Considering a Financial Transactions Tax

If implemented properly, the duty could potentially help everyday investors.

An Income-Tax Rebate To forestall the complaints: This column intends to save you money. (Or your clients, if you are a financial advisor.)

Historically, proponents of financial transaction taxes--that is, tariffs on investment trades--have advocated their positions to punish Wall Street, to increase federal revenues, and/or to discourage what they view as excess trading. The first two reasons inspired Bernie Sanders and Elizabeth Warren to offer FTT proposals, while the latter prompted Jack Bogle to state in 2011 that FTT was "an idea whose time has come."

None of those motives underlie today’s suggestion. I quarrel neither with Wall Street nor its level of trading volume. Neither I do wish to fill the Treasury’s coffers. My version of the FTT is revenue-neutral, removing one dollar of federal income tax receipts for every dollar raised through the FTT. Effectively, this process would shift some of the nation’s tax burden from wages to consumption.

The Congressional Budget Office has already conducted the groundwork. In 2018, it evaluated various potential new taxes, including a financial transactions tax. That proposal would impose a tariff of 0.1% when trading stocks, debt obligations with maturities of more than 100 days, and most derivatives. Initial public offerings would be exempted.

Because this tax would be applied to a single payment that is shared by two parties, the effective tariff on each the buyer and seller would be 0.05% (one part in two thousand). Each side of the trade would forfeit 5 basis points to the federal government. For 1,000 shares of Facebook FB traded at $244, creating a transaction amount of $244,000, that would equate to a $122 assessment for the buyer and an equal $122 assessment for the seller.

The 3.5% Solution The CBO estimates that enacting its version of the FTT would generate $778 billion in additional federal revenues over the ensuring decade. Its calculations were thorough. The department modeled the effect of an initial hit to asset prices; lower proceeds from income and payroll taxes; and, naturally, sharply reduced trading volume. Whether the department's estimates are accurate cannot be known, but they at least were sincerely developed.

Per the CBO's forecast of $22 trillion in income tax revenues during that same time period, adding $778 billion of new FTT revenues would permit cutting federal income taxes by 3.5%. The rebate will be a flat reduction: All income tax bills will drop by the same percentage. (Actually, slightly more than 3.5% due to the interaction between the FTT and income taxes that is mentioned in the previous paragraph, but never mind that detail.)

That’s the deal: Institute an FTT, and in exchange for accepting that additional tax, everybody’s federal income tax liability will decline by 3.5%. Admittedly, the deal will be moot for most investors who make less than the median income because they will neither pay much in federal income taxes nor have much of a portfolio with which to transact. For half the country, adding an FTT would be a footnote.

By the Numbers For those with greater means, though, the effect can be meaningful. Let's see how the proposal would work for somebody who earns the median income. In 2017, the median wage for a single household was $41,740, with the average tax bill for that income being $6,674. The 3.5% rebate would lead to $234 in savings. The question then becomes: How large can the investor's portfolio become before the costs of paying the FTT outweigh the benefits for the $234 rebate?

The answer, of course, depends upon the volume of the investor’s trades. We could tinker endlessly with that variable. For this column, though, let’s settle on a single, middle-of-the-road figure: Vanguard Balanced Index’s VBAIX 37% turnover ratio. The leading equity index funds are much less active, while most actively run funds are more active. This seems like a fair compromise.

Because a fund’s turnover ratio represents the lesser of its purchases or sales, its official figure represents something less than half of its total trading volume. We will make that adjustment, assuming that Vanguard Balanced’s annual trading activity, counting purchases and sales, sums to 80% of its net asset value. Now we can compute the portfolio breakeven point. The equation is $234 (rebate) = $X (portfolio amount) * 0.0005 (the fund’s share of the FTT for each dollar that it trades) * 0.80 (the fund’s roundtrip turnover rate). The solution is X = $585,000.

Thus, if their turnover rate resembles that of Vanguard Balanced Index, single investors who earned the national median of $41,740 and who paid the average income tax rate for that salary will pay lower taxes under my proposal--unless they hold a portfolio worth at least $585,000. That seems highly likely. There aren’t many people with taxable incomes of $40,000 who have portfolios that are larger than half a million dollars.

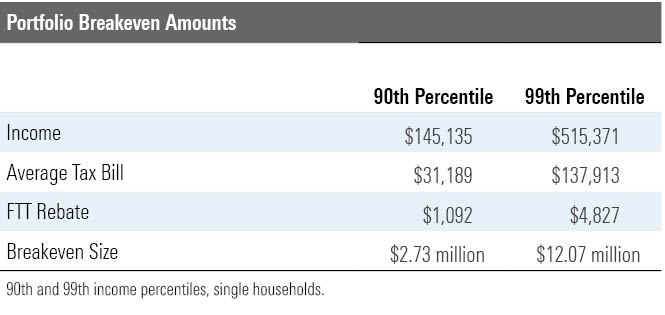

Here are the results for two other income percentiles, using the same assumptions.

Once again, it seems that most investors at these wage levels would be helped by the tax-law change. If not, they could take simple steps to improve their situation. For example, the 99th percentile investor who forwent Vanguard Balanced and instead split her assets evenly between Vanguard Total Stock Market VITSX and a 10-year Treasury note ladder would have a lower overall tax bill under my proposed tax scheme even she possessed a $60 million portfolio.

Winners and Losers If most investors would be helped by paying an FTT in exchange for reducing their income taxes, who would be hurt? The main answers: 1) high-frequency traders; 2) hedge funds that use algorithmic trading processes; 3) foreign investors; and 4) day traders. That seems like a desirable outcome. My guess is that policymakers wouldn't mind if everyday investors were treated somewhat better by the tax code, and those parties somewhat worse. I suspect that most of you feel similarly.

To be sure, chasing away the marketplace's most active traders could create unpleasant side effects. It's one thing for me to write a high-level column explaining the possible benefits. It's quite another to make such a plan work in practice. But I think it should not be dismissed out of hand, as many critics have done. There are merits to the idea.

Note: In February, Morningstar’s Lia Mitchell discussed how an FTT might work when applied to exchange-traded funds. As you will see, her analysis is complementary to mine, as she gets into the investment details.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)