Cash as an Inflation Hedge

It fares surprisingly well, if the Federal Reserve obliges.

Currency Versus Cash Several readers questioned my claim in "What If Inflation Isn't Dead?" that cash would be a useful portfolio asset, should inflation resurface. Let's discuss.

To start, the standard depiction of cash as an asset that withers over time is false. The motivational speaker holds up a 3-cent stamp and proclaims, "This is what happens to people who don't invest." (I watched that very presentation.) Not so, unless the cash consists of currency stashed under a mattress, thereby becoming a foolish version of gold that burns all too easily.

Cash as an investment--meaning cash that is held in an account--behaves differently. It appreciates in nominal terms, because of compounding. If placed into one-month Treasury bills, and reinvested, three 1933 dollars would now be worth $54. What once could purchase 100 first-class stamps currently buys 98 stamps. Roughly speaking, reinvested cash preserves purchasing power. The reason to hold riskier assets is not to protect against the damage caused by inflation, because reinvested cash does that, but instead to grow one's wealth.

(Note: Properly speaking, cash has a very short life span: at most one year, and likelier only a few months. People often call long-term bank CDs "cash," but if the investment is for three or five years, the term is inaccurate. Such certificates are the equivalent of intermediate-term bonds.)

That is a reasonable goal, for which cash is ill-suited. Under normal circumstances, cash hampers portfolios. To reiterate, the problem is not that cash tends to lose value in real terms (that is, after adjusting for inflation), but rather that it doesn't increase an investor's net worth. For the most part it sits there, treading water.

History's Guide There are, however, times when going nowhere is relatively attractive, because other investments are heading south. One such occasion, obviously, is during a recessionary panic. Nobody doubted cash's value during the Great Depression, nor during the 2008 global financial crisis. Losing nothing was far better than the alternative. The question for this column then becomes, does the same hold true when the threat is inflation, as opposed to deflation?

The query is difficult to answer, as the post-World War II sample size is effectively 1. Inflation in the United States was dormant from 1948 through the mid-1960s, then rose sharply until 1981, then began a long decline. (The pattern was very similar in the United Kingdom and moderately so in Japan and Germany.) There just aren't very many data points to analyze.

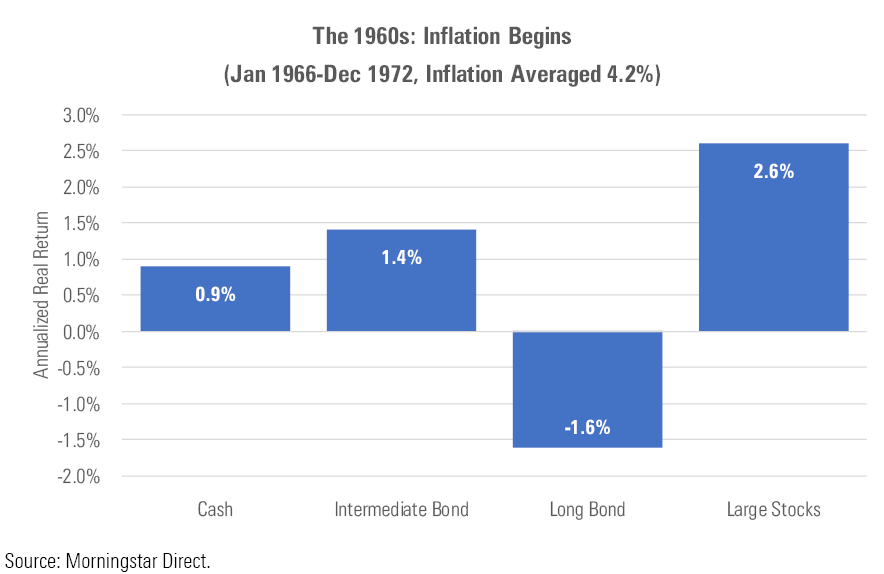

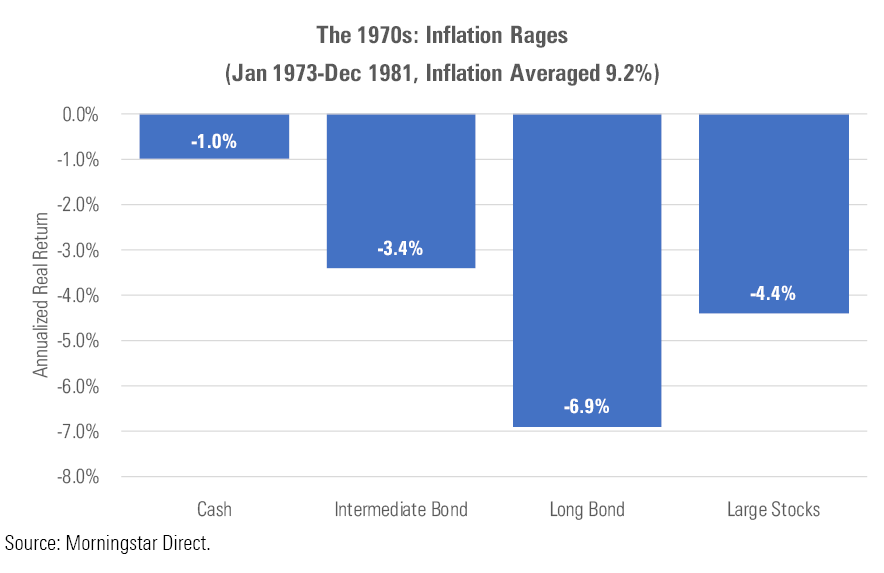

We can, at least, divide that inflationary period into two parts. The first is the introduction, when price increases initially appeared. The second is the main event, when inflation raged so fiercely that onlookers feared it would never be tamed. The introduction ran from 1966 through 1972, featuring an average annual inflation rate of 4.2%. The main event followed from 1973 through 1981, with the annual inflation rate averaging a debilitating 9.2%.

By the Numbers Below are the after-inflation returns for four U.S. assets during the first period, as measured by Ibbotson's database (which is owned by Morningstar). The assets are: 1) cash, represented by one-month Treasury bills; 2) intermediate-term notes; 3) long-term bonds; and 4) large-company U.S. stocks. All figures assume reinvestment.

Cash was useful but not necessary. It outperformed long bonds, which quite naturally were depressed by the prospect of spending many years making the same fixed payments, even as inflation abraded those future values. However, cash slightly trailed intermediate-term bonds and fell further behind stocks. Cash fared acceptably, but all but the most risk-averse of investors would have been happier holding a balanced fund.

Then the problem became real.

Ouch! Those performances were bad. Annualizing the returns disguises the destruction. When calculated as cumulative results, that 6.9% annual long-bond decline translates into 52 cents on the dollar. Talk about losing purchasing power! Large stocks shed one third of their worth (although curiously, small stocks fared well--perhaps that's a topic for another column), and intermediate bonds fell by more than one fourth. Of the four assets, only cash came close to retaining its value.

That outcome was the basis for my defense of cash as an inflation hedge. Only once in the past 75 years has inflation seriously threatened U.S. investments, and when it did, cash acquitted itself fairly well. As inflation spiked, Treasury-bill rates followed suit, reaching as high as 15%. Cash is light on its feet. If market rates change dramatically, cash reacts quickly, while rival investments are hobbled by their longer durations.

Further Considerations I have two caveats. One is that tangible assets--commodities such as gold, energy futures, and real estate--will likely outgain cash should inflation return. I recommended such investments only half-heartedly in last week's column, because they are often illiquid and almost always volatile, while cash is neither, but their strength should be noted. Unlike cash, they have the potential to score significant after-inflation profits.

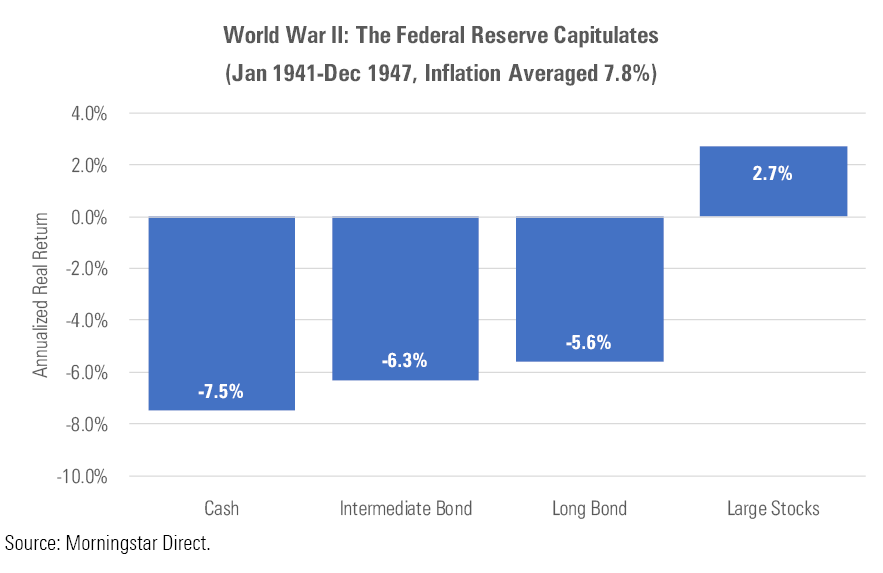

The other is the possibility that the Federal Reserve repeats its World War II policy. When prices surged--more than 9% in each of 1941 and 1942, and then a shocking 18% in 1946--the Fed surrendered. Rather than fight the trend, it kept short-term interest rates at the very low level of 0.375%, thereby assisting the war effort by inflating away much of the country's debt. Unsurprisingly, cash performed terribly.

Should inflation return, I do not think today's Federal Reserve will act similarly. The memory of the 1960s and 1970s still lurks in central bankers' minds. Also, economic decisions made during peacetime differ from those made during total war. For those reasons, I believe the Fed would respond to rising inflation in customary fashion, by raising short-term rates. That would be good for cash returns.

However, I realize that many readers do not share my faith that the U.S. government will treat its creditors so graciously. They foresee the U.S. implicitly shirking its debt obligation, by keeping rates relatively low, as it did before. Such skeptics will prefer tangible assets, and perhaps even equities.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)