First-Quarter Fixed-Income Roundup

Barclays' credit rating downgraded; UnitedHealth acquiring Catamaran.

In first-quarter 2015, the flattening yield curve predominately drove fixed-income returns. On the shorter end of the curve, interest rates tightened modestly as indicated by the 2-year Treasury bond, which only tightened 11 basis points to 0.56%. The Federal Open Market Committee released its meeting statement and updated economic projections on March 19, and based on the changes in the FOMC's language and revisions to its economic forecasts, many investors are betting that the Fed will keep short-term interest rates lower for longer.

On the longer end of the curve, the 5-year Treasury bond tightened 27 basis points to 1.38%, the 10-year treasury tightened 24 basis points to 1.93%, and the 30-year Treasury bond tightened 21 basis points to 2.54%. In our view, the decline in long-term interest rates was driven by a combination of softening economic conditions in the United States as well as heightened demand from global investors. Compared with the minuscule interest rates in Europe and Japan, foreign investors have been attracted to U.S.-denominated fixed-income securities in order to pick up the higher-yield U.S. corporate bonds offer and invest in the safety of the strengthening dollar. Highlighting this differential in yields, the spread between the 10-year U.S. Treasury and 10-year German Bund has risen to +175 basis points, which is near the widest spread that Treasuries have ever offered over Bunds.

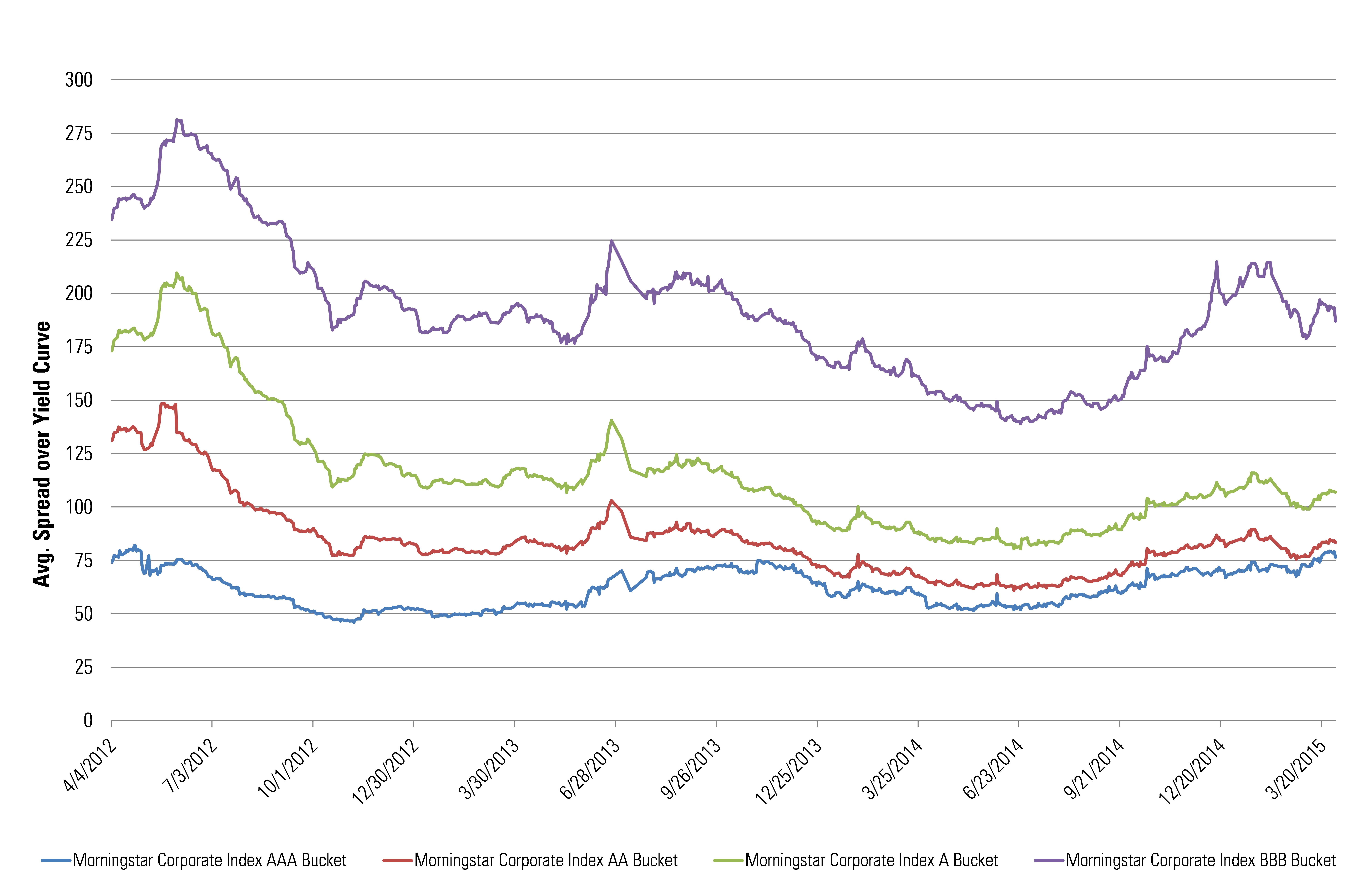

The Morningstar Core Bond Index, our broadest measure of the fixed-income universe, rose 1.63% in the first quarter. The long end of the curve predominately drove the return. In the first quarter, our Long-Term Core Bond Index rose 2.72%, which substantially outpaced the 0.71% gain in the Short-Term Core Index and 1.49% in the Intermediate Term Core indexes. Because of its longer duration, the Morningstar Corporate Index outperformed both the Core Index as well as our US Government Index. Our Corporate Bond Index rose 2.25% in the first quarter whereas Morningstar's US Government Index returned 1.50%. Corporate credit spreads were almost unchanged for the quarter, tightening only 2 basis points since the end of last year to +138 basis points.

As has been the case for the past several years, TIPs lagged the other fixed income classes and only rose 1.26% as inflation expectations remained in check as oil prices traded in a range around $50 per barrel. With its intermediate duration, the Morningstar Mortgage Index also performed in line as it rose 1.30% in the first quarter.

As the ECB began its QE program in early March, interest rates across Europe hit new all-time lows. The yield on Germany's benchmark 10-year Bund had dropped to 0.18% at the end of the quarter and even the lower-rated peripheral eurozone countries such as Italy and Spain had declined in March to heretofore unprecedented levels of 1.13% and 1.15%, respectively. Investors looking to reduce their exposure to the plummeting euro were even willing to lock in negative interest rates in Swiss bonds, whose 10-year traded at a negative yield of 0.06% at the end of the quarter. There is reportedly over EUR 2 trillion of euro-area government bonds that are currently trading at negative yields. Most of these bonds are issued from the core European governments with maturities of up to seven years. Among other developed markets, Japanese 10-year government bonds don't provide much additional yield either, as they currently yield only 0.34%.

The U.S. dollar strengthened against the euro, rising over 11%, which in turn led to losses in those indexes denominated in U.S. dollars but invested in foreign-denominated securities. For example, the Morningstar Global Government Bond Index declined 2.47% and excluding U.S. government bonds, the Morningstar Global Ex US Government Bond Index fell 4.20%. For those European indexes both denominated and invested in the euro, returns were boosted by declining interest rates across the eurozone. The Morningstar Eurozone Index jumped 4.29%.

Elsewhere across the globe, the Morningstar Emerging Market Composite Bond Index rose 2.32% based on the combined 5.63% increase in the Emerging Market Sovereign Bond Index and 2.25% increase in the Emerging Market Corporate Bond Index.

Considering interest rates on sovereign bonds in developed markets are near their historically lowest levels, we think corporate bonds should perform well on a relative basis. The proceeds from the ECB's purchases of sovereign debt and asset-backed securities will need to be reinvested somewhere, and the path of least resistance will be the corporate bond market. This demand will likely drive corporate credit spreads tighter. As corporate credit spreads in Europe contract, we think it will also pull credit spreads tighter in the U.S. as well. Over the past year, the differential in yield between the Morningstar Corporate Bond Index and the Morningstar Eurobond Corporate Index has doubled. Currently the average yield of our U.S. corporate bond index is 2.88% as compared to our European corporate bond index at 0.78%. Even after adjusting for the longer duration of the U.S. index, investors are picking up significantly more yield in the United States. Among those global fixed-income investors that can purchase debt denominated across multiple currencies, the higher all-in yields and the rising value of U.S. dollar have driven up demand for U.S. corporate bonds.

- source: Morningstar Credit Analysts

Credit Rating Downgrade: Barclays PLC We are downgrading our credit rating on Barclays BCSPRC (no moat) to BBB+ from A- to reflect the company's weak earnings and lower assumed government support. Other negative factors in our credit assessment include a lack of clarity concerning Barclays' strategy and business model after shrinking its investment bank and shedding noncore businesses.

During the past three years, Barclays' profits have been weak, driven by both lower revenue and higher costs constraining the bank's Solvency Score. Return on equity was modestly negative in 2014 and 2012, and only a weak 1.0% in 2013 following an average annual 8.2% reported in the prior three years ended 2011. Postcrisis revenue peaked in 2010 at GBP 31.3 billion and has declined about 4.5% per year on average to GBP 25.7 billion in 2014. In addition, profits were hurt by a range of material legal and regulatory expenses. In 2012, a settlement involving rigging Libor interest rates cost the CEO his job and led to a management overhaul. In 2014, the bank recorded a GBP 1.1 billion expense for mis-selling PPI after reporting a GBP 2.0 billion expense in 2013. The bank also reported a GBP 1.3 billion provision for a foreign exchange settlement that is still pending, as well as GBP 0.9 billion for additional loan reserves. We expect such large legal expenses to continue in the near future and are including GBP 3.0 billion in our estimates. Barclays has also incurred significant restructuring costs in an attempt to shrink its investment bank and shed noncore assets.

Despite weak operating performance, Barclays has been successfully building capital to median levels relative to peers. Barclays' fully phased common equity Tier 1 ratio finished 2014 at 10.3%, over 200 basis points higher than year-end 2012 levels. Asset quality has also improved. Impaired loans relative to risk-weighted assets finished 2014 at 2.3%, a level consistent with higher-rated peers, and nearly half the rate reported in 2012. The bank also maintains a solid funding mix with customer deposits fully funding the bank's loan book.

Our credit rating no longer assumes ratings uplift from government ownership. The EU's recently enacted BRRD and emerging TLAC regulation support this stance. The BRRD prohibits future government bailouts of banks and describes a process for resolving a bank by "bailing-in" bank holding company creditors and equity holders in order to recapitalize primary operating units. Similar to this, we expect TLAC regulations to explicitly designate holding company debt as part of a buffer for a bank's primary operating units. As a result, we are no longer including ratings uplift for government ownership.

Barclays scores strongly in our Stress Test analysis because above-average underwriting ratings for its loans and securities lead to minimal loss of capital under our stress-case assumptions. However, the bank's Solvency Score is mediocre, because recent poor earnings and lower reserves detract from its sound capital position. Barclays received a fair Business Risk Score due to its lack of an economic moat and management missteps during recent years. Taken together, these factors lead to a rating of BBB+.

UnitedHealth Acquiring Catamaran; Credit Rating Under Review (Negative) On March 30, UnitedHealth UNH (rating: A-, narrow moat) announced plans to acquire second-tier pharmacy benefit manager Catamaran CTRX (not rated, narrow moat). We are placing our credit rating under review with negative implications given the significant leverage that may be required to fund the transaction. At first glance, we do not believe our rating would drop by more than a notch, though, and it could even be maintained given the potential for increasing power in the organization.

Strategically, this agreement will combine United's OptumRx pharmacy benefit management unit and all of Catamaran's operations, creating an organization more on par with Express Scripts ESRX (rating: A-, wide moat) and CVS Health CVS (rating: BBB+, wide moat). We believe this development would be quite positive strategically for UnitedHealth, given the power and advantages that large PBMs possess along the pharmaceutical supply chain. The combined entity will process approximately 1 billion prescription claims annually and become the nation's third-largest PBM after Express Scripts (1.3 billion annual claims) and CVS (1.1 billion annual claims).

That increasing power may even help UnitedHealth maintain its credit profile even as it is likely to need to increase its debt leverage to close the $12.8 billion deal, which is scheduled to close in the fourth quarter. We expect the firm to need significant debt financing to complete the transaction because only $738 million of its $7.5 billion in cash was available for general corporate purposes at the end of December. Therefore, we are putting UnitedHealth on our Potential New Issue Supply list. If the firm decides to finance the deal entirely with new debt, debt/EBITDA would rise by about a turn from the 1.5 times it operates with at the end of 2014, which would be the main catalyst for a potential one-notch downgrade. If UnitedHealth chooses to use less debt financing by earmarking free cash flow generated over the next year for general corporate purposes (the firm generated about $7 billion in free cash flow in 2014), a downgrade may not be necessary. Also, as we analyze the competitive position of the combining entities, we may see enough improvement in that position to offset the potential increase in debt leverage.

Mergers and Acquisitions

Teva Acquiring Auspex; No Rating Change Expected Teva Pharmaceutical TEVA (rating: A-, narrow moat) announced plans to acquire Auspex Pharmaceuticals for $3.2 billion in enterprise value. At first glance, we do not anticipate changing our credit rating for Teva as a result of this transaction, although we think the firm's financial flexibility will decline somewhat as a result of this deal. Teva expects to use existing cash on hand ($2.2 billion of cash at the end of December), excess proceeds from recently issued debt (EUR 2 billion) beyond current maturities ($1.8 billion in debt due in 2015 as of the end of December), and ongoing cash flow to acquire Auspex in the second quarter. Teva could also draw on its unused credit lines ($3 billion) to manage any liquidity needs in the short term.

Given this financing plan, gross debt leverage does not look likely to change because of this deal. However, we think Teva has reduced its financial flexibility to expand its central nervous system-focused pipeline. Since Auspex's assets have not yet been approved for marketing, we see uncertainty in this transaction, which Teva hopes will boost its long-term growth prospects. Auspex's pipeline includes a handful of near-term opportunities in motor-coordination disorders like Huntington's disease, which if successful in the marketplace, should bolster Teva's existing product portfolio in CNS drugs. However, none of its drugs are approved in the marketplace yet, which creates uncertainty around this multibillion-dollar investment. For example, Auspex's nearest-term drug candidate, SD-809, is likely to receive approval for addressing Huntington's disease by 2016. These products will need to succeed in the marketplace to justify the price tag Teva is paying. Also, beyond the Auspex deal, Teva kept the door open for more transformational acquisitions, which could influence its credit profile going forward, depending on the size and financing terms of any future deals.

We maintain a market weight recommendation on Teva's bonds, and we require a significant margin of safety given this ongoing event risk. For example, Teva's notes due 2022 were indicated at +122 basis points over the nearest Treasury as of close March 27. That is roughly in line with AbbVie's ABBV (rating: A-, narrow moat) notes due 2022 that were indicated at +127 bps. Both firms' notes are indicated wider than the Morningstar Industrials A- Index at +112 basis points. However, given the ongoing event risk in both issuers, which have been active in the M&A market recently, we continue to recommend both issuers at market weight.

No Change Expected to Our Credit Rating After Downgrading Xerox's Economic Moat to None We recently downgraded our moat rating on Xerox XRX (rating: BBB-) to none from narrow and shifted the trend to negative from stable. We also increased our uncertainty rating to high from medium. However, we do not anticipate changing our credit rating as a result of these adjustments. Our BBB- rating reflects Xerox's historically low returns on invested capital, which has the effect of skewing the Business Risk and Solvency Score pillars lower in our model. This is balanced by Xerox's stable cash flow and liquidity profile. Over time, we expect the company's Solvency Score to remain stable. Despite a significant shift in its revenue mix in recent years, Xerox continues to be plagued by stable, but lackluster, operating margins and persistently high leverage. As a result, it is shifting from legacy equipment sales toward a higher-growth service-oriented platform, but we believe Xerox's competitive position remains weak compared with competing tech firms. Over the long term, we think Xerox's growth in its services business will reduce credit risk, as engagements are long-term in nature and customers face significant costs in migrating to another vendor. However, the external environment remains extremely competitive, and we think legacy players like Xerox are likely to face ongoing challenges for top-line growth. While the print market represents annual global spending of $173 billion, according to data from research firm Gartner, Xerox's market share is not sufficient to position it as one of the top five vendors in the market, which we view as indicative of a competitive disadvantage in a mature market facing secular decline. Xerox has been growing its business process, outsourcing business to compensate for this risk. However, while the long-term contracts help improve revenue visibility, we don't view margins in the business as sufficient to offer material profit expansion over time given the extremely competitive nature of this industry.

Notwithstanding Xerox's formidable operating challenges, we continue to regard its financial health as stable. At year-end, its Cash Flow Cushion was indicative of full coverage over its financial obligations. At year-end 2014, Xerox held $1.4 billion in cash and equivalents against $7.7 billion in total debt, with gross leverage at 2.5 times and net leverage ratio at 2.1 times trailing EBITDA. Over half of Xerox's debt, $4.2 billion, has gone toward the provision of leasing and customer finance for its equipment. The firm targets a debt/equity leverage ratio of 7/1 on its finance operations. This debt is currently backed by $4.8 billion of lease receivables and equipment. Xerox also generates solid, consistent cash flow. Over the past four quarters, the company generated $1.7 billion of free cash flow, of which it paid out 78% to shareholders. We view this capital allocation policy as reasonable for a company of its maturity.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)