Sheryl Rowling's Practice Wise: Converting to Morningstar Office in Real Time

The decision by any advisor to change a software provider is a big one. It's an investment of time and money, and a poor choice can have a meaningful negative impact on a firm and its clients.

My registered investment advisor firm, Rowling & Associates, is making a big switch. We’re converting from PortfolioCenter to Morningstar Office. In this column, and periodically in the months ahead, I'm going to document the experience as a way to share lessons I'm learning about changing software platforms.

Of course, I have worked part-time for Morningstar ever since I sold my software company (Total Rebalance Expert) to them in 2015. While I continue to spend most of my days managing my advisor business and working with clients, I'm also on the payroll at Morningstar writing this column, helping with other projects, and being an internal sounding board for Morningstar's advisor products group.

That said, Morningstar has never pressured me to switch providers on any of our software. And, although we've used Morningstar research tools forever, our technology suite consisted of what we considered to be "best of breed" at the time we implemented each program. So my decision to switch to Morningstar was based on my firm's and my clients' best interests. And as I document this switch, anyone who knows me, can count on it being a warts-and-all description.

Why We Are Leaving PortfolioCenter

For a long time, we were happy with PortfolioCenter. The quality of the data is great, and we are used to it. Sure, it's not a web-based platform nor does it have a lot of fancy bells and whistles, but it does the job and does it well. We considered switching portfolio accounting software in the past, but the potential pain didn't seem to justify the added benefits of a shiny, new program.

But when PortfolioCenter was acquired by Envestnet Tamarac, the picture changed.

At a recent T3 Advisor Conference, Kunal Kapoor, Morningstar's chief executive officer, said RIAs should "think closely about who (they) are partnering with … we encourage advisors to not just learn about the services they use, but also to understand what's behind it." He elaborated at this year's Morningstar Investment Conference, saying, "Transparency of data privacy practices will be the new and defining criteria that drive industry success. So, when it comes to using your data or your clients' data, we will always ask for permission, and we will never put you or ourselves in a position to beg for forgiveness."

This is a sentiment I agree with, and not just because Kunal is my boss at Morningstar! As a fiduciary to my clients, I believe in vetting every provider we work with.

As caretakers of our clients' personal information, I don't want my clients' data to be sold in any form—even if it's masked and aggregated—and I don't want my contact information or other unspecified information about our positions given to asset managers if I'm using their funds.

Unfortunately, now that Envestnet has bought PortfolioCenter, I'm not comfortable with the privacy policy – which you can find here - that has come along with the new owners, which allows them to do those exact things. If I decided to stay with PortfolioCenter, I would need to ask each of my clients to acknowledge or give permission in order to protect myself from liability. In the end, I can't ask my clients to do that. I believe that for advisors, client data privacy is a bright-line rule, and if our client information is being sold or shared without explicit knowledge or permission, I won't work with that company.

What We Looked for in a New Software

After using PortfolioCenter for more than 20 years, the thought of leaving our most utilized software package was quite daunting. Knowing that we had to make the leap, we needed to compile a list of what was important to us. We sought a program with the following characteristics:

• Accurate data, including correct cost-basis tracking and performance indexes.

• Privacy of client data.

• Experience with converting from PortfolioCenter.

• Web-based platform.

• Financially stable provider.

• Provider with high marks for ethics, diversity, and social consciousness.

• Flexible report formats.

• Good graphics.

• High-quality support.

• Back-office services.

• Integration with other software we use.

Yes, we were searching for the golden chalice. We think we found it.

Why We Chose Morningstar Office

Office was naturally a front-runner because I work for Morningstar. That alone would not be enough to choose Morningstar Office above any other offering. But data security has become a front-burner issue for me.

Morningstar does not sell client data—to hedge funds or any other market participant—and commits to always prioritizing data security and the individual investor's right to privacy.

Of course, there's more to the decision than that. When we looked at the other providers, we were not able to check the boxes on all of our requirements.

In the end, after a thorough evaluation, we chose Morningstar Office because:

• The quality of the data is excellent—even for cost basis.

• Morningstar is known for its independence and high ethics.

• Morningstar has a lot of experience with conversions from PortfolioCenter.

• Morningstar includes back-office services and bundles everything—with nothing that looks to me like "nickel-and-diming."

• It is cloud-based.

• The graphics and client-facing output are visually attractive and easy to read.

• Reports are customizable, allowing snapshot views and detailed asset allocation.

• It integrates with all of the important Morningstar tools that we already use, including Total Rebalance Expert, analyst research, security research and screening, ByAllAccounts, and more.

• It includes a client portal that is interactive and user-friendly.

The Conversion Process

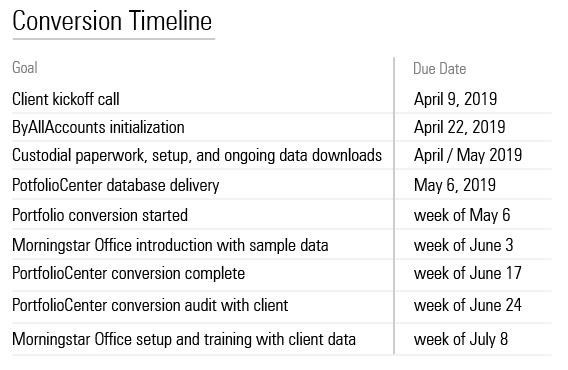

At the moment, our PortfolioCenter is hosted by Back Office Support Service, so Envestnet does not have access to our client data. But I would rather move to Morningstar Office sooner than later. Our goal is to have the conversion complete no later than mid-summer.

We are currently very early in the process. We've had our kickoff meeting in which we were introduced to the team that will work on our project. We have been given Morningstar Office logins so we can start training. And, our ByAllAccounts data has been cloned so we can run parallel on both systems.

Next comes the hard, "roll up your sleeves" work. Stay tuned!

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54TDG3XJRJOCAZKHKCHGIUEXS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLBBRDZCH5HV7PZBIFSY6DM72E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)