Corporate Bond Markets Retrace Half of Late 2018 Downturn in Early 2019

Investors have become increasingly comfortable taking on corporate credit risk.

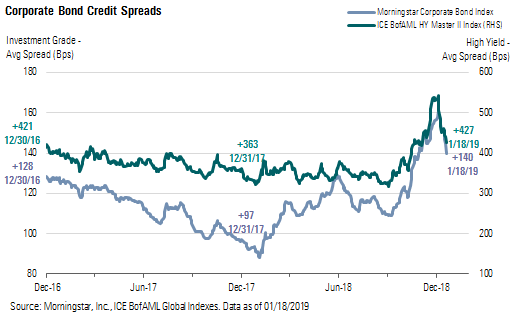

Corporate bond credit spreads continued to tighten last week, and since the beginning of the year, they have retraced about half of the amount that they widened in late 2018. In the investment-grade corporate bond market, the average spread of the Morningstar Corporate Bond Index tightened 11 basis points to +140. In the high-yield market, the average credit spread of the ICE BofAML High Yield Master Index tightened 28 basis points to +427. The spread of the Morningstar Corporate Bond Index peaked at +161 at the beginning of January, rising from +109 in early October. Over the same period, the spread of the high-yield index rose as high as +544 after having traded as low as +316.

We are only about halfway through earnings season, but based on the reported results thus far, investors have become increasingly comfortable taking on corporate credit risk. Generally, earnings and forecasts have been within expectations. However, risk has not disappeared from the current landscape. Among macroeconomic factors that could derail the recent appetite for credit risk, the United States and China continue to be at loggerheads and have not been able to settle on new trade terms. While the negotiations drag on, trade data out of China suggests that its economy may be flagging. According to recent metrics, the country's December exports fell 4.4% compared with a year ago. Closer to home, it's too early to gauge the impact of the U.S. government shutdown on the overall economy. With government offices shut down--such as the Commerce Department, which releases a significant amount of economic data--it is increasingly difficult to detect if contagion from the drawdown in the securities markets at the end of last year had an impact on the real economy. In Europe, the United Kingdom continues to be embroiled in political deadlock as it tries to come to terms with its impending exit from the European Union. A "no-deal Brexit" from the EU could have negative short-term economic implications for the U.K. as well as its major trading partners in Western Europe.

Idiosyncratic catalysts that could affect investor sentiment include the expected bankruptcy filing of PG&E (not rated). Thus far, the decline in PG&E's bond prices has been limited to that specific company and has not spread across the rest of the investment-grade universe. In addition, following the equity market sell-off and recent rebound, it appears that mergers and acquisitions may be making a return. Last week, Newmont Mining (BBB, stable) announced that is acquiring Goldcorp (not rated) in a stock transaction valued at approximately $10 billion. This acquisition comes on the heels of Barrick Gold's (BBB, stable) announcement three months ago that it will acquire Randgold Resources (not rated) in a transaction valued at $5.4 billion. In addition, MNG Enterprises (not rated) recently announced its intention to acquire Gannett (not rated).

Based on our assessment, Newmont's acquisition will not affect our credit rating on the company. Pro forma for the acquisition, the combined company will have $7.1 billion in debt and leverage will only increase to 2.1 times from 1.8 times as of Sept. 30 (1.1 times net leverage from 0.4 times as of Sept. 30). Newmont's management said it intends to keep net debt/EBITDA under 1.0 times going forward. Newmont's BBB rating is supported by its size as one of the world's largest gold producers and conservative financial philosophy as well as having most of its production come from mine-friendly jurisdictions in North America and Australia. The acquisition of Goldcorp will add gold production and reserves in Canada and Latin America. We continue to expect that debt/EBITDA will remain at approximately 2.0 times or lower and that free cash flow will remain robust. For now, these acquisitions have not had a meaningful impact on sentiment in the corporate bond markets; however, should further M&A switch to debt-funded transactions, sentiment could quickly sour.

Recent Morningstar Credit Ratings Research Last week, Morningstar Credit Ratings published an update on the oil sector. Since we published our energy chartbook in December, the West Texas Intermediate oil price has modestly rebounded from $45 per barrel to its current level around $52, largely on news that Saudi Arabia intends to more than double its cut commitment from the Dec. 7 OPEC-Russia production agreement. In addition, the possibility that Venezuelan production will plunge further, recent evidence that Western producers are cutting 2019 capital budgets that should slow production growth, and economic growth kindled by lower oil prices should lead to a gradually improving supply/demand balance over the next several months. There is no change to our price projection. Our forecast for a modest liquids supply deficit and crude inventory draw for full-year 2019, possibly continuing into 2020, supports our current crude oil price forecast for an average 2019 oil price of $55-$60 per barrel and $60 per barrel for 2020. Our forecast of $65 in 2021 and 2022 remains the same. Assuming energy pricing gradually cycles higher, we expect the credit trend for the exploration and production and oilfield services segments to be stable.

Morningstar Credit Ratings also published its healthcare quarterly. According to our healthcare team, during the fourth quarter, legal threats appeared to build for many healthcare players. Specifically, the Affordable Care Act was deemed unconstitutional by a federal judge in Texas. Also, the challenges and media coverage continued for opioid manufacturers, distributors, and outlets. Legal exposure and headline risk for Johnson & Johnson continued to grow as well. While these factors have not affected our ratings or outlooks yet, we view the repercussions from efforts to stem opioid overuse and the increase of the talc liability caseload, in particular, as potentially material risks to credit quality at related entities over a longer time horizon.

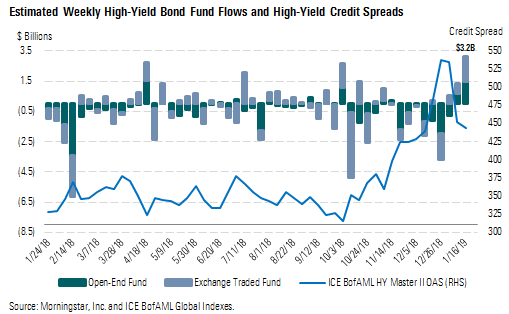

Weekly High-Yield Fund Flows Both institutional and retail investors continued to flock back into the high-yield sector last week. Total inflows in this asset class registered $3.2 billion last week, the greatest weekly inflow over the past 52 weeks. Fund flows were relatively balanced as net inflows into open-end mutual funds registered $1.5 billion and net new unit creation across exchange-traded funds totaled $1.7 billion.

Morningstar Credit Ratings, LLC is a credit rating agency registered with the Securities and Exchange Commission as a nationally recognized statistical rating organization ("NRSRO"). Under its NRSRO registration, Morningstar Credit Ratings issues credit ratings on financial institutions (e.g., banks), corporate issuers, and asset-backed securities. While Morningstar Credit Ratings issues credit ratings on insurance companies, those ratings are not issued under its NRSRO registration. All Morningstar credit ratings and related analysis contained herein are solely statements of opinion and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions. Morningstar credit ratings and related analysis should not be considered without an understanding and review of our methodologies, disclaimers, disclosures, and other important information found at https://ratingagency.morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)