Corporate Credit Spreads Snap Tighter

Strong demand easily soaked up the deluge of new issue supply.

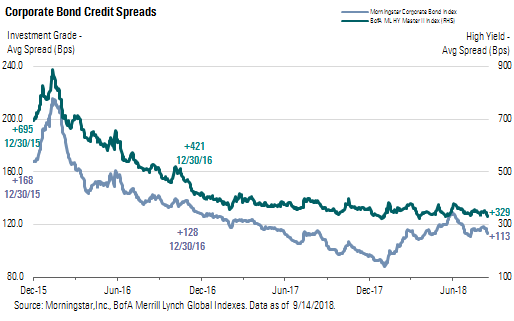

Credit spreads in the corporate bond market snapped tighter last week as strong demand easily soaked up the deluge of new issue supply over the past two weeks. The average spread of the Morningstar Corporate Bond Index (our proxy for the investment-grade market) tightened 5 basis points to end the week at +113. In the high-yield market, the BofA Merrill Lynch High Yield Master Index tightened 19 basis points to end the week at +329. Across other asset markets, equities continued their upward march as the S&P 500 rose 1.16% and commodities generally strengthened, with oil rising $1.25 per barrel to $69.

While the prevailing sentiment was "risk on" across most of the market, bond prices in the U.S. Treasury market were smacked down, sending yields higher across the curve. The yields on 2- and 5-year Treasury bonds rose 8 basis points to 2.78% and 2.90%, respectively. In the longer end of the curve, the yield on the 10-year rose 6 basis points to hit 3.00% and the 30-year rose 3 basis points to 3.13%. Year to date, the entire yield curve has surged higher as strong economic conditions and mounting inflation pressures have taken their toll on bond prices. With an increase of 90 basis points, the 2-year bond has risen the most. The next-greatest increase resides with the 5-year, which has risen 69 basis points. The 10-year has risen 59 basis points and the 30-year has risen 39 basis points. At their current levels, both the 2- and 5-year are at their highest yields since the fall of 2008.

Based on the current market-implied probabilities for additional hikes to the federal-funds rate, it appears that the yield on the 2-year may have further to rise. According to the CME FedWatch Tool, following the next Federal Open Market Committee meeting, which concludes Sept. 26, the market is pricing in a 25-basis-point increase to the federal-funds rate to 2.00%-2.25% from its current range of 1.75%-2.00%. Following this hike, the market is pricing in an 80% probability of an additional increase following the December FOMC meeting to over 2.25%. According to market pricing, the Federal Reserve will have at least one more rate hike in store for 2019 and possibly two. The futures market is pricing in an 80% probability that the federal-funds rate will end 2019 at 2.50% or higher and a 46% probability that it will be 2.75% or higher.

The prospect for further hikes is founded on the expectation that the economy will continue to run full steam ahead and inflation will continue to average near the Fed's target. Among economic projections, the Atlanta Fed's GDPNow forecast for third-quarter GDP growth is currently 4.4%, which would be an acceleration from the already strong 4.1% rate in the second quarter. Although the August report of the Consumer Price Index revealed a slight deceleration in inflation from the July report, inflation remains above the Fed's 2% target. The overall annual inflation rate rose 2.7%, and inflation excluding food and energy rose at an annual 2.2% rate. However, the pullback in the rate of inflation growth from July will probably be short-lived as pressures from wage inflation, due to the low unemployment rate, will course through the economy and recently enacted tariffs will begin to affect prices over the next few months.

Although economic growth in the United States remains robust, economic activity remains sluggish in Europe and may be starting to soften. Following its September meeting, the European Central Bank lowered its forecast for GDP in the euro area. Its 2018 projection fell to 2.0% from 2.1% and its expectation for 2019 declined to 1.8% from 1.9%. However, ECB president Mario Draghi continues to expect that the underlying inflation rate in the euro area will pick up toward the end of the year and will rise toward the ECB's targeted rate over the medium term. As such, the ECB will continue to move forward with its plan to taper its asset-purchase program to EUR 15 billion and will end the purchase program at the end of the year. But we don't expect the ECB to follow the Fed anytime soon by raising short-term rates. The ECB intends to maintain its current short-term rates at least until mid-2019.

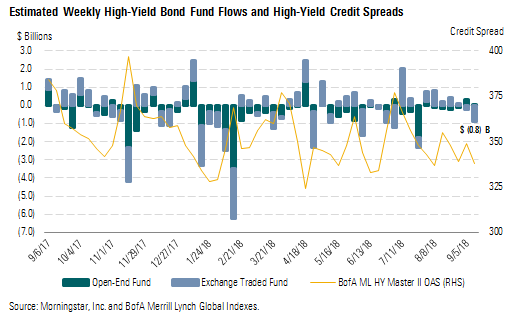

Weekly High-Yield Fund Flows Net fund flows into the high-yield asset class turned negative last week as a total of $0.8 billion was redeemed out of the asset class. The outflows were driven by $0.9 billion of net unit redemptions across high-yield exchange-traded funds, which were only partially offset by $0.1 billion of inflows among the open-end high-yield mutual funds. This net weekly outflow is the first hint of volatility in this asset class that we have seen over the prior six weeks, as the average weekly fund flow was only $0.3 billion of inflows over that period. Year to date, fund flows have registered a total outflow of $15.7 billion, consisting of $3.4 billion of net unit redemptions across ETFs and $12.3 billion of redemptions among open-end funds.

Morningstar Credit Ratings, LLC is a credit rating agency registered with the Securities and Exchange Commission as a nationally recognized statistical rating organization ("NRSRO"). Under its NRSRO registration, Morningstar Credit Ratings issues credit ratings on financial institutions (e.g., banks), corporate issuers, and asset-backed securities. While Morningstar Credit Ratings issues credit ratings on insurance companies, those ratings are not issued under its NRSRO registration. All Morningstar credit ratings and related analysis contained herein are solely statements of opinion and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions. Morningstar credit ratings and related analysis should not be considered without an understanding and review of our methodologies, disclaimers, disclosures, and other important information found at https://ratingagency.morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)