Save Your Clients Money With These Tax Tips

Examining tax returns can help clients maximize tax savings and avoid investment mistakes.

Knowing how to review a tax return is important. The tax return contains clues for how to save clients money—at year-end and all year. And when it’s a potential client, finding savings is a sure way to convert them to a paying client. You don’t need to be a CPA or know all the tax rules. You just need to be aware of where the clues are hiding.

What Types of Savings Are Possible?

The types of savings that could apply to clients based on what you see on their tax returns can be broken down into three categories:

- Deductions

- Investment Strategies

- Roth Conversions

Deductions

For the most part, income is something that people want to maximize. They want higher wages, bigger bonuses, greater rental income, and so on. Reducing income is generally not an ideal planning strategy—until and unless tax rates exceed 100%. However, deductions present an opportunity to lower taxes. Here are some deduction strategies:

Itemized Deductions

Recent tax laws greatly increased the standard deduction—the amount taxpayers can write off without any proof or outlays. For 2023, the standard deduction is $13,850 for singles and $27,700 for married taxpayers filing jointly. For taxpayers that have almost or barely enough to itemize, consideration should be given to “bunching” itemized deductions. This means accelerating some deductions so the client can itemize one year and take the standard deduction the next.

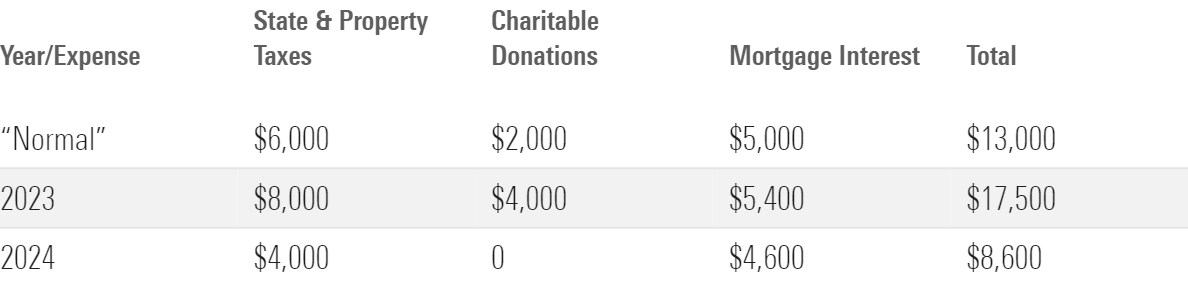

For example, consider the following example for a single individual.

Bunching Deductions

In a “normal” year, this person will take the standard deduction because $13,000 is less than the allowed $13,850. But what if the client prepays property taxes, charitable donations, and January’s house payment in 2023—and every other year? In 2023, itemizing will create an additional deduction of $3,650, while in 2024, the standard deduction will still apply. If your client is in the 32% tax bracket, that’s a savings of over $1,100!

Charitable Contributions

To better accomplish bunching, clients should consider a donor-advised fund. This account is like a “charitable IRA.” The donor makes a contribution to the fund, gets an immediate tax deduction, and then can dole out the money to charities of the donor’s choosing over a period of time. While the funds are in the account, they can be invested to grow the donation pool tax-free.

Donations to donor-advised funds can be supercharged by contributing appreciated securities. The donation is claimed at fair market value and the donor does not recognize capital gain from appreciation.

Qualified Charitable Distributions

Once a client reaches age 70 1/2, they can transfer up to $100,000 per year to a qualified charity from their IRA—without paying tax on a distribution. The other side of the equation means no charitable deduction. But for those 72 and older, these qualified charitable distributions can also offset required minimum distributions. Essentially, the “deduction” is claimed a reduction to gross income and is a benefit even if the client does not itemize.

Business Deductions

Self-employed individuals are allowed to claim legitimate business expenses against their self-employment income. These deductions don’t necessarily have to be from additional dollars spent. Expenses that could be deductible include home office expenses, business auto expenses, professional education, supplies, and advertising. Additionally, self-employed individuals are allowed to deduct the cost of health insurance if not covered by an employer plan.

SALT Workaround

Under current tax laws, state and local taxes, or SALT, are only deductible up to a maximum of $10,000 on a personal tax return (for singles and marrieds). For many clients, their property taxes alone could exceed this amount. Add in state income taxes, and your clients are missing out on a lot of tax savings.

For those clients with businesses operated as a “pass-through entity,” most states offer a SALT workaround that allows an above-the-line federal deduction for state taxes related to the business entity. Many clients and even CPAs are not aware of this opportunity. To qualify for the deduction, the business must operate in a state that has adopted SALT workaround rules. Next, the business must be structured as a pass-through entity.

A pass-through entity is a business where the tax is paid by the owners, not the business itself, such as a partnership, LLC, or S corporation. However, a sole proprietorship or single-member LLC does not qualify. For profitable businesses that are currently run as a sole proprietorship or single-member LLC, the advisor might suggest adding a partner or converting to an S corporation to take advantage of the SALT workaround. Of course, you should always involve the client’s CPA and attorney. There might be nontax reasons against making this change.

Finally, to obtain the benefit, the business and client must follow prescribed procedures such as making a timely election and prepaying taxes. Again, working with the client’s CPA is imperative.

To give an example of this benefit, assume your client Ben is a majority owner of a partnership and his share of income is $100,000. Ben’s property taxes are greater than $10,000, so the $9,300 of California tax that he pays due to his partnership income is not deductible. If the partnership made the SALT workaround election, Ben would get a full benefit on his federal tax return for the $9,300 paid. If Ben is in the 35% Federal tax bracket, he would save over $3,200!

Qualified Business Income Deduction

Another deduction that can apply to clients’ businesses is the qualified business income deduction. The QBI deduction can be as much as 20% of the net business income and is deducted from adjusted gross income prior to claiming itemized deductions. The QBI deduction applies to sole proprietorships, partnerships, LLCs, and S corporations. Calculation of the deduction is very complex and is generally not available to service businesses of single taxpayers with taxable income in excess of $182,100 or married couples with taxable income over $364,200. Since the rules are very complicated, be sure to work with the client’s CPA on this one.

Retirement Contributions

Opportunities for increasing retirement contributions should be considered for clients in a high tax bracket. As long as the client has adequate cash flow, retirement contributions offer tax deductions for moving money from “one pocket to the other.” Is there a nonworking spouse? In most cases, IRA contributions can be made for a nonworking spouse of up to $6,500 ($7,500 if age 50 or older). Want to super-charge your self-employed client’s retirement contributions? Consider a defined-benefit plan where allowable contributions can sometimes exceed $200,000 per year. The best type of retirement plan can be determined with the help of a pension consultant. As the advisor, you can alert your client to the possibility.

Investment Strategies

Tried-and-true tax-aware investment strategies are always worth keeping in mind.

Tax-Loss Harvesting

Tax-loss harvesting is recognizing a loss solely for the purpose of claiming a tax loss when the market or price of a particular position drops. To avoid loss disallowance due to the wash sale rule, the sold position cannot be repurchased within 30 days. Rather than stay in cash for that period and potentially miss a rebound, a similar (but not “substantially equal”) position should be purchased as an immediate replacement.

Short-Term Gains Avoidance

Since short-term gains are taxed at ordinary rates, care should be taken to avoid recognizing gains on positions held for less than a year. Waiting until long-term capital gains rates apply can save almost 50% of the tax cost.

Location Optimization

When clients hold investments in different types of accounts, the tax implications of which investments are held in which accounts can be huge. There are three types of accounts in terms of tax treatment: taxable (personal accounts held at a brokerage or bank), tax-deferred (IRAs, retirement accounts, annuities), and tax-free (Roth IRAs, Roth 401(k)s). Investments have varying types of taxability. Bonds and savings accounts produce ordinary interest income, tax-exempt bonds pay lower interest rates but are exempt from tax, low-dividend-paying stocks are held for appreciation that is taxed at long-term capital gains rates when sold or receive a stepped-up basis at death, high-dividend-paying stocks produce ongoing taxable income, and so on. Location optimization attempts to place investments according to the most appropriate tax treatment. In general, this means:

- Put interest-bearing and income-producing investments in the tax-deferred accounts. The income won’t be taxed until funds are withdrawn. Although the withdrawals are taxed at ordinary rates just as the income earned in a taxable account would be, this strategy provides the benefit of tax deferral.

- Put appreciating investments in taxable accounts. No tax will be paid while the investments grow in value. If sold, gains will be tax as capital gains (rather than ordinary rates if held in a tax-deferred account). If held until death, the basis is stepped up and no tax will apply to the appreciation.

- Put high-growth, riskier investments in the Roth accounts. Since these accounts are not taxed, it makes sense for these accounts to hold the highest-growth investments.

Capital Gains Distributions Avoidance

Mutual funds distribute income from internal capital gains to their fundholders at the end of the year. In some cases, these distributions of “phantom income” can be quite material—even if the value of the fund has declined during the year. By identifying funds estimating high capital gains distributions and selling them prior to posting dates, clients can avoid the unhappy paradox of paying taxes on income they’ve never received. When analyzing these transactions, care must be taken to not recognize gains from selling funds in excess of the savings from avoiding the distribution income.

For all of these tax-efficient investment strategies, using an automated rebalancing tool like Morningstar’s Total Rebalance Expert can be a blessing.

Roth Conversions

If you have clients in a low tax bracket, they might be able to convert a portion of their individual retirement accounts to a Roth account at little to no extra tax cost. Whenever IRA money is converted to a Roth IRA, tax is due on the amount of the conversion in the year of the conversion. The money in the Roth IRA will then grow tax-free for the remainder of the owner’s life and can pass to heirs income-tax free. Distributions from a Roth IRA are also tax-free, and there are no required minimum distributions.

This strategy should also be considered for clients in higher tax brackets—if they are willing to write a check for taxes. Since tax rates are likely lower than they will be in the future and future growth on amounts converted will permanently avoid tax, Roth conversion for higher income clients can be very beneficial.

Analyze the Tax Return

Matching these deduction strategies to individual client situations is where an advisor can truly shine. Let’s take a look at how reviewing a tax return can lead to big savings.

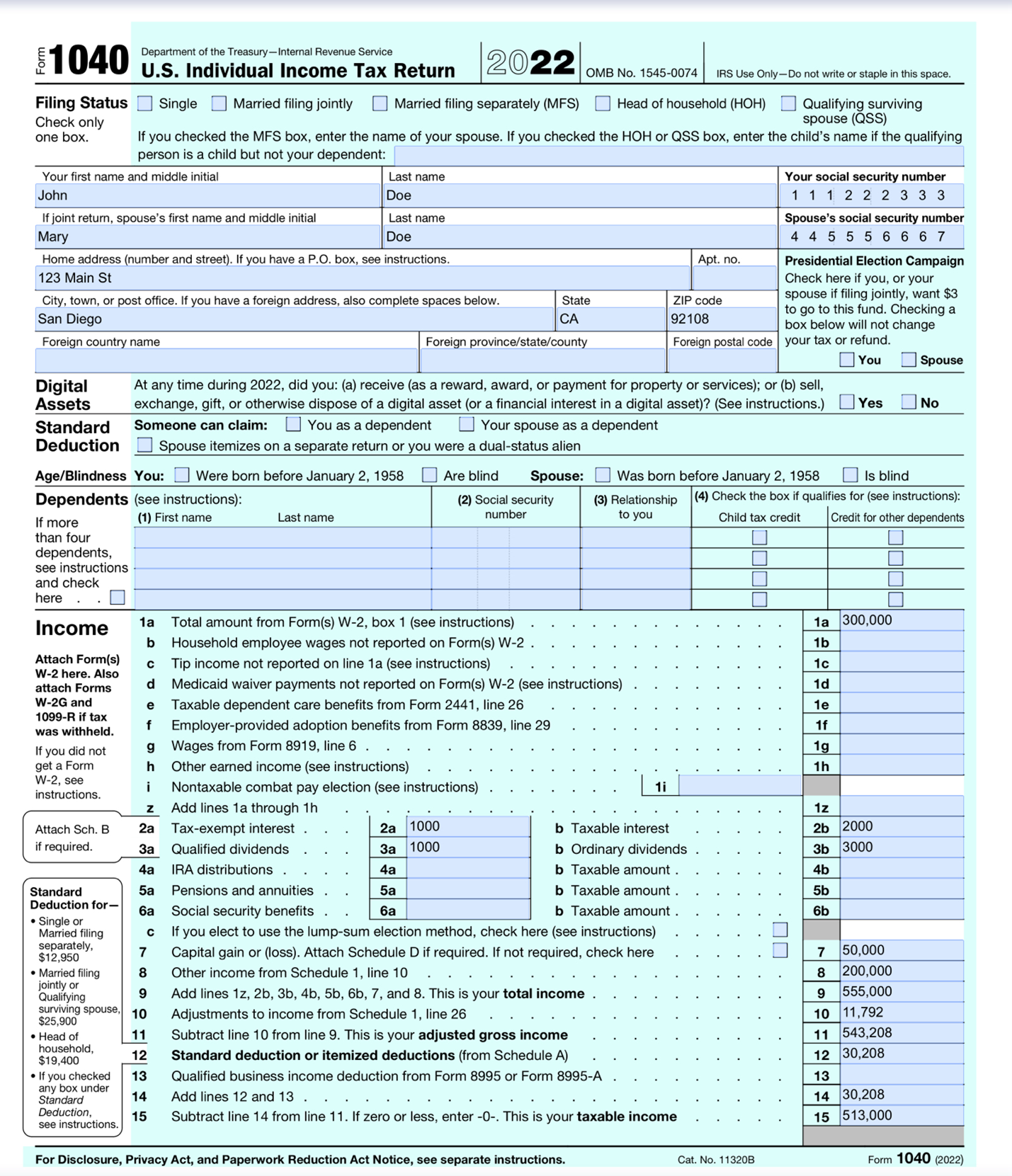

1040, Page 1

The first step in reviewing a tax return is to look at Page 1 of Form 1040. Here, you can see the various income sources of your client.

Form 1040, Page One

In this example, we can see that John and Mary Doe have income in the form of wages, interest, dividends, capital gains, and other income. We can see that their total income is $555,000, and their taxable income is $513,000.

On Line 2, we can see $1,000 of tax-exempt interest and $2,000 of taxable interest.

- Tax-Savings Strategy: It is likely that the Does could earn higher interest rates (not need exempt bonds) and pay less in taxes if the interest-bearing investments are held in retirement accounts or IRAs. (Note that if John and Mary were in a low tax bracket, tax-exempt bonds might not be appropriate at all.)

- Investment Strategy: Knowing what the interest rates were like in 2022, it’s possible that John and Mary are holding too much in cash.

On Line 3, we can see qualified dividends of $1,000 and ordinary dividends of $3,000.

- Tax-Savings Strategy: Ordinary dividend-paying securities might be better held in a retirement account or IRA. And if these securities are high income and/or high growth, they might be more appropriately held in a Roth.

- Investment Strategy: Look at Schedule B to see the source of dividend income. If there are individual company securities, this could indicate outside holdings that are not part of a cohesive investment plan or it could mean that the investor has too high a concentration in a particular security that would be better off diversified.

After reviewing Page 1 of Form 1040, as well as Schedule B, we now look at the next item of income: capital gains. This means looking at Schedule D.

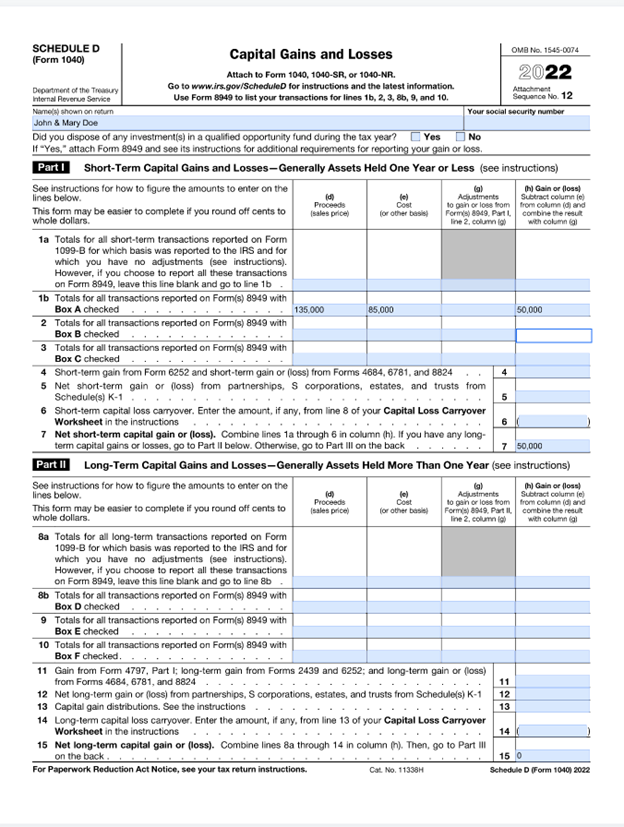

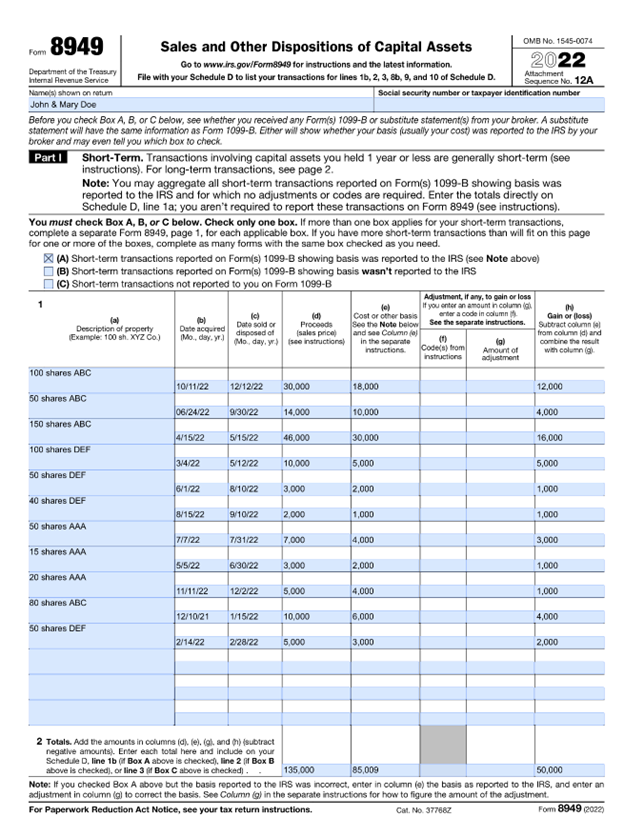

Schedule D and Form 8949

There is much to be learned from Schedule D, specifically the detailed Form 8949. This form provides complete information on short-term and long-term sales during the year. When reviewing this form, consider the following questions:

- Are there numerous transactions? Small transactions? A large number of short-term transactions? If yes, this could indicate churning—meaning the investor’s current advisor is unnecessarily creating excess trades.

- Are there many gains? If yes, it could mean that the investor’s current advisor is not choosing the highest-cost tax lots when making sales.

- Are there many short-term gains? If yes, this could indicate that the investor’s current advisor is not managing the portfolio tax-efficiently.

- Are there many losses? If yes, this could mean that the investor’s current advisor is not managing the portfolio well or it could evidence the advisor’s active tax-loss harvesting.

Here is the Does’ Schedule D and Form 8949:

Form 1040 Schedule D

Form 8949

Schedule D shows total short-term gains of $50,000. The Form 8949 shows that these gains were generated from three securities with 11 transactions, all with holding periods of less than four months.

- Tax-Savings Strategy: Consider holding securities for more than a year to avoid recognizing short-term gains. Also, consider tax-loss harvesting to offset gains.

- Investment Strategy: Beware of churning!

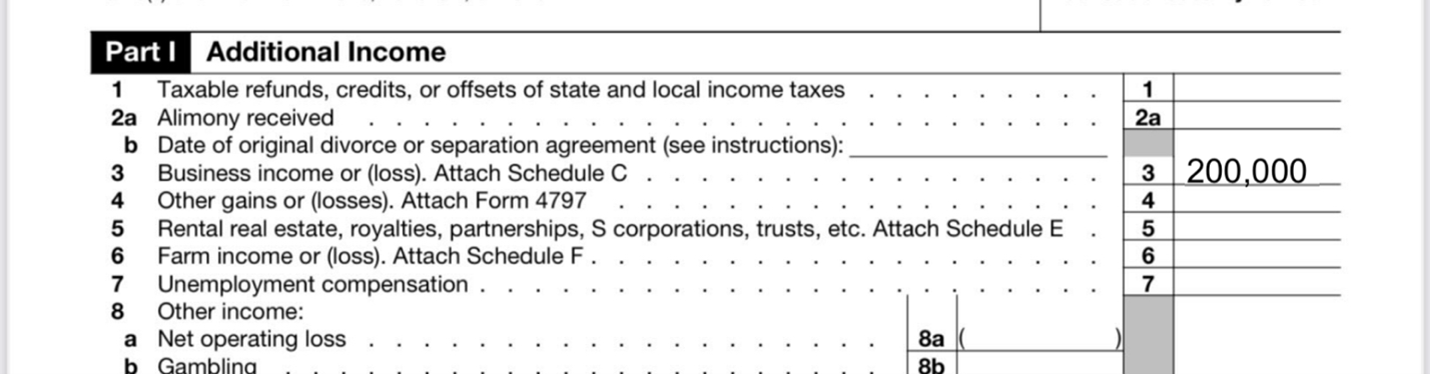

Schedule 1, Part 1, and Schedule C

Now, we need to look at Schedule 1, Part 1 to see the source of the other income.

Schedule 1, Part 1

We see that the entire $200,000 is business income, as shown on Schedule C:

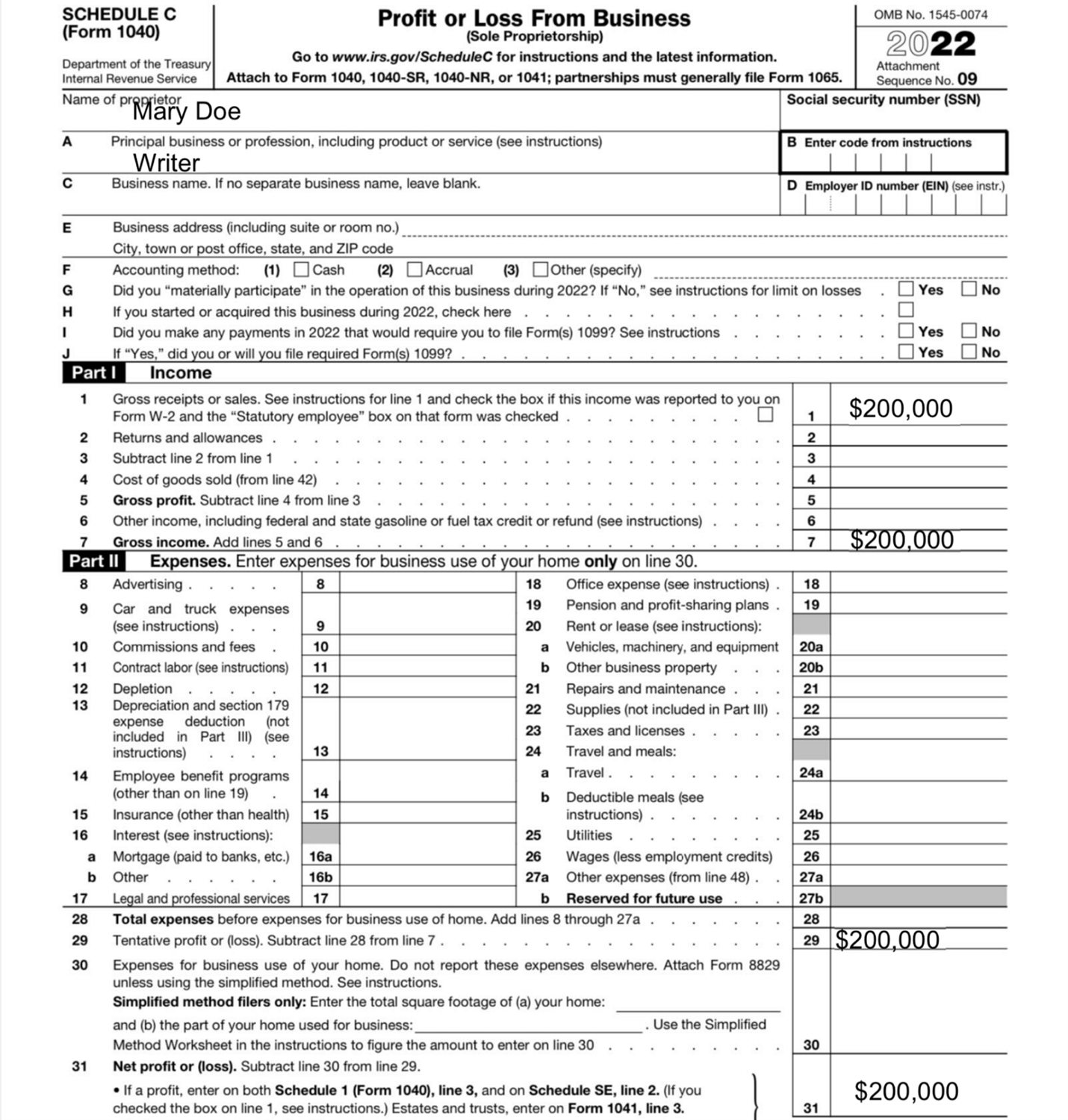

Schedule C

Here, we can see that Mary earned $200,000 from writing and claimed no expenses.

- Tax-Savings Strategy: Mary claimed no deductions and yet certainly incurred deductible expenses, such as supplies, travel, and so on. These should be claimed. Also, why is there no home office deduction? And by adding a partner or forming an S corporation, Mary could likely take advantage of the SALT workaround. (The nature of her business and high joint income likely make the qualified business income deduction inapplicable.)

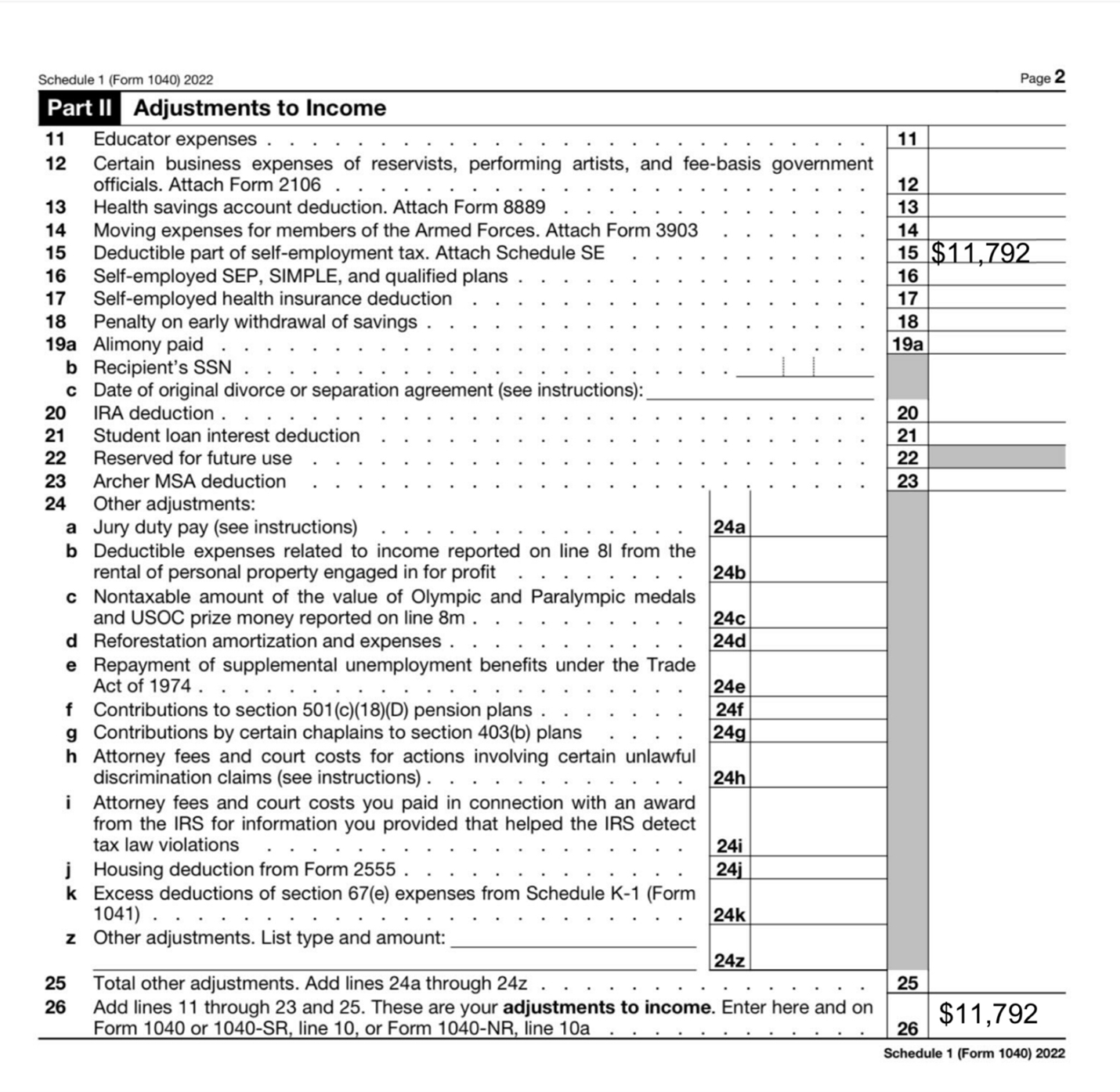

Schedule 1, Part 2

With her high business income, we need to see if Mary has made any retirement contributions. Looking back at Page 1 of Form 1040, we see that line 10 shows adjustments of $11,792. We need to refer to Part 2 of Schedule 1 to see what those are.

Part 2 of Schedule 1

Here, we see that the entire amount of adjustments to income is attributable to the deductible portion of self-employment tax. Thus, Mary has not made any retirement contributions—as seen by the lack of entries on lines 16 or 20.

- Tax-Savings Strategy: Consider contributing to an IRA or qualified retirement plan. Also, if Mary (and John) are not covered under John’s employer’s health insurance plan, Mary might be entitled to deduct self-employed health insurance premiums on line 17.

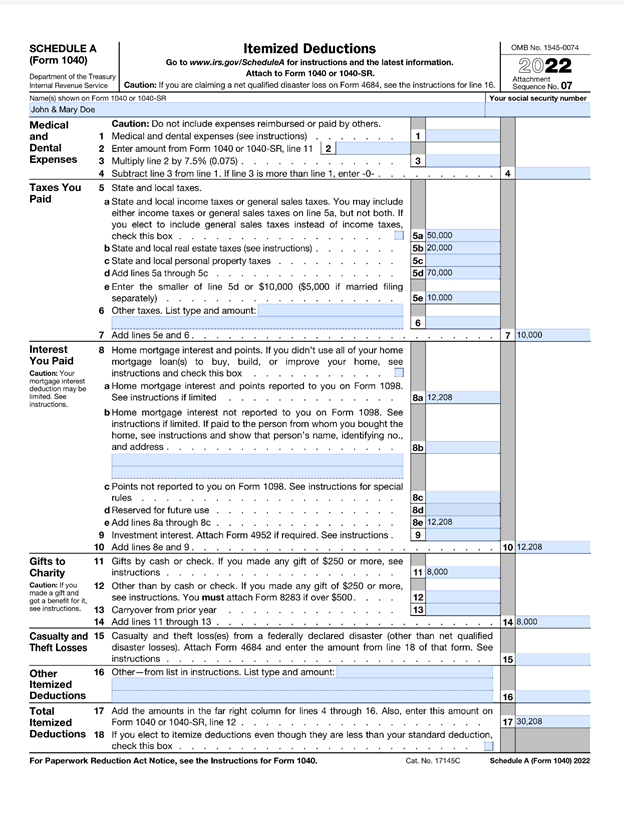

We will now review Schedule A of Form 1040, Itemized Deductions.

Schedule A

Schedule A of Form 1040, Itemized Deductions

We see that John and Mary are not benefiting from their state income tax expense because of the $10,000 limitation. We have previously determined that Mary might benefit by restructuring her business to qualify for the SALT workaround. We can also see that John and Mary are barely eligible to itemize because the standard deduction for 2022 was $25,900.

- Tax-Savings Strategy: Consider bunching itemized deductions and using a donor-advised fund.

Finally, although John and Mary are in a high tax bracket, consideration should be given to Roth conversions.

Conclusion

Through examining the tax return, an advisor can help current and potential clients take advantage of tax strategies while avoiding investment mistakes. These common opportunities include:

- Avoiding excess cash in portfolios

- Holding investments in various accounts based on tax efficiency (location optimization)

- Taking advantage of business deductions

- Contributing to a retirement account

- Using tax-efficient portfolio management

- Avoiding short-term gains

- Harvesting tax losses

- Avoiding capital gains distributions

- Making the most of itemized deductions and charitable contributions

- Evaluating opportunities for the SALT workaround and qualified business income deduction

- Considering Roth conversions

Finally, for advisors who want to really understand how tax returns work and further explore savings opportunities, consider the Kitces Course “How to Find Planning Opportunities When Reviewing a Client’s Tax Return.” The course provides six hours of education credits, and Morningstar readers can get a $50 discount with the code Morningstar50.

5 Ways to Be a More Tax-Savvy Investor in 2024

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)