How to Keep Building Trust With Clients and Why You Should

Personalization, deep knowledge, and shared goals can establish advisor-client trust.

When it comes to the advisor-client relationship, research finds that retention and new client acquisitions may depend more on the level of trust a client has in the advisor, than on the advisor’s portfolio management and performance.

Every good relationship--whether personal or professional--relies heavily on building trust. That especially goes for the financial advisor-client relationship where someone’s long-term future and livelihood are involved.

It’s mutually beneficial for clients to trust their advisors, because it then becomes more likely that clients will benefit from the expert advice that the advisor offers. On the advisor side, having a full picture of a client’s financial circumstances and goals allows the advisor to choose the best options for the client.

It’s hard to argue against the importance of trust, but it’s also hard to pinpoint how to build trust in the advisor-client relationship. In our research, we began to dig into this conundrum.

What Drives Trust in Advisor-Client Relationships?

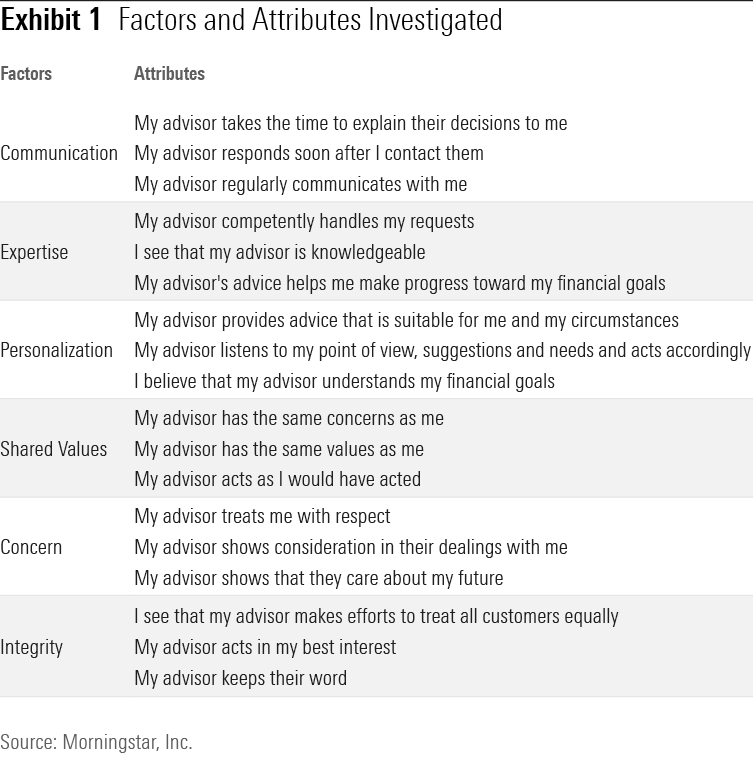

We began by narrowing our focus on 18 different advisor behaviors, ranging from whether they keep their word, to whether they take the time to explain their decisions to clients. Each of these 18 behaviors related to six distinct factors, commonly referred to in trust-related research (see Exhibit 1).

- Communication

- Expertise

- Personalization

- Shared values

- Concern

- Integrity

We asked 588 individuals to complete a direct-ranking exercise using these 18 behaviors. In this exercise, participants were asked to rank them based on the following question: “When it comes to developing trust in the advisor-client relationship, what behaviors are most impactful?“ We then calculated the average ranking per behavior.

3 Ways to Build Client Trust

When looking at the overall average rankings, the following three behaviors rose to the top:

- "When my advisor acts in my best interest."

- "When I see that my advisor is knowledgeable."

- "When I believe that my advisor understands my financials goals."

Given these results, here are three actionable ways advisor can build trust with clients.

Make It Clear That You Put Your Client’s Interests First

You can clearly demonstrate your willingness to work for your client’s interest by showcasing that you are a fiduciary on your website, while also explaining what that means. Many individual investors may not be familiar with the term or how much of a difference it can make in their experience. Make sure you provide a simple explanation, with links to a few resources so that clients can learn more about what it means to be a fiduciary.

Demonstrate Your Financial Expertise

Your capabilities can be displayed easily by showing your credentials, whether those are certifications or degrees. Another strategy is to put your experience on full display. This is traditionally done by stating the years you have been in practice or your assets under management. Another option is to consider stating how many families you have helped, or your average tenure with clients. It wouldn’t hurt to have a couple of success stories readily available.

Place Personalization and Goals at the Forefront

At every opportunity, make sure to emphasize how a client’s personal preferences, characteristics, and financial goals are incorporated at each step of the financial planning process. This should remain consistent from the initial conversation focused on building an in-depth understanding of the client and their financial goals, to the final plan that will get them closer to achieving those goals.

To learn more about this research and see how the rest of the behaviors ranked, download our full paper here.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)