Interest Rates Spike, but Credit Spreads Contract as Investors Find Value in Corporate Bonds

Strategic M&A heats up while large LBOs remain cool.

After hitting their lowest levels since May 2013 the prior week, interest rates rose at the beginning of last week and then spiked higher Friday after a relatively strong payroll report. Nonfarm payrolls increased by 257,000, well ahead of the consensus estimate. The yield on the 10-year U.S. Treasury bond rose 26 basis points over the course of the week to end Friday at 1.94%. Although underlying interest rates rose, tightening corporate credit spreads were able to offset some of the principal loss. The average spread of the Morningstar Corporate Bond Index tightened 7 basis points to +148 and the average spread of the Bank of America Merrill Lynch High Yield Index tightened 48 basis points to +478. Year to date, the Morningstar Corporate Bond Index has risen 1.55% compared with the 1.11% increase in the Morningstar US Government Bond Index.

In addition to the strong employment report, China fueled the "risk on" sentiment last week after it announced it is cutting its reserve requirement ratio. The reserve requirement ratio determines the amount of capital that Chinese banks must hold against loans. Decreasing the ratio frees up capital that the banks can use to make additional loans. The intent is that these additional loans will help stimulate the Chinese economy, which has been slowing. Two weeks ago, we highlighted that while Chinese GDP had increased 7.3% in the fourth quarter, we expect its growth rate will slow substantially. A significant amount of the growth in China's economy has been driven by a boom in real estate. However, real estate prices have stagnated or declined and demand has faltered, leading to declining new construction starts and slowing real estate sales. With faltering starts and sales, floor space under construction growth is likely to weaken in the next several quarters. With it, so will real estate fixed-asset investment and GDP.

A few weeks ago, we noted that oil prices had appeared to bottom out in the mid- to high $40s; subsequently, they have rebounded into the low $50s. Corporate bonds in the energy sector have rebounded as well. The average credit spread in the energy sector of our index has tightened 22 basis points to +242. Yet even with this bounce, year to date the sector has continued to underperform the general corporate bond market. The other sector that has dragged on corporate credit spreads this year has been basic materials. As iron ore, copper, and coal prices have fallen substantially, credit spreads have widened to account for increasing default risk in the metals and mining subsector. However, the risk-on appetite spread to the basic materials sector last week, even though there has not been an appreciable increase in the prices of those commodities. The credit spread in the basic materials sector tightened 13 basis points to +197, although it still remains comparatively wider year to date than the general market.

For the most part, the corporate bond market ignored the vacillating headlines regarding Greece's attempt to renegotiate, swap, or write down its outstanding sovereign debt. Depending on whether the European Union and Greece negotiate a mutually acceptable agreement or if Greece conducts a hard default on its debt and exits its position in the EU, global capital markets could be extremely volatile in the near term. However, we caution investors from panicking if Greece defaults and/or exits the EU. The credit counterparty risk is substantially different now than it was in 2010 when the Greek debt crisis began. At that time, Greek debt was widely held throughout the European banking system, yet no one knew exactly who held how much. Banks were concerned that even if they did not hold the exposure directly, if Greece defaulted it could weaken the solvency of other banks to which they had counterparty risk. In 2012, Greece and the EU restructured most of the country's outstanding debt, and now almost 80% of Greece's debt is held by nongovernmental organizations such as the International Monetary Fund, European Financial Stability Facility, and European Central Bank. While it is unclear exactly what impact a Greek default would have on these organizations, it would not instigate the same systemic concerns that rippled through the financial markets before.

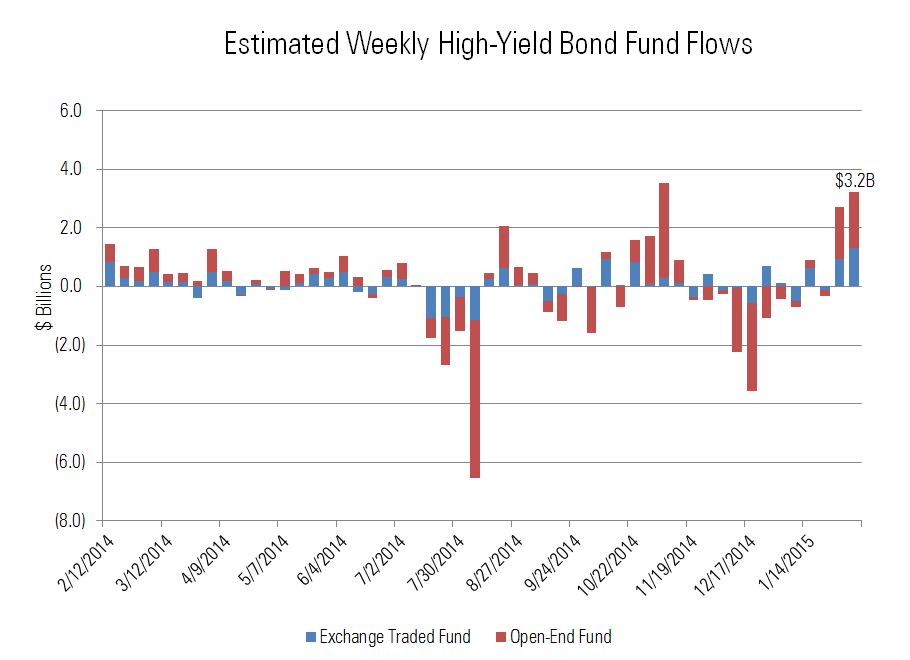

Investors continue to be attracted to the higher yield offered on below-investment-grade bonds as fund flows into high-yield mutual funds and exchange-traded funds rose by $3.2 billion last week. This is the second-highest weekly inflow over the past 52 weeks and follows $2.7 billion of inflows into high yield the prior week. Over the past two weeks, the cumulative amount of inflows into the high-yield asset class ($5.9 billion) is the greatest amount of inflows in a two-week period since October 2011.

Strategic M&A Heats Up While Large LBOs Remain Cool Merger and acquisition activity thus far in 2015 continues to be driven predominantly by strategic deals as management teams look for ways to increase earnings as organic growth remains tough to generate. Even though interest rates are low and the credit market is open to new issues, high enterprise multiples have precluded private equity sponsors from conducting a meaningful amount of leveraged buyouts. Two recent announcements resulted in removing two recommendations from our Best Ideas Lists.

While we continue to expect real GDP growth in the United States to range between 2.0% and 2.5% in 2015, it appears that global economic growth will continue to be sluggish, thus limiting opportunities for organic growth. To enhance shareholder value, management teams are likely to continue to pursue nonorganic ways to support their equity prices. We saw a resurgence in strategic acquisitions over the past few years and expect that trend to continue. The number of leveraged buyouts over the past few years has thus far been modest, as many private equity firms have been more interested in selling many of their portfolio companies through initial public offerings and harvesting gains while the equity market is hot. However, with capital available from portfolio sales, private equity sponsors have significant amounts of dry powder and may use any pullbacks in the equity market as an opportunity to purchase quality businesses.

Most recently, we placed our rating for Hospira HSP (rating: BBB/UR+, narrow moat) under review with positive implications after the firm agreed to be acquired by Pfizer PFE (rating: AA-, wide moat). We had placed Hospira on our Best Ideas List in June 2014 as we thought there was significant upside in the bonds due to the firm's deleveraging potential. Following the acquisition announcement, the credit spread on the firm's 5.80% senior notes due 2023 tightened about 75 basis points. Currently, the credit spread on the notes is +109. While we continue to think there is further upside in the bonds once the transaction closes, we removed the bonds from our investment-grade Best Ideas list. Conversely, we have long recommended investors to underweight Pfizer's bonds as we have noted the firm's weak growth prospects, which provided the firm with incentive to make unfriendly capital-allocation decisions from a creditor's perspective. Based on the anticipated financing of the transaction (two thirds cash and the remaining amount in new debt), we expect our rating will remain AA-, albeit on the weak end of that rating's scale.

Frontier Communications FTR (rating: BB/UR-, narrow moat) announced that it would acquire a significant amount of wireline assets from Verizon Communications VZ (rating: BBB, narrow moat). The purchase price will be $9.9 billion plus an addition $600 million of assumed Verizon subsidiary debt. To finance the transaction, Frontier anticipates raising $3 billion of a mix of equity and equity-linked financing along with $7 billion-$8 billion of new debt with resulting pro forma net leverage at closing increasing to an expected 3.8 times. We had originally placed Frontier's bonds on our high-yield Best Ideas list as we had expected that the firm would quickly deleverage after its most recent acquisition of wireline assets in Connecticut. We removed Frontier's bonds after this announcement as we no longer expect the firm's leverage to decline as quickly as we had forecast and presume that the potential for the bonds to trade up meaningfully will be limited in the near term as the market awaits pricing the new issue to fund the acquisition.

The management teams of similar-rated Rock-Tenn RKT (rating: BBB, no moat) and MeadWestvaco MWV (rating: BBB, no moat) announced plans to merge in a transaction that is expected to maintain leverage within the range of each company's current levels. The combination of these two companies does not surprise us, as we had thought that MeadWestvaco's 2013 sale of its timberland and real estate assets to Plum Creek Timber and last month's announced spin-off of its specialty chemical unit and sale of the European tobacco business were all steps toward a strategic combination. In this case, our ratings are unchanged as management confirmed that following the merger, pro forma net leverage including synergies will be around 1.75 times.

Expedia EXPE (rating: BBB, narrow moat) announced that it will acquire Travelocity for $280 million. Given the relatively small size of the transaction, we don't view this as having a material impact on our credit rating. We still find Expedia's bonds undervalued, as the 2024 notes were recently indicated at +233 basis points over the nearest Treasury and we place fair value around +190.

We placed our credit rating for AmerisourceBergen ABC (rating: A/UR-, wide moat) under review with negative implications in January after the firm revealed plans to acquire animal health distributor MWI Veterinary MWIV (not rated) for $2.5 billion in cash. By our estimates, gross debt/EBITDA will increase by about a turn to the mid-2 times area and will remain inflated from preacquisition levels for about two years, which may warrant a downgrade. Still, we maintain our market weight recommendation on AmerisourceBergen's 3.40% senior notes due 2024, which are indicated at +130 basis points over the nearest Treasury.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)