Sustainable Funds Weather the First Quarter Better Than Conventional Funds

These funds were helped by a focus on companies with strong ESG profiles and less exposure to energy.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

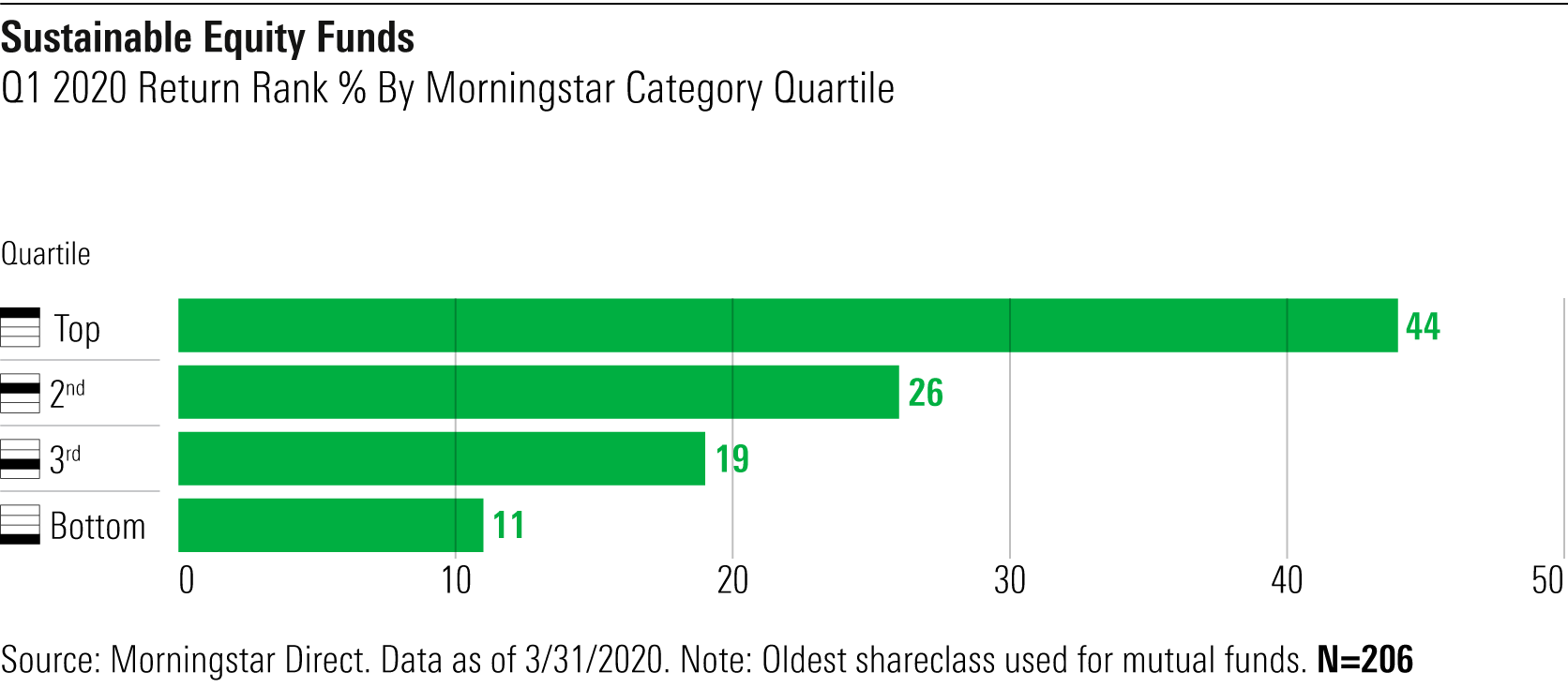

Like all equity funds, sustainable equity funds suffered sudden and large losses during the first quarter of 2020 because of the coronavirus pandemic, but they held up better than conventional funds. Seven out of 10 sustainable equity funds finished in the top halves of their Morningstar Categories, and 24 of 26 environmental, social, and governance-tilted index funds outperformed their closest conventional counterparts.

Sustainable Funds Lost Less Than Their Peer Groups Based on a comparison of the first-quarter returns of 206 sustainable equity open-end and exchange-traded funds available in the United States with those of their respective categories, sustainable funds performed better on a relative basis.

Bear in mind that sustainable funds do not constitute an asset class of their own; they invest across capital markets. For purposes of peer grouping, Morningstar therefore places them into our standard categories alongside conventional funds that invest in the same parts of the market, defined for equity funds in terms of region, market cap, and investment style (value, blend, or growth).

During the first quarter, the returns of sustainable equity funds were clustered in the top halves of their respective categories, and more sustainable funds' returns ranked in their category's best quartile than in any other quartile. The returns of 70% of sustainable equity funds ranked in the top halves of their categories and 44% ranked in their category's best quartile. By contrast, only 11% of sustainable equity funds finished in their category's worst quartile. That's 4 times more sustainable funds finishing in the best quartile than in the worst quartile of their categories.

Based on first-quarter returns, sustainable funds were substantially over-represented in the top quartiles and top halves of their peer groups (by definition, 25% of all funds in a category place in each of four quartiles).

Sustainable Index Funds Lost Less Than Conventional Index Funds Sustainable index funds are designed as alternatives to conventional index funds across equity markets. Based on a comparison of 26 sustainable index funds with those of conventional index funds covering U.S. stocks, non-U.S. developed-markets stocks, and emerging-markets stocks, 24 of them outperformed the comparable conventional index fund.

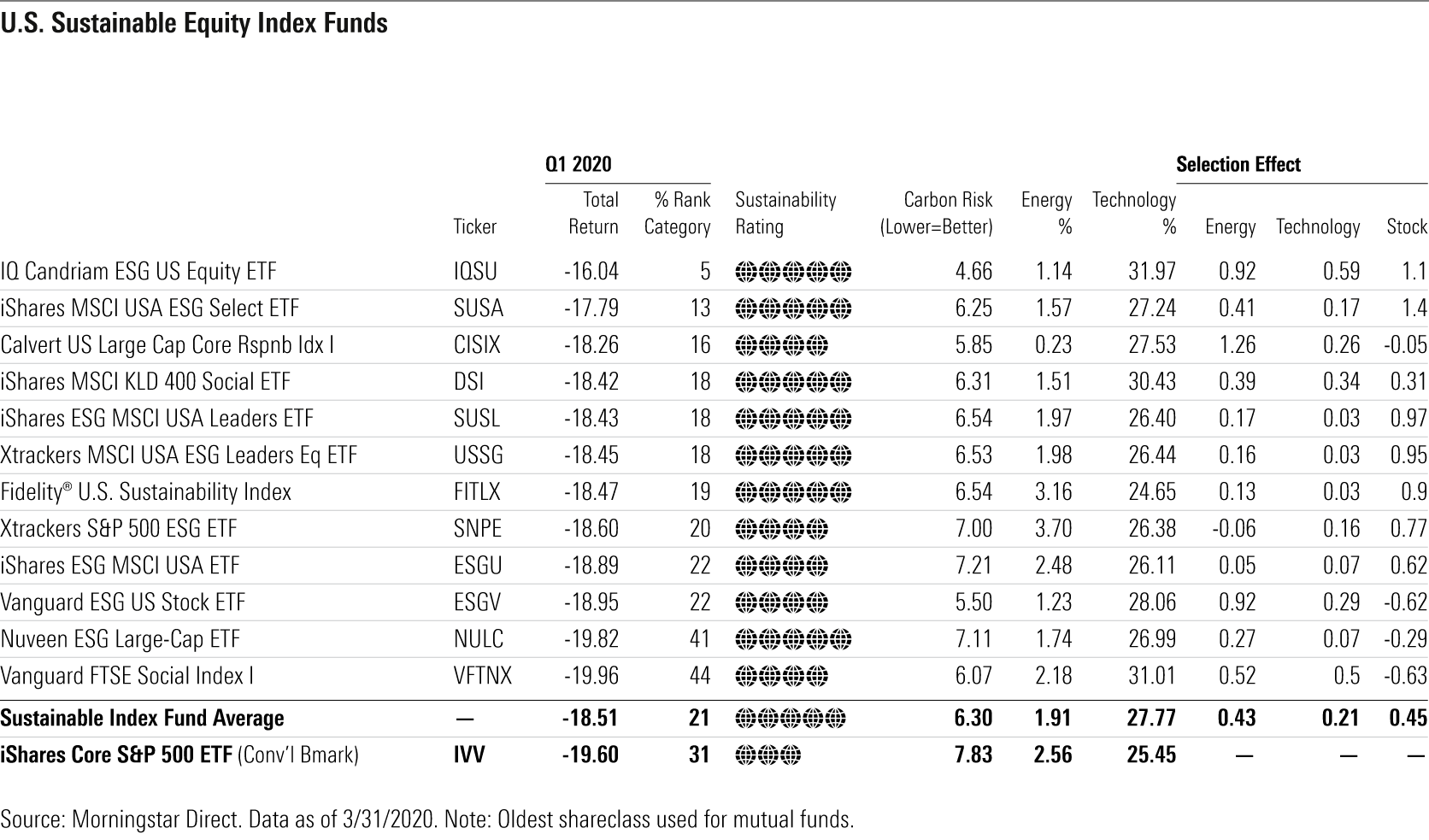

U.S.: Among U.S. stock index funds, 10 of the 12 sustainable funds found in the large-blend category lost less than iShares Core S&P 500 ETF IVV for the quarter. While IVV lost 19.60%, the average ESG passive fund's return was negative 18.51%.

These returns are net of expenses and thus take into account the higher expense ratios of the ESG funds. IVV has an ultralow expense ratio of 0.04%, while the expense ratios of the dozen ESG passive funds range from 0.10% to 0.25%, and average 0.16%.

The top-performing sustainable index funds for the quarter were IQ Candriam ESG U.S. Equity ETF IQSU, which is based on a proprietary index developed for IndexIQ by European sustainable asset manager Candriam, and iShares MSCI USA ESG Select ETF SUSA, based on MSCI's ESG Select index series.

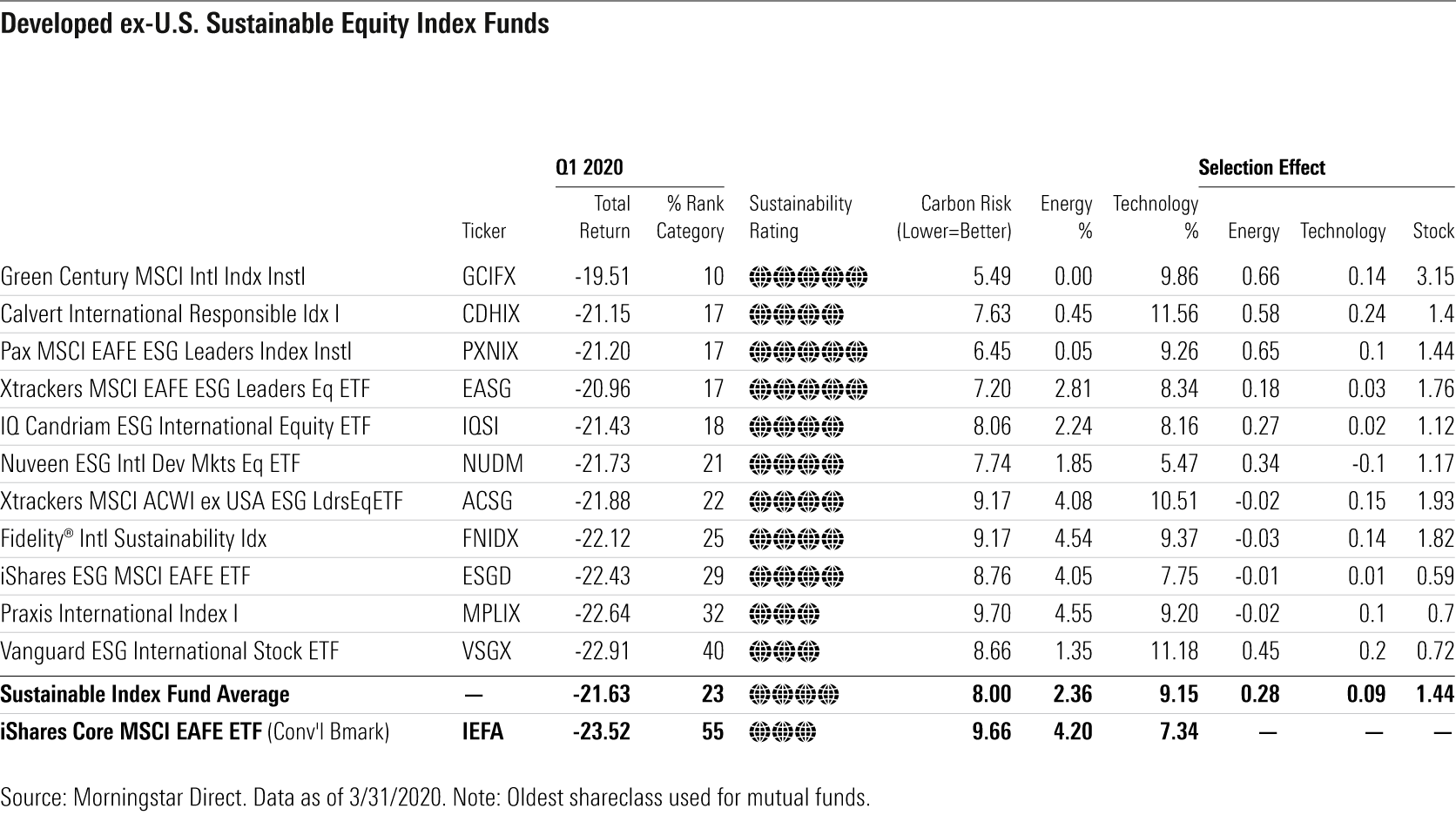

Non-U.S. Developed Markets: The story looks even better for sustainable index funds investing outside of the U.S. All 11 passive sustainable funds in the foreign large-blend category outperformed iShares Core MSCI EAFE ETF IEFA for the quarter. While IEFA lost 23.52%, the average ESG index fund return was negative 21.63%.

As with the comparisons of U.S. funds, these returns are net of expenses and thus consider the higher expense ratios of the ESG funds. IEFA has an expense ratio of 0.07% while the expense ratios of the 11 passive ESG funds range from 0.14% all the way to 0.98%, and average 0.34%. Five funds have expense ratios between 0.14% and 0.20%.

The top-performing passive international ESG funds for the quarter were Green Century MSCI International Index GCIFX, a proprietary version of the MSCI World ex USA ex Fossil Fuels Index, and Calvert International Responsible Index CDHIX, based on Calvert's own proprietary index. While the Green Century fund is the one that has the aforementioned 0.98% expense ratio, it's worth noting that all of the profits earned in managing the Green Century fund go to its environmental nonprofit owners and can be used to support their environmental and public health campaigns.

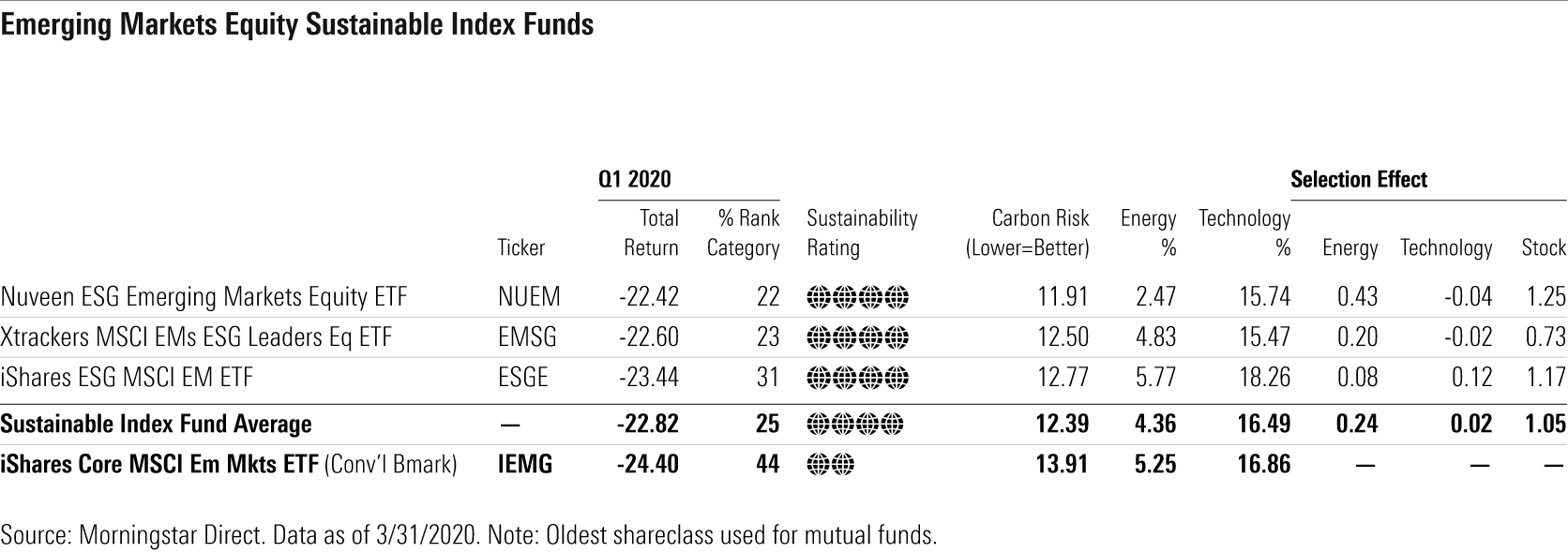

Emerging Markets: All three emerging-markets sustainable index funds outperformed iShares Core MSCI Emerging Markets ETF IEMG for the quarter. They posted an average return of negative 22.82%, outperforming IEMG by 1.58 percentage points. The ESG funds also had to overcome higher expenses (0.20%, 0.25%, and 0.45% compared with IEMG's 0.13%).

Why Did Sustainable Funds Hold Up Better? Sustainable funds were helped by having less exposure to energy stocks than market indexes. Energy stocks fell more, by far, than those of any other sector during the quarter. The U.S. sustainable index funds, for example, had average energy exposure of 1.9% compared with 2.6% for the S&P tracker IVV. Based on attribution analysis, U.S. sustainable index funds' energy-sector underweightings contributed an average of 0.43% to their outperformance of the S&P 500. Non-U.S. sustainable index funds were also underweight energy, leading to 0.28% and 0.24% energy-sector selection effects for developed-markets and emerging-markets funds, respectively.

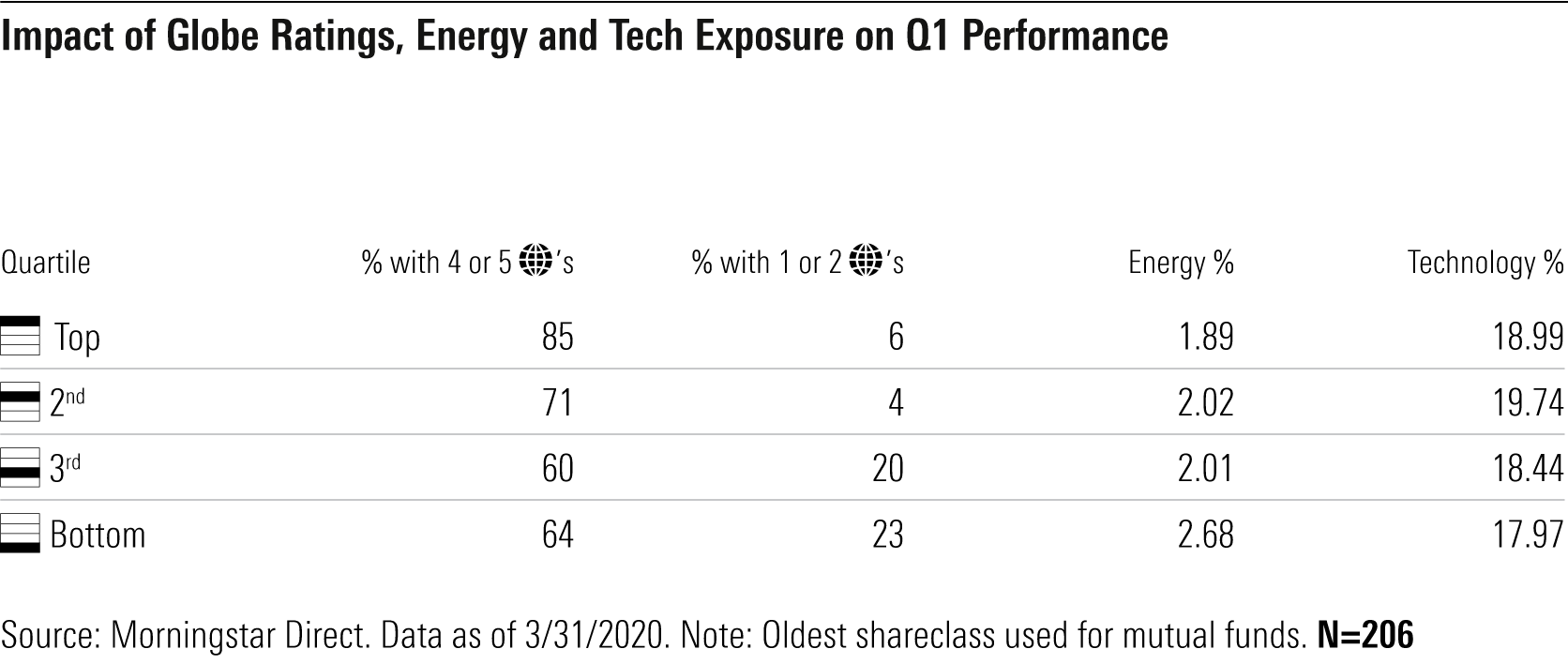

For sustainable equity funds overall, we see in the exhibit below that lower energy exposure is associated with higher returns, based on category rankings.

Technology had some impact on sustainable-fund outperformance but a much smaller one than energy. Information technology was the quarter's best-performing sector, and sustainable funds were generally overweight here. This had a positive effect on index fund performance, albeit not of the magnitude of the energy effect, and it applied mainly to U.S. funds. The U.S. sustainable index funds had an average 27.8% technology-sector exposure, compared with 25.5% for the S&P 500-based IVV. Those overweightings contributed an average of 0.21% to their outperformance of the S&P 500, which was about half the energy-sector effect. For non-U.S. sustainable index funds, the technology-sector effects were de minimus because technology has a much smaller weighting in those markets' indexes. For sustainable equity funds overall, technology exposure does not appear to be associated with higher returns for the quarter.

Perhaps the biggest reason for their outperformance is that sustainable funds appear to have benefited from selecting stocks with better ESG credentials. A feature of sustainable funds is, of course, their emphasis on companies across sectors that have performed well on various ESG criteria. These tend to be companies that attend to their environmental challenges, treat their stakeholders well, and govern themselves in an ethical way. Many such companies are proving to be more resilient during the sudden crisis in which we now find ourselves. They are the quality companies of the 21st Century, and quality companies tend to hold up better than their lower-quality counterparts in difficult markets.

Among the sustainable index funds considered here, all but two have Morningstar Sustainability Ratings of 4 or 5 globes, indicating they hold companies with stronger ESG profiles and lower ESG risk. Moreover, we see from the attribution analysis that the average overall stock-selection effect for sustainable index funds was not only positive but also larger than the energy sector-selection effect for U.S. and non-U.S. funds. For U.S. funds, stock selection contributed an average of 0.45% to outperformance. For non-U.S. funds, the stock-selection effect was much greater: 1.44% for developed-markets funds and 1.05% for emerging-markets funds. From the previous exhibit, we also see that sustainable funds with first-quarter returns in the top halves and especially the top quartiles of their categories, tended to be those with better globe ratings.

Short-Term Performance, Long-Term Impact The better relative performance of sustainable funds in the first quarter derives mainly from their focus on companies that have stronger ESG profiles/lower ESG risk and, secondarily, from their tendency to be underweight energy.

Given the magnitude of the stock market decline in the first quarter, the actual difference between the returns of sustainable funds and conventional funds may seem trivial. But most of the growth of sustainable investing has taken place since the global financial crisis, much of it in just the past five years. That means few sustainable funds have been through the stress test of a bear market until now. In this bear market, they have proved to be decent performers.

But the bigger-picture rationale for sustainable investing is also important to keep in mind in a time like this. It's one that I expect will be strengthened in the aftermath of this global pandemic. Yes, sustainable investing is about delivering competitive financial performance on an ongoing basis, aided by the insights of ESG analysis, but it's also about helping companies move toward a more long-term stakeholder-centric model of corporate behavior. That longer-term impact, not short-term performance, is the motivating factor behind sustainable investing. When all is said and done, I think we'll find that companies already moving in that direction will be the ones remembered for helping us get through this crisis, and demand will grow for others to follow suit in the future.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)