How to Advise Conscientious Investors

Contributor Michael Pompian offers ideas for working with this personality.

This is the eighth article in a series focusing on the Big Five personality traits and how they relate to the behavioral biases of investors. Over the years, I have followed a debate between the effectiveness of the Myers-Briggs test versus another widely used personality test, the Big Five. More recently, the debate has intensified. I decided to conduct a study of the Big Five. I studied 121 investors, examining the relationship between the Big Five and investor biases. Why? Because taking the time to understand the underlying personality of the investor leads to better advice and results.

This month's article provides advice on dealing with investors high in conscientiousness, the subject of last month's article.

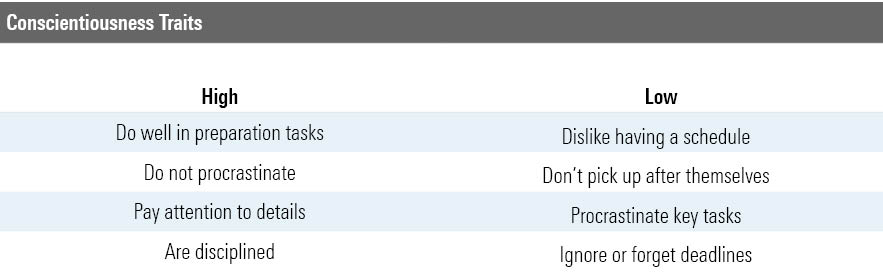

As a quick refresher, people high in conscientiousness are thoughtful, disciplined, goal-oriented, and possess good impulse control. They’re well organized and pay close attention to detail. The conscientious are planners who think about how their behavior affects others. Lastly, they are mindful of deadlines.

Working with Conscientious Investors Conscientious investors tend to have original ideas about investing and like to get involved in the investment process. They may even have a contrarian mindset. Conscientious investors can and do stick to an investment plan to accomplish their financial goals. At their essence, they are analytical, critical thinkers who make many of their decisions based on logic and their own gut instincts. They are willing to take risks and act decisively when called upon to do so. These investors can accomplish tasks when they put their minds to it; they tend to be thinkers and doers as opposed to followers and dreamers.

The risk tolerance of conscientious investors tends to be higher than average and so is their ability to understand risk; they are realistic in understanding that risky assets can and do go down. Conscientious investors may choose to do their own research and feel uncomfortable with an investment until they have confirmed their decision with research or some form of corroboration. They are comfortable collaborating with advisors, though they typically use advisors as sounding boards for their own ideas. Conscientious investors are often comfortable speaking the language of finance and understand financial terms, including market and economic-related vocabulary. They aren’t afraid to delve into the details of investments, including the related costs and fees.

Upside/Downside of Conscientious Investors There are certain benefits that accrue to conscientious investors. At their essence, they are cerebral thinkers who aren't afraid to put their investment ideas into action by implementing them in their portfolios. Successful investing requires the fortitude to not only have original ideas, but also to put them into action when required to do so. Conscientious investors can take risks and act decisively. They also can be contrarian investors and are often successful, as there are many investors who follow the herd and are often unhappy as a result. As they are analytical in nature, conscientious investors may help themselves by finding the lowest-cost service providers.

The downside for conscientious investors mainly has to do with biases that can torpedo their ability to reach their financial goals. For instance, they may seek information that confirms their decisions, as opposed to finding information that may contradict their hypotheses, which can lead to suboptimal results. They may also irrationally cling to their self-generated ideas as opposed to being open to new thoughts that may prove them wrong. Their analytical nature may actually work against them at times. For example, some conscientious investors may focus too much on taxes and not enough on pursuing an appropriate investing strategy.

Advice for Conscientious Investors Conscientious investors can be difficult clients to advise due to their cerebral mindset, but they are usually grounded enough to listen to sound advice when it is presented in a way that respects their independent views. As we have learned, they are confident in their beliefs and decisions but can be blinded by their contrary thinking.

Education is essential to changing behavior of conscientious investors. A good approach is to have regular educational discussions during client meetings--this way, the advisor doesn’t point out unique or recent failures, but rather educates regularly and incorporates concepts that may be appropriate for the client. Because conscientious investors’ biases are mainly cognitive, education on the benefits of portfolio diversification and sticking to a long-term plan is usually the best course of action.

Advisors should challenge their conscientious client to reflect on how they make investment decisions and provide data-backed substantiation for recommendations. Offering education in clear, unambiguous ways is effective, and if advisors take the time, then this steady, educational approach should yield positive results.

Michael M. Pompian, CFA, CAIA, CFP is an investment advisor to family office clients and is based in St. Louis. His book, Behavioral Finance and Wealth Management, is helping thousands of financial advisors and investors build better portfolios of investments. Contact him at michael@sunpointeinvestments.com.

The author is a freelance contributor to Morningstar.com. The views expressed in this article may or may not reflect the views of Morningstar.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)