Stocks Cheap After First-Quarter Plummet

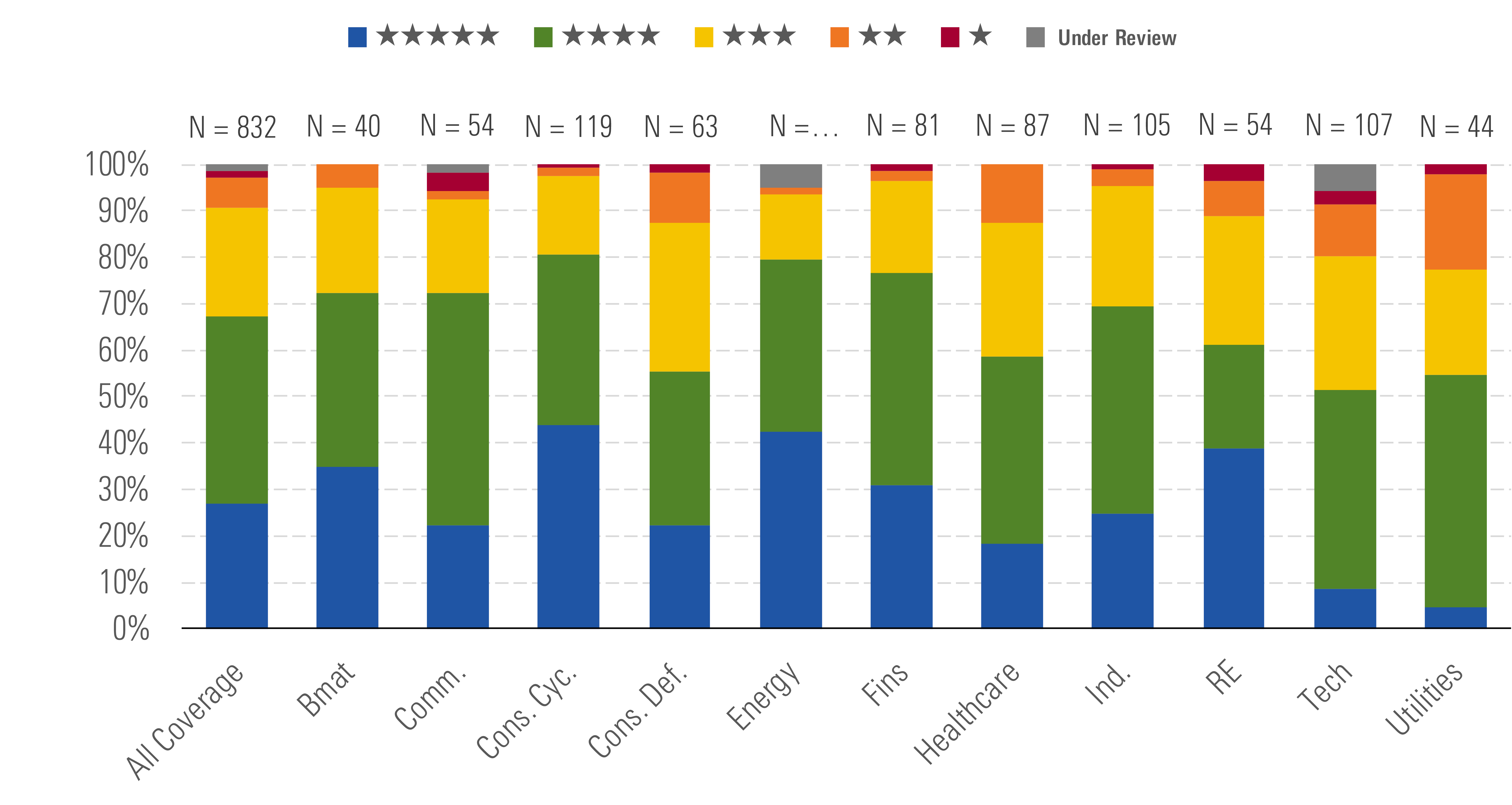

Two thirds of the stocks in our North American coverage are undervalued, trading at 4 or 5 stars.

The global COVID-19 pandemic has swiftly reversed our view of the North American equity market. Amid virus and related economic concerns, the Morningstar US Market Index has plummeted roughly 20% from the end of 2019. And although we have lowered many of our fair value estimates, the market drop has revealed numerous buying opportunities across sectors. The median stock in our North American equity coverage now trades at a 22% discount to our fair value estimate compared with the 3% premium at the end of last year. Of the roughly 800 North American stocks we cover, a hefty 67% have an undervalued rating of 4 or 5 stars, whereas three months ago, only about 20% were undervalued. Excluding utilities, the median stock in the other 10 sectors we follow trades at a more than 10% discount to intrinsic value. The market hasn’t been this heavily discounted in many years.

- Energy remains the cheapest sector in our coverage following shocks to both oil demand (COVID-19) and supply (break up of OPEC+). We don't think today's low oil prices are sustainable in the long run, and our $55 per barrel midcycle price forecast is unchanged.

- The sell-off in consumer cyclical stocks is also overdone. The median travel and leisure stock in our coverage trades at about half of our estimate of intrinsic value.

- For investors looking for companies less likely to be affected by a recession, tech and utilities, two sectors that we thought looked materially overvalued heading into 2020, now trade at discounts.

Two Thirds of Our North American Coverage Is Undervalued - source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)