Gamma in Action

Financially sound households get advice from financial planners.

In 2013, Morningstar researcher Paul Kaplan and I introduced a concept we called gamma.[1] Gamma attempts to quantify the potential value of financial planning. As U.S. households increasingly become responsible for more financial decisions, such as determining how much to save for retirement, how to invest those savings, and when to retire, and yet typically lack financial acumen, financial advisors are well-positioned to help improve household financial decision-making. Indeed, a growing body of theoretical research, including our gamma research, has noted the potential value of advisors in a variety of financial domains; however, empirical evidence on the topic is mixed and generally suggests households that use financial advisors do no better (or even worse) than those who don't, especially when it comes to investment-related domains.

These findings may be explained in a variety of ways. One explanation could be that the empirical research, which is largely investment-focused, has not captured value created in other domains such as improved savings rates or life insurance coverage. Another reason could be that certain types of advisors, such as financial planners, provide valuable services that are not consistently captured in a relatively broad financial advisor description.

In this article, we examine this last point— whether some types of advisors are providing better services to households than others. To do this, we use the six most recent reports of the Survey of Consumer Finances (from 2001 to 2016) to explore how financial decision-making varies for households that use different types of sources of information. We concentrate on five decision-making domains: portfolio risk level, savings habits, life insurance coverage, revolving credit card balances, and emergency savings. And we look at four information sources: financial planners, transactional financial advisors, friends, and the Internet. By dividing financial advisors into two types, we can better understand if any differences exist by the type of the advice engagement.

The analysis focuses on the soundness of household financial decisions versus more outcome-oriented variables. Therefore, for example, we want to know whether a household carries any revolving credit debt as opposed to the household’s level of wealth or savings.

Focusing on financial decisions allows us to:

- Capture differences between decision-making domains.

- Reduce issues associated with reverse causality (because clients with more wealth become increasingly attractive to financial advisors and it may be difficult to determine the role of the financial advisor with respect to the wealth creation).

- Control for the fact that higher wealth (or more savings) doesn't necessarily imply the household is behaving optimally. (For example, adequate life insurance may reduce available savings, but it is a vital component of a sound financial plan for most households.)

Financial Planners Lead the Way Of the four sources of financial information we studied, we find that households working with a financial planner made the best overall financial decisions. Meanwhile, those households working with a transactional advisor made the worst financial decisions of the group.

Because of potential selection bias, we cannot be sure that the financial planner was the only—or even main—reason these households made better planning decisions. After all, better decision-makers might choose to use a financial planner, and not the other way around. However, our findings do at least suggest financial planners are adding the most value among the information sources we considered, especially compared with transactional advisors.

We also find that households using the Internet as a source of information scored second to those using financial planners on overall financial soundness. This is noteworthy given the low cost of Internet information (relative to many financial advisors) and the growing use of the Internet as the primary information source for households included in our analysis. In 2001, only 3% of households used the Internet as their primary source of financial information. In 2016, 40% did. However, the better outcomes associated with the Internet declined from 2001 to 2016, so it is not clear to what extent this relation will persist.

All financial advice is not the same, nor are advisor types. Thus, we shouldn’t expect the value of advice to be uniform; research that does not attempt to control for advice type may likely produce biased results.

How We Conducted Our Analysis Determining the soundness of financial decision-making for a household is obviously subjective. For our analysis, as we mentioned above, we focus on household decisions instead of outcome-oriented variables.

The analysis uses data from the 2001, 2004, 2007, 2010, 2013, and 2016 waves of the Survey of Consumer Finances. To be included in our analysis, the respondent had to be between the ages of 25 and 55, have children, have a minimum income of at least $25,000, and have at least $5,000 in financial and retirement assets.

A question in the survey asks respondents about their source of financial information:

“What sources of information do you (and your family) use to make decisions about saving and investments? (Do you call around; read newspapers, magazines, material you get in the mail; use information from television, radio, the Internet, or advertisements? Do you get advice from a friend, relative, lawyer, accountant, banker, broker, or financial planner? Or do you do something else?)”

We use a household’s response to this question to determine the financial information source for the household in our analysis. If the respondent provided multiple sources, we assume the first response listed is the household’s primary information source.

We classify financial advisors into two types: financial planners and transactional advisors. If “banker” or “broker” is mentioned, the financial advisor is deemed to be transactional. We don’t include lawyer or accountant in either financial advisor group because these are not professions typically associated with financial advice.

We choose to use the term “transactional advisor” over “banker” or “broker” to reflect the likely scope of services associated with the advice. Being a broker (or banker) and a financial planner is not mutually exclusive; there are many advisors who work for a broker/dealer who provide comprehensive financial planning services. Therefore, we assume the response to the question is based on the nature of services being provided, where advisors who are providing holistic services are referred to as financial planners while advisors that are less holistic in nature, and likely more transaction-oriented, are transactional advisors.

Decision-Making Domains As we mentioned above, we considered five financial decision-making domains: portfolio risk appropriateness, savings habits, life insurance coverage, revolving credit card debt, and emergency savings. These are briefly summarized here:

Portfolio Risk Appropriateness This test determines if the household's retirement assets are invested in a portfolio that has a risk level that would be considered prudent given the respondent's age. For this test, the equity allocation of the investor's retirement assets is compared with the Morningstar Moderate Lifetime Index. If the equity level is within 25 percentage points of the index, the portfolio is deemed to be appropriately invested.

Savings Habits For this test, households that have some type of savings plan are considered to have good savings habits. We focus on the savings habits, instead of the amount of savings, to simplify the analysis and because of survey data limitations related to savings variables.

Life Insurance This test focuses on whether the household has face-value life insurance at least equal to the total wage income of the household. All households in this analysis have children; therefore, it is reasonable to assume that some level of life insurance would be desirable for most households.

Credit Card This question focuses on whether the household has any revolving credit card debt at the end of the month. If the household maintains revolving credit debt, we assume the household is making a poor decision.

Emergency Savings For this test, we simply divided total liquid savings, which includes balances in checking accounts, savings accounts, money market mutual funds, and money market demand accounts, by average normal income. The goal is to have at least three months' income set aside in emergency savings.

Each household in each survey has five different observations, or implicates. Each of the five tests are conducted for each implicate (25 total tests for a household). The results of the test for each implicate are combined, based on implicate weights, to get a “pass rate” for the respective domain. Pass rates ranged from 0%, where none of the implicates passed, to 100%, where all the implicates passed. The scores at the individual domain level are then averaged to get the aggregate financial soundness score for the household. Demographic control variables (for example, total financial assets) are also created using the implicate weights (that is, the weighted average of the implicate values for that household), so that each household has a single set of values.

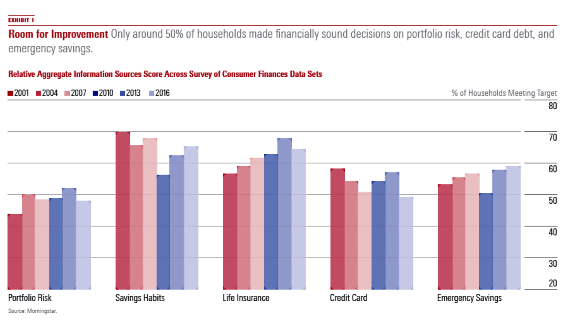

EXHIBIT 1 provides insight into the percentage of households that pass the respective tests for each of the six Survey of Consumer Finances data sets included in the analysis.

- source: Morningstar Analysts

In EXHIBIT 1, most of the tests (except for savings habits) have approximately a 50% pass rate, which suggests there is a large potential benefit for financial advisors to help the households make better financial decisions.

The Results To determine whether financial soundness varied by information source, we perform a variety of ordinary least squares regressions. For the regressions, the dependent variable is the average pass rate across the five domains for each household. We conduct four regressions including different sets of available independent variables.

We find that households that make better financial decisions tend to be younger, married, and white, and to have lower incomes, more financial assets, higher levels of education, and a male respondent. The most significant variables are financial assets and years of education, both of which have positive coefficients. This is consistent with our expectations as well as with past research. Age and income had negative coefficients, which is surprising and warrants greater study, given that typically both are positively associated with financial sophistication.

We also find that the base demographic variables explain a significant degree more of household financial soundness than the financial information source. This suggests that while the source of financial information is important, other household attributes were materially more important.

Households that use financial planners as their financial information source were making the best decisions of the groups studied, followed by the Internet. Households that were using a transactional advisor were making the worst decisions, and households using friends were the second worst. We cannot conclude that working with a financial planner is the reason those households are making better financial choices due to potential selection bias. The outcome could be endogenous to the selection of the information source. However, these findings at least imply that working with a financial planner can help households make better financial decisions, while working with a transactional advisor may actually result in worse decisions.

We do not know why households working with a transactional advisor were making the worst decisions of the groups studied, although we can speculate. One possibility is that these households may have a false sense of confidence about their financial soundness because they get advice in a few domains and think that they are covered in all areas— when in fact they are not. One problem with this hypothesis is that households working with a transactional advisor were doing the worst in effectively every domain we considered. In other words, it’s not as if households working with a transactional advisor were doing portfolio risk really well and everything else poorly; they were doing everything poorly. It’s possible there are aspects of households that select transactional advisors that are not being controlled for in this analysis or other areas where transactional advisors improve outcomes affecting these results. Perhaps future research can provide clarity here.

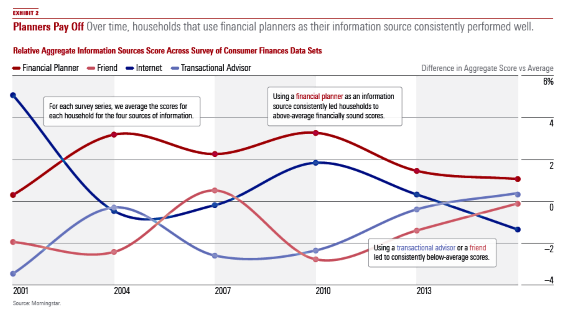

We perform a secondary analysis to see how the aggregate scores changed across the four information sources. This analysis is similar to the regression information above; however, instead of looking at the individual results, we compare the average aggregate score for each household based on household information source and then control for the Survey of Consumer Finances year. This approach ensures the average score among the four sources for each survey is zero. The results are included in EXHIBIT 2.

- source: Morningstar Analysts

Overall, the time-varying results in EXHIBIT 2 are relatively similar to the regression results, where the financial planner values are consistently the highest and the transactional advisor and friend are typically (and consistently) the lowest.

One notable item, though, is the reduction in the average score among households that use the Internet. Households using the Internet as the primary information source scored almost 5% higher than the average in 2001, and households using the Internet in 2016 scored 2% below average (which was the worst among the four sources considered). There are a variety of possible reasons for this. One may be that the benefits associated with the Internet were due largely to early adopters, and as usage has increased, the caliber and intentions of Internet users have declined.

This gets to the fundamental issue around selection bias that is difficult to control for in this type of analysis. This topic is also likely worth exploring in future research.

Important Implications The value of financial advice, something we've called gamma in the past, can be significant. In this article, we explored how the quality of five household financial planning decisions (portfolio risk level, savings habits, life insurance coverage, revolving credit card balances, and emergency savings) varies across four information sources (financial planners, transactional financial advisors, friends, and the Internet). We found that the quality of household decisions varies across sources but that households using a financial planner made the best decisions, followed by the Internet, while households using a transactional advisor made the worst decisions.

We could not conclude that using a financial planner entirely explains better decision-making of those households due to implications around selection bias. However, these findings do at least suggest that the potential value associated with working with a financial advisor could differ significantly by type.

These findings also have important implications for future research exploring the value of financial advice, especially in an empirical setting. Any kind of analysis that focuses primarily on transactional advisors may yield significantly different conclusions on the value of financial advice than one focused on advisors who are comprehensive (such as financial planners). Additionally, we found significant evidence that households using the Internet are making better-than-average financial planning decisions. The potential value of the Internet as a source of financial information and advice is notable given the significant increase in usage over the past 15 years, especially if its role as an information source continues to increase.

[1] Blanchett, D. & Kaplan, P. 2013. “Alpha, Beta, and Now… Gamma.” Journal of Retirement, Vol. 1, No. 2, PP. 29–45.

This article originally appeared in the Spring 2019 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/s3.amazonaws.com/arc-authors/morningstar/951e122c-7299-4252-bafb-80cfefb25764.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/951e122c-7299-4252-bafb-80cfefb25764.jpg)