Financial Services Is Undervalued Based on Long-Term Fundamentals

Berkshire an ideal defensive investment for the long term.

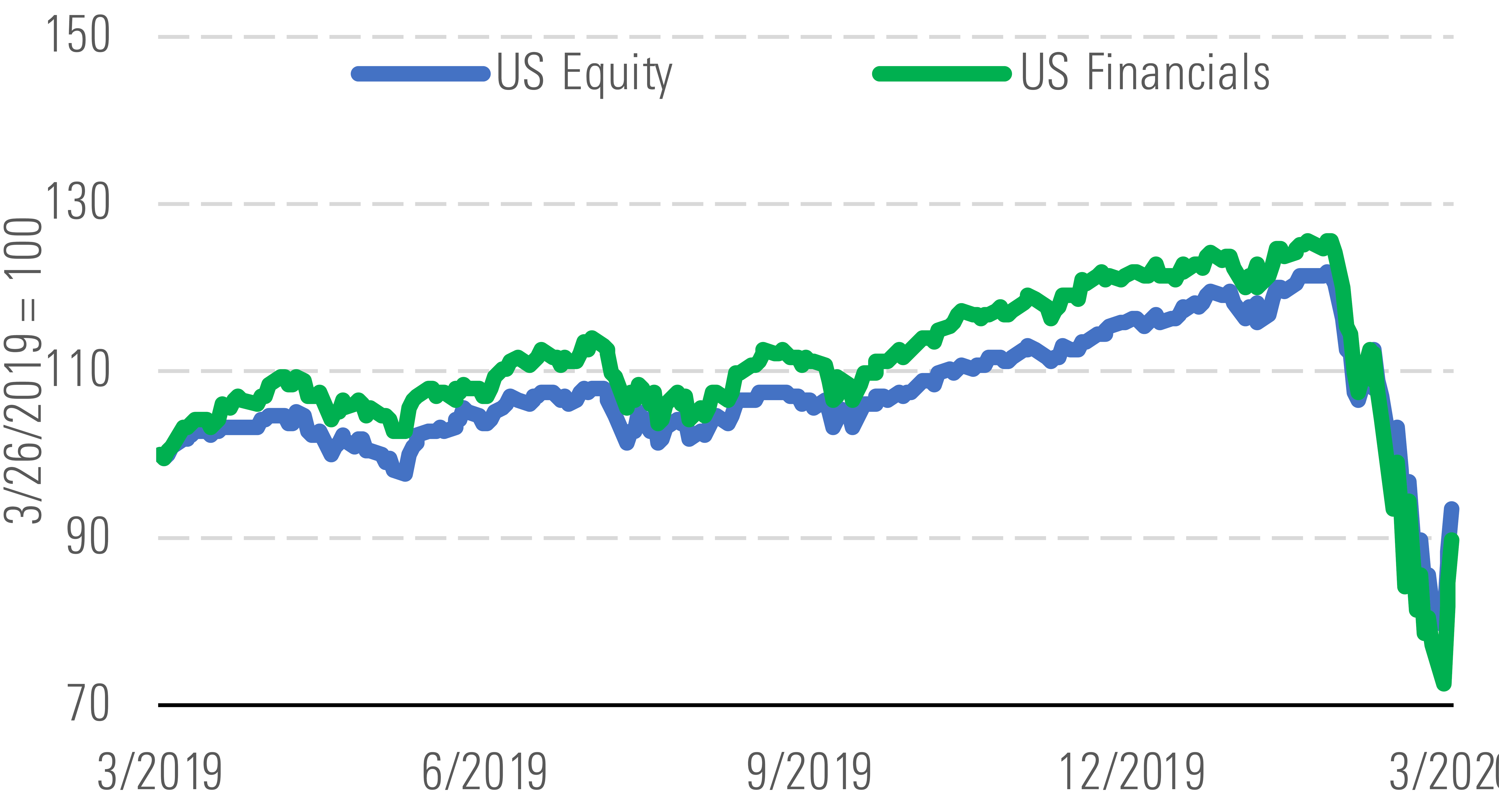

The Morningstar US Financial Services Index has significantly underperformed the Morningstar US Markets Index quarter to date, down 26.2% compared with 19.1%, and year to date, down 10.3% compared with 6.4%. That said, the median North America-based financial-services stock trades at a 27% discount to its fair value estimate, so we consider the North American financial sector undervalued. The valuation of financials has rapidly changed from a quarter ago, when the median financial sector stock was 3% overvalued.

Financials have been one of the worst-performing sectors. - source: Morningstar

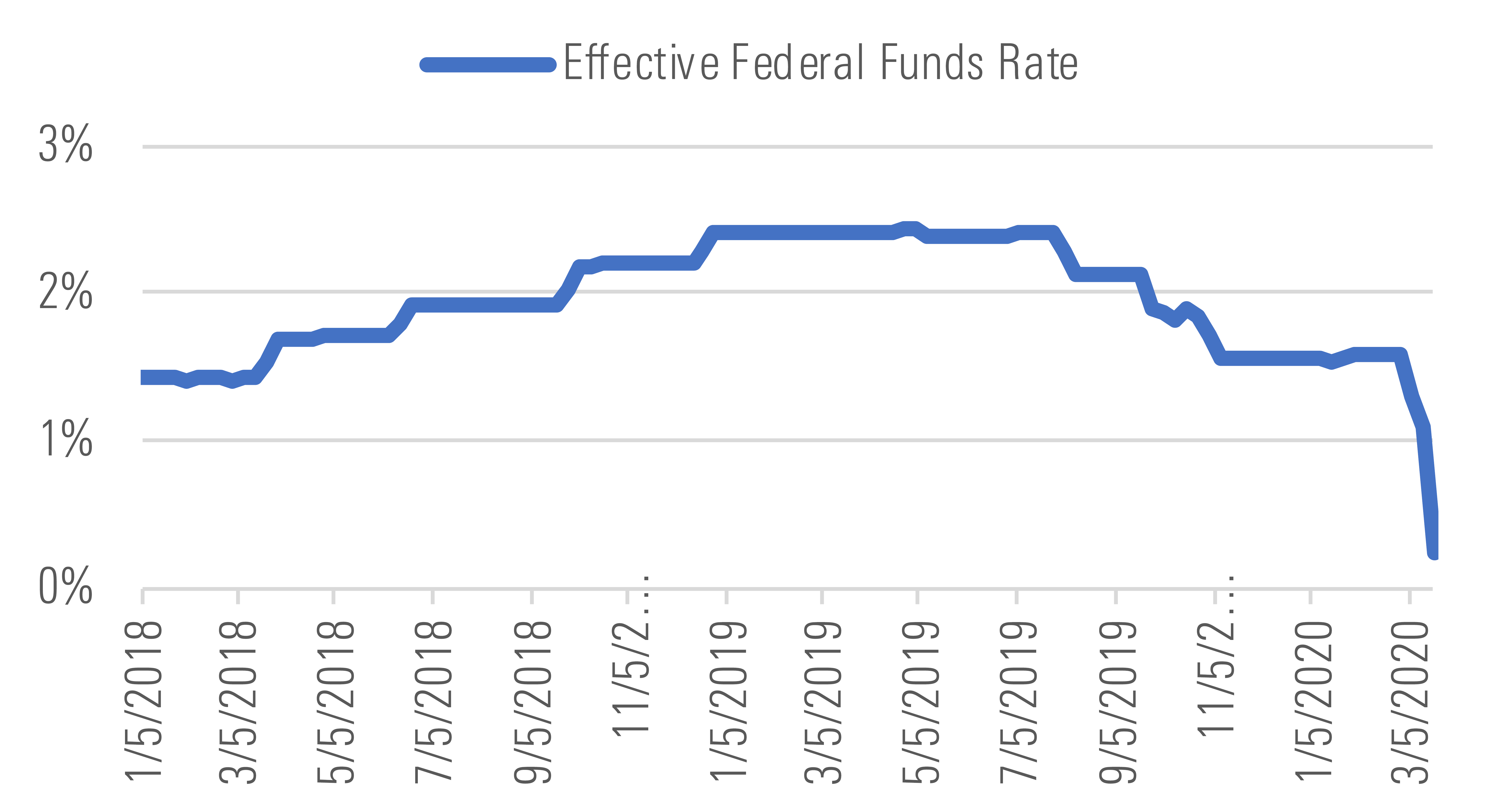

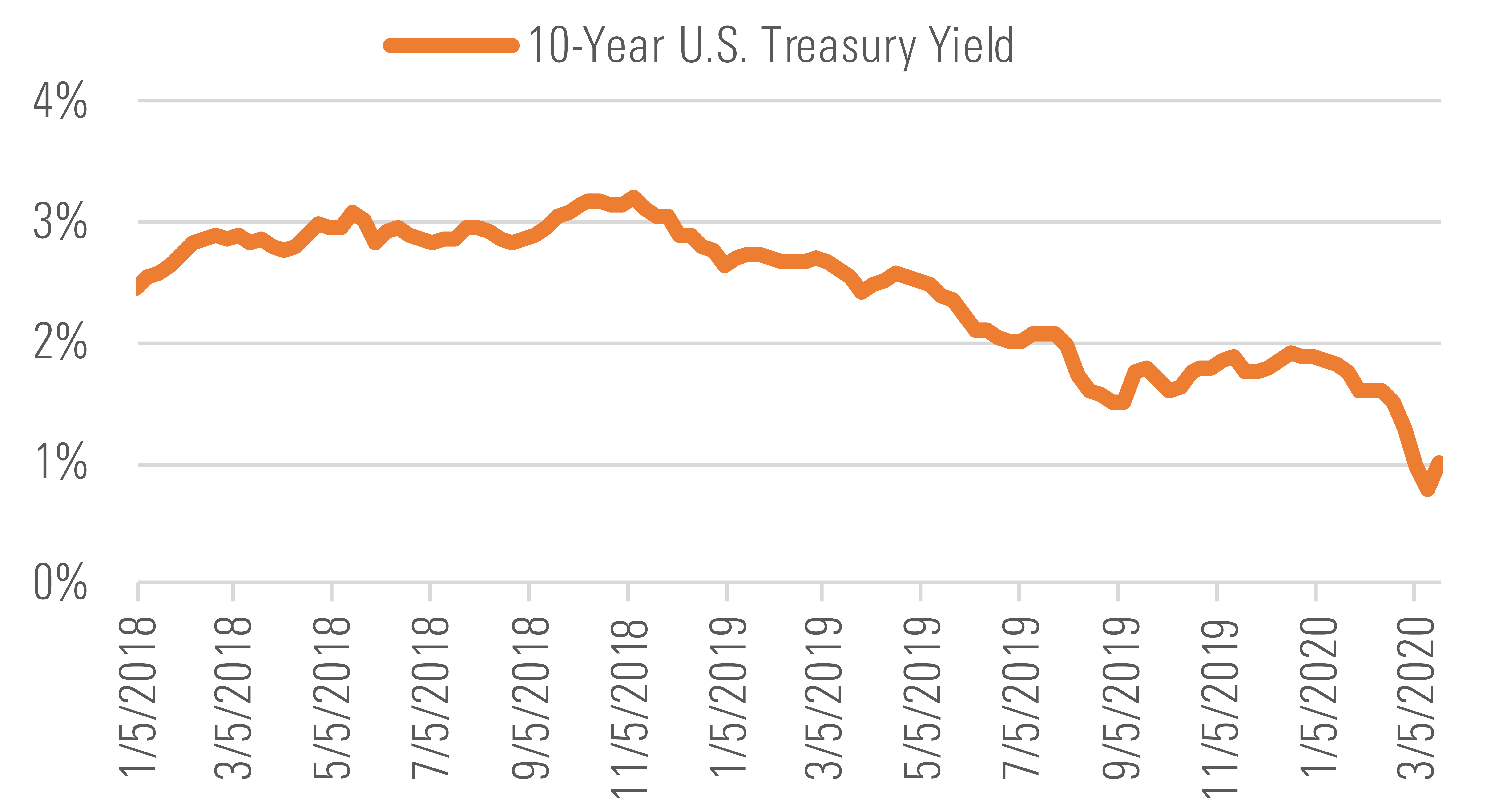

The recent underperformance of the financial sector is understandable, given that two of its primary earnings drivers, interest rates and asset prices, have been in free-fall over the past several weeks because of the coronavirus outbreak. The U.S. Federal Reserve cut the federal-funds rate 150 basis points to a target range of 0% to 0.25% in March 2020 to deal with the negative economic impact of the coronavirus. This compares with the target range of 1.5% to 1.75% at the end of 2019 and a recent peak of 2.25% to 2.5% at the end of 2018. The 10-year U.S. Treasury yield has also fallen, to about 1% from about 1.9% at the end of 2019. Many financial industries are sensitive to changes in interest rates, such as banking, insurance, and investment services.

Short-term interest rates have dived. - source: Morningstar

Along with long-term rates. - source: Morningstar

Despite easing monetary policy, the Morningstar U.S. market has continued to fall and is down about 23% from the beginning of the year and down 27% from its peak in February. Asset- and wealth-management firms whose primary business involves managing client assets will be the most directly affected by the decrease in asset prices. However, many other firms still have exposure to falling asset prices, as they hold securities on their balance sheet, such as insurers and investment banks.

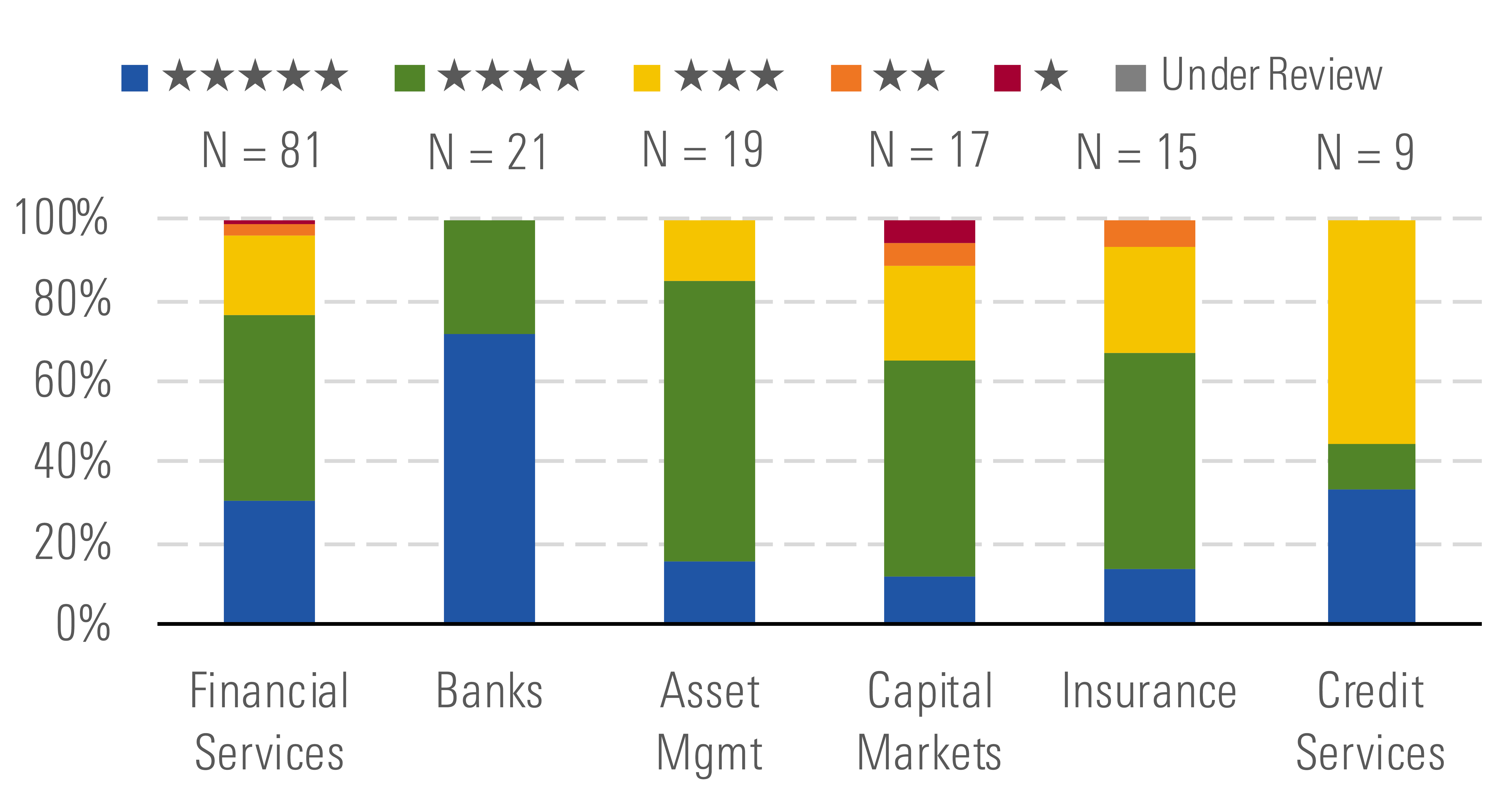

Financial sector earnings are destined for a significant decline. There are also risks that could still take several quarters to become apparent, such as the severity of unemployment, bankruptcies, and duration of low interest rates. That said, we believe many financial sector companies are trading below their long-term intrinsic value.

Majority of financials trading at less than intrinsic value. - source: Morningstar

Top Picks

Berkshire Hathaway BRK.B Economic Moat Rating: Wide Fair Value Estimate: $253 Fair Value Uncertainty: Medium

While Berkshire Hathaway will see some impact to its equity investment portfolio, as well as some of its more recession-sensitive businesses, in the near term, the company has a larger percentage of businesses that are neither interest-rate- nor economically sensitive, with the firm's stock tending to perform better than the broader market during market and economic downturns. Berkshire currently has a ton of cash on hand, a propensity for finding uniquely profitable investments during downturns, and a disciplined share-repurchase program, making it an ideal defensive name right now for long-term investors.

American Express AXP Economic Moat Rating: Wide Fair Value Estimate: $125 Fair Value Uncertainty: Medium

Investors should expect American Express to see a significant decline in profitability in 2020 as a result of COVID-19. We believe the company’s wide moat partly insulates American Express, giving the company significant resilience in today's crisis. Early indications suggest Amex revenue will fall by only a mid-single-digit percentage before rebounding in 2021. We’ll remind investors that in the 2008 recession, Amex’s returns on equity bottomed at just below 14% in 2009 before rebounding to 26% a year later. The market price implies that Amex will see a sustained decline in returns on equity. We anticipate returns on equity to fall below 11% in 2020 then bounce back the following year as businesses resume spending and credit losses decline.

Broadridge Financial Solutions BR Economic Moat Rating: Narrow Fair Value Estimate: $116 Fair Value Uncertainty: Low

We view Broadridge as a haven in volatile times. Its core proxy and interim business is driven by the number of positions held for stocks, mutual funds, and exchange-traded funds, which tends to be relatively inelastic to market conditions. We note that during the Great Recession, the worst year-over-year change was a 2% decline in fiscal 2009 for equity positions. We also expect Broadridge’s global technology and operations segment to modestly benefit in the near term from higher trading volumes. COVID-19 disruption will likely elongate sales and implementation cycles, but we expect Broadridge to continue to achieve 97%-plus revenue retention.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)