Enbridge's Sell-Off Looks Exaggerated

The market is underestimating long-term cash flows once oil prices normalize.

Wide-moat and 5-star-rated Enbridge ENB/ENB remains one of our top picks in the energy sector, as we think the market is mistaken about the future of the company’s cash flows. However, we don’t expect the market’s concerns will be fully addressed for some time, which can lead to volatile swings in the stock. We advise investors to stay the course while getting paid a handsome 8.4% dividend yield. In the end, we believe Enbridge’s long and winding road will lead to 40% upside.

Before the downturn in the financial and oil markets, we saw evidence that the stock market was beginning to appreciate Enbridge’s ability to generate long-term sustainable cash flows and offer a healthy, safe dividend. The stock appreciated nearly 25% from September 2019 until the beginning of the downturn in the markets in February. It also outperformed the general market and its top Canadian midstream peer, TC Energy TRP/TRP, while closing in on our fair value estimate, which was $47/CAD 62 at the time. In our view, positive sentiment around the future of the Line 3 replacement project and the outlook for long-term oil sands supply growth drove the stock’s outperformance.

Since the market crash, the narrative has flipped. The crash in oil prices has renewed fears about the long-term health of Enbridge’s Mainline pipeline. The Mainline holds the potential for cash flow fluctuations, which could impair dividend stability. Accordingly, Enbridge’s stock has underperformed the general market and TC Energy, shedding over 30% from its Feb. 12 high.

In the face of drastically lower oil prices, we think the market expects minimal long-term Canadian oil supply growth and assumes that the Mainline’s utilization remans just over 60% indefinitely, as a result of competing pipeline expansions displacing current throughput, and that Line 3 is not built. However, we think that the market is more bullish in the near term, as it doesn’t expect as big of a dip in Mainline utilization along with utilization on noncontracted liquids and gas pipelines as a result of lower crude and gas supply. To arrive at the market-implied assumptions for Enbridge’s stock, we use our discounted cash flow model, flexing mainline cash flows to arrive at a valuation that approximates the current share price. However, we think the market’s assumptions implied by the current stock price are incorrect.

In our view, the market is underestimating Enbridge’s ability to generate stable, long-term cash flows and maintain its dividend. In the near term, we expect Canada’s oil supply to decline in response to the massive dip in oil prices. But beyond 2021, we still expect robust crude oil demand growth, as disruptive factors like electric vehicles are likely to take much longer to meaningfully reduce the intensity of global crude consumption. Yet U.S. shale would be the cheapest source of incremental supply, and it has a marginal cost of $55/barrel for West Texas Intermediate. Prices must therefore recover to encourage this expansion, or the glut will flip into a painful shortage.

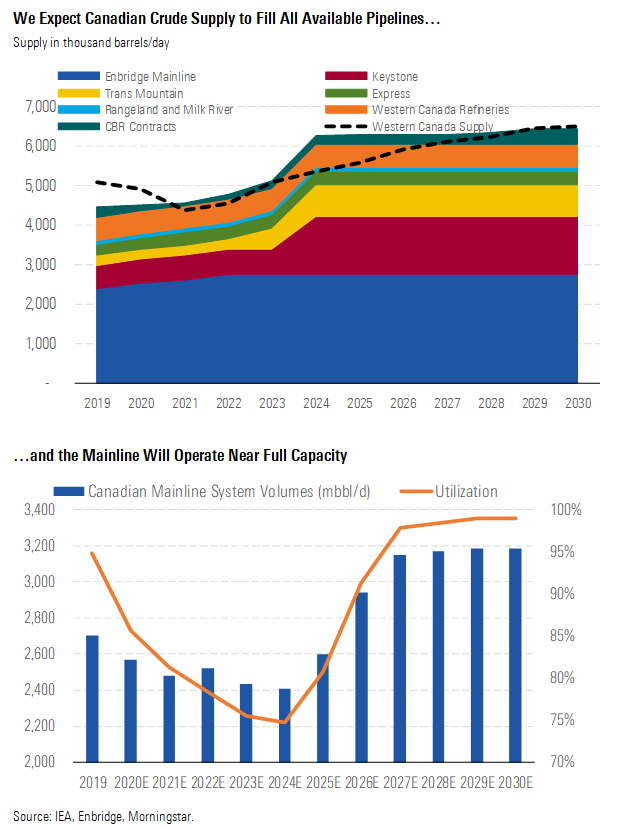

If our midcycle forecast of $55/barrel WTI is correct, we would expect long-term supply growth in Canada, primarily driven by the oil sands. We think advancements associated with solvent-assisted technology will lower oil sands break-evens, leading to long-term Canadian production that will surprise to the upside and add 1.3 million barrels of oil per day over the next decade. Even with the Keystone XL and Trans Mountain Expansion pipelines likely to be operational by 2023, investors shouldn’t expect Mainline underutilization to last indefinitely, as we expect the pipeline to operate at near full capacity as supply ramps up to our forecast levels by 2027.

Even when the Mainline is operating at a lower capacity, we expect Enbridge to generate enough cash flow to meet our 3% annual dividend growth forecast, aided by stable cash flows associated with its other top-tier assets, which carry long-term secured contracts.

Enbridge remains one of our best ideas for investors in the energy sector. With the stock currently trading near 52-week lows, we see over 40% upside. The stock is also yielding an attractive 8.4% on its dividend, which looks safe even with a temporary dip in Mainline throughput. In this article, we take a look at what the market is missing about Enbridge’s future cash flows and the stock’s significant upside.

Mainline's Underutilization Looks Temporary The Mainline is Enbridge's and Canada's most prized infrastructure asset, constituting 70% of Canada's pipeline takeaway capacity. Because of its importance, the pipeline operates as a common-carrier pipeline, and none of the nameplate capacity is secured under firm contracts. Rather, the pipeline is governed by a competitive tolling settlement, which allows producers to nominate volumes for shipment on a monthly basis.

Accordingly, the pipeline is more exposed to volumetric risk than other Canadian pipelines, which are underpinned by take-or-pay contracts. In periods of excess pipeline capacity compared with the available supply, the Mainline loses the most throughput volumes because of the lack of take-or-pay contracts. Canadian supply averaged over 5.5 mmb/d in 2019 in the face of Alberta’s mandatory curtailment, allowing the Mainline to operate at near full capacity as almost all available pipeline capacity was utilized. But with the crash in oil prices, we expect supply to dip sharply over the next three years, evidenced by major capital spending cuts from the major oil sands producers and a massive decline in rig counts.

The major impact of drilling declines and lower oil sands capital spending won’t be fully felt until 2021 and 2022, resulting in our supply forecast of 4.4 mmb/d and 4.5 mmb/d, respectively. As such, we expect the Mainline’s utilization to decline in the near term, even with the added capacity from the company’s Line 3 replacement, which we expect to be placed into service by the end of 2021.

To further complicate matters for Enbridge, we expect the Keystone XL and Trans Mountain Expansion to be built and fully operational by 2023. Both pipelines carry significant take-or-pay contracts, which likely will be filled from production that is currently shipped on the Mainline. Accordingly, we expect a period of overcapacity until 2027 in which unused pipeline capacity exists until supply ramps up to our forecast levels. During that period, we expect lower utilization of the Mainline compared with today’s levels.

But we expect the dip in the Mainline’s throughput to only be temporary. Once oil prices recover to our midcycle forecast of $55/barrel WTI by 2022, we expect oil sands producers to turn their attention to growth. We expect solvent-assisted steam-assisted gravity drainage methods to fuel oil sands production growth. With companies using this technology, we believe break-evens for the best in situ projects can fall to $45/barrel WTI by the end of the decade versus current levels of $50-$65/barrel WTI for traditional SAGD operations. Accordingly, we expect SA SAGD break-evens to be generally commensurate with marginal U.S. shale break-evens ($55/barrel WTI).

Given our differentiated oil sands cost outlook, we still think that future production will be higher than some expect after oil prices recover and pipeline expansions are placed into service. Our 2028 Canadian supply forecast is 6.6 mmb/d compared with the Canadian Association of Petroleum Producers’ forecast of 6.1 mmb/d. Further, we expect Canada to add over 1.3 mmb/d of supply growth in the next 10 years, with more than 90% of it coming from the oil sands. We do expect oil sands producers to take a more cautious approach to growth and devote resources to their balance sheets before restarting the growth engine. Accordingly, we have deferred our forecasts for many of the oil sands growth projects in our long-term oil sands supply forecast by about three years.

We think that investors are mistakenly worried that these lower Mainline utilization rates will continue indefinitely. Even with the competing pipelines placed into service as we forecast, we expect the Mainline to operate at near full capacity as we reach midcycle and supply ramps up to our forecast levels. Even though the Mainline won’t be supported by take-or-pay contracts like the competing pipelines, we expect the increased supply to support Mainline cash flows. Accordingly, we expect all the major pipeline expansions to be operating at near full capacity within the next decade. However, supply growth will take a while to play out, and we don’t expect the market to realize Enbridge’s value until it can observe more certainty regarding the stability of the Mainline’s utilization.

Enbridge's Take-or-Pay Won't Pay Off Our base-case assumptions do not include a change to the Mainline's tolling framework, but Enbridge does aim to change the Mainline's contract structure with the competitive landscape tilting away from Enbridge's favor. Under the proposed "priority access" framework, Enbridge intends to convert the contract structure so that 90% of the Mainline's capacity would operate under long-term take-or-pay agreements, with the remaining 10% reserved for spot capacity.

While there has been support for the change in contracts, there has been plenty of pushback by Canada’s large producers. Opponents argue that the new framework puts smaller producers at a disadvantage, acts contrary to the pipeline’s common-carrier purpose, and allows Enbridge to abuse its market power. Even though a supply surplus exists in the market, the additions of the Keystone XL and Trans Mountain Expansion, coupled with declining production levels, will turn that surplus to a deficit that won’t be fully eliminated until 2027, when supply fully ramps up to fill all available pipeline options. As such, producers risk overcommitting to pipeline capacity and significantly increasing the cost structure by agreeing to the Mainline priority access framework. With oil sands costs on the higher end of the cost curve and crude prices sitting at depressed levels, we don’t think it’s something that many producers will risk, even with the development of lower-cost extraction technology keeping oil sands competitive. It’s also likely that the supporters may fall off in response to lower oil prices and the positive momentum associated with the construction of the Keystone XL and Trans Mountain Expansion. As such, we don’t think Enbridge will succeed in implementing the new framework.

If Enbridge is successful in converting the Mainline’s framework, we would only modestly increase our fair value estimate to $42/CAD 59 from $41/CAD 57. Although we see increased medium-term (2021-26) Mainline throughput and cash flow under this scenario, our midcycle estimates remain more or less consistent with our base case, which assumes that all pipelines are operating at near full capacity.

There's More to Enbridge Than the Mainline Enbridge's portfolio contains a breadth of attractive assets carrying long-term contracts that insulate the company's cash flows. We think that the market is overlooking the cash flow-generating ability of these assets to sustain the dividend while the Mainline is operating at lower levels. These assets also reinforce our wide moat rating.

Before the acquisition of Spectra Energy in 2017, the Mainline was the biggest driver of Enbridge’s profitability, accounting for approximately 60% of EBITDA in 2015. Since the acquisition, the Mainline represents only about 30% of the company’s EBITDA. Enbridge added assets from the legacy Spectra business along with organic growth projects to reduce its reliance on the Mainline.

Aside from the Mainline, Enbridge operates long-haul natural gas pipelines, a majority of which are legacy Spectra assets, that are underpinned by long-term take-or-pay contracts. These assets offer stable cash flows that can be used to offset any volatility in Mainline cash flows. Combined, Enbridge’s gas pipelines carry an average remaining contract term of over 10 years, and an average of 97% of the assets’ throughput is under contract.

Enbridge also operates a regulated utility in the greater Toronto area. Under the regulated framework, Enbridge often earns returns on equity in excess of 10% compared with the average allowed ROE for U.S. utilities of 9.6%, creating stable cash flow generation. Strengthening the utility’s position is the region’s growth outlook. The Ontario government expects the greater Toronto area’s population to grow at a nearly 2% compound annual rate over the next five years, which provides opportunities for Enbridge to expand its utilities rate base and further increase its cash flow generation.

Enbridge’s liquid pipeline business includes other assets with long-term take-or-pay contracts that can insulate cash flows amid Mainline throughput volatility. The company operates the Express-Platte long-haul crude pipe and regional oil sands pipelines. It also operates downstream pipelines that connect Canadian and Bakken crude supply from the Chicago area into other regions of the U.S. Midwest; eastern Canada; Cushing, Oklahoma; and the U.S. Gulf Coast. On these downstream pipelines, Enbridge has 1 mmb/d of firm commitments. The downstream connections can only be reached by the Mainline system. Thus, 35% of the Mainline’s capacity is essentially under firm contracts. Combined, almost 75% of the company’s 2019 EBITDA was underpinned by long-term take-or-pay contracts or other secured contracts.

Not only do these contract structures help generate stable cash flow and preserve the balance sheet, but also they provide dividend stability. After a 10% increase in 2020, we expect Enbridge to increase the dividend 3% annually as future growth projects slow. Even with the smaller long-term growth portfolio and the associated increase in cash taxes due to the lower growth, Enbridge should have enough distributable cash flow to meet our projected dividend increases in the near term when the Mainline is operating at reduced levels and in our midcycle environment. Accordingly, we expect the company’s distributable cash coverage ratio to decline to a normalized level around 1.3 times within the next decade, which is more than enough buffer to maintain the dividend level.

Balance Sheet Looks Solid Enbridge possesses a strong balance sheet with excess liquidity. The company set a leverage target of 4.5-5 times net debt/EBITDA, which it met by the end of 2018. Because of lower volumes on the noncontracted portions of the company's pipelines, we expect leverage to creep slightly above the target range in 2020 and 2021 before gradually falling below the target range over our forecast period.

The company also has over CAD 9 billion of undrawn liquidity on its revolving credit facilities paired with almost CAD 4 billion in cash after its recent debt issuance. We expect Enbridge to meet all of its 2020 obligations, but it will need to extend some of its debt maturities by the end of 2021, which we don’t think will be a problem, given its investment-grade status and the breadth of long-term take-or-pay contracts.

Multiples Tell the Same Story: Enbridge Is Highly Undervalued Our base-case intrinsic fair value estimate implies that Enbridge is highly undervalued. But the stock is also cheap when looking at historical multiples, which reinforces our $41/CAD 57 fair value estimate.

Enbridge’s business model has evolved with the acquisition of Spectra Energy, so our analysis includes the historical multiples of both companies. Since 2010, Enbridge’s stock has traded at an average enterprise value/forward EBITDA multiple of 12.1 times, slightly less than Spectra Energy’s average multiple of 13.2 times. At the current share price, Enbridge is trading at 9.6 times, about a 20% discount to its long-term average and a 35% discount to Spectra’s long-term average. To further support our valuation, our fair value estimate approximates an enterprise value/forward EBITDA multiple of 11.7 times, which is still a discount to Enbridge’s and Spectra’s long-term averages.

Relative to the S&P 500 index, Enbridge’s EV/EBITDA trailing multiple has traded at 1.4 times premium since 2010, while Spectra traded at an average 1.6 times premium. However, Enbridge’s stock is currently trading at a 50% discount to its historical relative trading multiples. To further support our valuation, our fair value estimate approximates a relative multiple of 1 times relative to the index, which is still 40% below Enbridge’s historical averages.

/s3.amazonaws.com/arc-authors/morningstar/767bcaab-ca87-4ef4-95f9-7d05d83708bc.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/767bcaab-ca87-4ef4-95f9-7d05d83708bc.jpg)