Social Security for Beginners, Part I

When should you start your retirement benefit?

The Reward for Waiting

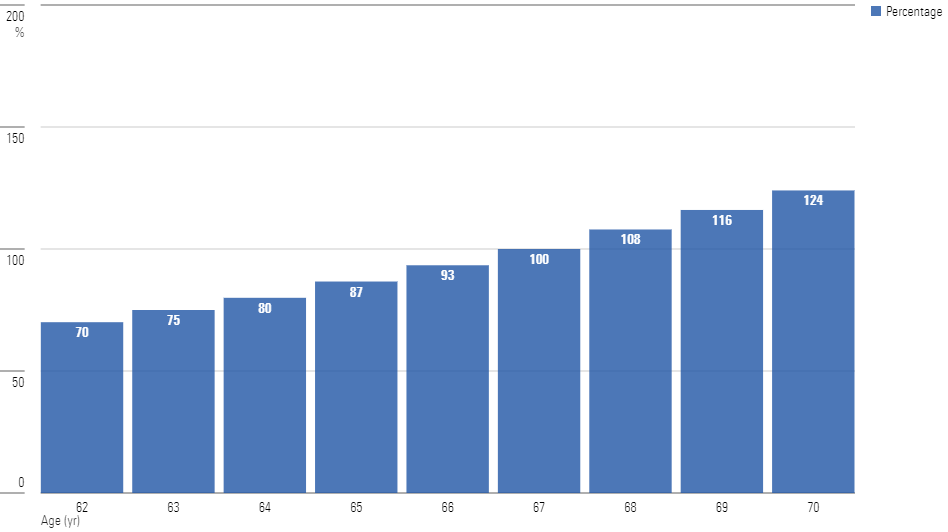

The Social Security Administration’s current regulations—the details have shifted over time—stipulate that workers become eligible to receive their full Social Security retirement benefit at age 67. However, should they so choose, they may begin their Social Security tenure as early as five years before that date, at age 62. They may also defer the decision by up to three years, until age 70.

There is, of course, no reason to delay that decision, unless the payouts were to increase over time. Otherwise, it would make no sense to forgo the benefit. That is indeed how Social Security is structured. The chart below depicts its official payment schedule. The percentages represent the proportion of the full benefit to which the retiree is entitled, determined by the age when the benefit begins.

The Reward for Waiting

Starting to collect at the earliest possible age of 62 provides 70% of the retiree’s earned benefit; delaying to age 67 confers 100%; and postponing until age 70 creates a bonus, boosting the percentage to 124%. These amounts are fixed, save for the inflation adjustment that is applied to all Social Security disbursements. That is, the 62-year-old recipient will collect 70% of the full benefit for the rest of their life, while the retiree who holds out until age 70 will receive 124%.

Case Study

Let’s consider an example. Assume that a worker’s full benefit, computed for retirement at age 67, is $2,500 per month, or $30,000 per year. That participant would receive $21,000 annually if she began her benefit at age 62. (As always, that amount would thereafter be adjusted for inflation.) If she waited another eight years, until turning 70, the annual payment would be $37,200—a 77% hike.

In practice, the increase in the benefit that occurs from deferral is even greater than those figures suggest. There are two reasons for that. The first is trivial. Postponing collection not only furnishes the official raise, which is expressed in real terms, but also the expansion that owes to inflation. That gain is illusory, as inflation does not improve the benefit’s purchasing power.

The second item is small but meaningful. Besides adjusting for inflation, the full retirement benefit grows in real terms over time, as it is based on the nation’s level of overall wealth. This amount is not large, accounting for less than 1% per year, but it nevertheless provides an additional bonus to those who defer.

Most experts who analyze the Social Security program conclude that retirees should at the least wait until their full benefit age of 67 before receiving Social Security and perhaps delay until age 70. That is a reasonable conclusion. However, the general advice does not apply to all.

Notable Exceptions

For some retirees, the question of when to collect Social Security benefits is moot. They either cannot or should not postpone that decision. Here are the main reasons why delay does not suit them.

1) Need

Need is the most common explanation for not exercising patience when filing for Social Security benefits. The choice to postpone Social Security only exists for those who can afford to wait. For the millions of retirees who rely on Social Security to supply their daily needs, because they lack meaningful additional resources, delay is an unrealistic option. It exists in theory but not in practice.

2) Poor Health

As my next column will demonstrate, deferring Social Security payments is an excellent decision for the long-lived. Often, it is also a sound policy for those with average life spans. The strategy, however, is pointless for those who will not survive to enjoy the advantage. If one is to die at age 70, then do not wait until that birthday to begin receiving Social Security checks!

Most people, of course, cannot know if they will be among the unfortunate group that will not survive long enough to reap the income advantage that accrues to those who defer their Social Security receipts. But some retirees do suffer severe health conditions that significantly shorten their life expectancies. For such participants, it is quite reasonable to take the money now rather than later.

3) Spousal Circumstances

When both parties of a marriage are entitled to receive Social Security, the partner receiving the lesser amount faces a choice. Such retirees may collect either their own benefit or up to 50% of their partner’s age 67 benefit, whichever is greater. Although too complex to be discussed in this space, the upshot is that in such cases, the lower earner may sometimes be well served by filing early for Social Security benefits.

4) Social Security Reform

A final consideration is the prospect that in the attempt to balance the nation’s books, legislators will cut workers’ future Social Security benefits. (The chance that they will do so for current retirees is slim and none, and as my father liked to say, Slim left town a while ago.) If so, it’s unlikely that the reductions would meaningfully affect the analysis, but the possibility at least deserves mention.

Part II

This article has supported, at a very high level, the arguments in favor of delaying the receipt of Social Security benefits. The next column will test those claims by running through the numbers. In particular, it will consider whether most workers are best served by waiting until the full benefit date of 67 or whether they would fare better yet by postponing until the maximum age of 70.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)