12 Compelling Stocks

These high-quality names were recently added to the Morningstar Wide Moat Focus Index.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. How has this cluster of high-quality names performed over time? Pretty well: The index has beaten the S&P 500 during the trailing three-, five-, and 10-year periods.

With those performance numbers on the index's side, its constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes the index regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

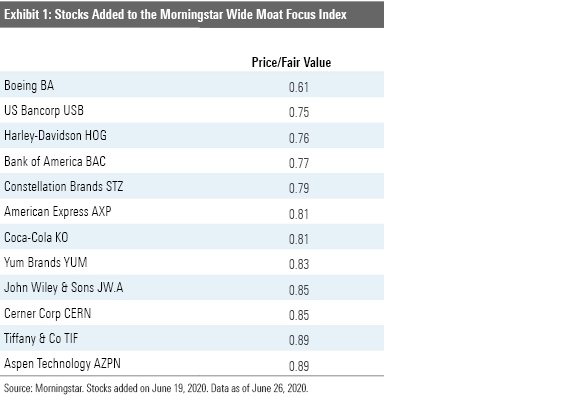

After the most recent reconstitution on June 19, 2020, half of the portfolio added 12 positions and eliminated 11. The index now holds 49 positions.

The Additions Two of the newcomers hail from the banking industry: Bank of America BAC and U.S. Bancorp USB.

After a decade of troubles, we think Bank of America has righted its ship. Management has reshaped the franchise, says analyst Eric Compton. “Bank of America's strategy of simplification, efficiency, and risk reduction has paid off,” he says. “The balance sheet is finally growing again, after years of planned sell-offs in an effort to derisk and reform the business.”

U.S. Bancorp, meanwhile, is one of the strongest and best-run regional banks we cover, argues Compton: “Few domestic competitors can match its operating efficiency, and for the past 15 years the bank has consistently posted returns on equity well above peers and its own cost of equity.”

Dig deeper: Stress Test Confirms Our Overall Banking Sector Thesis

The other additions hail from a hodgepodge of industries.

Boeing BA raised $25 billion in bonds several weeks ago, which we estimate should allow the company to survive for about of a year of cash flow as bad as what it experienced in March. “We think the firm will return to being cash flow positive in the months after the 737 MAX is recertified, which we’re expecting will happen in late summer 2020,” says analyst Burkett Huey. We also are encouraged by its plans to shrink the balance sheet, he adds--as long as the firm continues to reinvest sufficiently to drive product innovation.

Harley-Davidson HOG enjoys brand loyalty and a solid dealer network, which underpin its wide moat rating. “However, there are no switching costs to protect Harley's brand when consumers replace their bikes, and the premium price Harley commands relative to its peers has proved problematic during cyclical downturns and periods of competitive pricing,” explains senior analyst Jaime Katz. We expect new product introductions will continue to try to reach a wider user base.

Dig Deeper: Harley's New Rewire Plan Puts Focus on Profits

Thanks to the long-term strength of its business, Constellation Brands STZ is a favorite of ours in the pure-play U.S. beverage space. “We see the firm’s overall Mexican beer portfolio as auspiciously situated at the confluence of unwavering secular and demographic trends,” says analyst Nicholas Johnson. “With an enviable growth profile and best-of-breed margins, we have confidence that the beer business can thrive even amid an evolving malt beverage landscape.”

Watch: 2 Consumer Defensive Brands Maintain Value Amid Uncertainty

American Express’ AXP biggest challenge remains adapting to the evolving payments landscape and attracting millennial customers, who are less impressed with the Amex brand and instead emphasize rewards and merchant acceptance, says Compton. “American Express has made significant strides to increase acceptance throughout North America, but we still believe the general perception of Amex is that its cards are not as widely accepted,” he notes. We’re confident in the firm’s solid position in the commercial side, however.

Related: 6 Stocks Top Managers Are Buying

Structural dynamics will ensure that Coca-Cola KO maintains its ubiquity and brand resonance. “We think that, despite competing in a mature industry, the firm is adequately exposed, either directly or indirectly, to growth vectors such as water and energy drinks,” asserts Johnson. “Moreover, we believe Coke will be able to continue extracting incremental value growth from the carbonated soft drink market, even as volumes decline.”

Dig deeper: Long-Term Value for Coke Despite Uncertainty

Yum Brands YUM has become one of the top innovators in the quick-service restaurant space, and we think it remains a dynamic consumer growth story despite recent coronavirus-related disruptions. “Over a longer horizon, new daypart expansion, customer engagement, product development efforts, alternative restaurant formats, and delivery partnerships can continue to elevate systemwide sales growth,” asserts strategist R.J. Hottovy.

John Wiley & Sons JW.A has built a wide moat thanks to a journal business with little direct competition, as well as deep relationships with academic institutions, corporate clients, and researchers. The shift away from print books is a threat for Wiley to overcome, but we think its educational publishing and services segments can create durable growth. “We see opportunity for patient investors willing to endure near-term uncertainty and able to wait for Wiley’s services businesses to scale and offset print publishing pressure,” observes analyst Zain Akbari.

Cerner CERN is a leading healthcare IT service provider that has built a wide moat thanks in large part to high customer switching costs. It has expanded beyond its core business focused on acute medical records into ambulatory (outpatient services), thereby positioning it as a single source provider. “Additionally, Cerner has started to cross-sell incremental analytics services to fortify already high retention rates,” reports analyst Soo Romanoff. “Incremental services are largely recurring in nature and include analytics, revenue cycle management, telehealth, and IT outsourcing.”

Our $135 fair value estimate for Tiffany TIF reflects LVMH’s acquisition premium; the deal was struck in 2019. The company’s brand is supported by its iconic collections and “Tiffany blue” color. “We believe it is relatively harder to establish an enduring brand moat in precious jewelry than in other luxury goods categories, given high raw material value and fewer opportunities to communicate the brand,” observes analyst Jelena Sokolova. Only a handful of precious jewelry brands have time-tested global recognition, and even fewer generate good capital returns.”

Aspen Technology AZPN is a leader in process automation software for complex industrial environments. The collapse in oil prices earlier this year led its energy-related customers to postpone projects. “We know management has been here before, and we are confident the company will emerge strong on the other side of this,” comments analyst Dan Romanoff. “Over the medium and longer term, we continue to see growth opportunities as capital-intensive industries advance their digital transformation strategies, especially while companies learn how to operate remotely.”

Related: 5 Stocks Buffett Might Buy, if He Could

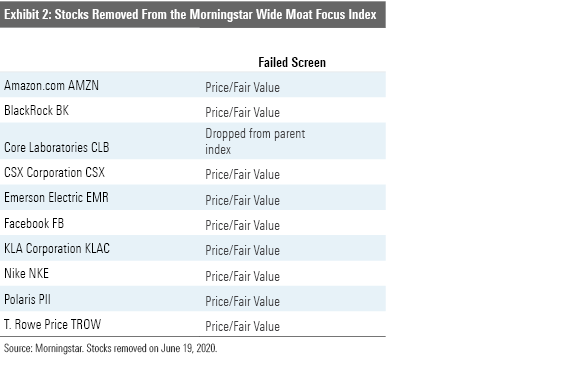

Removals Stocks can be removed from the index for a few reasons: If we downgrade their economic moats or if their price/fair values rise significantly. Most of the removals in the latest reconstitution were pushed out by stocks that were trading at more attractive price/fair values at the time of reconstitution. One--Core Laboratories CLB--was removed because it was reclassified as a micro-cap stock and therefore dropped from the parent Morningstar U.S. Market Index.

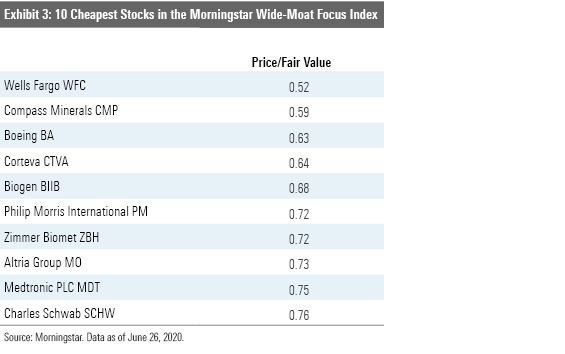

High-Quality Stocks in the Bargain Bin Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of June 26.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)