Fighting Inflation With ETFs

ETF investors can pick their spot on the yield curve with these inflation-protected bond funds.

Inflation is once again on investors' minds. After languishing for many years, core inflation has ticked up, and it stood at 2.1% as of April 2016. Meanwhile, a number of active fixed-income managers, including PIMCO and Fidelity, have favored Treasury Inflation-Protected Securities in their portfolios. Finally, flows to the Inflation-Protected Bond Morningstar Category have been positive over the past 12 months ended April 30, 2016, and performance has been strong through the first four months of 2016.

One of the most important measurements to be aware of regarding TIPS is the break-even inflation rate. This is the difference between the yield of a nominal Treasury bond and the yield on a TIPS of the same maturity. The break-even rate is often viewed as the market’s expectation for inflation. As of this writing, the break-even rate on 10-year maturities stood at 1.58%, compared with a long-term average of 2.12%. In February 2016, the break-even rate went as low as 1.2%.

Morningstar has published a number of articles on TIPS and their role in investors’ portfolios (here and here, for example) over the past year. This column will provide an overview of exchange-traded funds within the inflation-protected bond category.

TIPS ETFs As of April 30, 2016, the inflation-protected bond ETF category consisted of 12 different funds and held a total of roughly $26 billion in assets. ETFs in the category only invest in TIPS, whereas many open-end mutual fund peers invest in commodities and other assets believed to offer a hedge against inflation. Accessing TIPS through a relatively cheap, passive vehicle can make sense because of the small number of issues within the asset class. As of April 30, 2016, there were only 37 securities in the Barclays U.S. TIPS Index.

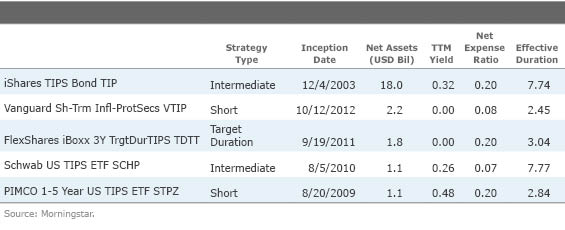

ETFs in the category are primarily distinguished by their duration, with the majority having either a short or intermediate duration. The chart below shows the five largest funds in the category.

iShares TIPS Bond

TIP

This is the oldest and largest fund in the group, accounting for roughly 70% of assets within the category. It tracks the Barclays U.S. TIPS Index, and its trailing three-year tracking error was 0.10% at the end of April. Despite being the largest fund in the category, its 0.20% expense ratio is also the second highest in the group.

Vanguard Short-Term Inflation-Protected Securities ETF

VTIP

Launched in October 2012, this is the fastest-growing fund in the category and has grown larger than many more-established competitors. Prior to launching the fund, Vanguard did research that demonstrated that the return on the short-term TIPS benchmark was more highly correlated to the Consumer Price Index than the full market benchmark, while also experiencing less volatility. The strategy is also offered as an open-end fund under the tickers VTAPX, VTSPX, and VTIPX. The total strategy, including all three mutual funds and the ETF, contains over $14 billion in assets. The ETF charges 0.08%, which is the second-lowest price in the group.

FlexShares iBoxx 3Yr Target Duration TIPS ETF

TDTT

and FlexShares iBoxx 5Yr Target Duration TIPS ETF

TDTF

Technically, TDTT falls into the short-term group and TDTF falls into the intermediate-term group. However, they do not simply track a market-cap-weighted benchmark. Rather, the funds have a duration target and will adjust their holdings so that they “float” around that target without significant deviations. Both funds charge 0.20%, and their standard deviation has been similar to short- and intermediate-duration ETFs that track market-cap-weighted benchmarks.

Schwab US TIPS ETF

SCHP

This fund has the distinction of being the cheapest in the category, with an expense ratio of 0.07%. Like TIP, it tracks the Barclays U.S. TIPS Index and has a similar tracking error of 0.07%. This is a broad market fund with an intermediate duration.

PIMCO 1-5 Year US TIPS ETF

STPZ

Launched in 2009, this was the first short-term fund in the category. Like VTIP, it targets the short end of the yield curve, although the two funds do have different benchmarks. The fund has a 0.20% expense ratio, which is on the higher side within the category. This is especially notable because of the small-to-nonexistent yield on short-term TIPS. The fund’s tracking error was 0.22%.

Performance So far this year, the inflation-protected bond ETF category has done well relative to the intermediate-term bond ETF category, returning 3.93% versus 3.38% for the year to date through April 2016. This outperformance is the result of a variety of factors, including widening break-even rates and falling long-term interest rates. Indeed, the PIMCO 15+ year US TIPS ETF has trounced the rest of the category with a 10.4% year-to-date return. However, long-term bonds often experience wide price swings; for example, the trailing one-year return for that same PIMCO ETF is a loss of 0.88%. Meanwhile, the short-term bonds have trailed the rest of the category, which is in line with the rest of the bond market.

Performance over longer time periods is not as attractive, given that TIPS lagged for several years prior to 2016. For the trailing three years, the inflation category lost 0.78% annualized while the intermediate-term bond category gained 2.18% annualized. Over that time period, the short-term ETFs lost much less than the rest of the category.

It often surprises investors that TIPS are much more volatile than nominal Treasury bonds. For example, during the 2013 taper tantrum, the inflation-protected bond ETF category lost 8% between April and September, compared with a 4.4% loss for the intermediate-term bond ETF category. Indeed, TIPS are vulnerable to losses when real yields rise. Over all standard trailing time periods, as well as a number of specific market environments, TIPS funds exhibit significantly higher volatility than traditional nominal bond funds, as measured by standard deviation. TIPS are also less liquid than nominal Treasuries, and there is often perceived to be a “liquidity premium” associated with buying and selling TIPS.

Take These Facts Into Consideration TIPS funds present investors with an interesting opportunity. They are relatively uncorrelated with other major asset classes and, as their name suggests, offer protection against inflation. However, that benefit often takes years to play out, and interested investors will need to be comfortable with the asset class' considerable volatility. Short-term TIPS are more correlated with realized changes in the Consumer Price Index than are long-term TIPS, but they currently carry a 0% yield. Intermediate- and long-term TIPS pay a slightly higher yield but are prone to volatile price swings.

Investors will also need to take the tax consequences of investing in TIPS into account. When the principal value of a bond is adjusted upward for inflation, the investor is subject to income tax on that adjustment (also called “phantom income”) in the year it occurred. However, the investor doesn’t actually receive that adjustment until the bond matures, which could be years away. This phantom income tax applies to TIPS held individually or in an ETF.

If investors are looking for inflation protection, TIPS should be considered one tool among many. A strategic, long-term allocation to TIPS makes sense if the investor can accept the volatility, and ETFs make an attractive wrapper because of the low expense ratios available on most offerings. Because of potential phantom income, TIPS should be held in a tax-advantaged account whenever possible.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4a71dba80d824d828e4552252136df22_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)