The Inflation Hedge That Cost Investors 17% of Their Purchasing Power

The average dollar invested in TIPS funds has lost money over the past decade.

In December 2020, inflation-protected securities funds were sitting pretty. The average fund had gained nearly 10% over the past year as Treasury Inflation-Protected Securities’ real yields went progressively lower. Investors noticed, shoveling $22 billion into TIPS funds that year. When inflation burst onto the scene the following year, it turbocharged demand, with investors pouring another $75 billion into TIPS funds in 2021.

Most of those investors flocked to TIPS funds seeking an inflation hedge. But they got more than they bargained for, with TIPS selling off sharply in 2022 as real yields reversed direction. All told, the average inflation-protected securities fund fell 9.5% in 2022. Taken together with the 7.5% inflation rate that year, investors in TIPS funds saw a 17% loss of purchasing power in 2022.

True, TIPS investors are eventually made whole for whatever inflation they endure, so the 7.5% lost to inflation in 2022 was temporary in theory. But that’s only the case if investors hang onto the bonds long enough to get the principal adjustments that are made to offset inflation. Have investors in TIPS funds hung on? Some have, but hardly all. Indeed, TIPS funds have seen $33 billion in net outflows since 2021.

Estimating TIPS Fund Investors’ Returns

Given this, we wondered how much TIPS fund investors have earned in dollar-weighted terms in recent years. To that end, we compiled all inflation-protected securities funds for which we had complete net assets and flow data over the 10 years ended April 30, 2023. There were 44 of these funds which held around $187 billion in net assets, in aggregate, as of April 30, 2023.

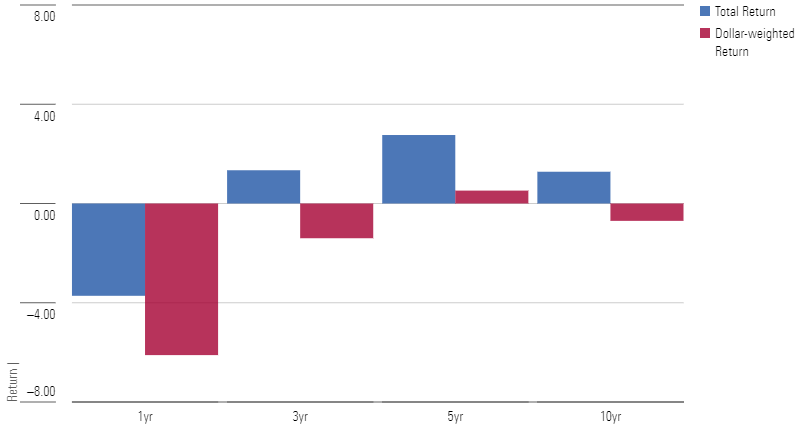

We found the average dollar invested in TIPS funds lagged the total return of the average TIPS fund by at least 2% per year over all trailing periods ended April 30, 2023, as shown below.

TIPS Funds: Trailing Total Returns vs. Dollar-weighted Returns (as of 4/30/23)

Notably, the average dollar lost 1.4% per year over the past three years, a period that spans the recent spate of inflows and outflows. Inflation ran at 5.8% per year over those three years, so that means the average dollar lost about 7.2% of its purchasing power annually. To put that in perspective, if in April 2020 an investor had bought an individual TIPS bond and held it to maturity on April 30, 2023, she’d have lost less than half a percentage point of purchasing power per year.

A Chronic Problem

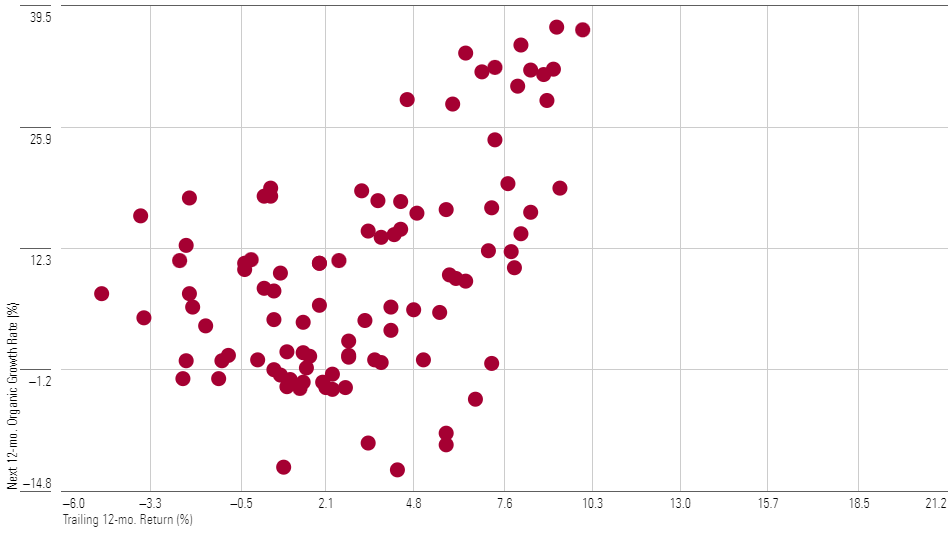

Is the chasing behavior we’ve seen from TIPS fund investors recently a new phenomenon? It doesn’t appear so. When we compared these 44 funds’ rolling one-year average total returns to their subsequent rolling 12-month organic growth rates, we found they were highly correlated. In other words, the better TIPS funds’ recent performance, the stronger the demand, and vice versa.

TIPS Funds: Rolling 12-mo. Avg. Total Returns (x-axis) vs. Avg. Forward 1-year Organic Growth Rate (y-axis) (10 years ended 4/30/23)

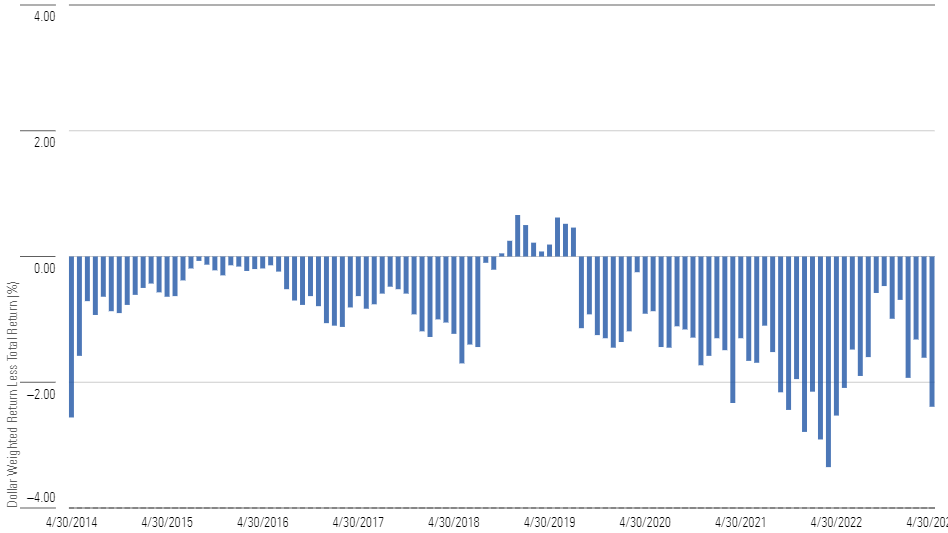

This has been persistently costly to TIPS fund investors over the past decade. When we calculated the 44 funds’ rolling one-year dollar-weighted returns and compared them to their rolling 12-month average total returns, we found a chronic gap. The average dollar lagged the average fund’s returns by about 1% over the rolling periods we examined and the gap was nearly always negative.

TIPS Funds: Rolling 12-mo. Gap Between Average Dollar-weighted Return and Average Fund's Total Return

Takeaways

While TIPS funds can serve a useful purpose, the data we analyzed suggests that investors have struggled to use them successfully in practice. They’ve chased returns, allocating more to TIPS funds after they’ve gained and fleeing when they falter. Thus, they have little to show for their efforts: By our estimates, the average dollar invested in TIPS funds lost 0.70% per year over the 10 years ended April 30, 2023.

How can TIPS fund investors avoid the timing mistakes that have plagued them? One simple approach is to automate their investments by averaging in and rebalancing back to a predetermined target. While this will not yield an optimal result, it should at least ensure they benefit from the inflation guarantee while earning a normalized return above and beyond the rate of inflation.

Those determined to invest in TIPS funds in a more discretionary manner should bear in mind that the inflation guarantee gets one only so far. There is also the matter of TIPS price relative to fair value, a relationship investors rediscovered the hard way when TIPS real yields sharply changed course in 2022, rising several hundred basis points that year alone. This is especially important considering that TIPS funds don’t necessarily hold their investments to maturity, making year-to-year fluctuations in value a fact of life.

For those willing to tolerate those fluctuations but seeking to take some of the edge off, short-term TIPS funds are worth considering. These strategies boast the ability to hedge inflation over shorter horizons but do so without courting the same degree of interest-rate risk that intermediate- and long-term TIPS strategies assume. Provided that the inflation guarantee baked into these shorter-maturity inflation-protected bonds approximates the longer-term rate of inflation, they should at least fulfill the objective of hedging inflation, even if it means sacrificing a bit of real return.

Other investors might want to consider bypassing TIPS funds altogether and instead investing directly in individual inflation-indexed Treasuries. To be sure, this is administratively burdensome, as the investor must select the appropriate TIPS maturities and maintain their portfolio over time. But it’s inexpensive and a TIPS ladder might give a buy-and-hold investor seeking the inflation guarantee peace of mind.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)