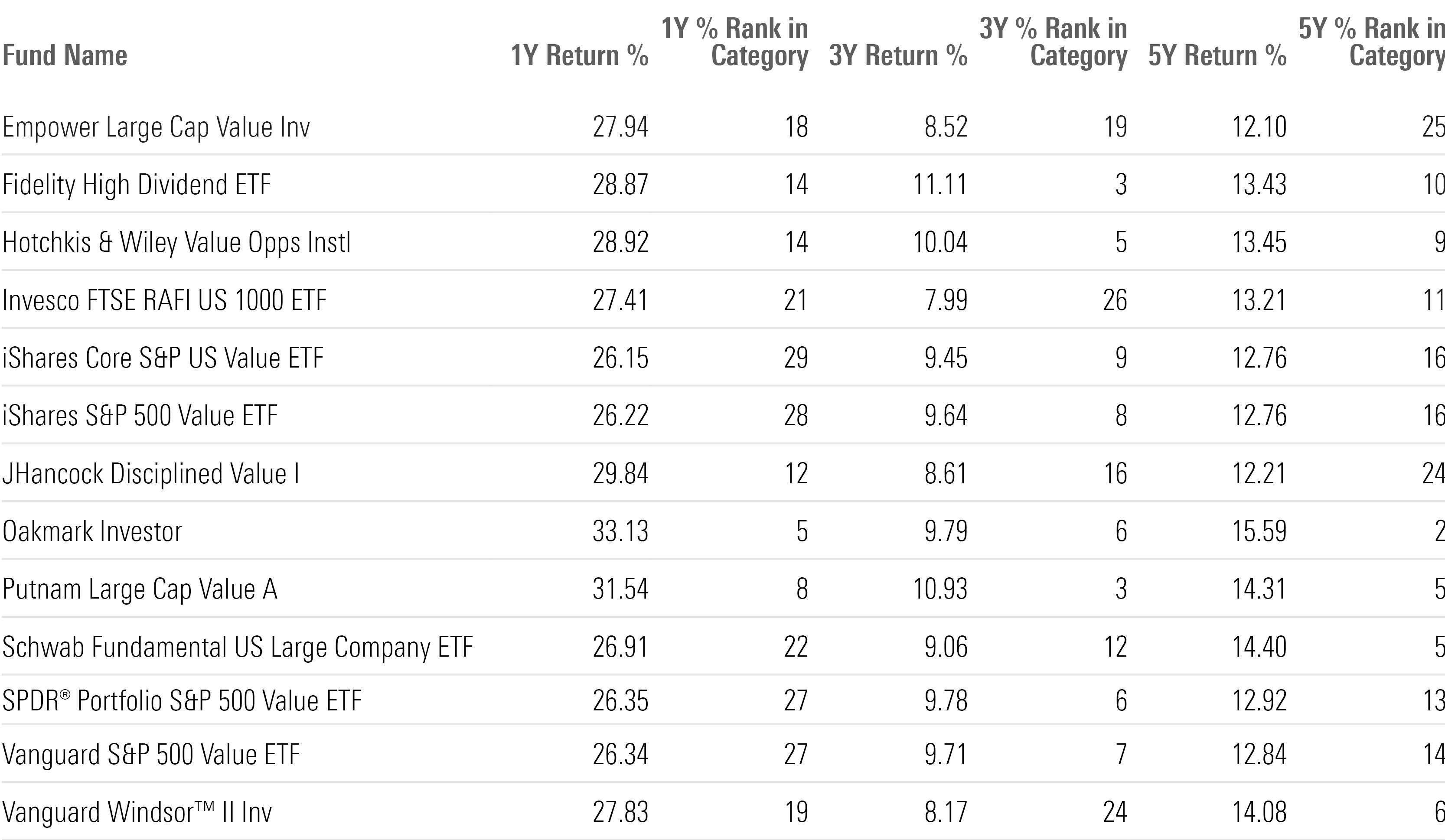

Top Performing Large Value Funds

Here’s a closer look at what Morningstar analysts say about the top-performing large-value funds.

Empower Large Cap Value

- Ticker: MXEQX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Bronze

“A stock with a hefty dividend may attract yield-focused investors, but it is just a start for John Linehan. For instance, he has long held less capital than the Russell 1000 Value Index in high-yielding telecom providers AT&T T and Verizon VZ because of concerns around their earnings power amid fierce competition. While he will not sacrifice quality to reach for yield, he is willing to lower his sights if a stock’s valuation is attractive enough.

“Yet Linehan’s willingness to hold on to cheap fare hasn’t always paid off. Such tendencies explain why the strategy has been a touch more volatile than its benchmark, though Linehan’s thoughtfulness around the sizing of bets and adequate diversification ensures a smoother ride than more aggressive deep-value strategies.”

—Adam Sabban, senior manager research analyst

Fidelity High Dividend ETF

- Ticker: FDVV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“The Fidelity High Dividend Index, which this fund fully replicates, starts by screening out the least-liquid quintile of all U.S. stocks. It surveys the largest remaining 1,000 firms, filters out those that don’t pay dividends, and then removes those whose payout ratios rank in the worst 5%. Each remaining stock receives a composite dividend score that incorporates yield (70% of the composite score), payout ratio (15%), and 12-month dividend growth (15%)--all of which are measured on a sector-relative basis. The latter two metrics identify fundamentally sound stocks that are more likely to sustain their dividends. The index repeats these steps among the universe of international developed-markets stocks and adds the best-rated foreign firms to the selection universe.”

—Ryan Jackson, manager research analyst

Hotchkis & Wiley Value Opps

- Ticker: HWAIX

- Morningstar Rating: 3 stars

- Morningstar Medalist Rating: Bronze

“Hotchkis & Wiley uses the same contrarian value philosophy across its equity strategies, but this one has the most leeway. It invests across the market-cap spectrum, though small- and mid-cap stocks must clear higher hurdles than large caps. It also invests across the capital structure, buying high-yield and convertible bonds when prices are attractive. It may invest in special situations, such as risk arbitrage, and can buy stakes in private firms. It often has sizable non-US equity positions, and it hedges currency exposure opportunistically.”

—Chris Tate, manager research analyst

Invesco FTSE RAFI US 1000 ETF

- Ticker: PRF

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“Invesco FTSE RAFI US ETF, the Canadian-domiciled version of this strategy, invests in the US-domiciled Invesco FTSE RAFI US 1000 ETF and uses forward contracts to hedge the currency risk.”

—Ryan Jackson

iShares Core S&P US Value ETF

- Ticker: IUSV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“The S&P 900 Value Index starts by pulling in the constituents of the S&P 500 and S&P MidCap 400 indexes and assigning a value-growth score to each stock. It then selects the most undervalued stocks based on their book/price, earnings/price, and sales/price ratios.”

—Mo’ath Almahasneh, associate manager research analyst

JHancock Disciplined Value

- Ticker: JVLIX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“The managers employ Boston Partners’ compelling three-pillar approach, which focuses on finding stocks with reasonable valuations, positive business momentum, and strong fundamentals. A quantitative screen ranks constituents of the Russell 1000 Index as well as ADRs based on a comprehensive 13-factor model. Value-oriented factors, such as P/E, constitute 40% of the model’s weighting; business momentum indicators, including profit margin trends, account for another 40%; and signs of healthy fundamentals, such as returns on invested capital, make up the final 20%. This effectively narrows the strategy’s universe and sets the team up well to carry out its fundamental research.”

—Andrew Redden, manager research analyst

Oakmark Investor

- Ticker: OAKMX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

“Bill Nygren and his team ascribe to three key tenets. They target cheap large-cap stocks—more explicitly, those trading at least 30% below the team’s estimate of their intrinsic value. They want companies that can grow per-share value at least as fast as the S&P 500. And they believe that the management teams best suited to deliver such results are those that think and act like owners.”

—Tony Thomas, associate director of equity strategies

Putnam Large Cap Value

- Ticker: PEYAX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Bronze

“Manager Darren Jaroch applies a multifactor model he developed in the early 2000s to screen an initial universe of roughly 500 stocks that includes the constituents of the Russell 1000 Value Index, foreign-domiciled multinationals, and analyst suggestions. Jaroch routinely updates the model’s components to improve factors, add new ones, and remove ineffective ones. Currently, the model has six factors and more than 35 underlying subfactors. Jaroch continues to tinker with the exact makeup of the models, but his investing philosophy remains the same.”

—Tony Thorn, manager research analyst

Schwab Fundamental US Large Company ETF

- Ticker: FNDX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Silver

“Schwab takes a contrarian approach, fundamentally weighting its portfolio holdings and following a strict rebalancing schedule. Its broad reach, low turnover, and demonstrated ability to excel when valuations mean-revert make it an attractive option. It earns a Morningstar Medalist Rating of Silver.”

—Ryan Jackson

Vanguard Windsor II Inv

- Ticker: VWNFX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Bronze

“The two most value-oriented strategies each run roughly 20% of assets. Deep-value manager Hotchkis & Wiley seeks about 70 firms whose problems have created low stock prices relative to normalized earnings. Sanders Capital’s behavioral approach seeks 50 stocks that are cheap because market anxiety lowered their prices relative to Sanders’ outlook for future cash flows.”

—Todd Trubey, senior manager research analyst

SPDR Portfolio S&P 500 Value ETF

- Ticker: SPYV

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Silver

iShares S&P 500 Value ETF

- Ticker: IVE

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

Vanguard S&P 500 Value ETF

- Ticker: VOOV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“The S&P 500 Value Index starts with stocks in the S&P 500. It calculates a value-growth composite score for each stock. The value metric is based on stocks’ price/book, price/earnings, and price/sales ratios. Then, each stock is assigned to either the S&P Value or S&P 500 Growth Index. Stocks exhibiting less-pronounced growth or value traits are then allocated to each index based on the relative strength of their traits until each index reaches half of the S&P 500′s market cap. The index weights stocks by market cap and implements value-growth score buffers around their lower bound to limit turnover. The index is reconstituted annually.”

—Morningstar Research

Top-Performing Large Value Funds' Long-Term Returns

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)