5 Charts on the Investor Surge Into Sector Equity ETFs

ARK's ETFs aren't the only beneficiaries.

Investors are pouring more money than ever into sector mutual funds, and they are increasingly choosing index-tracking exchange-traded funds as their destination.

The flood of money into ARK Invest's funds has been a major driver of the ETF trend over the past year, but investor interest has been broad-based among sector-fund managers.

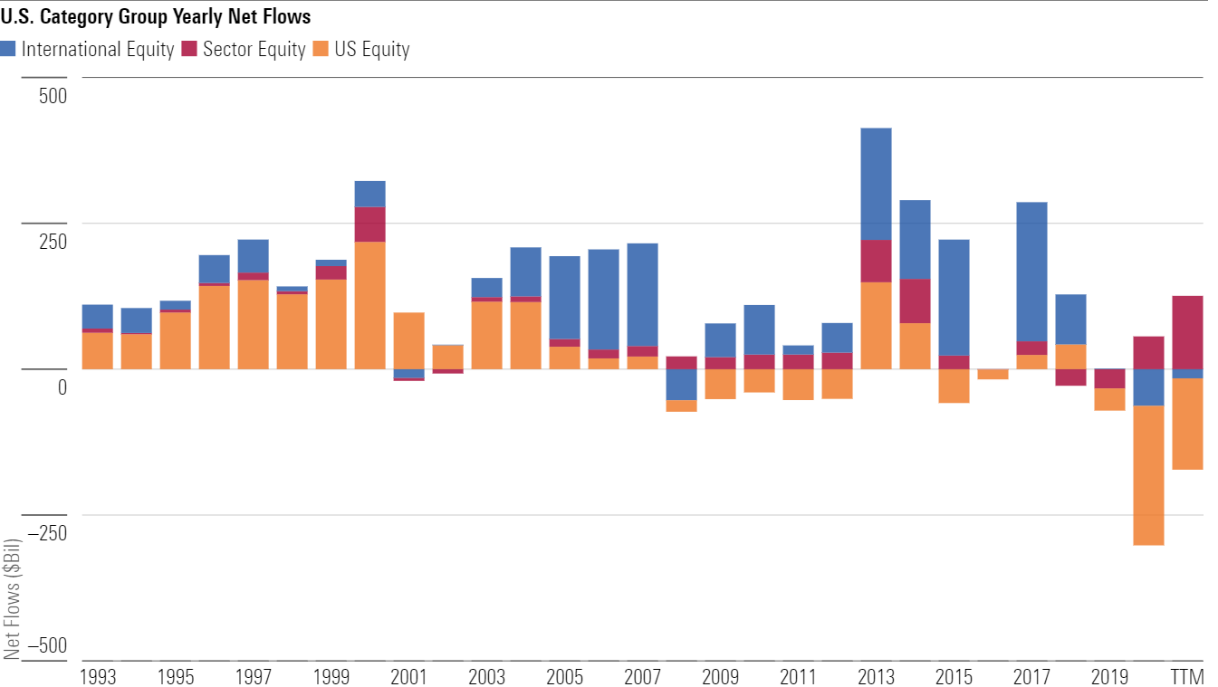

During the trailing 12 months ended March 2021, the U.S. sector equity broad category group posted record inflows of more than $125 billion, while U.S. equity funds recorded outflows of $239 billion. While the inflows trend for sector funds has been slowly building over the past decade--sector equity funds outdrew U.S. equity funds in six out of the past 10 years--the change over the past 18 months has been dramatic. In the first three months of 2021, $56 billion went into sector funds. (Morningstar Direct clients can find the full version of this article here and our flows research and commentary library here.)

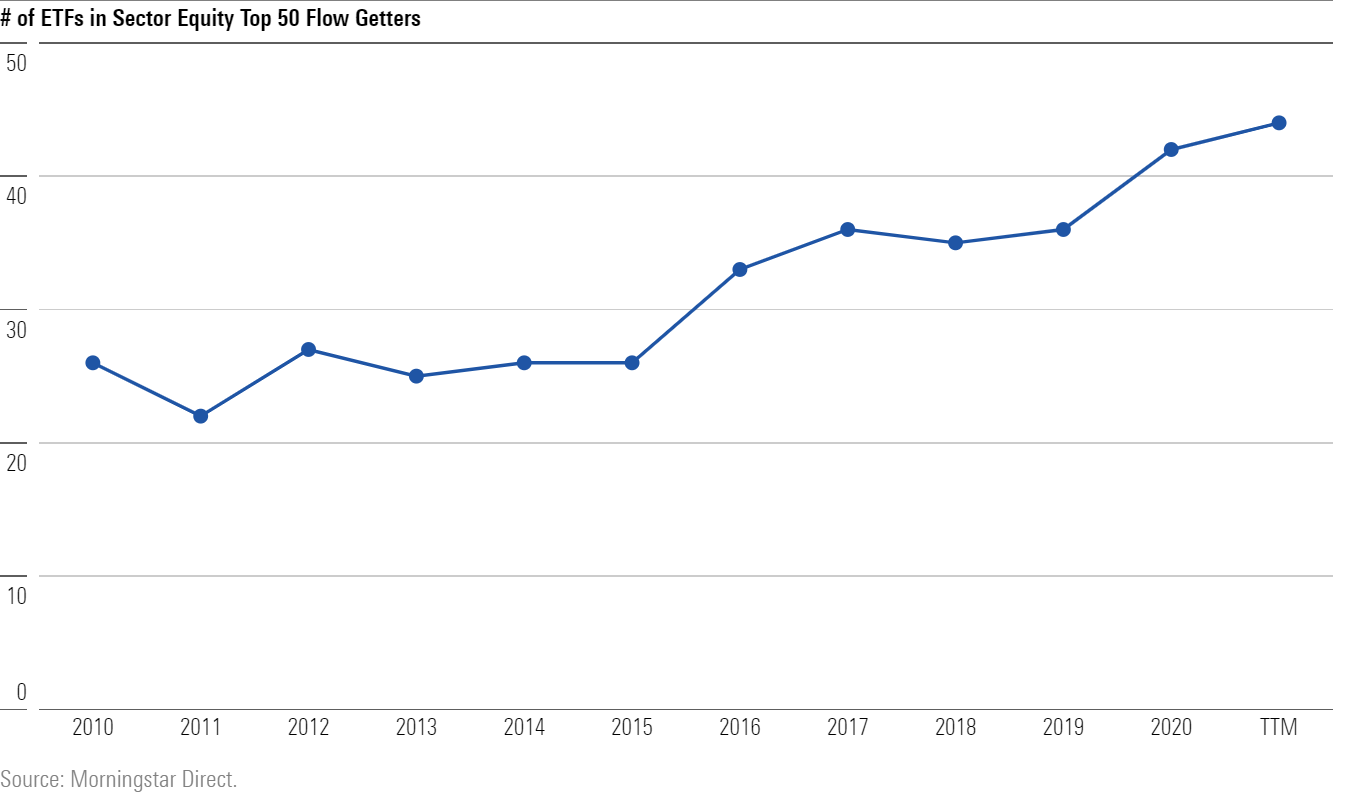

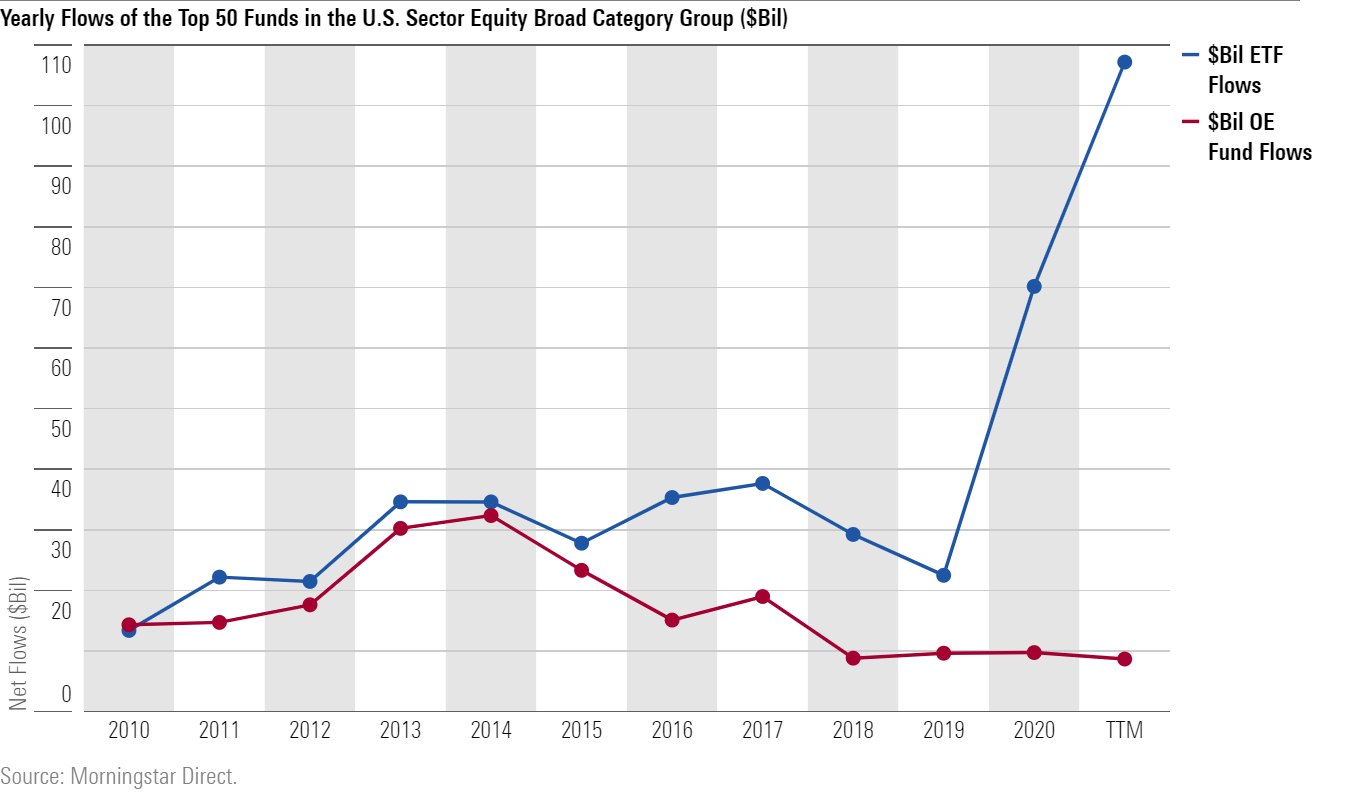

Over the past decade there has been a clear shift toward ETFs in the sector equity category group. For this article, we focused on the 50 funds in the category group with the largest inflows on a trailing 12-month basis. The top 50 funds generally account for more than 100% of the group's net flows (offsetting redemptions elsewhere).

As of the end of the first quarter, there were with 44 ETF strategies among the 50 funds with the highest trailing 12 months' worth of flows. By contrast, there were 20 ETFs among the 50 funds with the greatest U.S. equity fund inflows.

This trend has picked up in the past two years. Of the $56 billion of inflows into the category group for the year to date, on net, all were from ETFs, with open-end funds recording a small outflow.

While there has been greater interest among investors in actively managed ETFs in general--ARK Innovation ETF ARKK being a prime beneficiary--out of the 44 ETFs in the top 50, only nine are actively managed. In the top 50, index fund representation has increased 56% and 34% since 2010 and 2015, respectively. Index funds in the top 50 of U.S. equity have increased only 3 percentage points since 2015.

Looking more narrowly at the sector composition of the top 50, technology funds have grown in popularity and lead all other sectors in recent flows.

Among the individual sector equity funds with the largest flows over the past 12 months, ARK funds make up four of the top 10, with total inflows of more than $19 billion in the trailing 12 months with a weighted average growth rate of 20%. IShares Global Clean Energy ETF ICLN, the highest-growth environmental, social, and governance fund in the sector, had an organic growth rate of 8.85% for the trailing 12 months and 30.93% over the past three years. ARK's funds are often thought of as thematic, but they fall under the sector categories in Morningstar's classification system.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)