Few Buy Ideas in the Tech Sector Today

Pandemic could speed up the transition to cloud computing and remote working.

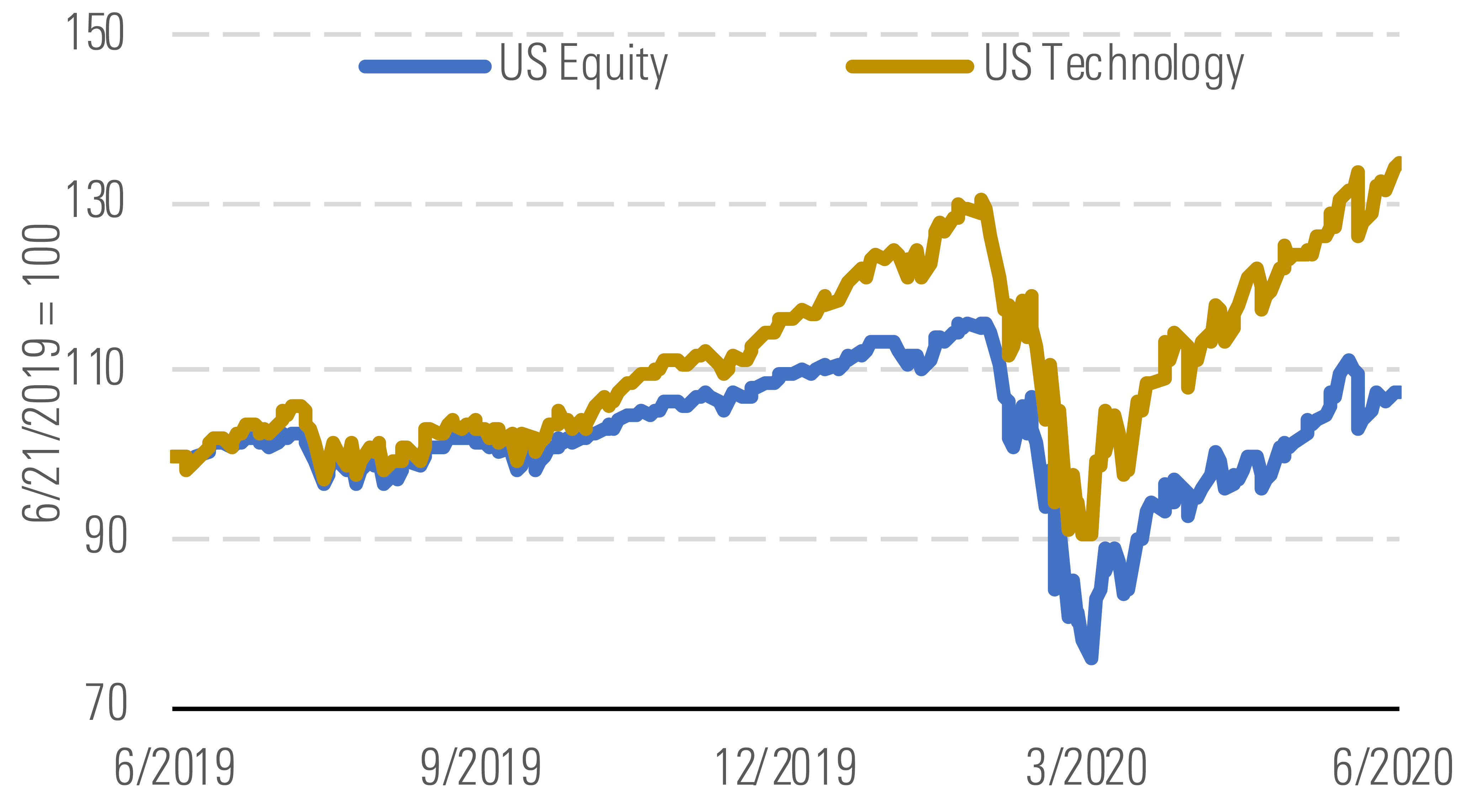

Like the broader stock market, technology stocks sold off at the end of the first quarter over concerns about the coronavirus but rebounded sharply thanks to renewed optimism around the economic damage from the pandemic. That said, the long-term tech story is compelling, as the pandemic might be accelerating the trend toward cloud computing, remote working, and other technology productivity solutions. As of June 23, the Morningstar US Technology Index was up 35% on a trailing 12-month basis, vastly outperforming the U.S. equity market, which is up 7.7% in the same period. Over the past three months, tech readily outperformed the broader market during the COVID-19 rebound, up 31.4% compared with the broader U.S. equity market, which was up 23.1% as of June 23. Before coronavirus concerns, tech stocks fared well in late 2019, with optimism about a resolution to the U.S.-China trade wars that weighed on the sector in late 2018 and at times in 2019.

Tech outperformed broader market in both the recent sell-off and rebound. - source: Morningstar

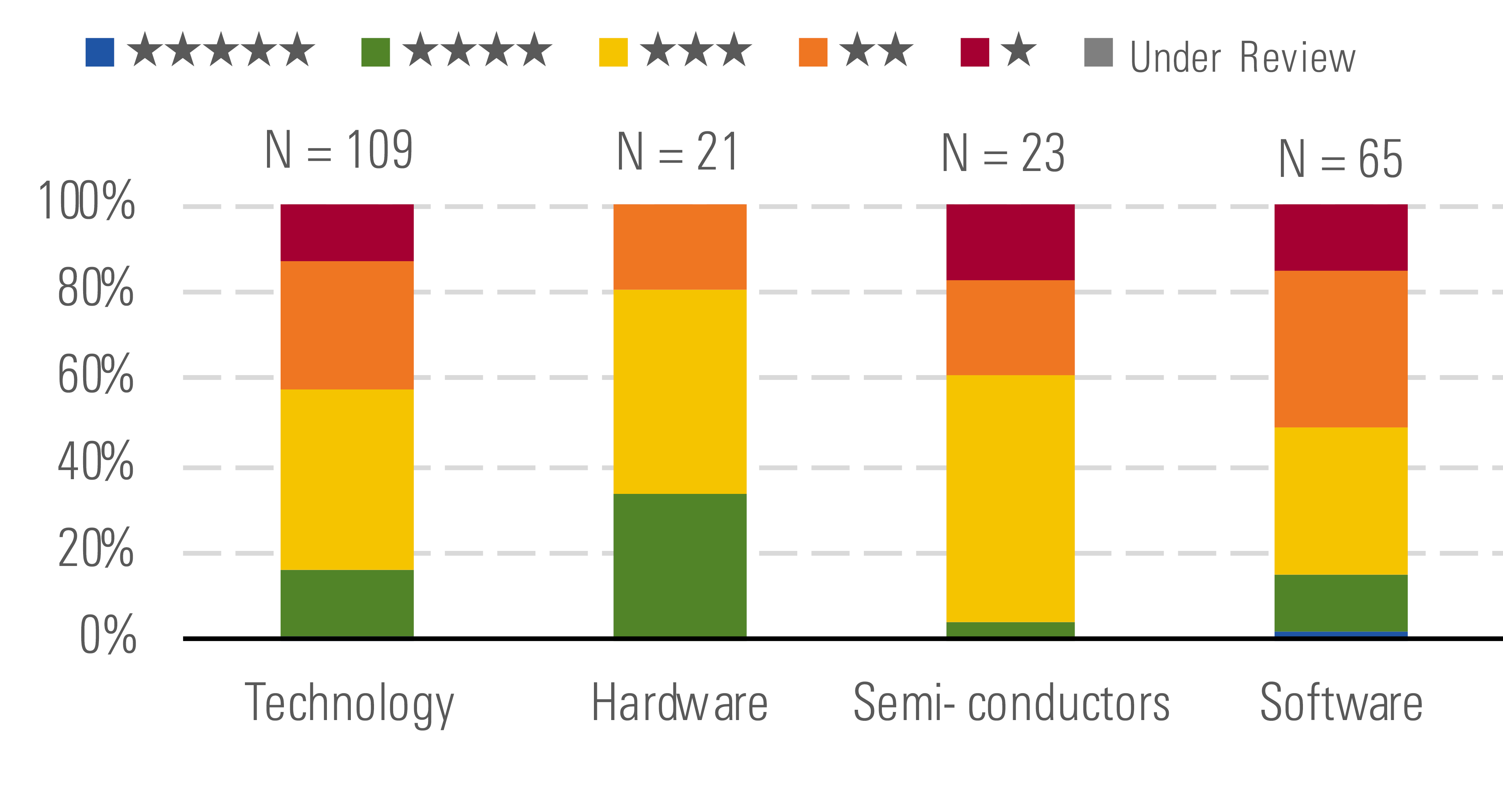

As of June 23, the median U.S. technology stock was 6% overvalued, a dramatic reversal from the attractive opportunities three months ago when the sector was 20% undervalued. We see very few buy ideas today, similar to the months immediately before the pandemic. Hardware is still the cheapest subsector, with the median stock 5% undervalued today. However, the higher-quality names under our coverage tend to be in semiconductors and software. While both sectors were nicely undervalued a quarter ago, both have rebounded, and the median stock in both subsectors are now 12% overvalued.

Tech has now rebounded after the COVID-19-driven sell-off. - source: Morningstar

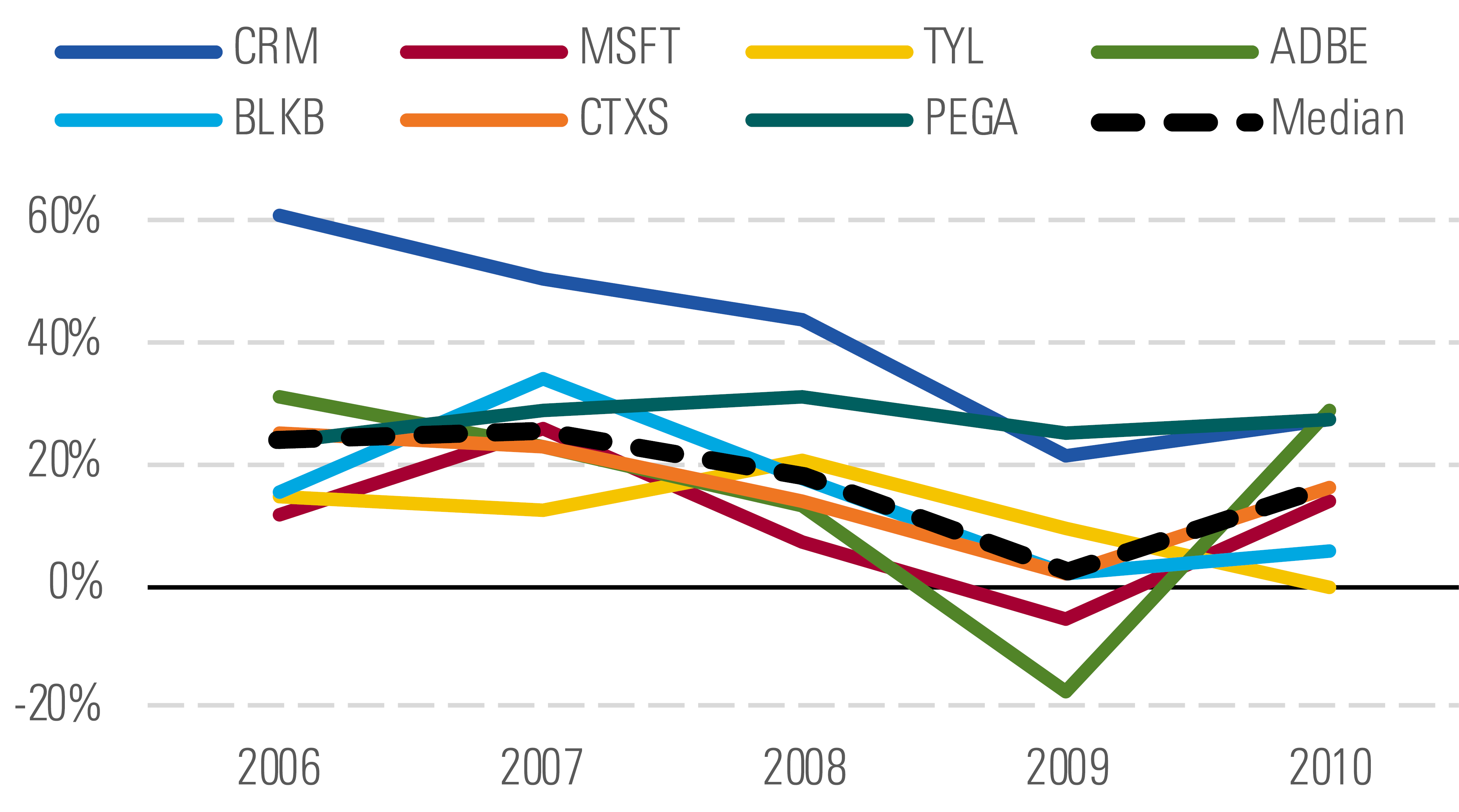

A quarter ago, amid the broader market sell-off, we saw buying opportunities across high-quality software names. We're especially fond of their business models, as these firms generate revenue on a subscription basis with little risk of cancellations, even as work shifts to homes and away from the office. Software was also resilient during the credit crisis, and if there is another round of coronavirus shutdowns, we would again look toward software as a safe haven.

Software firms in '08-09 point to robust revenue amid a recession. - source: Morningstar

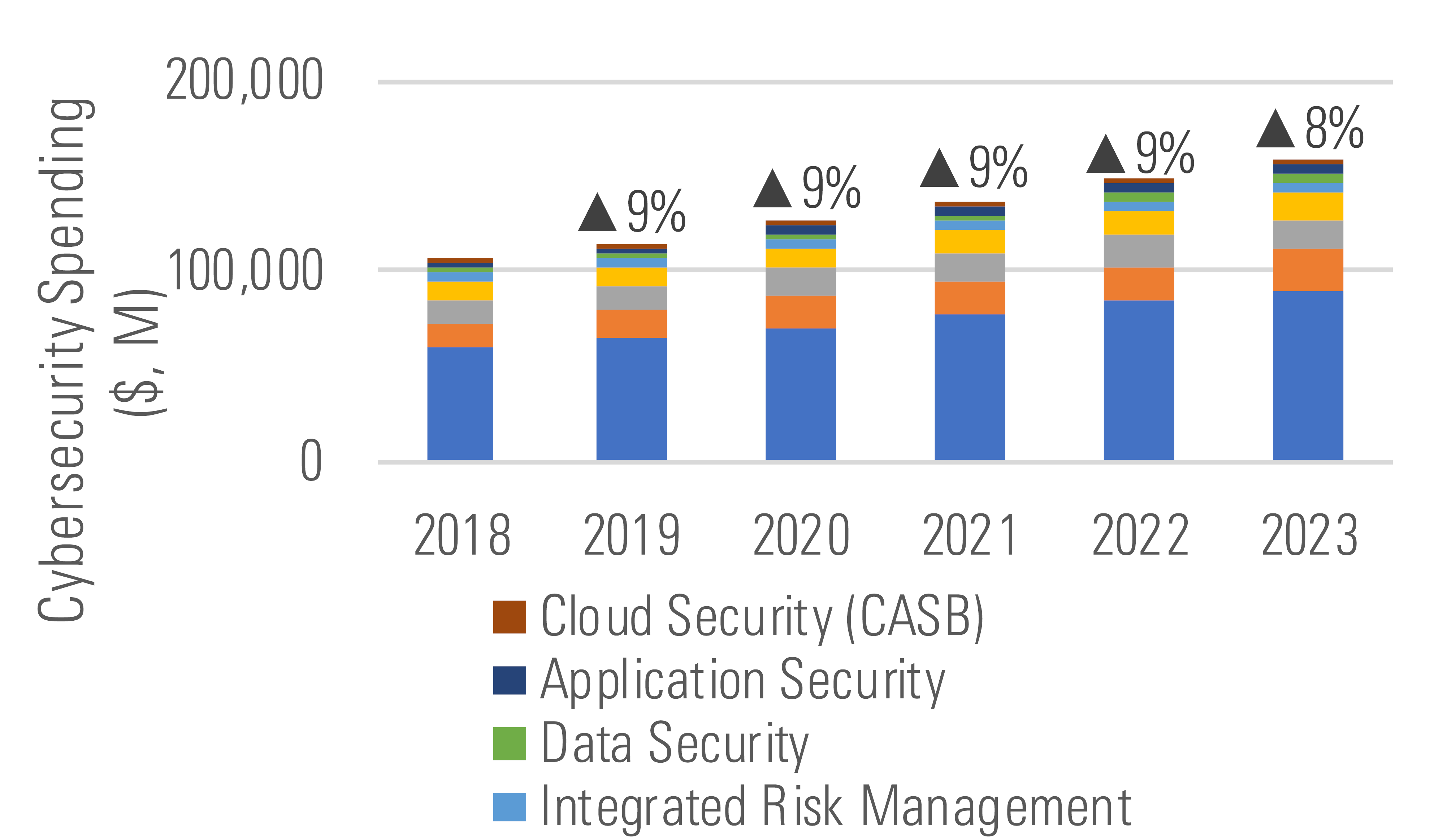

Cybersecurity also appears to be a bit of a haven. Besides the subscription revenue model, additional solutions are being deployed as more people work remotely. The risk for bad actors disrupting data traffic won't slow down any time soon, so IT departments will remain proactive in monitoring its various software and solutions that each employee needs to be productive. We think the $100 billion-plus cybersecurity market will grow at a five-year CAGR of 9%.

Cybersecurity spending should rise at a 9% CAGR through 2023. - source: Morningstar

Top Picks

Cognizant Technology CTSH Economic Moat Rating: Narrow Fair Value Estimate: $70 Fair Value Uncertainty: Medium

We see an attractive long-term investment opportunity in narrow-moat Cognizant Technology Solutions, as we think the market has overcompensated for the effects of the coronavirus and the company’s recent Maze ransomware attack. We recognize that 2020 will be a tough year for Cognizant, as we expect that IT discretionary spending will suffer and the company will have to endure increased costs to mitigate and further secure its systems after the Maze attack. However, we think that Cognizant is well positioned in the long term to keep pushing its reputation past a back-office outsourcer to higher-value technical offerings.

Palo Alto Networks PANW Economic Moat Rating: Narrow Fair Value Estimate: $305 Fair Value Uncertainty: High

Narrow-moat cybersecurity pure play Palo Alto Networks trades at an attractive discount to our fair value estimate. In our view, cyber threats do not yield to any global economic concerns, and the severely increased fines for data privacy woes and a dearth of talent within security make cybersecurity a top concern for enterprises. To supplement its firewall market leadership, Palo Alto aggressively built out a platform that contains cloud security and threat response automation. In our view, entities will favor adding on Palo Alto's security subscriptions over managing various vendors to alleviate toolset management burden.

VMware VMW Economic Moat Rating: Narrow Fair Value Estimate: $202 Fair Value Uncertainty: High

We believe that VMware's position as the commonality between public clouds, private clouds, and on-premises ecosystems gives it an enviable position. In our view, the company has nicely made the transition away from relying on server sales and has established itself as a key player in more nascent high-growth areas. The diversification into markets such as container management, end-user computing, software-defined networking, and security should help insulate VMware from hardware spending pauses or softer virtualization demand.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)