Risky Assets Reduce Fixed-Income Returns

Only U.S. Treasuries have been able to generate gains as the severe widening across credit spreads on risky assets has led to losses across the rest of the fixed-income universe.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Investment allocations in the fixed-income sector typically provide at least a modicum of return during equity market pullbacks; however, only Treasury bonds have been immune to the effects of the COVID-19 pandemic. The heightened uncertainty as to how long the virus will persist, as well as wide estimates as to how quickly the economy can normalize thereafter, has driven down the value of corporate and structured-finance bonds. Bonds that trade at a spread over Treasuries have been decimated across the board over the past few weeks. Markets have looked to sell risk assets first and ask questions later.

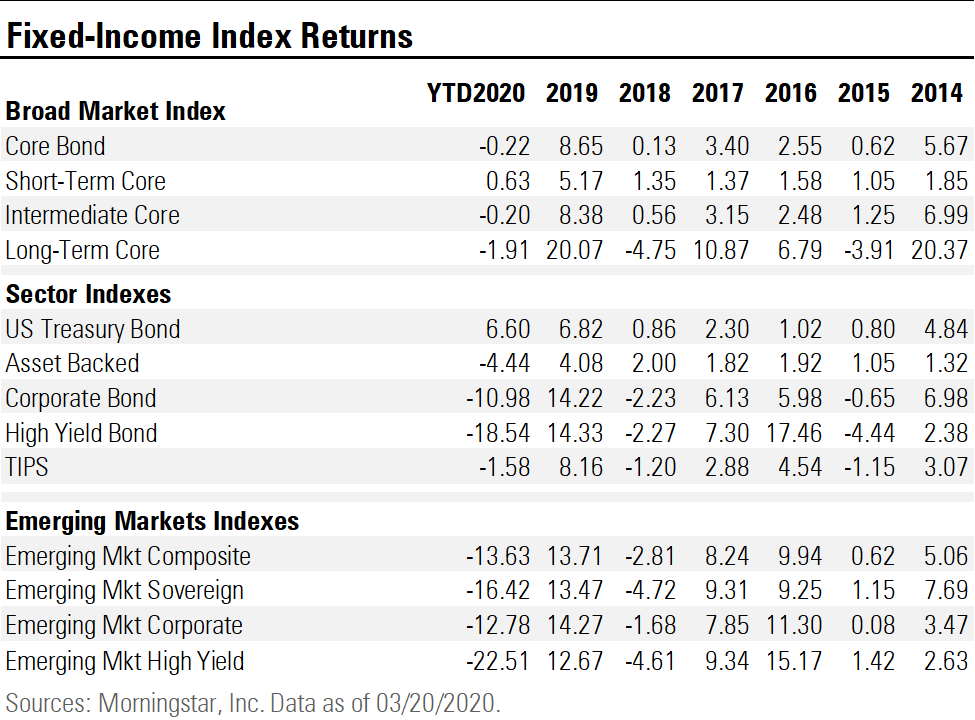

Year to date through March 20, the Morningstar Core Bond Index (our broadest measure of the fixed-income universe) is essentially unchanged, registering a return of negative 0.22%. Within the overall fixed-income universe, the Treasury bond component has performed well thus far this year as the Morningstar US Treasury Bond Index has risen 6.60%. This gain has mainly been driven by a decline in interest rates across the entire yield curve, which has pushed Treasury bond prices up over the short term. The yield on the 2-year Treasury has plummeted 127 basis points to 0.31%, and the 5-year has plunged 123 basis points to 0.46%. In the longer end of the curve, the 10-year has dropped 107 basis points to 0.85%, and the 30-year has declined 97 basis points to 1.42%.

However, while Treasury bonds have provided significant gains, corporate bonds and asset-backed securities have declined substantially as widening credit spreads have more than offset the decline in interest rates. The Morningstar Asset-Backed Bond Index has declined 4.44%, the Morningstar Corporate Bond Index has dropped 10.98%, and the Morningstar High-Yield Index has plunged 18.54%.

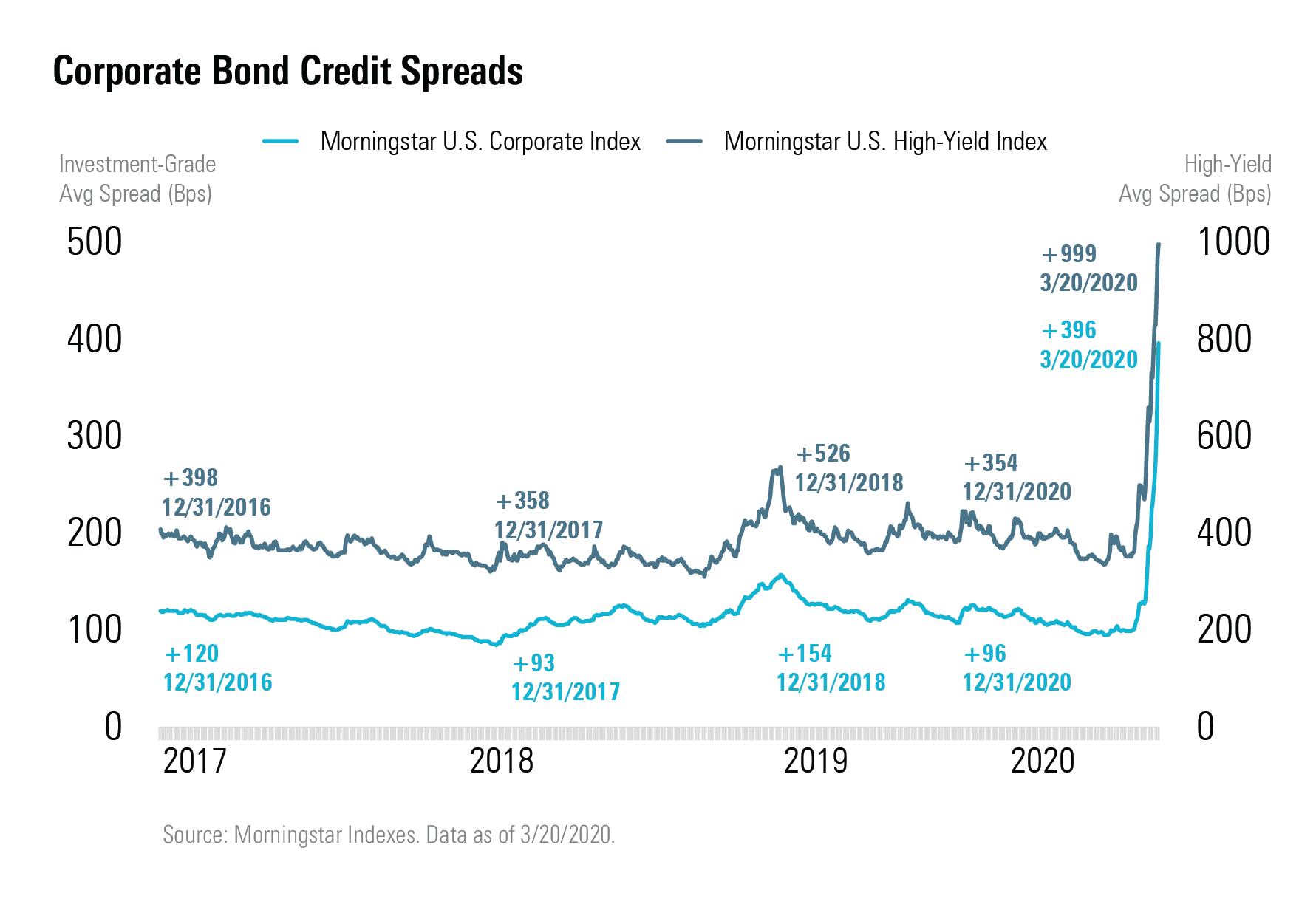

As investors attempt to gauge the overall global impact of COVID-19 and the resulting economic shutdowns, credit spreads have blown out to account for the increased risk of credit rating downgrades and defaults. The negative impact of the coronavirus has been exacerbated in the corporate bond markets as an oil price war emerged between Russia and Saudi Arabia. This has pushed the per-barrel price of oil down into the mid-$20s, below the break-even cost for many oil companies. In the investment-grade sector, the average credit spread in our index has widened out 299 basis points to +396 thus far this year. A significant amount of the widening in the overall index has occurred in the energy sector. The plunge in oil prices has greatly increased the risk that energy companies currently rated in the low-investment-grade category could be downgraded to junk bond status in the near term. Among high-yield bonds, the average credit spread has skyrocketed 643 basis points to +999.

At these levels, a significant amount of the downside risk for corporate bonds has already been priced in. The corporate bond market is pricing in wholesale downgrades across the energy and cyclical sectors. In fact, many of the issuers that are at risk of being downgraded from investment grade to high yield are already trading at high-yield levels. In addition, in the high-yield asset class, bond prices for those companies that will be most affected by either the economic slowdown or low oil prices are trading at prices that reflect the estimated value of a company in bankruptcy. Once a bond price hits recovery value, that price typically acts as a floor and limits further downside risk.

Investor Takeaway Considering that U.S. Treasury bonds have not only held their value but risen, now may be a good time to revisit investment allocations in fixed-income portfolios. While no one can time a market bottom, and momentum certainly could continue to push credit spreads wider, corporate credit spreads are at levels similar to where they peaked during other times of market turmoil. For investors able to withstand additional market volatility, now may be an opportune time to rebalance fixed-income portfolios and start to layer in additional corporate credit fund exposure.

This article has been written on behalf of Morningstar, Inc., and is not the view of DBRS Morningstar.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)