Gold Shares or Bullion as Portfolio Diversifiers?

The answer depends upon the size of the investment.

Following Up Tuesday's column about using long bonds and gold to diversify conventional portfolios shortchanged the metal. As several readers pointed out, the article assessed the effect of holding the stocks of gold miners, but not of investing in bullion itself. In addition, I evaluated a portfolio that used atypically long bonds. Best to run a controlled study that changes only a single factor, not two.

That's what we'll do today. First, we will compare the historic performance of gold-mining equities to that of bullion. Then we will measure how each asset would have affected a standard balanced fund by replacing half the fund's fixed-income position with either gold shares or bullion. Finally, we'll halve the gold weighing to 10% to see whether that amount is large enough to make a meaningful difference.

As with Tuesday's column, the study begins on Jan. 1, 1986, and concludes April 24, 2020. Stocks are represented by Vanguard 500 Index VFINX, fixed-income securities by the intermediate-term Bloomberg Barclays U.S. Aggregate Bond Index, gold equities by Fidelity Select Gold FSAGX, and bullion by the London Bullion Market Association Gold Price AM Index. (Although retail investors could not have owned an electronic version of bullion during the study's time period, they can do so now via the exchange-traded funds SPDR Gold Shares GLD or iShares Gold Trust IAU.)

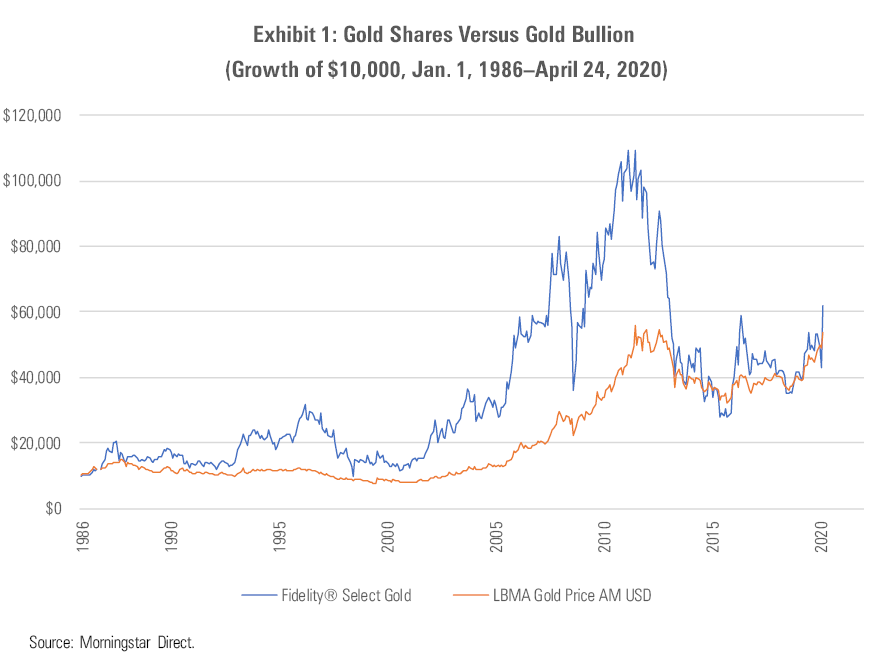

Standing Alone I knew that gold equities were more volatile than bullion, because of both operating and financial leverage, but I hadn't realized that their risk was that much greater.

Gold shares went nowhere for 15 years, grew eightfold over a decade, and then fizzled during the final decade (until gaining 40% over the past four weeks). Unsurprisingly, Fidelity Select Gold's inflows ballooned along with its returns, with the fund receiving $1.5 billion in inflows from 2008 through 2010. Performance then reversed, chasing $1.2 billion of assets away from the fund over the next three years. The fund's investors mistimed their transactions miserably.

Bullion had its own rough stretch, shedding 40% of its price from 2012 to 2015. Despite its recent comeback, it trades well below its peak value. However, as even the most cursory glance at the chart reveals, bullion is nonetheless far easier to hold than gold equities. Were this a contest of stand-alone investments, bullion would win in a walk. Gold shares are too psychologically difficult to own.

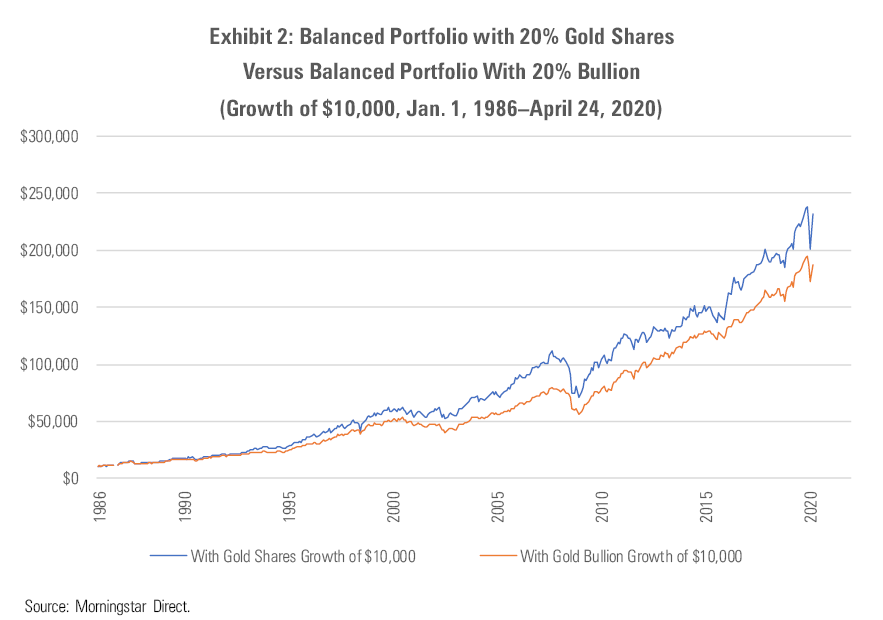

Within Portfolios They may, however, be superior diversifiers. That leads to the second test: comparing portfolios that use gold equities against those that use bullion. The gold shares portfolio consists of 60% Vanguard 500 Index, 20% Aggregate Index, and 20% Fidelity Select Gold. For its part, the gold bullion portfolio holds the same initial two investments, in the same proportion, but substitutes a 20% stake in the LBMA Gold Price Index for Fidelity's gold share funds. For this simulation, both portfolios were rebalanced monthly.

As I anticipated, the gold shares portfolio was the riskier of the two. It was bound to be, unless gold equities were so negatively correlated with the overall stock market that their extra volatility reliably pushed in the right direction (that is, upward when stocks/bonds declined), or unless gold equities were much less positively correlated with mainstream investments than was bullion. Neither possibility seemed likely.

As it turned out, both portfolios were equally uncorrelated with the rest of the marketplace. The correlation between Fidelity Select Gold and a balanced fund comprised of 60% equities and 40% intermediate-term bonds was negative 0.01, while that between the LBMA Gold Price Index and the balanced fund was negative 0.02. Round them both to zero. Whether as shares or bullion, gold walks randomly.

What surprised me was that gold shares comfortably outgained gold bullion. As illustrated in the initial graph, Fidelity Select Gold barely beat the LBMA Gold Price Index over the study period. Thus, the two versions of gold had almost identical correlations and similar cumulative returns. Yet when inserted into the same balanced portfolio, gold equities were considerably better at improving returns.

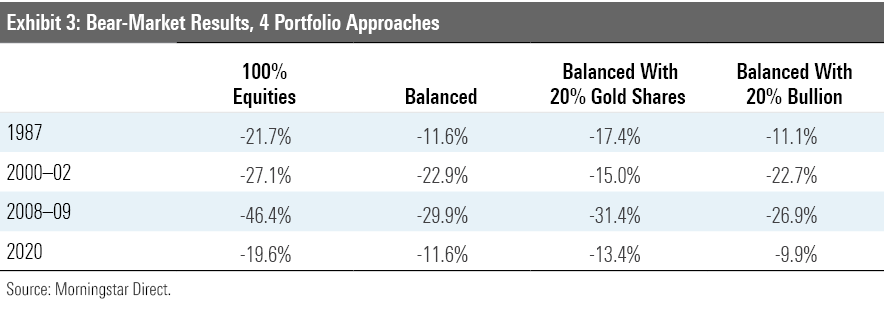

Hmmm. My initial hypothesis was that I had botched the spreadsheet, but that was not so. My second hypothesis was that the calculations had overlooked gold shares' bear-market superiority, because they did not directly measure bear-market results. However, when I compared the returns for gold shares against those of gold bullion during the study period's bear markets (while also providing, for context, the results for the S&P 500 and for a balanced fund), bullion won three of the four trials.

My third hypothesis, which I have not yet tested, is that the difference owes to rebalancing effects. Over the weekend, I will tinker with the rebalancing rules to see how that alters the outcome.

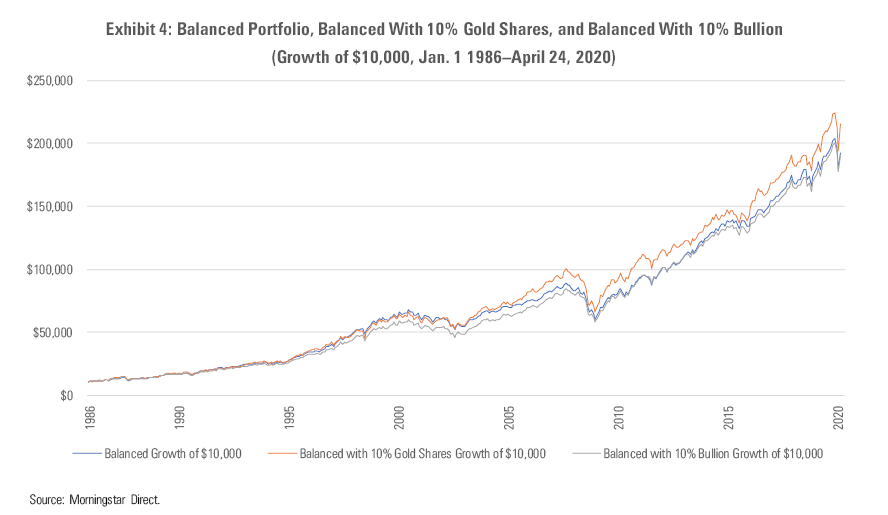

The 10% Solution Let's see how things look using a lighter gold position. This time, the gold shares and gold bullion portfolios are 60% equities, 30% intermediate-term bonds, and 10% in Fidelity Select Gold and the LBMA Gold Price Index, respectively. For comparison's sake, I have also included the results of a 60/40 balanced fund.

My tentative conclusions:

- If investing 10% in gold with a mainstream portfolio, use equities rather than bullion, because bullion lacks oomph. It is volatile by the standards of traditional investments but not enough to achieve the desired effect of diversification when used in a 10% dose.

- If investing 20% in gold, use bullion unless your risk tolerance is unusually high. Gold equities may lead to higher returns, but most will find the ride to be unduly bumpy.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)